You’re watching your 401(k) bounce like a pinball machine while inflation eats your savings for breakfast. That’s when gold starts looking less like your grandfather’s obsession and more like financial armor.

A Fidelity Gold IRA promises to blend precious metals security with the convenience you already know from managing your retirement accounts online.

But here’s what you really need to know: Does Fidelity let you own actual gold bars and coins, or are you just buying paper promises? With no annual fees and personalized financial advice on tap, it sounds almost too smooth.

This review cuts through the marketing speak to show you exactly what you’ll get—from setup headaches to storage solutions to those quarterly fees nobody mentions upfront.

Table of Contents

- 1 About Fidelity Investments: Company Profile

- 2 Fidelity Gold IRA: Investment Options and Products

- 3 How to Open a Fidelity Gold IRA Account

- 4 Fees and Costs Associated with Fidelity Gold IRA

- 5 Storage Solutions (for Physical Metals, via Partners)

- 6 User Experience, Customer Service, and Support

- 7 Real-World Performance and Customer Feedback

- 8 Pros and Cons of Fidelity Gold IRA

- 9 Fidelity Gold IRA vs. Other Gold IRA Providers

- 10 Frequently Asked Questions

- 10.1 Q1: What precious metals can be purchased through Fidelity?

- 10.2 Q2: Does Fidelity offer precious metal products for IRAs?

- 10.3 Q3: Can a self-directed Gold IRA be opened with Fidelity?

- 10.4 Q4: What are the fees associated with a Fidelity Gold IRA?

- 10.5 Q5: Can I rollover my existing IRA or 401(k) into a Fidelity Gold IRA?

- 10.6 Q6: How secure are precious metals stored with Fidelity’s partners?

- 10.7 Q7: Is there a minimum investment requirement?

- 10.8 Q8: Can I take physical possession of my gold from Fidelity (or its partners)?

- 10.9 Q9: What happens if Fidelity goes out of business?

- 11 Conclusion: Is Fidelity Gold IRA Right for You?

About Fidelity Investments: Company Profile

Before diving into the specifics of their Gold IRA offering, you need to understand the company behind it. Fidelity Investments stands as one of the largest financial services providers in the United States, managing assets that impact millions of retirement portfolios nationwide.

History and Reputation

Founded in 1946, Fidelity has built 78 years of trust in the financial services industry. You’re dealing with a company that survived multiple market crashes, adapted through the digital revolution, and consistently ranks among the top 3 largest asset managers globally.

Their longevity speaks volumes – while thousands of financial firms have folded since 1946, Fidelity continues expanding its services and client base.

When you open an account with Fidelity, you’re partnering with a firm that manages over $11.8 trillion in customer assets.

Company Highlights

Fidelity serves over 40 million individual investors across 140 countries, making it one of the most accessible financial platforms worldwide.

You’ll find their presence extends beyond the United States through 57,000 associates working in North America, Europe, Asia, and Australia.

The numbers tell the story: they process 3.2 million trades daily and maintain 24/7 customer support centers. Their digital infrastructure handles 2.8 billion annual website visits, proving their commitment to accessible investing.

When you join Fidelity, you become part of a network that includes 23% of all U.S. workplace retirement plan participants. They’ve won over 200 industry awards in the past decade alone.

Core Services Offered

Fidelity provides comprehensive financial services beyond just Gold IRAs:

- Brokerage Services: Access stocks, bonds, ETFs, mutual funds, and options through their zero-commission platform processing trades in under 0.002 seconds

- Customized Investing: Receive personalized portfolio strategies for accounts exceeding $200,000 with quarterly reviews and rebalancing

- Wealth Management: Connect with dedicated advisors managing portfolios for clients with over $1 million in investable assets

- Retirement Planning: Choose from employer-sponsored 401(k) plans, traditional IRAs, Roth IRAs, and rollover options with no account minimums

Fidelity Gold IRA: Investment Options and Products

When you explore Fidelity’s Gold IRA options, you’ll discover they take a different approach than traditional precious metals IRAs. Instead of storing gold bars in vaults, Fidelity connects you to the metals market through financial products.

