Disclosure: “The owners of this website may be paid to recommend Goldco or other companies. The content on this website, including any positive reviews of Goldco and other reviews, may not be neutral or independent.” Learn More

You’re considering a self-directed IRA to invest in real estate or precious metals, but you’re stuck comparing custodians.

With over $52 billion in assets under management and 368,000 clients since 1974, Equity Trust Company stands out as one of the largest players in alternative asset investing. But bigger doesn’t always mean better for your portfolio.

Before you commit your retirement savings to any custodian, you need the full picture. This review breaks down Equity Trust’s services, fees, and customer experiences to help you decide if they’re the right fit for your investment goals.

Table of Contents

- 1 Introducing Equity Trust Company: Background & Overview

- 2 Diverse Investment Options and Account Types

- 3 Getting Started: Account Opening Process

- 4 Platform Design and Usability (myEQUITY)

- 5 Fees and Charges Analysis

- 6 Customer Service and User Experience

- 7 Pros and Cons of Equity Trust Company

- 8 Comparing Equity Trust to Alternatives

- 9 Conclusion: Is Equity Trust Right for You?

Introducing Equity Trust Company: Background & Overview

You’re examining a financial institution that’s been shaping self-directed retirement investing for five decades.

Equity Trust Company manages billions in alternative assets and serves hundreds of thousands of investors across the United States.

Foundation and History

Richard Desich founded Equity Trust Company in 1974, establishing the foundation for what would become a major force in self-directed investing.

You’re looking at a company that achieved IRS approval as a non-bank custodian in 1983—a critical milestone that legitimized its operations in the alternative asset space.

The company reached another pivotal moment in 2003 when it received its Trust Charter. This charter transformed Equity Trust from a standard financial services provider into a fully regulated trust company.

You’re dealing with an institution that’s weathered market cycles, regulatory changes, and industry evolution for 50 years.

Leadership Team

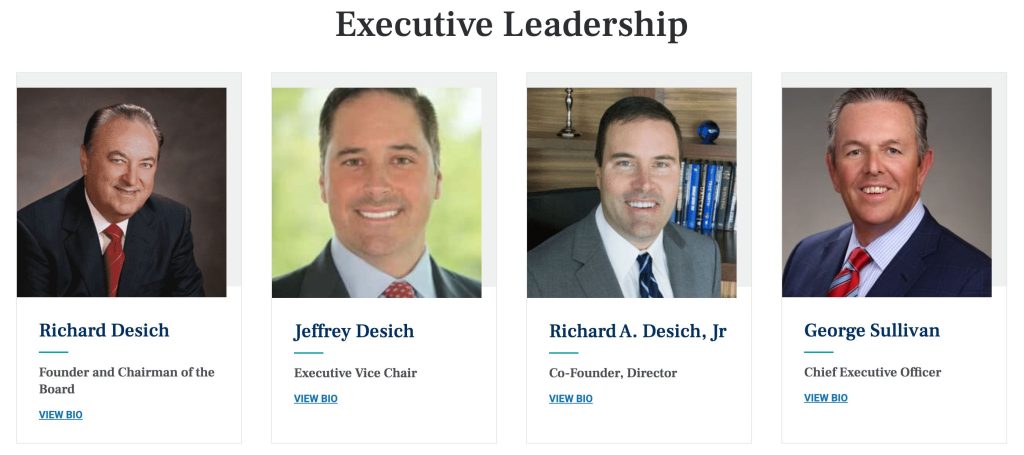

Four key executives drive Equity Trust’s strategic direction. Richard Desich continues serving as Founder and Chairman of the Board, maintaining the company’s original vision.

Jeffrey Desich holds the Vice Chair position, while Richard A. Desich Jr. serves as Executive Director—creating a family leadership structure that spans generations.

George E. Sullivan occupies the CEO role, bringing external perspective to the founding family’s leadership core.

You’re investing with a company where leadership stability meets fresh strategic thinking. This blend of institutional knowledge and modern management approaches shapes how Equity Trust serves its clients today.

Company Size & Operations

Equity Trust’s scale reveals both impressive growth and reporting inconsistencies. Assets under management range from $12 billion to $70 billion depending on the source—a variance that raises questions about transparency. Client accounts show similar discrepancies, with reports ranging from 130,000 to 412,000 accounts.

