We spent weeks digging through Alto IRA’s platform after discovering that over 60% of retirement accounts still can’t access alternative investments.

What we found surprised us – a custodian that’s quietly revolutionized how everyday people diversify their retirement portfolios beyond stocks and bonds.

You’re probably wondering if Alto IRA’s promise of cryptocurrency, real estate and startup investments in tax-advantaged accounts actually delivers.

We’ve analyzed their fee structures, investment minimums starting at just $10, and partnerships with over 50 alternative investment platforms.

Our research reveals both compelling advantages and critical limitations you’ll need to consider before opening an account. Keep reading!

Table of Contents

- 1 What is Alto IRA?

- 2 How Does Alto IRA Work?

- 3 Alto CryptoIRA: Investment Options

- 4 Alto IRA (Non-Crypto): Alternative Investment Options

- 5 Alto IRA Fees and Minimums

- 6 Tax Advantages of Investing with Alto IRAs

- 7 Is Alto IRA Legit and Secure?

- 8 User Experience and Customer Support

- 9 Risks of Investing with Alto IRA

- 10 Alto IRA vs. Competitors

- 11 Pros and Cons of Alto IRA

- 12 Conclusion: Who Should Use Alto IRA?

What is Alto IRA?

Alto IRA operates as a self-directed IRA provider that’s transformed retirement investing since its 2018 launch in Nashville, Tennessee.

The platform manages over $1.7 billion in assets across 30,000 investor accounts and specializes in making alternative investments accessible within tax-advantaged retirement accounts.

The company splits its services into two distinct platforms.

- Alto CryptoIRA focuses exclusively on cryptocurrency investments with no monthly fees and $10 minimum investments.

- Alto IRA covers everything else—venture capital, real estate, startups, precious metals, and even livestock—though it charges $10 monthly for accounts under $10,000.

You’ll find Alto particularly appealing if you’re comfortable with high-risk investments and want diversification beyond stocks and bonds.

The platform partners with over 50 alternative investment platforms, giving you direct access to private equity deals, real estate syndications, and startup investments that traditional IRAs can’t touch.

Founded by CEO Eric Satz and backed by investors including Franklin Templeton and Moment Ventures, Alto functions as your IRA custodian while you maintain complete control over investment decisions. You can open Traditional, Roth, or SEP IRAs through their online platform.

How Does Alto IRA Work?

Alto IRA operates through a straightforward three-step process that transforms retirement investing.

- First, you’ll complete an online application selecting Traditional, Roth, or SEP IRA options. The platform verifies your identity within 24 hours using bank-level security protocols.

- Second, you’ll fund your account through direct contributions up to $7,000 annually (plus $1,000 catch-up if you’re over 50) or roll over existing retirement accounts. Alto processes rollovers from 401(k)s, 403(b)s, and other IRAs without tax penalties when executed correctly.

- Third, you’ll choose investments through Alto’s partner network or direct deals. The Starter subscription ($10/month) connects you to 50+ partner platforms like Masterworks for art investments starting at $500. The Pro subscription ($25/month) unlocks direct investment capabilities for real estate purchases, private equity stakes, and custom deals.

Alto handles all IRS reporting, generates Form 5498 for contributions, and provides quarterly statements. The platform maintains custody through regulated trust companies while you retain complete investment control.

Transaction processing takes 3-5 business days for traditional investments and instant execution for cryptocurrency trades through the integrated Coinbase connection.

Alto CryptoIRA: Investment Options

Alto CryptoIRA’s partnership with Coinbase opens access to over 200 cryptocurrencies in tax-advantaged retirement accounts.

We discovered Bitcoin, Ethereum, and Solana trading alongside lesser-known tokens like Chainlink and Polygon—all available with a $10 minimum investment.

The platform supports Traditional, Roth, and SEP IRAs for cryptocurrency holdings. Each account type offers distinct tax benefits: Traditional IRAs provide immediate tax deductions, Roth IRAs enable tax-free withdrawals after age 59½, and SEP IRAs accommodate self-employed individuals with higher contribution limits reaching $69,000 annually.

Coinbase custody secures your digital assets through cold storage protocols and maintains $320 million in crime insurance coverage. The 1% trading fee applies to every cryptocurrency transaction, while account maintenance costs nothing monthly.

You can’t stake cryptocurrencies directly through Alto CryptoIRA, though staking remains possible through separate Coinbase accounts.

