When I first stumbled into the world of precious metals investing, BGASC caught my eye like a glinting piece of gold.

This review peels back the layers of their reputation, revealing insights that could be the difference between a smart investment and a costly mistake.

Stick with me through the next few paragraphs—your financial future might just depend on the details I’m about to share.

Table of Contents

What is BGASC?

BGASC stands as a prominent precious metals dealer that established its operations in Dallas, Texas in 2012, rapidly ascending to become a leading supplier of precious metals across the United States.

The founders established BGASC with a customer-centric vision, creating a marketplace that mirrors their ideal shopping experience – offering comprehensive inventory, swift shipping, competitive pricing, and unwavering integrity in every transaction.

Their extensive catalog encompasses various gold and silver products alongside an impressive collection of numismatic pieces sourced globally, featuring selections from the United States, Canada, European nations, the United Kingdom, and Australia.

This comprehensive selection positions BGASC as an ideal destination for both investment-focused buyers and passionate coin collectors.

BGASC has garnered significant credibility through various accolades, including an A+ Better Business Bureau rating and affiliations with prestigious coin grading and trading organizations, demonstrating their expertise and commitment to ethical business practices.

Despite their substantial growth and capability to handle major transactions, BGASC maintains an inclusive approach, welcoming customers regardless of their purchase volume.

Their track record includes successfully fulfilling over 500,000 orders, representing billions in precious metals transactions, with each shipment protected by comprehensive insurance coverage, ensuring complete peace of mind for their customers.

What Makes BGASC Stand Out?

BGASC has more achievements than other online precious metals companies that are working in this field. The company has a very big vision to make precious metals investment easier and also wants to make metal trading possible for different investors, especially beginners.

Below are important elements that show the company’s strengths and special services:

- Diverse Inventory: A good precious metals company can give high-quality gold and silver coins, which help traditional investors complete their investment goals.

- Bullion Bars: These bars make your investment very easy by giving you many size options that help to match your budget.

- Collectible Coins: Many collectors can add rare and historical coins that are very useful for collection growth.

- Innovative Products: Different products like copper bullets make precious metals trading very interesting for enthusiasts.

- Efficient Transactions: A proper buying process helps to complete purchases safely and quickly.

- Accessibility: Small minimum purchase amounts make metal investment possible for many people.

- Dedicated Support: Customer service teams solve problems and make trading experience very good for investors.

BGASC proves just how innovative the precious metals market is and how they sustain trading traditions. These services may depict different patterns and beautiful possibilities containing stories of the investment and about people’s financial goals and preferences.

Products Offered by BFASC

BFASC provides a comprehensive selection of precious metals, encompassing gold, silver, platinum, and palladium. Their inventory features an extensive range of coins, bars, and rounds.

The collection includes unique collectible pieces. With various sizes and styles available, you’ll find options suitable for both novice collectors and seasoned investors.

1. Gold

BGASC offers extensive gold selections. Their inventory features sought-after items like American Gold Eagles and Canadian Gold Maple Leaves, which attract both collectors and investors.

The collection extends to international offerings, including South African Krugerrands and Australian Kangaroos.

Their gold bar selection showcases products from renowned manufacturers like PAMP Suisse and Valcambi, available in multiple sizes to accommodate varying budgets.

Each gold product maintains high-quality standards, featuring distinctive designs and authentication markers.

2. Silver

BGASC’s silver collection stands out with its diverse offerings. American Silver Eagles remain a customer favorite due to their exceptional design. The selection includes unique Poured Silver Bars and Shapes for distinctive tastes.

Canadian Silver Maple Leaves attract attention with their intricate designs. International options like Austrian Silver Philharmonic and British Silver Coins represent global minting excellence.

Bulk silver coin boxes provide an efficient option for substantial acquisitions. BGASC’s international silver selection ensures broad choice availability.

3. Platinum

This premium metal commands higher prices than gold or silver due to its rarity. Platinum coins come in one-ounce and half-ounce denominations.

Available options include the Platinum Canadian Maple Leaf and Platinum American Eagle. These coins combine aesthetic appeal with premium platinum quality.

Their scarcity adds value to collections, making them particularly desirable. Investors and collectors choose these coins for both collection enhancement and potential value appreciation.

4. Copper

While precious metals dominate, copper gains increasing recognition. Its industrial applications and rising value drive growing interest.

Distinctive pieces like the 1 oz Year of the Dragon Copper Round and 10-pound Elemental Cast Copper Bar appeal to both investors and collectors, combining investment potential with aesthetic value.