The company employs between 400 and 500 staff members who process approximately 2.5 million transactions annually.

You’re evaluating a custodian that operates at significant scale, yet these conflicting numbers suggest careful due diligence is essential.

The transaction volume—roughly 6,850 daily—demonstrates substantial operational capacity regardless of the exact client count.

Diverse Investment Options and Account Types

Equity Trust Company distinguishes itself through comprehensive investment flexibility that extends far beyond traditional retirement account offerings.

You’ll find both conventional and alternative investment opportunities across multiple account types, giving you control over your retirement strategy.

Core Self-Directed IRA Accounts

Equity Trust provides five primary self-directed IRA account types. Traditional IRAs let you contribute pre-tax dollars and defer taxes until withdrawal. Roth IRAs accept after-tax contributions but offer tax-free withdrawals in retirement.

SEP IRAs serve small business owners and self-employed individuals, allowing contributions up to 25% of compensation or $69,000 for 2024.

SIMPLE IRAs work for businesses with fewer than 100 employees, featuring lower administrative costs than 401(k) plans.

Solo 401(k) accounts cater to self-employed individuals or business owners without employees. You can contribute as both employee and employer, reaching contribution limits of $69,000 in 2024, or $76,500 if you’re 50 or older.

Other Tax-Advantaged Accounts

Beyond IRAs, Equity Trust administers Health Savings Accounts (HSAs) and Coverdell Education Savings Accounts (CESAs).

HSAs triple your tax advantages—deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. You can invest HSA funds in real estate, precious metals, and other alternatives just like IRAs.

CESAs help you save for education expenses with tax-free growth. Annual contribution limits reach $2,000 per beneficiary, and funds must be used by age 30.

You can invest CESA assets in the same alternative investments available for IRAs, providing unique education funding strategies beyond traditional savings accounts.

Wide Array of Investment Options

Equity Trust supports an extensive investment catalog spanning traditional and alternative assets. Alternative investments include real estate (rental properties, raw land, commercial buildings), private lending opportunities, and tax lien certificates. You can hold physical precious metals like gold and silver coins or bars meeting IRS purity standards.

Digital currency investments through Equity Trust include Bitcoin and Ethereum held in specialized cryptocurrency IRAs. Private equity investments, forex trading, and futures contracts round out the alternative options.

Traditional investments remain available—stocks, bonds, mutual funds, and ETFs trade through the platform’s brokerage services.

This combination lets you build diversified portfolios mixing conventional securities with alternative assets under one custodian.

Notable Products and Services

The Equity Universal IRA® stands as Equity Trust’s flagship product, consolidating multiple investment types within a single account structure. You avoid maintaining separate accounts for different asset classes, streamlining administration and reducing fees.

Equity Advisor Solutions provides tools and support for financial advisors and broker-dealers working with self-directed accounts. The platform includes compliance resources, client education materials, and streamlined account opening processes.

ETC Brokerage combines traditional investment capabilities with alternative asset tools. You access real-time trading for stocks and ETFs while managing real estate transactions and private placements through the same interface.

Strategic Partnerships

Equity Trust maintains strategic relationships to expand investment opportunities. The partnership with Augusta Precious Metals facilitates gold IRA investments, providing dedicated specialists who guide you through precious metals selection and storage arrangements.

This collaboration streamlines the process of adding physical gold and silver to retirement accounts. Augusta’s team coordinates directly with Equity Trust for account setup, funding transfers, and ongoing administration.

The partnership exemplifies how Equity Trust leverages specialized expertise to enhance specific investment categories while maintaining its role as neutral custodian.

Getting Started: Account Opening Process

Opening a self-directed IRA with Equity Trust takes about 10 minutes through their myEQUITY platform. You’ll navigate a streamlined process that gets your account ready for alternative investments within three business days.

Three-Step Process

Step 1: Create Your Account

You’ll start by selecting your account type—Traditional IRA, Roth IRA, or Solo 401(k)—through the myEQUITY Online Application Wizard.

The wizard walks you through entering personal details like your Social Security number, employment information, and beneficiary designations. This initial step takes 10 minutes and requires a $50 setup fee.

