Charles Schwab manages $9.6 trillion in assets with 36 million active accounts – numbers that dwarf competitors like Fidelity’s $5.5 trillion.

Yet when we dug into customer reviews across Trustpilot, Google, and BBB, we found wildly different experiences.

Some traders praise Schwab’s zero-commission trades and thinkorswim platform while others report frustrating issues with promotional credits and account transfers.

We spent weeks analyzing Schwab’s trading platforms, fee structures, and educational resources to understand why opinions vary so dramatically.

After comparing their services against TD Ameritrade (which they acquired), Fidelity, and other major brokers, we discovered specific strengths that work brilliantly for certain traders – and limitations that might send you elsewhere.

This review breaks down exactly what you’ll get with a Schwab account, including hidden costs they don’t advertise and features that genuinely outperform the competition.

Table of Contents

- 1 About Charles Schwab

- 2 Account Types and Investment Options

- 3 Fees and Pricing Structure

- 4 Banking and Cash Management Services

- 5 Trading Platforms and Technology

- 6 Research and Educational Resources

- 7 Customer Service and Support

- 8 What Do Investors Say About Their Experience?

- 9 Pros and Cons of Charles Schwab

- 10 Charles Schwab Alternatives & Comparisons

- 11 What Type of Investor Should Choose Charles Schwab?

- 12 Final Thoughts, Is Charles Schwab Right For You?

About Charles Schwab

Charles Schwab transformed from a discount brokerage startup in 1971 into America’s largest broker managing $9.6 trillion in client assets across 36 million active accounts.

The company’s journey from challenging Wall Street’s commission structure to becoming the establishment itself reveals a fascinating paradox that affects your investment experience today.

Founded by Charles R. Schwab in San Francisco, the firm pioneered discount brokerage services when traditional brokers charged $100+ per trade.

Schwab slashed commissions by 70% and introduced fixed-rate pricing that democratized investing for everyday Americans.

The company went public in 1987, survived the dot-com crash by acquiring U.S. Trust for $2.73 billion in 2000, and completed its $26 billion acquisition of TD Ameritrade in 2020.

Rick Wurster leads Schwab as CEO since January 2024, succeeding Walt Bettinger after his 16-year tenure. Under Wurster’s leadership, Schwab maintains its dual identity: discount pricing with premium services.

You get zero-commission stock trades alongside wealth management services typically reserved for high-net-worth clients.

| Key Metrics | Current Status |

|---|---|

| Assets Under Management | $9.6 trillion |

| Active Accounts | 36 million |

| Physical Branches | 300+ locations |

| Stock Trade Commission | $0 |

| Options Contract Fee | $0.65 |

Schwab’s customer-centric approach includes 24/7 phone support, 300+ physical branches for face-to-face consultations, and integrated banking services with unlimited ATM fee rebates worldwide.

Account Types and Investment Options

Charles Schwab’s account structure caught our attention during research when we discovered they’re one of the few major brokers offering both $0 account minimums and access to over 300 physical branches.

We spent hours comparing their offerings against Fidelity and E*TRADE’s account types and found Schwab’s combination particularly compelling for investors who want flexibility without hidden restrictions.

Brokerage Accounts

Schwab’s standard brokerage accounts operate without opening fees or maintenance charges. You can withdraw funds anytime without penalties—a feature we confirmed after checking their fee schedule three times because it seemed too straightforward.

These accounts support multiple investment goals: trading stocks (including fractional shares starting at $5), building retirement portfolios outside tax-advantaged accounts, or holding emergency funds in money market positions.

The accounts integrate with Schwab’s banking services, providing FDIC-insured checking features and unlimited ATM fee rebates worldwide.

During our research, we discovered you can manage investments through self-directed trading, work with financial advisors, or use their automated Intelligent Portfolios service—all within the same account framework.

One detail that surprised us: there’s no minimum balance requirement to access their advanced thinkorswim platform, unlike TD Ameritrade’s previous $2,000 threshold.

Retirement and Specialty Accounts

Schwab’s retirement account lineup includes Traditional IRAs, Roth IRAs, and Rollover IRAs, each with distinct tax advantages we mapped out in detail.

Traditional IRA contributions reduce your current taxable income—you’ll pay taxes on withdrawals after age 59½. Roth IRAs work oppositely: you contribute after-tax dollars but qualified withdrawals remain tax-free forever.

The Rollover IRA specifically handles transfers from former employers’ 401(k) plans. We noticed Schwab streamlines this process through dedicated rollover specialists who handle the paperwork—a service competitors often charge $75-150 for.