5. Other

BGASC extends beyond traditional precious metals. Their palladium selection, crucial for automotive applications and coinage, includes notable pieces.

Popular palladium options feature American Palladium Eagle and Canadian Palladium Maple Leaf coins. Premium palladium bars from established manufacturers like Argor Heraeus, PAMP Suisse, and Valcambi complete the selection.

The company provides essential accessories including holders, capsules, and gloves for proper coin and bar maintenance.

Their specialty items extend to commemorative notes and coins, featuring unique designs like baseball bucks and Donald Trump coins, offering opportunities for collection diversification or investment expansion.

Services Offered by BGASC

BGASC provides comprehensive services that cater to both investors and collectors. Their offerings include precious metal IRAs, secure storage solutions, and valuable educational resources designed for investors at all experience levels.

1. Precious Metals IRAs

You can enhance your retirement portfolio by incorporating gold and silver through BGASC, creating a more balanced and potentially secure investment strategy.

Starting a precious metals IRA with BGASC requires a minimum investment of $30,000. Storage and management fees apply, so consulting directly with BGASC representatives helps understand all associated costs.

How to Get Started

Follow these steps to begin investing with BGASC:

- Open a Self-Directed IRA Account: Select an IRA Custodian and submit your personal and banking details for account creation.

- Fund the IRA Account: Transfer funds from existing retirement accounts or make new deposits. Await custodian confirmation.

- Buy Approved Precious Metals: Select from BGASC’s range of IRA-approved gold and silver products. BGASC manages storage and documentation.

Popular IRA-approved products include:

- 2024 1/10 oz Australian Gold Kangaroo Coin (BU)

- 1 oz American Gold Eagle Coin (Random Year)

- 1 oz Canadian Gold Maple Leaf Coin (Random Year, .9999 Pure)

- 2024 1 oz American Gold Buffalo Coin (BU)

Custodian Choices

BGASC allows flexibility in custodian selection, offering recommended options while allowing you to choose your preferred custodian. These professionals ensure account compliance and proper management.

- GoldStar Trust Company: Based in Canyon, TX, GoldStar Trust Company stands as a reliable IRA custodian, specializing in account management and setup services. Contact them for IRA assistance.

- Equity Trust: Operating from Westlake, OH, Equity Trust specializes in self-directed IRAs, including precious metals investments. Their extensive experience ensures smooth, compliant investment processes.

- STRATA Trust Company: Located in Waco, TX, STRATA Trust Company specializes in self-directed IRAs for precious metals and real estate investments. They excel in providing personalized service and educational resources for informed retirement planning.

Research each custodian thoroughly to determine the best match for your investment goals before proceeding with your precious metals IRA.

BGASC’s Preferred Depository

A-M Global Logistics, LLC, situated in Las Vegas, Nevada, serves as BGASC’s preferred storage partner. They provide comprehensive services including secure storage, verification, packaging, and shipping capabilities, with additional international storage options available.

2. Sell to Us Service

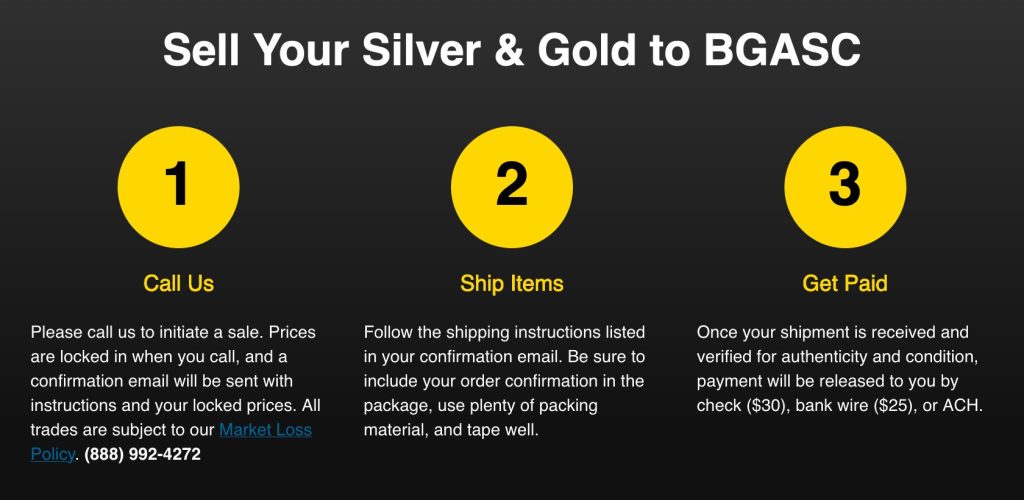

BGASC provides a straightforward service for selling your silver and gold. They ensure competitive market-based pricing when you contact them for a sale.