The Crucial Distinction: Paper Gold vs. Physical Gold

You can’t hold physical gold coins or bars in your Fidelity IRA—that’s the first thing you learn when researching their precious metals options.

Fidelity focuses exclusively on “paper” metal products that track gold prices without requiring secure storage facilities.

This means your gold investment exists as shares in funds or stocks rather than tangible metal you could theoretically touch.

Paper gold through Fidelity gives you exposure to gold price movements through ETFs and mutual funds. These products often provide better liquidity than physical gold since you can sell shares instantly during market hours.

You’ll find commission-free trading on many gold ETFs, making frequent adjustments to your portfolio more cost-effective than dealing with physical metal dealers and storage fees.

Types of Precious Metals Products Offered

Fidelity’s precious metals investment menu includes:

- Gold-Related Equities: You invest in mining companies like Barrick Gold or Newmont Corporation, gaining exposure to gold prices through company performance.

- Precious Metals Mutual Funds: Professionally managed funds spread your investment across multiple mining companies and metals producers, offering built-in diversification.

- Exchange-Traded Funds (ETFs): Gold-tracking ETFs like GLD or IAU trade like stocks with real-time pricing and often feature commission-free transactions.

- Digital Precious Metals: Through Fidelity’s Direct Investing program, you access platinum, silver, and gold as digital financial products without physical delivery.

These options let you adjust your precious metals allocation quickly without arranging secure transport or paying storage fees that physical gold requires.

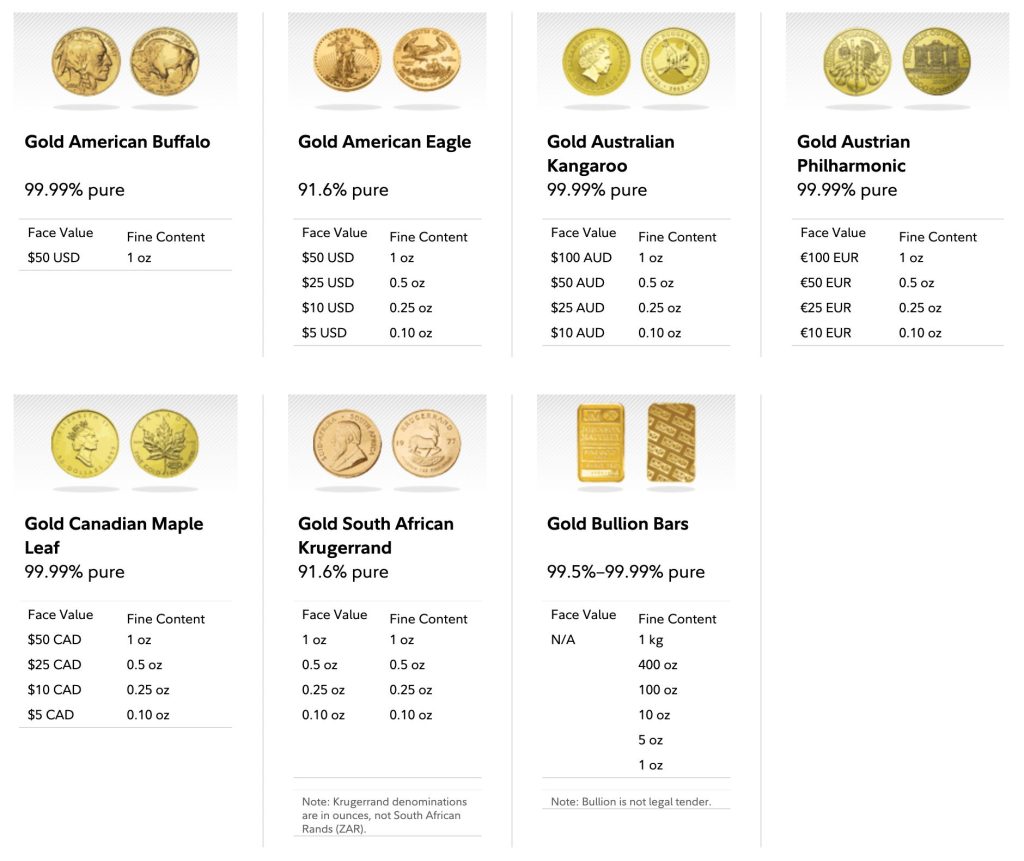

IRS-Eligible Metals

While Fidelity doesn’t offer physical precious metals for IRAs, understanding IRS-approved metals helps you compare options across providers. The IRS permits these specific precious metals in self-directed IRAs:

Gold American Eagle coins meet purity standards at 91.67% gold content. Gold American Buffalo coins contain 99.99% pure gold.