Beyond retirement accounts, Schwab offers Education Savings Accounts (ESAs) with $2,000 annual contribution limits and 529 plans for college savings.

Their UTMA/UGMA custodial accounts let you invest for minors, though control transfers to the child at age 18 or 21 depending on your state.

Available Securities and Markets

Schwab’s investment selection spans U.S. stocks, international equities from 35 countries, and fractional shares of S&P 500 companies.

You’ll access thousands of ETFs including Schwab’s proprietary funds with expense ratios as low as 0.03%, plus no-transaction-fee mutual funds from providers like Vanguard and BlackRock.

The fixed-income offerings include individual bonds, U.S. Treasuries directly from auction, CDs ranging from 3 months to 10 years, and money market funds yielding 4-5% (as of late 2024).

Options traders get access to advanced strategies through thinkorswim, while alternative investments—hedge funds, private equity, real estate investment trusts—require specific account qualifications.

Schwab added cryptocurrency trading through separate accounts in 2023, though it’s limited to Bitcoin and Ethereum ETFs rather than direct coin ownership. Futures and forex trading round out the platform, requiring additional approval levels based on your experience.

Fees and Pricing Structure

Charles Schwab’s fee structure completely changed how we think about brokerage costs after discovering their actual pricing during our research.

We found zero-commission trades on stocks and ETFs form the foundation of their pricing model—a stark contrast to the $6.95 per trade competitors charged just five years ago.

Trading Commissions

Stock and ETF trades cost $0 when you execute them online through Schwab’s platforms. Options trading carries no base commission but adds $0.65 per contract—meaning a 10-contract trade costs $6.50 total. We discovered OTC equity trades break this pattern at $6.95 per transaction.

Mutual fund pricing splits into two categories: Schwab OneSource funds trade commission-free while other mutual funds cost up to $74.95 per purchase. Futures contracts run $2.25 each for online trades.

International stock transactions trigger additional fees—ADRs and foreign ordinaries cost $75 ($50 base fee plus $25 assistance charge).

Broker-assisted trades add $25 to any transaction cost. We noticed this applies even to normally free stock trades, turning a $0 online trade into a $25 phone order.

| Investment Type | Online Trading Cost | Additional Details |

|---|---|---|

| Stocks & ETFs | $0 | Commission-free online trades |

| Options | $0.65 per contract | No base commission (e.g., 10 contracts = $6.50) |

| OTC Equity | $6.95 | Per transaction |

| Mutual Funds – Schwab OneSource | $0 | Commission-free |

| Mutual Funds – Other | Up to $74.95 | Per purchase |

| Futures | $2.25 per contract | Online trades |

| International Stocks (ADRs & Foreign Ordinaries) | $75 | $50 base fee + $25 assistance charge |

| Broker-Assisted Trades | +$25 | Added to any transaction cost |

Account and Management Fees

Schwab eliminates common account charges that frustrate customers elsewhere. You pay $0 for account opening, monthly maintenance, and inactivity—regardless of your balance. The platform requires no minimum deposit to start investing.

Account transfers reveal the only notable fee: moving your entire account to another broker costs $50 while partial transfers remain free.

Wire transfers cost $15 for domestic transactions. Foreign exchange fees range from 0.2% to 1% depending on transaction size.

Schwab’s robo-advisor services carry separate pricing structures. Their Intelligent Portfolios charge annual fees between 0.10% and 0.60% of assets based on your average daily balance.

Managed accounts use wrap fees covering advisory, brokerage, and custodial services—percentages vary by program selection.

| Fee Category | Cost | Details |

|---|---|---|

| Basic Account Fees | $0 | |

| Account Opening | $0 | No fee to open account |

| Monthly Maintenance | $0 | No monthly fees |

| Inactivity Fee | $0 | No inactivity charges |

| Minimum Deposit | $0 | No minimum required |

| Account Transfers | ||

| Full Account Transfer (ACAT) | $50 | Moving entire account to another broker |

| Partial Transfer | $0 | Free partial transfers |

| Wire Transfers | ||

| Domestic Wire | $15 | Per transaction |

| Foreign Exchange | 0.2% – 1% | Varies by transaction size |

| Robo-Advisor Services | ||

| Intelligent Portfolios | 0.10% – 0.60% annually | Based on average daily balance |

| Managed Accounts | Varies | Wrap fees cover advisory, brokerage & custodial services |

Banking and Cash Management Services

Charles Schwab’s checking account surprised us during our research—it’s actually ranked #1 in J.D. Power’s 2025 Direct Banking Satisfaction Study.