Step 2: Fund Your Account

You have three funding options:

- Rollover: Transfer funds from an existing 401(k) or employer plan

- Transfer: Move money from another IRA custodian

- Contribution: Make annual contributions up to IRS limits ($7,000 for 2024, $8,000 if you’re 50+)

Step 3: Start Investing

You find the investment opportunity—whether it’s a rental property, private loan, or cryptocurrency. You then instruct Equity Trust to execute the transaction. They handle all paperwork and ensure IRS compliance while you maintain control over investment decisions.

Educational Tools & Security

Equity Trust arms you with knowledge through their comprehensive education platform. You’ll access:

- Live webinars covering topics like real estate investing and tax strategies

- On-demand tutorials explaining account setup and transaction processes

- Investment guides detailing specific alternative asset classes

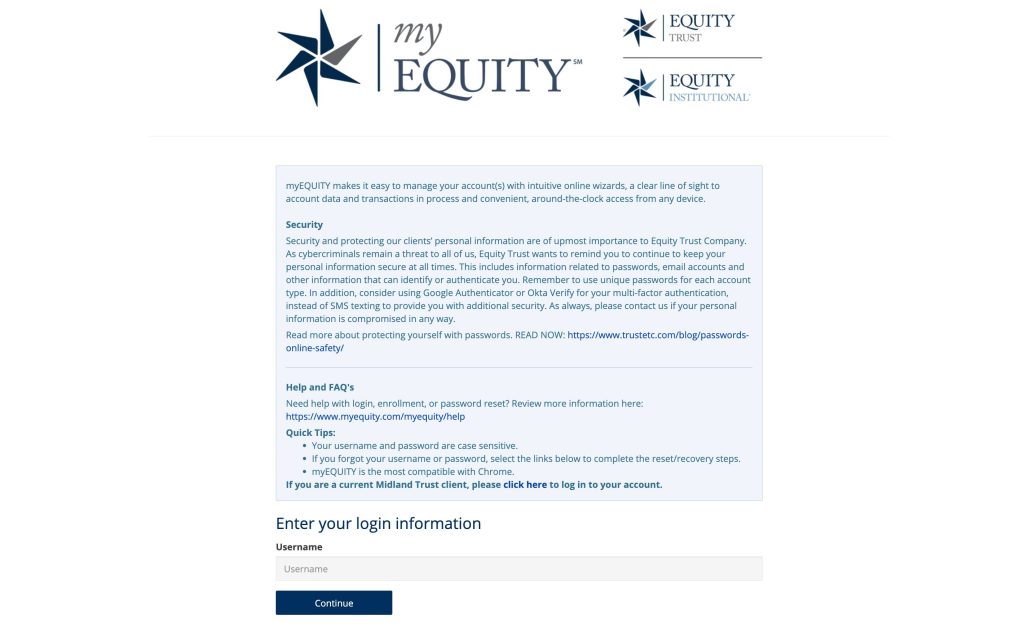

Your account stays protected through enterprise-level security measures. The myEQUITY platform uses advanced encryption to safeguard your personal data during every transaction.

Multi-factor authentication adds an extra security layer—you’ll verify your identity through text messages or authentication apps each time you log in.

The platform operates across all devices. You can check account balances on your phone during lunch or initiate a real estate purchase from your laptop at home. Customer support stands ready at 888-382-4727 (9 AM – 6 PM EST) if you hit any roadblocks during setup.

Platform Design and Usability (myEQUITY)

The myEQUITY platform serves as your digital command center for self-directed IRA investing at Equity Trust.

This web-based system transforms complex investment management into streamlined workflows, though user experiences vary significantly.

Features of myEQUITY

You’ll access your entire portfolio through myEQUITY’s dashboard on desktop or mobile devices. The platform tracks all your alternative assets—real estate holdings, private equity positions, cryptocurrency investments—in real-time. Online bill pay eliminates paper checks for property taxes or maintenance fees on your rental properties.

The myEQUITY Connect API suite integrates with external investment platforms, keeping you in one interface while automating IRA transactions.

You can open new accounts, submit investment requests, and download tax documents like 1099-R forms directly. The platform supports diverse asset classes: stocks, bonds, futures contracts, precious metals, and private lending notes.

Mobile functionality lets you approve transactions during your morning commute or check account balances from your couch.