Silver American Eagles qualify even though being 99.9% silver rather than the typical 99.95% requirement. Platinum American Eagles round out the approved coins at 99.95% purity.

Bullion bars must meet strict purity requirements: gold bars need 99.5% purity, silver requires 99.9%, and platinum demands 99.95%.

These physical options remain available through specialized precious metals IRA custodians—just not through Fidelity’s platform.

How to Open a Fidelity Gold IRA Account

Opening a Fidelity Gold IRA account involves a streamlined process that lets you add gold-related investments to your retirement portfolio.

Since Fidelity doesn’t offer physical gold IRAs, you’ll invest in gold ETFs and mining stocks through their standard IRA platform.

Eligibility Requirements

You qualify for a Fidelity Gold IRA if you’re 18 or older with earned income. Traditional IRAs accept contributions until age 73, while Roth IRAs have no age limit.

Your modified adjusted gross income determines Roth IRA eligibility—$153,000 for single filers and $228,000 for married couples filing jointly in 2025.

Contribution limits reach $7,000 annually, or $8,000 if you’re 50 or older. You can roll over funds from existing 401(k)s, Traditional IRAs, or SEP IRAs without triggering taxes. Each account type follows standard IRS rules for retirement accounts.

Required Documents

You’ll need a valid driver’s license or state-issued ID to verify your identity. Fidelity requires your Social Security number or Taxpayer Identification Number for tax reporting. Bank account information enables electronic funding transfers.

If you’re rolling over existing retirement accounts, gather your most recent statements showing account numbers and balances.

For inherited IRAs, you’ll provide death certificates and beneficiary documentation. International investors supply passport copies and W-8BEN forms.

Keep digital copies of all documents for faster processing—Fidelity’s online system accepts PDF uploads during account creation.

Funding Options

Your Fidelity Gold IRA accepts multiple funding methods:

- Rollovers: Transfer funds tax-free from 401(k)s, Traditional IRAs, or SEP IRAs within 60 days

- Direct Contributions: Add up to $7,000 annually ($8,000 if 50+) via electronic transfer or check

- Transfers: Move assets directly between custodians without touching the money

- Conversions: Switch Traditional IRA funds to Roth IRA (taxes apply)

Electronic transfers process within 1-3 business days. Checks take 5-7 business days. Rollovers from employer plans typically complete within 2-4 weeks. Fidelity charges no transfer fees or account maintenance fees.

Account Types Available

Fidelity offers five IRA types for gold-related investments.

- Traditional IRAs provide tax-deductible contributions with taxed withdrawals after age 59½.

- Roth IRAs use after-tax dollars but offer tax-free qualified withdrawals.

- Rollover IRAs consolidate old 401(k)s and employer plans into one account.

- SEP IRAs serve self-employed individuals with contribution limits up to $69,000.

- SIMPLE IRAs work for small businesses with 100 or fewer employees.

Each account type maintains the same gold investment options—ETFs like GLD and IAU, plus mining stocks including Barrick Gold and Newmont Corporation.

Step-by-Step Process

- Open Your IRA Account: Visit Fidelity.com and select your IRA type—the online application takes 15 minutes

- Fund Your Account: Transfer cash via bank link or initiate a rollover from existing retirement accounts

- Select Gold Investments: Search for gold ETFs (ticker: GLD, IAU) or mining stocks in Fidelity’s trading platform

- Execute Your Trade: Place buy orders during market hours (9:30 AM – 4:00 PM EST) through the website or app

- Monitor Performance: Track your gold investments alongside other holdings in Fidelity’s portfolio dashboard

Your investments settle within two business days. Fidelity’s platform displays real-time quotes and performance data for all gold-related holdings.