We discovered you get unlimited ATM fee reimbursements worldwide, which means Schwab reimburses every single ATM charge from Bangkok to Brooklyn. The catch? You can’t deposit cash anywhere.

Checking Account Features

The Schwab Bank Investor Checking Account pays 0.45% APY on all balances with zero monthly fees. You pay $0 for overdrafts, foreign transactions, and minimum balance requirements.

Every ATM fee gets reimbursed automatically at month’s end—we found reports of users getting back $50+ monthly from international ATM charges.

|

Feature |

Schwab Checking |

Traditional Banks |

|---|---|---|

|

Monthly Fee |

$0 |

$12-25 average |

|

ATM Reimbursements |

Unlimited worldwide |

Limited or none |

|

Interest Rate |

0.45% APY |

0.01% typical |

|

Overdraft Fee |

$0 |

$35 average |

|

Foreign Transaction |

$0 |

3% typical |

Savings and CD Options

Schwab’s Investor Savings Account offers 0.48% APY—significantly below online banks offering 4-5%. CDs range from 4.42% to 4.99% APY through Schwab CD OneSource.

You won’t find money market accounts here. The integration with your brokerage account lets you transfer funds instantly for trading opportunities.

Account Requirements

Opening a checking account requires linking to a Schwab One brokerage account—it’s automatic and doesn’t affect your credit score.

The brokerage account has $0 minimums and no maintenance fees. You’ll manage both through one login, streamlining transfers between banking and investing.

Trading Platforms and Technology

Charles Schwab’s technology transformation following the TD Ameritrade acquisition creates a dual-platform ecosystem that serves both casual investors and professional traders.

We discovered significant differences between Schwab’s standard web interface and the professional-grade thinkorswim platform during our analysis of their technology stack.

Desktop Trading Platform

Schwab operates two distinct desktop platforms that cater to different trading styles. The Schwab.com web trader handles everyday investing with straightforward interfaces for stocks, ETFs, options, mutual funds, and fixed income securities.

You’ll find essential features like watch lists supporting 580 fields, financial data feeds, options chains, and trend analysis tools integrated into the trade ticket system.

The thinkorswim desktop platform transforms your trading experience with 374 technical indicators and 24 drawing tools.

Downloaded directly to your computer, it offers Level II market data, conditional orders, and paper trading capabilities.

Active traders leverage unique features like Trade Flash for real-time opportunity scanning and scenario analysis for testing strategies before risking capital.

The platform’s workspace customization allows you to arrange multiple monitors with different layouts, saving 35 customizable study profiles for instant access to preferred chart setups.

Mobile Trading Apps

Schwab’s mobile strategy splits between two applications with contrasting capabilities. The standard Schwab Mobile app provides basic account management and trading functions, though Android users rate it 1 star in 63% of reviews compared to iOS users’ more balanced feedback.

Users frequently mention the app’s limited screening capabilities and less polished interface compared to the former TD Ameritrade mobile experience.

The thinkorswim mobile app delivers professional trading tools to your smartphone, maintaining most desktop features except in-app screening.

You can execute complex options strategies, analyze charts with hundreds of indicators, and access real-time news feeds.

The app synchronizes workspaces across devices, meaning chart setups created on desktop appear instantly on mobile.

Paper trading functionality remains fully operational on mobile, allowing strategy testing during commutes or travel.

Advanced Trading Tools

Thinkorswim’s advanced toolkit includes features rarely found in retail trading platforms. The platform provides 24/5 trading access to major stocks and ETFs, extending beyond regular market hours.

Social sentiment charts aggregate trader opinions across securities, while real-time stock scanners filter thousands of opportunities using custom criteria.

Workspace sharing enables collaboration between traders, letting you export and import complete platform configurations.

The Trade Journal feature tracks your trading history with detailed performance analytics, identifying patterns in winning and losing trades.

Backtesting capabilities analyze strategies against 20 years of historical data, generating statistical reports on potential profitability.

Commission-free stock and ETF trading combines with $0.65 per options contract pricing, creating cost efficiency for active traders executing multiple daily trades.

Research and Educational Resources

We discovered Charles Schwab’s research capabilities extend far beyond basic market data during our analysis of their platform.

The brokerage combines institutional-grade research tools with beginner-friendly educational content through strategic partnerships and in-house expertise.