The selling process follows clear steps, offering multiple payment options to ensure a seamless transaction experience.

How to Sell Your Precious Metals

Follow these steps to establish an account and sell precious metals to BGASC:

- Call Us: Contact (888) 992-4272 to initiate your sale. BGASC locks your price immediately and sends detailed instructions via email. All transactions must comply with BGASC’s market price policies.

- Ship Items: Package your items according to email instructions. Include your confirmation document within the shipment. Ensure secure packaging to protect items during transit.

- Get Paid: Upon receipt, BGASC verifies authenticity and condition. Select your preferred payment method: bank wire ($25), check ($30), or ACH (free).

BGASC requires a minimum sale order of $1,000. For items not listed on their website, contact their purchase team for potential offers.

Payment Options

BGASC offers these payment methods:

- Electronic Check (ACH): No charge.

- Check by Mail: $30 fee.

- Bank Wire Transfer: $25 fee.

Consider each option’s fees when making your selection.

Popular Products to Sell

BGASC commonly purchases these items:

Gold:

- 1 oz American Gold Eagle Coin (Random Year)

- 1/10 oz American Gold Eagle Coin (Random Year)

- 1 oz South African Gold Krugerrand Coin (Random Year)

- Gold Bars (1 oz)

Silver:

- 1 oz Canadian Silver Maple Leaf Coin (Random Year)

- 1 oz Silver Round (Any Mint)

- Silver Bars (1 oz, 10 oz, 100 oz)

Platinum:

- 1 oz American Platinum Eagle Coin (Random Year)

- 1 oz Canadian Platinum Maple Leaf Coin (Random Year)

- Platinum Bars (1 oz)

What Are the Customer Reviews and Ratings for BGASC?

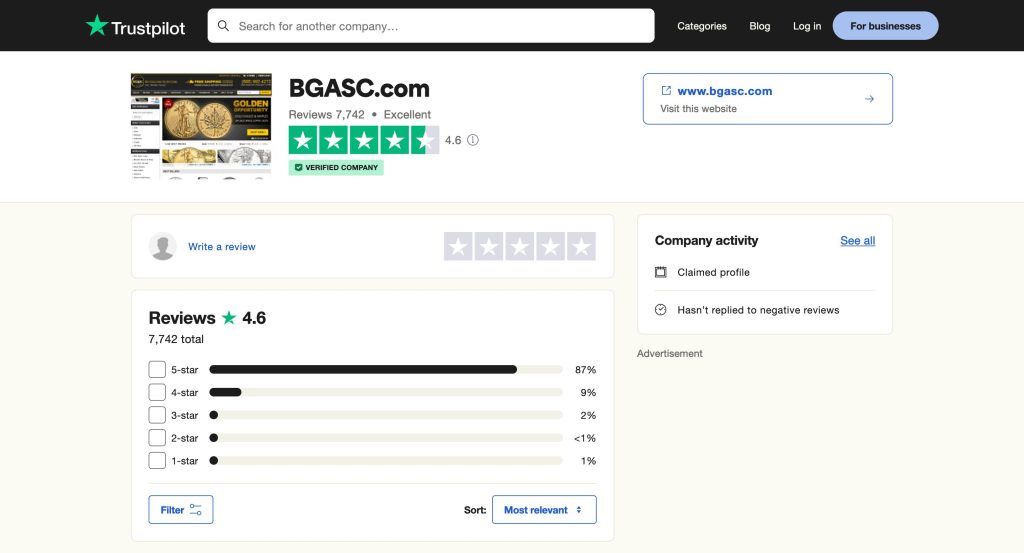

BGASC operates as a precious metals retailer specializing in gold and silver products, garnering predominantly positive feedback from customers.

Their Trustpilot profile showcases an impressive rating of 4.5 out of 5, compiled from 7,741 customer reviews.

Similarly, on Shopper Approved, they maintain an equally strong performance with a 4.8/5 rating based on 4,868 customer evaluations.

The Better Business Bureau (BBB) presents a contrasting perspective, where BGASC holds a rating of 3.87 out of 5, though this score stems from merely 36 reviews.