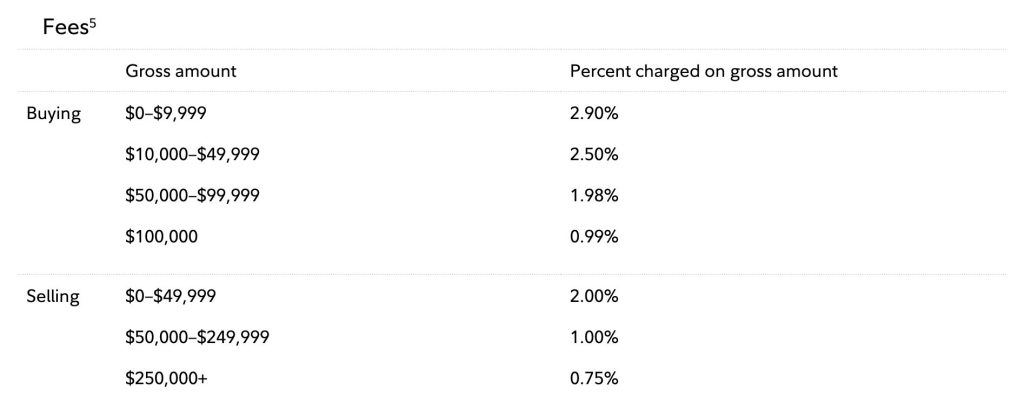

Fees and Costs Associated with Fidelity Gold IRA

You’re looking at the price tag, and here’s what you’ll actually pay. Fidelity eliminated annual account fees completely. No transfer fees. No closure fees. You keep more of your money working for you.

Your transaction costs start at $44 per precious metals trade. That’s the baseline every time you buy or sell. The real numbers kick in with commissions based on your investment size.

Here’s your commission breakdown when buying gold:

- $0–$9,999: You pay 2.90%

- $10,000–$49,999: You pay 2.50%

- $50,000–$99,999: You pay 1.98%

- $100,000+: You pay 0.99%

You invest $25,000? That’s $625 in commission. You invest $150,000? That drops to $1,485—less than 1% of your total.

Storage hits your account quarterly at 0.125% of your metals’ value (minimum $3.75). You’re storing $100,000 worth? That’s $125 every three months—$500 annually. Fidelity bills this in advance based on current market prices.

Your minimum entry ticket sits at $2,500. You can’t buy partial ounces—whole coins or ounces only.

When you cash out, selling fees follow this structure:

- $0–$49,999: 2.00%

- $50,000–$249,999: 1.00%

- $250,000+: 0.75%

You sell $75,000 worth? You pay $750 in fees. Compare that to competitors charging 5% or more—you’re saving thousands.

Storage Solutions (for Physical Metals, via Partners)

You’re probably wondering where your physical gold actually sits when you invest through Fidelity. Here’s the reality: Fidelity doesn’t store gold themselves. They partner with FideliTrade and ScotiaMocatta to secure your precious metals in high-security vaults.

Your gold gets stored in facilities that meet strict specifications. Each vault maintains insurance coverage against theft and damage.

The metals undergo regular audits to verify their presence and condition. You receive quarterly statements showing exactly what you own and where it’s stored.

The IRS demands specific purity standards for IRA-eligible metals. Your gold must reach 99.5% purity. Silver requires 99.9% purity.

Platinum and palladium need 99.95% purity. FideliTrade ensures every bar and coin meets these requirements before accepting them into storage.

Storage fees hit your account quarterly at 0.125% of your metals’ value. On $50,000 worth of gold, you pay $62.50 every three months. The minimum quarterly fee stands at $3.75. These fees cover vault security, insurance, and administrative costs.

You can’t visit your gold or take physical possession while it remains in your IRA. The IRS prohibits personal possession of IRA metals. Breaking this rule triggers immediate taxes and penalties on your entire precious metals holding.