Desktop access provides fuller reporting capabilities for analyzing your portfolio’s performance across multiple investment types.

User Feedback

You’ll find stark contrasts in how investors rate myEQUITY’s usability. Users managing simple portfolios praise the intuitive design—they complete transactions in minutes and appreciate real-time investment tracking.

Complex portfolio holders report different experiences: sluggish report generation, confusing navigation paths, and steep learning curves for first-time self-directed IRA investors.

Customer reviews highlight specific pain points. You might wait 30+ seconds for pages to load during peak hours. The platform occasionally times out when generating quarterly statements. Some users struggle locating specific functions, particularly tax document downloads.

Positive feedback centers on educational resources. You’ll access webinars explaining investment processes and tutorials walking through common tasks.

Users managing alternative assets value the platform’s flexibility—tracking rental income, precious metals holdings, and cryptocurrency positions in one dashboard.

Even though technical hiccups, investors appreciate consolidating diverse investments under single account management.

Fees and Charges Analysis

You’re looking at costs that range from reasonable to eyebrow-raising when you open an account with Equity Trust Company.

Understanding the complete fee picture requires digging past the advertised rates to uncover what you’ll actually pay.

Annual Fee Structure

Equity Trust charges annual fees based on your account value, starting at $205 for accounts under $15,000 and climbing to $2,150 for portfolios exceeding $2 million.

You’ll find conflicting information across different sources—some report the bottom tier at $225 and the top tier at $2,250. The company uses a tiered structure with approximately 10 different pricing levels.

| Account Value | Annual Fee |

|---|---|

| Up to $14,999 | $205 |

| $15,000-$24,999 | $320 |

| $25,000-$49,999 | $350 |

| $50,000-$99,999 | $425 |

| $100,000-$199,999 | $500 |

| $200,000-$299,999 | $700 |

| $300,000-$399,999 | $750 |

| $400,000-$499,999 | $1,075 |

| $500,000-$999,999 | $1,750 |

| $1M-$2M | $1,850 |

| Over $2M | $2,150 |

These fees cover standard custodial services but don’t include transaction-specific charges you’ll encounter throughout the year.

Additional Charges

You’ll face a $50 application fee when opening your account online, though some sources report fees up to $75 for paper applications.

Closing your account triggers termination fees—$100 per asset for partial terminations or a flat $225 for complete account closure. Distribution and re-registration fees add another $100 per asset.

Digital asset investors pay extra: $500 for platform setup, $150 for segregated storage, plus $20 monthly maintenance. Paper statements cost $40 annually, while each paper check or distribution runs $15.

Cashier’s checks and certified mail each cost $30. Precious metals storage fees typically run $150 yearly, though rates vary by depository.

Fee Complaints vs Cost-Savings Claims

You’ll hear dramatically different stories from Equity Trust customers about fees. Supporters praise the all-inclusive annual fee model, highlighting the absence of transaction fees on most investments—a feature that saves active traders hundreds of dollars yearly. Critics counter with complaints about surprise charges and unclear fee disclosures.

Customer reviews reveal frustration with “being charged at every stage” and fee changes without notification. The company’s defenders argue that competitors nickel-and-dime investors with multiple small fees, making Equity Trust’s transparent annual structure more economical. Your actual experience depends on your investment style and transaction frequency.

Fee Waiver Opportunities

You can reduce fees through strategic choices and partnerships. Electronic statements and online bill pay eliminate paper fees entirely—saving $40 annually on statements alone. The myEQUITY platform lets you avoid the $15 per transaction charge for paper distributions.

Partnership deals offer substantial savings. Augusta Precious Metals customers qualify for up to 3 years of waived annual fees on eligible accounts.

First-time investors sometimes receive promotional pricing during special enrollment periods. Electronic processing through the digital platform waives most transaction fees that paper submissions would incur.

Customer Service and User Experience

Your experience with Equity Trust’s customer service can vary dramatically depending on when you contact them and which representative handles your account. The company’s support infrastructure shows both strengths in expertise and weaknesses in consistency.

Support Channels and Hours

You can reach Equity Trust’s customer service team Monday through Friday from 9 AM to 6 PM EST at 888-382-4727.

The company doesn’t offer live chat support, which means you’re limited to phone calls and emails for immediate assistance.