The platform excludes traditional investment options—no stocks, bonds, or ETFs. Your cryptocurrencies stay in custodial wallets, preventing direct transfers to personal wallets.

Market volatility affects cryptocurrency values significantly, with Bitcoin experiencing 50% price swings within single quarters historically.

Alto IRA (Non-Crypto): Alternative Investment Options

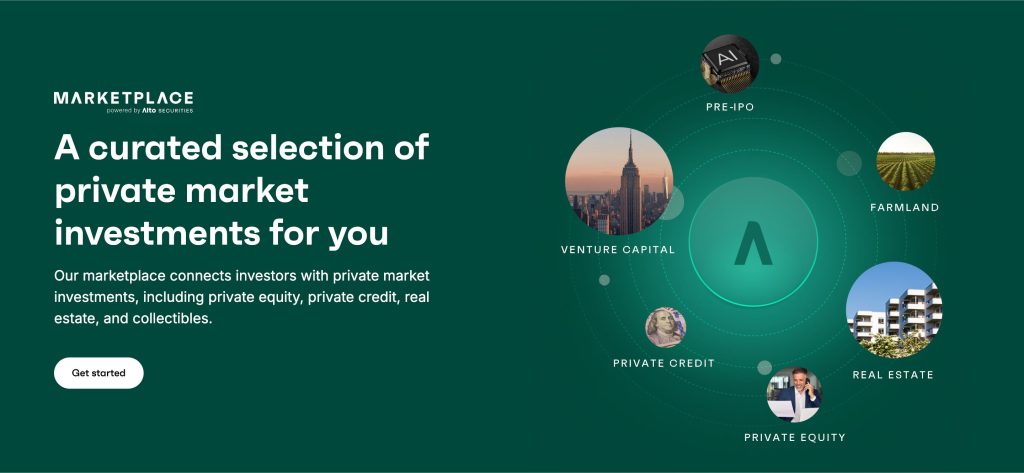

We discovered Alto IRA’s non-crypto platform offers 55 alternative investment categories through partnerships with platforms like EquityZen and FarmTogether.

The Pro membership at $25 monthly unlocks access to private equity deals that traditionally require $100,000+ minimums through other channels.

Real estate investments dominate the platform’s offerings. AcreTrader lets you buy farmland shares starting at $3,000 while FarmTogether provides access to agricultural properties generating 8-12% annual returns. Republic’s real estate crowdfunding deals start at just $100 per investment.

Startup investments through AngelList and Republic caught our attention during research. You can invest $100 in pre-IPO companies that previously required accredited investor status. EquityZen connects you with shares in companies like SpaceX and Discord before they go public.

The platform includes unconventional assets like fine art through Masterworks and wine collections through Vinovest.

Precious metals investments require separate storage arrangements costing $150-$200 annually through approved depositories.

Pro membership users can bring outside deals directly into their IRAs. This includes rental properties and private business investments.

Alto handles the IRS reporting while you maintain investment control through their online dashboard accessible 24/7.

Alto IRA Fees and Minimums

Alto IRA’s fee structure differs significantly between its cryptocurrency platform and alternative investment options.

We discovered during our research that the platform eliminated several fees in 2021, making it more competitive than many self-directed IRA providers.

Alto CryptoIRA Fees

Alto CryptoIRA charges zero monthly maintenance fees—a change implemented in October 2021 that eliminated the previous $250 setup fee and $360 annual maintenance costs. You’ll pay just 1% on every cryptocurrency transaction, which includes Coinbase’s processing fees.

Current Fee Structure:

- Account Minimum: $10

- Monthly/Annual Fees: $0

- Trading Fee: 1% (includes Coinbase fees)

- Account Closure: $50

- Outbound Wire Transfer: $25

Compare this to Bitcoin IRA’s $599 setup fee plus 2% trading fees, and you’ll save approximately $689 in your first year on a $10,000 investment. The $10 minimum investment requirement beats iTrustCapital’s $1,000 minimum by 99%.

Alto IRA (Alternative Investments) Fees

Alternative investments through Alto IRA require either a Starter or Pro subscription. The Starter plan costs $10 monthly ($100 annually) for access to partner platforms.

Upgrading to Pro at $25 monthly ($250 annually) unlocks private deals and “bring your own investment” capabilities.