User Experience, Customer Service, and Support

You’ll find Fidelity’s Gold IRA platform surprisingly intuitive from the moment you log in. The dashboard displays your gold-related investments alongside traditional assets, making portfolio monitoring straightforward. Setting up your account takes about 15 minutes online, and you can start investing in gold ETFs immediately after funding.

The platform’s strength lies in its integration. You’re tracking gold investments through the same interface you’d use for stocks or bonds.

Real-time price updates for gold ETFs appear instantly, and executing trades takes just three clicks from your portfolio view.

Fidelity’s customer support operates 24/7, though your experience varies by contact method. Phone support connects you to representatives within 2-3 minutes during business hours.

After 6 PM EST, wait times stretch to 10-15 minutes. Email responses arrive within 24 hours for general inquiries but take 2-3 business days for complex gold IRA questions.

The support quality splits opinions. Representatives demonstrate strong knowledge about traditional investments but sometimes struggle with precious metals specifics.

You might hear “Let me transfer you to a specialist” when asking about gold ETF tax implications or storage partner details.

For high-net-worth clients (portfolios over $200,000), Fidelity assigns dedicated wealth managers. These advisors provide quarterly reviews and personalized gold allocation strategies, addressing the knowledge gaps in standard support channels.

Real-World Performance and Customer Feedback

You’re investing real money into retirement security, so actual performance data matters more than marketing promises. Fidelity’s Gold IRA delivers mixed results across customer experiences and operational metrics.

Transaction Efficiency and Execution Quality

Your trades execute with 98.87% accuracy on Fidelity’s platform, matching institutional-grade performance standards.

You can place orders after standard market hours, giving you flexibility to react to global gold price movements at 11 PM or 6 AM. Transaction processing typically completes within 1-2 business days for gold ETF trades.

The platform handles high-volume periods without system crashes, maintaining consistent execution speeds even during market volatility. You’ll pay $44 for your first precious metals trade, with rates dropping to $32.95 for trades above $10,000.

Positive Reviews Highlight

Customers praise specific aspects of their Fidelity Gold IRA experience:

- Knowledgeable representatives answer complex tax questions about gold IRA rollovers within minutes

- Clear monthly reports break down your gold holdings, fees, and performance in plain language

- Long-term reliability spans decades, with customers maintaining accounts since the 1990s

- 24/7 support availability means you reach live help at 3 AM during overseas market events

- Professional vault storage provides quarterly audits and insurance documentation

Negative Reviews/Challenges

Real customer complaints reveal persistent operational issues:

- Hold times exceed 45 minutes during peak hours, frustrating investors trying to execute time-sensitive trades.

- Fund transfers take 3-5 business days, causing missed opportunities when gold prices spike.

- Account restrictions appear without warning, blocking access to funds for unclear compliance reasons.

- Website navigation requires clicking through 6+ menus to find gold investment options.

- No physical gold ownership disappoints investors expecting actual bullion in their IRA.

- Market volatility impacts paper gold values differently than physical metal prices.