Notably, BGASC maintains an A+ accreditation from BBB, indicating their commitment to sound business practices and customer service standards.

Customers particularly appreciate BGASC’s accommodating approach to smaller investments, allowing them to gradually build their precious metals portfolio through incremental purchases. The company’s efficient delivery system consistently receives praise for its promptness.

A significant number of customers highlight BGASC’s competitive pricing structure compared to industry competitors, along with their dedication to customer satisfaction.

Nevertheless, some customers have reported isolated incidents, including delivery issues such as empty packages or products not meeting quality expectations.

While these negative experiences represent a small fraction of overall customer interactions, they emphasize the importance of maintaining high service standards, particularly during leadership transitions.

The company’s ability to address and resolve these occasional issues remains crucial for sustaining their strong market reputation.

Pros and Cons of BGASC

BGASC offers many advantages and disadvantages for precious metals purchasing that need careful consideration. These points help make a proper assessment of the company’s services.

Pros:

- Extensive Product Range: BGASC provides a vast inventory with a broad selection of IRA-eligible and non-IRA precious metals. Many products cater to investor needs for retirement savings and casual investments in physical assets.

- High Customer Satisfaction: Customer feedback shows good performance with many 5-star reviews on Trustpilot and an A+ rating from Better Business Bureau (BBB). These ratings prove reliability and service quality.

- Investment Versatility: BGASC makes purchasing simple for casual investors who want few coins for non-retirement savings, giving good investment options.

- Benefits of Precious Metals Investment: Precious metals through BGASC give portfolio diversification, inflation protection, worldwide acceptance, and physical asset ownership. These features make BGASC a good choice for market protection and financial security.

- Expertise in Precious Metals IRA: BGASC gives special support and products for retirement account investors, using knowledge to help people add physical assets to retirement savings, though IRA services remain limited.

Cons:

- Limited IRA-Eligible Products: BGASC has many products but most cannot go into IRA accounts. This creates problems for retirement investors who want more precious metals choices.

- Service Streamlining Issues: Company operations show less efficiency compared to other dealers, which affects investment purchase and management ease.

- Operational Drawbacks: Online-only business model reduces personal contact which some investors prefer over digital service. Small orders need shipping payment and some customers report delivery delays and slow customer service responses.

BGASC shows good potential for precious metals investment but needs proper evaluation of benefits and problems.

Understanding these factors helps investors make good decisions matching their investment goals and needs.

Is BGASC a Reputable Company?

BGASC stands among the most trusted online precious metals dealers, specializing in gold and silver products.

Since their establishment in 2012, they have built a strong reputation through exceptional customer service and transparent business practices.

The company offers extensive selections of coins and bullion bars, many qualifying for precious metals IRAs.

Their competitive pricing, secure shipping protocols, and product authenticity verification make them stand out in the industry.

They maintain transparency with their fee structure, eliminating hidden costs. Their Better Business Bureau rating reflects their credibility, while customer testimonials consistently praise their service quality, timely deliveries, and product excellence.

Frequently Asked Questions

Q1. Who owns BGASC?

A-Mark Precious Metals, Inc. acquired BGASC through its subsidiary, JM Bullion, with a $4.5 million cash transaction.

Operating from California since 2012, BGASC has served over 70,000 customers, generating annual revenues exceeding $200 million.

The acquisition by A-Mark strengthens their market position and streamlines their precious metals supply chain management.

Q2. How long does BGASC take to ship?

Shipping typically occurs within 1-3 business days after payment confirmation. Delivery timeframes vary based on payment methods and order volumes.

Their secure shipping protocols include tracking capabilities for customer convenience. Express shipping options remain available for time-sensitive orders.

Q3. Where is BGASC located?

BGASC operates from their headquarters in Calabasas, California. This central location enables efficient nationwide distribution and customer service operations, supporting their commitment to rapid order fulfillment and customer satisfaction.

Q4. What is the return policy for BGASC?

Returns must be initiated within five business days of receipt. Products must remain in original, unopened condition for eligible returns.

Precious metals returns involve special considerations due to market price fluctuations. Additional fees may apply to returns, and customers bear return shipping costs.

Conclusion

BGASC proves itself as a reliable precious metals dealer, offering competitive pricing and diverse product selections suitable for both novice and experienced investors.

Their commitment to transparency and security establishes them as a trustworthy choice for precious metals purchases.