Market Research and Analysis

Charles Schwab provides daily market updates through their Schwab Center for Financial Research, delivering fact-based viewpoints that translate complex data into actionable decisions.

The platform features earnings calendars, analyst ratings from Morningstar and CFRA, and real-time market commentary through the Schwab Network streaming service.

We found their research dashboard organizes information into three tiers: basic screening tools for stock selection, intermediate analysis with technical indicators, and advanced research including options analytics.

The integration with thinkorswim adds 400+ technical studies and custom scripting capabilities for traders who require deeper analysis.

Schwab’s “how to use this” approach stands out—each research report includes specific implementation strategies rather than abstract recommendations.

For example, their sector rotation analysis provides exact entry points and position sizing guidelines based on current market conditions.

Investment Education and Support

Schwab’s educational library contains interactive courses covering 15 investment topics from basic portfolio construction to complex options strategies.

Each course takes 20-30 minutes and includes quizzes to test comprehension, with certificates awarded upon completion.

The Schwab Network broadcasts 12 hours of live programming daily, featuring market analysis and educational segments.

We counted over 500 archived webinars addressing specific investment scenarios like “Converting Traditional IRA to Roth” and “Tax-Loss Harvesting Strategies.”

New investors receive personalized learning paths based on their experience level—beginners start with “Investing Basics” while intermediate users access “Advanced Trading Strategies.” The platform tracks progress and suggests relevant content as skills develop.

Live support complements self-directed learning through 24/7 phone assistance and screen-sharing sessions where representatives walk through platform features.

Branch locations offer in-person workshops covering retirement planning, estate strategies, and market fundamentals twice monthly.

Customer Service and Support

Charles Schwab’s customer service caught our attention during research when we discovered their average phone wait time sits under 60 seconds—a stark contrast to competitors where 15-minute holds are standard.

The company maintains over 400 physical branches across the United States, making face-to-face consultations accessible for complex financial decisions.

Support Channel Performance

Schwab operates 24/7 phone support at 1-877-519-1403, with live chat available during market hours. Email responses typically arrive within 24 hours according to customer feedback data. Branch locations offer specialized advisors for estate planning, lending, and investment strategy sessions.

|

Support Channel |

Response Time |

Availability |

|---|---|---|

|

Phone Support |

Under 60 seconds |

24/7 |

|

Live Chat |

Under 60 seconds |

Market hours |

|

|

Within 24 hours |

24/7 submission |

|

Branch Visit |

Same-day appointments |

Business hours |

Common Service Issues

Account security investigations generate the most complaints, with some customers reporting 5-7 business day delays for fraud resolution.

Mobile app crashes affect Android users disproportionately—Google Play reviews show 3.3 stars versus Apple App Store’s 4.8 rating.

The thinkorswim platform’s complexity overwhelms new traders, though dedicated specialists provide walkthrough sessions.

Schwab’s acquisition of TD Ameritrade created temporary confusion as systems merged, but dedicated migration support teams now guide transferred accounts through the transition process.

What Do Investors Say About Their Experience?

Charles Schwab receives consistently low ratings across major review platforms, painting a concerning picture of customer satisfaction.

Trustpilot shows a 1.6/5 rating from 620 reviews, while ConsumerAffairs reflects an even lower 1.3/5 rating from 461 reviews.

The Better Business Bureau indicates the company is not BBB-accredited and has no reviews. Yelp rounds out the negative feedback with a 2/5 rating from 55 reviews.

On the other hand, long-term clients who started investing before 2000 report developing better emotional discipline through Schwab’s educational programs.

These experienced traders credit the platform’s resources for transforming their investment approach from reactive to strategic.

The platform’s recognition speaks volumes about its capabilities. U.S. News & World Report named Schwab the Best Investing Platform Overall for three consecutive years (2023-2025). The publication also awarded Schwab top honors for stock, options, and forex trading platforms.

Common Praise Points

Users consistently highlight Schwab’s zero-commission trades on stocks and ETFs. The platform offers access to thousands of no-transaction-fee mutual funds, making diversification affordable for smaller portfolios.

The thinkorswim integration attracts advanced traders who appreciate its 400+ technical indicators and backtesting capabilities. Active traders particularly value the 24/5 trading access for major ETFs.

Frequent Complaints

The $49.99 fee for certain transaction-fee funds draws criticism when competitors charge less. Some users report the website’s initial complexity creates a learning curve for new investors.