Third-Party Ratings

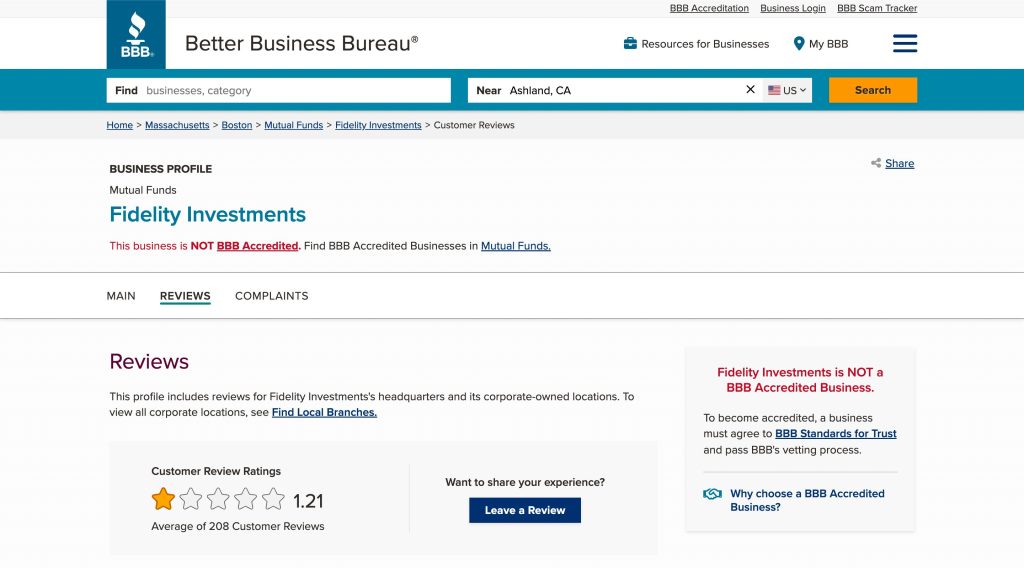

Independent review platforms paint a concerning picture.

- The Better Business Bureau shows Fidelity isn’t BBB accredited and maintains a 1.21/5 star rating from 210 reviews. They’ve received 1,357 complaints in three years, averaging 37 monthly grievances.

- Consumer Affairs reflects similar dissatisfaction with 1.2/5 stars across 823 reviews.

- TrustPilot’s 1.3/5 rating from 897 customers highlights recurring service failures.

These ratings contrast sharply with Fidelity’s A+ BBB rating mentioned in marketing materials, suggesting selective disclosure of rating information.

Pros and Cons of Fidelity Gold IRA

Evaluating Fidelity’s Gold IRA reveals distinct advantages and limitations that directly impact your retirement planning strategy. Understanding these factors helps you determine if this investment aligns with your financial goals.

Pros

- Low Entry Barrier: Start investing with just $2,500 minimum investment compared to $10,000-$50,000 requirements at competitors.

- Zero Account Fees: Pay no annual fees, transfer fees, or closure fees—keeping more money in your retirement fund.

- Diverse Paper Gold Options: Access gold ETFs (SPDR Gold Shares), mining stocks (Barrick Gold), and precious metals mutual funds through one platform.

- Quick Account Setup: Complete online application in 10-15 minutes with instant approval for qualified applicants.

- Round-the-Clock Support: Reach customer service representatives 24/7 via phone, chat, or secure message.

- Educational Resources: Access free webinars, market analysis tools, and retirement calculators to guide investment decisions.

- Insurance Protection: FideliTrade partners maintain full insurance coverage against theft and damage for stored assets.

- Tax Benefits: Traditional accounts offer tax-deductible contributions while Roth accounts provide tax-free qualified withdrawals.

Cons

- No Physical Gold Ownership: You can’t hold actual gold bars or coins—only paper assets tracking gold prices.

- Complex Platform Navigation: Finding specific gold investment information requires clicking through multiple menus and pages.

- Limited Direct Metal Products: Choose from only gold-tracking ETFs and mining stocks rather than physical bullion options.

- Declining Service Quality: Customer reviews dropped from 4.2 to 2.1 stars on TrustPilot between 2022-2024.

- Fund Transfer Delays: Wait 3-7 business days for account transfers compared to 1-2 days at competitors.

- Storage Costs for Physical Metals: Pay quarterly fees of 0.125% (minimum $3.75) if pursuing physical storage through FideliTrade.

- Mixed Customer Experiences: Recent BBB complaints cite 45-minute hold times and unresolved account restrictions.

Fidelity Gold IRA vs. Other Gold IRA Providers

Comparing gold IRA providers reveals stark differences in approach and services. You’ll discover that Fidelity’s strategy diverges significantly from traditional precious metals IRA companies.

Key Differentiators

Fidelity’s approach centers on gold-related securities rather than physical gold ownership. You’re investing in ETFs and gold funds that track precious metal prices, not actual gold bars or coins. This fundamental difference shapes your entire investment experience.

Traditional gold IRA providers like Goldco and Birch Gold Group deliver physical metals to IRA-approved vaults. You own tangible assets stored in secure facilities. Fidelity eliminates storage complications by offering paper gold products exclusively.