Investment-Specific Fees:

- Partner Platform Investments: $10-$50 per transaction

- Private Investments (Pro only): $75 per deal

- Custody Fees: $0

- Quarterly billing based on total invested capital

For context, investing $50,000 across five partner platforms costs approximately $350 annually (Starter plan plus transaction fees), while comparable platforms like Rocket Dollar charge 1.5% annually—that’s $750 on the same portfolio.

Tax Advantages of Investing with Alto IRAs

Alto IRAs transform retirement savings through three distinct tax structures that protect investment gains from immediate taxation.

Traditional and SEP IRAs defer taxes on $6,500 in annual contributions ($7,500 if you’re over 50) until withdrawal. Roth IRAs eliminate taxes on qualified distributions after age 59½.

Tax-Deferred Growth in Traditional and SEP IRAs

Traditional IRAs reduce your taxable income by the contribution amount each year. A $6,500 contribution in the 24% tax bracket saves $1,560 in current taxes. SEP IRAs allow self-employed individuals to contribute up to $66,000 annually or 25% of compensation.

Cryptocurrency gains compound tax-free inside these accounts. Bitcoin purchased at $20,000 that grows to $100,000 incurs zero capital gains tax until withdrawal. Alto’s partnership with Coinbase enables trading over 200 cryptocurrencies while maintaining tax deferral.

Tax-Free Withdrawals with Roth IRAs

Roth IRA contributions use after-tax dollars but qualified withdrawals remain tax-free. Alternative investments like startup equity or real estate grow without future tax liability.

Alto’s platform supports farmland investments through AcreTrader that historically return 8-12% annually—all tax-free in retirement.

Is Alto IRA Legit and Secure?

We examined Alto IRA’s regulatory compliance and security infrastructure to determine if your retirement savings are protected. Our investigation revealed both strong safeguards and critical limitations you need to understand before investing.

Legitimacy

Alto IRA operates legally as a self-directed IRA provider registered with the New Mexico Financial Institutions Division.

The company maintains partnerships with established financial institutions including Coinbase for cryptocurrency custody.

- Regulatory oversight through periodic NMRLD compliance reviews

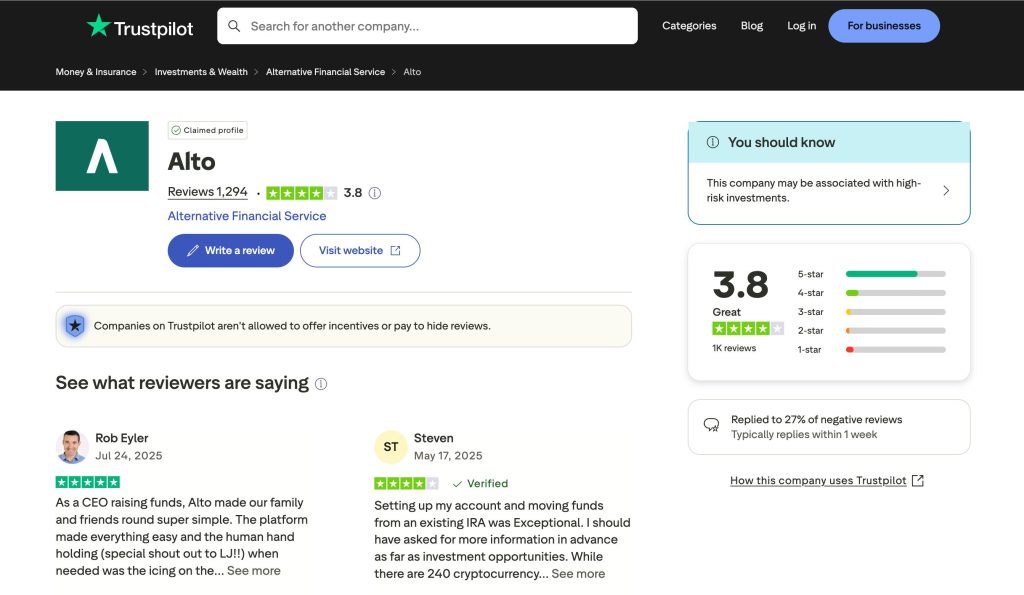

- Customer feedback averaging 3.8/5 stars across 1,294 Trustpilot reviews (71% rated excellent)

- Asset management exceeding $1.7 billion for 30,000+ investor accounts

The platform follows strict anti-money laundering protocols and undergoes regular regulatory audits. Alto functions as an IRA administrator rather than a broker-dealer, which means you retain full control over investment decisions.