During peak hours, you might face extended wait times. Some customers report holding for 30-45 minutes before speaking with a representative.

The absence of weekend support creates challenges if you’re managing time-sensitive transactions or need urgent assistance outside business hours.

Email support through help@trustetc.com provides an alternative, though response times vary. You’ll typically receive acknowledgment within 24-48 hours, but resolution of complex issues can take several days.

User Feedback

Customer reviews paint a divided picture of Equity Trust’s service quality.

Positive feedback highlights:

- Knowledgeable staff who understand IRS compliance requirements

- Comprehensive educational resources including webinars and tutorials

- Efficient processing of routine transactions like bill payments

Negative experiences include:

- Hold times exceeding 45 minutes during busy periods

- Inconsistent responses from different representatives

- Delayed tax form delivery (some customers report waiting 2-3 months)

- Slow fund returns during market volatility

One customer noted: “The educational support helped me understand complex regulations, but getting someone on the phone took forever.”

Reputation and Ratings

Equity Trust’s reputation varies significantly across review platforms:

| Platform | Rating | Reviews |

|---|---|---|

| Better Business Bureau | A+ accreditation, 2.86/5 | 78 reviews |

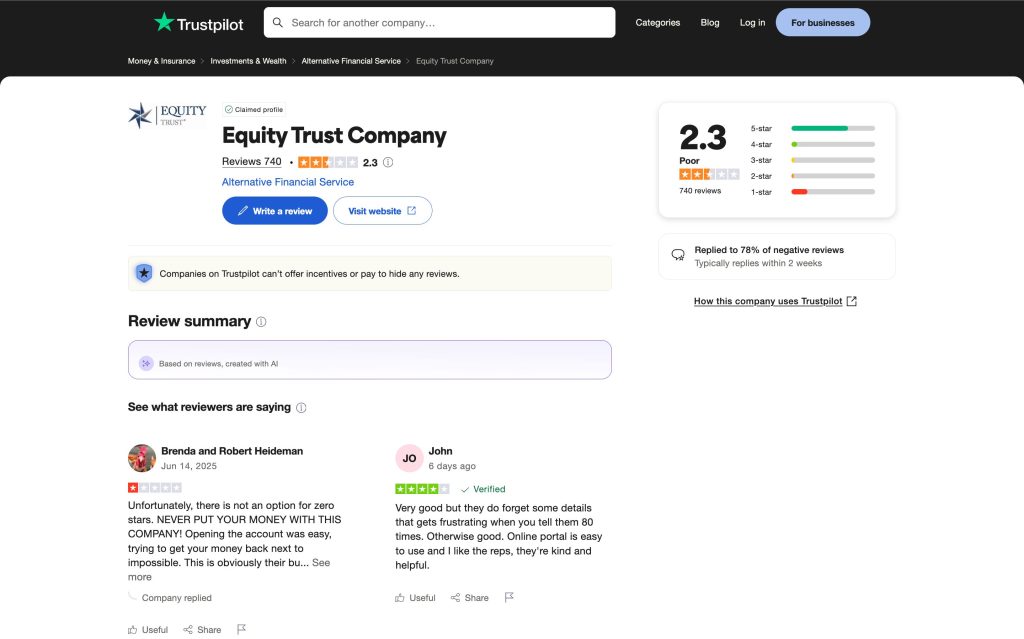

| TrustPilot | 2.3/5 | 740 reviews |

| Focus on the User | 3.4/5 | Not specified |

| Industry Rankings | 4th place | Among top 10 custodians |

The BBB’s A+ accreditation reflects regulatory compliance and business practices, though the 2.86/5 customer rating reveals service challenges. Trustpilot’s lower 2.3/5 score from 740 reviews suggests widespread frustration with customer support.

Aggregated ratings from various sources range from 0.9/5 to 3.8/5, indicating inconsistent customer experiences. Even though these mixed reviews, Equity Trust ranks 4th among the top 10 self-directed IRA custodians, suggesting competitive features offset service shortcomings for many investors.

Pros and Cons of Equity Trust Company

Evaluating Equity Trust Company’s strengths and weaknesses helps you determine if it’s the right custodian for your self-directed IRA. Here’s what 368,000+ clients have discovered about investing through this established platform.