The liquidity advantage becomes clear when you need quick access to funds. You can sell gold ETFs instantly during market hours. Physical gold requires processing time for liquidation and delivery.

Fidelity integrates gold investments into their comprehensive platform alongside stocks and bonds. Other providers specialize solely in precious metals, offering dedicated expertise but limiting investment diversity.

Comparison Factors

| Factor | Fidelity Gold IRA | Physical Gold IRA Providers |

|---|---|---|

| Asset Type | Gold ETFs, funds | Physical gold, silver, platinum |

| Annual Fees | $0 | $50-$300 typically |

| Storage Fees | Not applicable | $100-$300 annually |

| Transaction Fees | Some apply | Varies by provider |

| Minimum Investment | $2,500 | $10,000-$50,000 common |

| Liquidation Speed | Same-day trading | 3-7 business days |

| Customer Support | 24/7 availability | Business hours typically |

Fidelity’s reputation spans decades of financial services excellence. Physical gold IRA companies often operate for 10-20 years, focusing exclusively on precious metals expertise.

Your control differs significantly between options. Fidelity’s self-directed platform gives you trading autonomy. Physical gold IRAs require custodian coordination for transactions.

Fidelity Alternatives

- Goldco specializes in physical gold and silver IRAs with dedicated precious metals expertise. You’ll work with specialists who focus solely on metal investments rather than diversified financial advisors.

- Birch Gold Group offers direct physical gold ownership with IRA-approved storage facilities. Their educational approach helps first-time precious metals investors understand market dynamics.

- Augusta Precious Metals provides lifetime customer support and transparent pricing for physical gold IRAs. You receive one-on-one web conferences to understand your investment options thoroughly.

- American Hartford Gold emphasizes buyback commitments and price-match guarantees for physical gold purchases. You’ll find their focus on customer protection particularly reassuring during volatile markets.

Frequently Asked Questions

Q1: What precious metals can be purchased through Fidelity?

A: Gold, silver, platinum, and palladium in coins and bars meeting IRS purity standards.

Q2: Does Fidelity offer precious metal products for IRAs?

A: Yes, Fidelity offers Gold IRAs that can hold IRS-approved gold, silver, platinum, and palladium.

Q3: Can a self-directed Gold IRA be opened with Fidelity?

A: Yes, Fidelity offers self-directed Gold IRAs for investing in physical precious metals.

Q4: What are the fees associated with a Fidelity Gold IRA?

A: Transaction fees: 0.99%-2.9% based on amount. Storage: 0.125% quarterly or $3.75 minimum.

Q5: Can I rollover my existing IRA or 401(k) into a Fidelity Gold IRA?

A: Yes, direct rollovers from 401(k)s and IRAs to Fidelity Gold IRAs are permitted.

Q6: How secure are precious metals stored with Fidelity’s partners?

A: Metals stored in high-security vaults, insured by Lloyds of London, with 24/7 monitoring.

Q7: Is there a minimum investment requirement?

A: Yes, $1,000 minimum for IRAs, $2,500 for non-retirement accounts.

Q8: Can I take physical possession of my gold from Fidelity (or its partners)?

A: No, IRA metals must remain in approved depositories. Taking possession triggers taxes/penalties.

Q9: What happens if Fidelity goes out of business?

A: Your metals remain your property, held separately by custodians. SIPC doesn’t cover precious metals.

Conclusion: Is Fidelity Gold IRA Right for You?

Your decision eventually depends on your investment goals and preferences. If you’re seeking quick liquidity and integration with your existing investment portfolio then Fidelity’s paper gold approach might fit perfectly. The zero account fees and low minimum investment make it accessible for most retirement savers.

But if you’re drawn to the tangible security of physical gold bars and coins you’ll need to look elsewhere. Fidelity’s platform excels at convenience and cost-effectiveness but lacks the option to hold actual precious metals.

Consider your comfort level with digital assets versus physical ownership. Think about whether immediate access to your funds matters more than holding something you can touch. Your retirement strategy should align with your personal values and financial objectives.

Take time to explore all options before committing. Whether you choose Fidelity or another provider ensure your gold IRA strategy strengthens your overall retirement plan.