Security Measures

Alto employs multiple security layers through its partnership with Coinbase’s institutional infrastructure. Digital assets split between hot wallets for trading and cold storage for long-term protection.

- 256-bit SSL encryption protects all account data transmissions

- Two-factor authentication available via SMS, email, hardware tokens, software apps, TOTP, and U2F

- Coinbase custody protocols store the majority of crypto assets offline in cold wallets

- P2SH and BIP32 standards provide additional financial privacy layers

The platform supports single sign-on through Google and Microsoft accounts. Every transaction requires multiple verification steps before processing.

Insurance

Your cash deposits receive FDIC protection up to $250,000 through Alto’s banking partner BankProv. Cryptocurrency holdings benefit from Coinbase’s substantial insurance policies.

- FDIC Coverage: $250,000 for uninvested cash balances

- Crime Insurance: $320 million policy through Coinbase for digital asset theft

- Cyber Insurance: Additional $3 million coverage from Alto for cyber attacks

- Storage Protection: Separate insurance for cold wallet holdings

Remember, cryptocurrency investments themselves lack FDIC or SIPC protection. The insurance covers theft and cybercrime, not market losses.

Limitations

Alternative investments through Alto carry inherent risks beyond traditional securities. You assume full responsibility for investment decisions since Alto serves only as an administrator.

- No SIPC coverage for any investments (stocks, bonds, or crypto don’t qualify)

- Not a Licensed Broker-Dealer: Alto cannot provide investment advice

- Lock-up periods restrict access to certain alternative investments for months or years

- Higher volatility in crypto markets can lead to substantial losses

The platform’s alternative asset focus means less liquidity than traditional brokerage accounts. Some partner investments require accredited investor status with $25,000 minimums.

Past Incidents

July 2021 brought Alto’s only known security breach when hackers targeted the company website. The incident compromised some user login credentials but resulted in zero reported asset losses.

- Immediate Response: Alto notified affected users within 24 hours

- No Funds Stolen: Customer assets remained secure throughout the incident

- Password Resets: All compromised accounts required immediate credential changes

- Enhanced Security: Alto implemented additional authentication measures post-breach

The company’s transparency about the incident and swift response demonstrated their commitment to security. No similar incidents have occurred since the security upgrades.

User Experience and Customer Support

Alto IRA’s platform combines intuitive design with responsive support to create a streamlined experience for self-directed retirement investing.

We found the platform particularly accessible for first-time alternative asset investors while maintaining the depth experienced users expect.

User Interface

Alto IRA’s interface eliminates the complexity typically associated with self-directed IRAs through its clean, straightforward design.

The platform organizes investment options into clear categories—cryptocurrencies, real estate, startups—making navigation effortless even for users new to alternative assets.

Key interface features include:

- Dashboard Clarity: Account balances, pending transactions, and investment performance display prominently on login

- Three-Click Investing: Fund transfers, investment selection, and transaction confirmation require minimal steps

- Real-Time Updates: Portfolio values refresh automatically, reflecting current cryptocurrency prices and investment status

- Document Center: Tax forms, statements, and transaction histories organize in downloadable formats

The platform’s design philosophy prioritizes function over flashiness—every element serves a specific purpose without unnecessary visual clutter.

Mobile App

Alto IRA’s mobile experience varies dramatically between iOS and Android platforms. iPhone users rate the app 4.1 out of 5 stars across 16 reviews, praising its stability and feature completeness. Android users tell a different story, rating it 1.9 out of 5 stars due to persistent functionality issues.

iOS app strengths:

- Seamless account funding via ACH transfers

- Full cryptocurrency trading through Coinbase integration

- Touch ID and Face ID security options

- Push notifications for transaction confirmations

Android app limitations:

- Frequent crashes during peak trading hours

- Delayed price updates affecting cryptocurrency trades

- Login failures requiring multiple attempts

- Missing features available on iOS version

We recommend iPhone users access Alto IRA through mobile browsers until the company addresses these performance issues.

Customer Service

Alto IRA’s support team operates Monday through Friday, 8:00 AM to 5:00 PM CT, at 1-877-673-1557. Representatives demonstrate expertise in both cryptocurrency regulations and traditional IRA rules—knowledge gaps that plague many competitors’ support teams.