Pros

- Established Reputation Since 1974: Equity Trust manages $52 billion in assets and holds IRS approval as a non-bank custodian since 1983, giving you confidence in their regulatory compliance and financial stability.

- Extensive Investment Options: You can invest in real estate, private equity, cryptocurrency (Bitcoin, Ethereum), precious metals, tax liens, and traditional assets like stocks and bonds through one account.

- A+ Better Business Bureau Rating: This top rating reflects the company’s commitment to addressing customer concerns and maintaining business standards.

- myEQUITY Digital Platform: You’ll access real-time portfolio tracking, online bill pay for property expenses, and integrated tax document management from any device.

- Educational Resources: Free webinars, tutorials, and investment guides help you navigate alternative asset investing, especially useful for first-time self-directed IRA investors.

- Recognized Workplace Excellence: Named one of the Best Places to Work in 2025, indicating strong internal operations that often translate to better customer service.

Cons

- Complex Fee Structure: Annual fees range from $205 to $2,150 based on account value, plus transaction fees, storage fees, and unexpected charges that customers report discovering during withdrawals.

- Long Customer Service Wait Times: You might wait 30+ minutes on hold, with some customers reporting delays in receiving tax forms like 1099-Rs and inconsistent responses from representatives.

- Mixed Online Ratings: While Google shows 4.3/5 stars, BBB customer reviews average 2.86/5, with complaints about fund withdrawal difficulties and fee disputes.

- No Live Chat Support: You’re limited to phone and email during business hours (9 AM – 6 PM EST), making immediate assistance unavailable outside these times.

- Hidden Fees Reported: Multiple customers discovered unexpected charges during transactions, particularly when withdrawing funds or closing accounts, reducing transparency.

- Processing Delays: Some investors experience slow transaction processing times and delays in fund transfers that can impact time-sensitive investment opportunities.

Comparing Equity Trust to Alternatives

You’re not locked into Equity Trust as your only option for self-directed IRA investing. Understanding how it stacks up against competitors helps you make the smartest choice for your retirement portfolio.

Top Competitor Custodians

You’ll find five major players competing directly with Equity Trust in the self-directed IRA space. Strata Trust Company processes over $3 billion in assets and specializes in real estate transactions with faster processing times.

The Entrust Group manages $16 billion across 185,000 accounts and integrates with advanced financial planning tools.

Millennium Trust Company handles $40 billion in custody assets and excels at complex alternative investments like private equity.

Advanta IRA focuses on personalized service with dedicated account managers for portfolios over $100,000. GoldStar Trust Company offers the lowest annual fees starting at $75 for accounts under $25,000.

Each custodian brings unique strengths – Strata for speed, Entrust for technology, Millennium for complexity, Advanta for service, and GoldStar for affordability.

Comparison Tips

You’ll save yourself headaches by examining four critical factors before choosing any custodian. Compare fee transparency by requesting complete fee schedules upfront – look for hidden charges in transaction fees, wire transfers, and account terminations.

Assess investment flexibility by confirming which specific assets each custodian accepts – some restrict cryptocurrency or international real estate.

Test platform usability through demo accounts or trial periods. Click through investment processes, document uploads, and reporting features before committing funds.

Consider advisor access and educational tools – count the number of webinars, guides, and direct support hours available weekly.

Custodians offering 40+ hours of live support and comprehensive investment libraries typically serve complex portfolios better than those with limited resources.

Conclusion: Is Equity Trust Right for You?

Equity Trust Company stands as a significant player in the self-directed IRA space with its five-decade track record and extensive alternative investment options.

Your decision to work with them should align with your specific investment goals and tolerance for their fee structure and service inconsistencies.

If you’re seeking a well-established custodian with robust educational resources and a comprehensive digital platform for managing diverse assets like real estate and precious metals, Equity Trust could serve you well. Their A+ BBB rating and industry recognition add credibility to their operations.

But, if responsive customer service and transparent pricing are your top priorities, you might want to explore alternatives like Strata Trust Company or Advanta IRA.

The mixed customer reviews and reported service delays suggest that patience may be required when working with Equity Trust.

Eventually, success with any self-directed IRA custodian depends on matching their strengths to your investment strategy.

Take time to compare fee structures, evaluate platform capabilities, and consider how each custodian’s service model fits your portfolio management style.