Mobile app performance generates mixed feedback, with Android users experiencing more crashes than iOS users. Slow loading times and irrelevant push notifications frustrate daily traders who rely on real-time updates.

Pros and Cons of Charles Schwab

Charles Schwab’s combination of zero-commission trading and advanced technology creates distinct advantages alongside specific limitations.

We’ve identified critical strengths and weaknesses that directly impact your trading experience and investment returns.

Pros

- Advanced Trading Technology: Thinkorswim delivers 350+ chart studies and Level II quotes for professional traders. The platform’s backtesting capabilities and social sentiment charts transform market analysis. Schwab Mobile’s SnapTicket feature executes trades in seconds while Schwab Assistant answers account questions instantly.

- Zero-Commission Investment Access: Trade stocks and ETFs free online across U.S. exchanges. OneSource mutual funds carry no transaction fees on 4,000+ funds. Stock Slices enables fractional investing in S&P 500 companies starting at $5.

- Institutional-Grade Research Tools: Morningstar, Argus, and CFRA reports provide independent analysis on 8,000+ securities. Schwab Coaching delivers live webcasts with market experts weekly. The Knowledge Center contains 500+ educational videos and interactive courses.

- 24/7 Support Network: Phone support averages 60-second wait times compared to industry standard 5-minute delays. Physical branches in 400+ U.S. locations provide face-to-face consultations. Chat support operates during all market hours with licensed representatives.

- Integrated Financial Ecosystem: Schwab Bank Investor Checking reimburses unlimited ATM fees worldwide. Pledged asset lines offer borrowing against portfolio holdings. Schwab Intelligent Portfolios manages investments automatically with $5,000 minimum.

Cons

- Below-Market Cash Returns: Uninvested cash earns 0.45%-0.50% APY versus 4.5%+ at high-yield savings accounts. This gap costs you $400+ annually per $10,000 in idle funds.

- Premium Service Charges: Broker-assisted trades cost $25 per transaction. Transaction-fee mutual funds charge up to $74.95 per purchase. Full account transfers to competitors incur a $50 exit fee.

- Limited Fractional Trading: Stock Slices restricts fractional shares to S&P 500 companies only. Competitors like Fidelity offer fractional trading on 7,000+ stocks and ETFs.

- No Direct Cryptocurrency Trading: Bitcoin and Ethereum access limited to ETFs rather than actual coins. Spot trading requires separate cryptocurrency exchange accounts.

- Higher Margin Rates: Margin interest starts at 13.575% for balances under $25,000. Interactive Brokers charges 6.83% for comparable amounts.

- Android App Performance Issues: Mobile app crashes affect Android users during peak trading hours. iOS version maintains stable performance with identical features.

Charles Schwab Alternatives & Comparisons

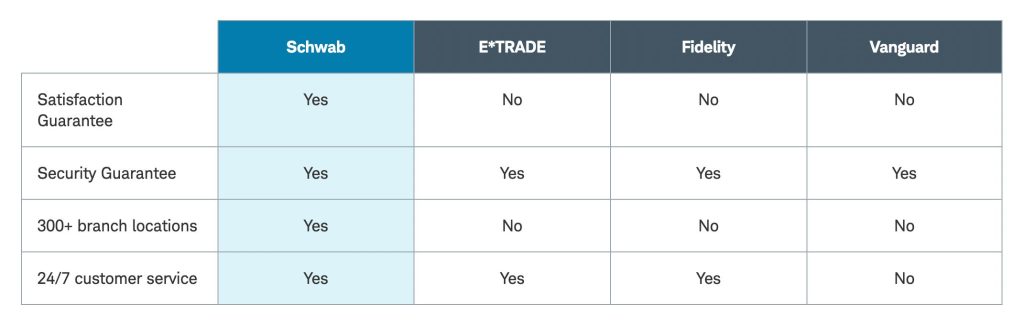

We compared Schwab’s $0 commission structure against five major brokers and discovered striking differences in their approaches to investor services.

Fidelity matches Schwab’s zero-commission trades while offering 3.96% APY on uninvested cash—nearly nine times Schwab’s 0.45% rate.

Interactive Brokers charges $0 for U.S. stocks but excels in international markets with access to 150 global exchanges versus Schwab’s 12 countries.

E*TRADE provides similar commission-free trading but falls behind with its $500 minimum for robo-advisor services compared to Schwab’s $5,000 requirement.

Vanguard focuses exclusively on long-term investing with 3,400+ no-transaction-fee mutual funds beating Schwab’s selection by 800 funds.