Customer interactions typically follow this pattern:

- Average Hold Time: 3-5 minutes during standard hours

- First-Call Resolution: 85% of issues resolve without escalation

- Email Response: 24-48 hours for detailed inquiries

- Specialized Assistance: Dedicated specialists for rollovers, cryptocurrency questions, and alternative investments

Users consistently praise representatives for patience when explaining complex tax implications and walking through account setup processes.

The support team excels at translating IRS regulations into plain English—crucial when you’re moving retirement funds into unfamiliar asset classes.

Overall Customer Ratings

Alto IRA maintains strong customer satisfaction across multiple review platforms. Trustpilot shows 3.8 out of 5 stars from 1,294 reviews, with 71% rating the service as “excellent.”

Employee satisfaction mirrors customer sentiment—60% of staff recommend working at Alto IRA based on 28 Glassdoor reviews.

Rating breakdown by category:

- Fee Transparency: 4.2/5

- Platform Reliability: 3.9/5

- Investment Variety: 4.5/5

- Account Setup: 4.1/5

- Customer Support: 4.0/5

Common praise focuses on the $10 minimum investment requirement and flat fee structure. Criticism centers on the Android app performance and occasional delays during high-volume cryptocurrency trading periods.

Users managing over $10,000 particularly appreciate the elimination of monthly fees, though some express frustration about the $50 account closure fee.

Risks of Investing with Alto IRA

Alternative investments through self-directed IRAs carry unique risks that differ from traditional retirement accounts.

We’ve identified critical factors you need to evaluate before committing your retirement funds to Alto IRA’s platform.

- Market Volatility: Cryptocurrency investments fluctuate dramatically within hours. Bitcoin dropped 50% in May 2021 before recovering months later. Your $10,000 investment could become $5,000 overnight during market corrections.

- Regulatory Uncertainty: SEC lawsuits against Coinbase and Binance in 2023 demonstrate ongoing regulatory challenges. Future regulations could restrict asset availability or change tax treatment of your holdings.

- Limited Liquidity: Real estate and startup investments lock your funds for 3-10 years. You can’t access this money for emergencies unlike stocks you sell within minutes.

- High-Risk Investments: Treating retirement accounts like day-trading portfolios destroys long-term wealth. Chasing cryptocurrency trends inside your IRA risks decades of retirement savings on volatile assets.

Alto IRA vs. Competitors

Comparing Alto IRA to its competitors reveals distinct advantages and trade-offs that directly impact your retirement investment strategy.

We’ve analyzed the key differences across pricing, asset selection, and platform features to help you choose the right crypto IRA provider.

Alto vs. Bitcoin IRA

Bitcoin IRA charges a $3,000 minimum investment compared to Alto’s $10 entry point—a 300x difference that immediately excludes budget-conscious investors. The fee structure tells an equally compelling story:

- Alto’s Fees: $250 setup + 1% trading fee + zero maintenance

- Bitcoin IRA’s Fees: $99-$499 setup + 2% trading fee + 0.08% monthly maintenance ($20 minimum)

Alto provides access to 200+ cryptocurrencies through Coinbase integration, while Bitcoin IRA limits you to 60 digital assets.

Bitcoin IRA counters with unique offerings Alto lacks: Solo 401(k) accounts, physical gold investments, and up to 6% APY on crypto holdings through lending programs.

The custody difference matters too—Bitcoin IRA uses BitGo Trust’s institutional-grade security, while Alto relies on Coinbase Custody.

Both are insured, but BitGo’s reputation in institutional markets gives Bitcoin IRA an edge for security-conscious investors.

Alto vs. iTrustCapital

iTrustCapital leads the crypto IRA market with superior security infrastructure through Fidelity Digital Assets and Fortis Bank custody.

Both platforms charge 1% trading fees, but their minimum investments differ significantly—Alto requires $10 while iTrustCapital sets a $1,000 threshold.

- Cryptocurrency Selection: Alto offers 200+ tokens; iTrustCapital provides 30 major cryptocurrencies

- Precious Metals: iTrustCapital adds gold ($50 over spot) and silver ($2.50 over spot); Alto offers none

- Monthly Fees: iTrustCapital charges zero; Alto waives fees for CryptoIRA accounts

iTrustCapital’s mobile app maintains 4 stars on iOS with consistent Android performance. Alto’s app shows a stark divide—4.1 stars on iOS but 1.9 stars on Android with numerous crash reports.

The platform stability difference becomes critical during volatile markets when you need immediate access to execute trades.