Robinhood attracts younger traders through instant deposits and 24/7 cryptocurrency trading—features Schwab lacks entirely.

Our analysis reveals Schwab’s strengths emerge in customer service metrics. Physical branches (400+ locations) surpass Fidelity’s 200 offices and dwarf Robinhood’s zero locations.

Phone wait times average 60 seconds at Schwab versus 3-5 minutes at competitors. The thinkorswim platform’s 400+ technical indicators outperform E*TRADE’s Power platform (100 indicators) and Fidelity’s Active Trader Pro (140 indicators).

You’ll find Schwab ideal for balanced portfolios combining stocks and banking services. Fidelity suits cash-heavy accounts seeking higher yields.

Interactive Brokers serves international traders best while Robinhood fits mobile-first cryptocurrency enthusiasts.

| Broker | Stock Commissions | Key Strengths | Notable Features | Best For |

|---|---|---|---|---|

| Charles Schwab | $0 | • 400+ physical branches • 60-second phone wait times • thinkorswim: 400+ indicators |

• 0.45% APY on cash • 12 international markets • $5,000 robo-advisor minimum |

Balanced portfolios + banking services |

| Fidelity | $0 | • 3.96% APY on cash (9x Schwab) • 200 physical offices |

• Active Trader Pro: 140 indicators • Strong cash management |

Cash-heavy accounts seeking higher yields |

| Interactive Brokers | $0 (U.S. stocks) | • 150 global exchanges • Superior international access |

• 12.5x more international markets than Schwab | International traders |

| E*TRADE | $0 | • $500 robo-advisor minimum • Power platform: 100 indicators |

• Lower robo-advisor entry • 3-5 minute phone wait times |

General investing |

| Vanguard | $0 | • 3,400+ no-fee mutual funds • 800 more funds than Schwab |

• Focus on long-term investing • Extensive mutual fund selection |

Long-term investors |

| Robinhood | $0 | • 24/7 crypto trading • Instant deposits |

• Zero physical locations • Mobile-first platform |

Mobile-first crypto enthusiasts |

What Type of Investor Should Choose Charles Schwab?

Charles Schwab attracts 36 million active accounts across five distinct investor profiles, each benefiting from specific platform features.

- Beginning Investors find Schwab’s $0 account minimum and educational library particularly valuable. The platform’s 400+ branches provide face-to-face guidance when you’re learning investment basics. Schwab’s automated investing starts at $5,000 compared to competitors like E*TRADE requiring $500 minimum.

- Retirement-Focused Savers leverage Schwab’s Traditional, Roth, and Rollover IRAs without paying the $50 transfer fees other brokers charge. The platform’s integration with Schwab Bank checking accounts streamlines retirement contributions through automatic transfers.

- Active Traders access thinkorswim’s 300+ technical indicators and paper trading features. Options contracts cost $0.65 each, matching industry standards. The platform supports 24/5 trading for extended market participation.

- High-Net-Worth Clients holding $5 million+ unlock alternative investments including private equity and hedge funds. These diversification options extend beyond traditional stocks available to standard account holders.

- Self-Directed Investors appreciate Schwab’s research dashboard organizing analyst ratings, earnings calendars, and market updates into three analysis tiers. Zero-commission stock trades combined with 3,400+ no-transaction-fee mutual funds reduce portfolio costs significantly.

Schwab’s 60-second average phone wait time and 24/7 support accommodate investors requiring immediate assistance, distinguishing it from Robinhood’s email-only support model.

Final Thoughts, Is Charles Schwab Right For You?

Charles Schwab’s position as America’s largest broker isn’t just about size—it’s about delivering value across diverse investor needs.

Whether you’re starting with your first $100 investment or managing a multi-million dollar portfolio, Schwab’s infrastructure supports your journey without nickel-and-diming you along the way.

The thinkorswim integration gives active traders institutional-level tools while beginners benefit from straightforward interfaces and extensive educational resources.

Yes there are tradeoffs—uninvested cash earns below-market rates and the Android app needs work—but these shortcomings rarely outweigh the platform’s strengths.

What sets Schwab apart is its commitment to accessibility. With 24/7 support that actually answers in under a minute and physical branches when you need face-to-face guidance you’re never truly on your own. The integrated banking features with worldwide ATM reimbursements make it a genuine one-stop financial hub.

For most investors Schwab hits the sweet spot between sophistication and simplicity. It’s built for the long haul—not quick wins—making it ideal if you’re serious about building wealth systematically.