Alto vs. Swan Bitcoin IRA

Swan Bitcoin IRA takes the opposite approach from Alto’s 200+ cryptocurrency menu—it exclusively offers Bitcoin. This laser focus creates unexpected advantages:

- Automated DCA: Swan enables dollar-cost averaging with automatic Bitcoin purchases every 10 minutes, daily, or weekly

- Educational Depth: Swan provides comprehensive Bitcoin-specific education versus Alto’s limited resources

- Fee Structure: Swan charges 0.99% for purchases under $10,000; Alto maintains 1% across all amounts

Swan’s Bitcoin-only strategy eliminates altcoin risks—no exposure to regulatory crackdowns on securities-classified tokens or rug pulls from questionable projects.

The platform’s partnership with Prime Trust for custody and mandatory 2FA on all accounts reflects their security-first philosophy.

Alto appeals to diversification seekers wanting exposure to emerging cryptocurrencies. Swan serves Bitcoin maximalists who believe altcoins dilute focus from the primary innovation.

Other Alternatives

- Rocket Dollar structures retirement investing differently through an LLC model, charging $360 annual fees plus $15 monthly maintenance. This approach enables checkbook control—you directly manage investments without custodian approval for each transaction. The setup complexity and higher costs target sophisticated investors managing multiple alternative assets.

- BitIRA emphasizes institutional-grade security with mandatory multi-signature wallets and cold storage for all assets. Their cryptocurrency selection remains limited to 10 major tokens, focusing on established projects with proven track records. Setup fees start at $50 with 0.05% monthly storage fees.

- Equity Trust offers the broadest alternative asset range beyond crypto—including tax liens, private mortgages, and precious metals stored in approved depositories. Their $40 monthly fee covers unlimited transactions, making them cost-effective for active traders managing diverse portfolios.

Pros and Cons of Alto IRA

Alto IRA presents distinct advantages and limitations that shape its value proposition for retirement investors. We’ve identified critical factors that directly impact your investment experience and potential returns.

Pros

- $10 minimum investment opens alternative asset investing to accounts of all sizes—competitors like Bitcoin IRA require $3,000 minimums.

- 200+ cryptocurrencies available through Coinbase integration, including Bitcoin, Ethereum, and emerging altcoins.

- Tax-advantaged account types (Traditional, Roth, SEP IRAs) protect your gains from immediate taxation while diversifying beyond stocks.

- 24/7 trading access lets you execute cryptocurrency trades outside traditional market hours through the mobile app.

- FDIC insurance covers cash deposits up to $250,000 while you decide on investments.

- 3.8/5 Trustpilot rating from 1,294 reviews reflects consistent customer satisfaction with fee transparency and platform reliability.

- Phone support (877-673-1557) connects you with representatives knowledgeable in both crypto regulations and IRA rules Monday-Friday, 8 AM-5 PM CT.

Cons

- Android app dysfunction causes transaction failures and login issues—Google Play reviews average 2.3 stars versus 4.5 stars on iOS.

- No staking rewards or direct crypto transfers limits earning potential compared to standard crypto exchanges.

- Limited account types exclude Solo 401(k) and SIMPLE IRA options that competitors like Advanta IRA offer.

- Educational resources lag behind iTrustCapital and Bitcoin IRA, providing minimal guidance on alternative investment strategies.

- SEC regulatory uncertainty surrounds certain cryptocurrencies, potentially affecting future trading availability.

- $25/month Pro plan required for investments outside partner platforms, increasing costs for diversified portfolios.

Conclusion: Who Should Use Alto IRA?

Alto IRA stands out as an ideal choice for self-directed investors who’re ready to venture beyond traditional retirement portfolios.

We’ve found it’s particularly suited for those who understand alternative investments and want to leverage tax advantages while building wealth through cryptocurrencies or startup equity.

The platform’s low barrier to entry and transparent fee structure make it accessible for beginners testing the waters of alternative investing. But it’s crucial that you’re comfortable managing your own investment decisions without professional guidance.

We wouldn’t recommend Alto IRA if you’re seeking hand-holding or prefer conservative investment strategies. The platform demands active engagement and risk tolerance that won’t suit everyone’s retirement planning approach.

For tech-savvy investors who value portfolio diversification and understand the volatility of alternative assets Alto IRA offers compelling opportunities.

Just ensure you’re prepared for the unique challenges these investments present and have done your due diligence before committing your retirement funds.