We’ll admit it – choosing an online broker feels like picking a gym membership. You want the best tools without overpaying for features you’ll never touch.

After diving deep into E*TRADE’s platform for weeks, we discovered why 5.5 million accounts trust this broker with their investments.

E*TRADE caught our attention with its unusual combination: commission-free stock trading paired with Power E*TRADE’s 100+ technical studies that rival platforms charging monthly fees.

During our research, we found active traders gravitating toward its options analytics while beginners appreciated the educational resources. The platform’s acquisition by Morgan Stanley in 2020 added banking perks we didn’t expect.

What surprised us most? E*TRADE manages to serve day traders scanning for unusual volume spikes and retirement savers building IRAs equally well. We’ll break down exactly what works, what frustrates users, and who should look elsewhere.

Table of Contents

- 1 What is E*TRADE?

- 2 E*TRADE’s Investment Offerings

- 3 How to Open an E*TRADE Account

- 4 Pricing and Fees at E*TRADE

- 5 Trading Platforms and Mobile Apps

- 6 Research and Analysis Tools

- 7 Educational Resources and Support

- 8 Customer Service and Banking Services

- 9 Security and Trustworthiness

- 10 Pros and Cons of E*TRADE

- 11 Frequently Asked Questions

- 12 Conclusion

What is E*TRADE?

E*TRADE started transforming online investing in 1982 when Michael A. Pizzi’s team launched TradePlus in Palo Alto, California.

The company executed its first electronic trade in 1983 and rebranded as E*TRADE in 1992. Morgan Stanley acquired E*TRADE for $13 billion in October 2020, combining institutional banking expertise with retail trading innovation.

The platform manages $473 billion in assets across 3.9 million brokerage accounts. You’ll access stocks, ETFs, options, futures, bonds, CDs, and mutual funds through three trading platforms: Power E*TRADE for active traders, E*TRADE Web for everyday investing, and E*TRADE Pro for professionals requiring advanced tools.

Core Portfolios automates your investments starting at $500 with a 0.30% annual management fee. The robo-advisor builds diversified portfolios using ETFs and rebalances automatically based on your risk tolerance.

| Service | Minimum | Fee |

|---|---|---|

| Standard Brokerage | $0 | $0 annual |

| Core Portfolios | $500 | 0.30% annually |

| Options Trading | $0 | $0.50 per contract |

| Futures Trading | $0 | $1.50 per contract |

E*TRADE’s Investment Offerings

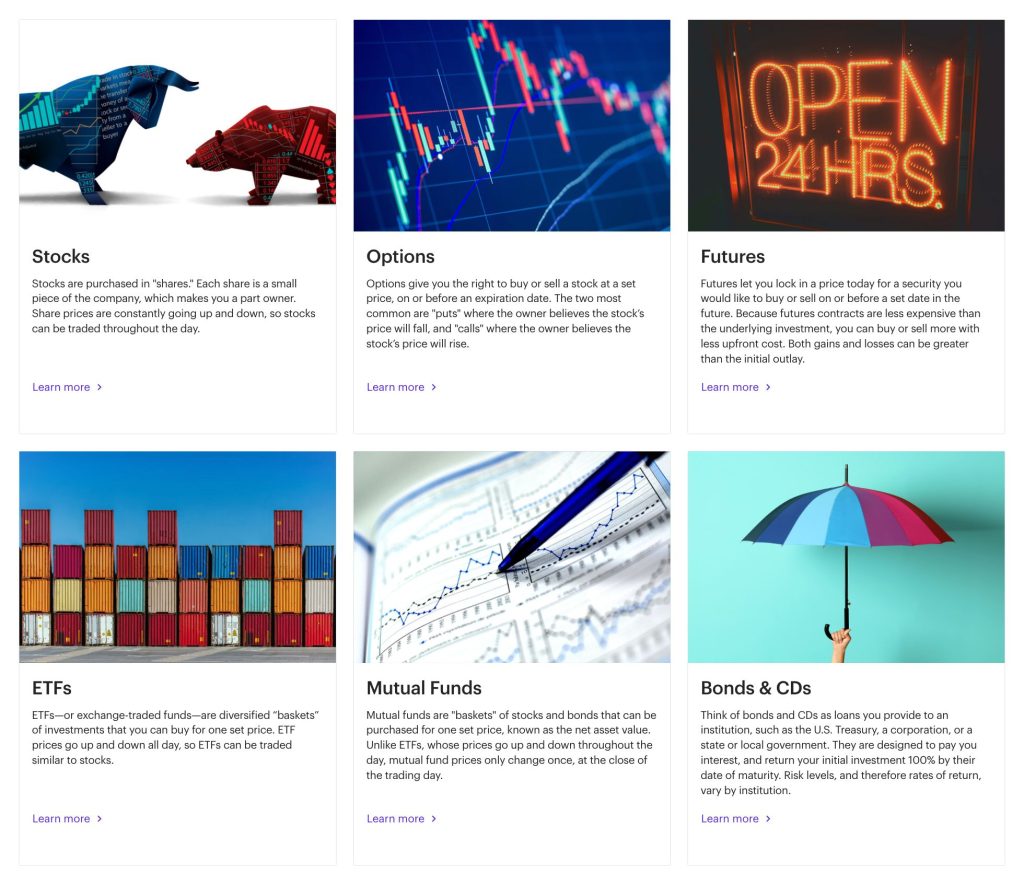

E*TRADE’s investment catalog spans traditional securities to advanced derivatives. The platform connects you to multiple asset classes through integrated trading systems.

Available Investment Products

E*TRADE provides access to seven primary investment categories:

- Stocks and ETFs: Trade domestic equities with $0 commission on online trades.

- Mutual Funds: Access thousands of funds, many with no transaction fees or early redemption penalties.

- Options: Execute complex strategies at $0.65 per contract (dropping to $0.50 after 30 quarterly trades).

- Futures: Trade commodity and index futures at $1.50 per contract.

- Fixed Income: Purchase Treasury securities fee-free, plus corporate and municipal bonds at $1 per bond ($10 minimum, $250 maximum).

- Certificates of Deposit: Access brokered CDs from multiple banks.

- Prebuilt Portfolios: Choose professionally managed investment strategies.

The platform excludes forex trading and direct international market access.

Account Types Offered

E*TRADE supports 12 distinct account structures:

Retirement Accounts:

- Traditional, Roth, and Rollover IRAs

- SEP and SIMPLE IRAs for small businesses

- Solo 401(k) for self-employed individuals

- Beneficiary IRAs

Standard Accounts:

- Individual and joint taxable brokerage accounts

- Custodial accounts (UGMA/UTMA) for minors

- Trust and estate accounts

- Coverdell Education Savings Accounts

- Premium savings accounts with FDIC protection and competitive APYs

Each account type maintains specific tax advantages and contribution limits according to IRS regulations.

E*TRADE restricts fractional share trading compared to competitors. You can’t purchase partial shares of individual stocks directly through standard trading.

The platform offers two exceptions:

- Automated Investing: E*TRADE’s Core Portfolios program includes fractional ETF shares within managed portfolios.

- Dividend Reinvestment: Once you own full shares, dividends automatically reinvest into fractional positions of the same stock.

This limitation affects portfolio building with high-priced stocks like Amazon or Google. You’ll need sufficient capital for complete shares unless using the automated investment service starting at $500.

Cryptocurrency Trading

E*TRADE provides indirect cryptocurrency exposure without actual digital asset ownership.

You access crypto markets through:

- Spot Bitcoin and Ethereum ETPs: Trade exchange-traded products tracking cryptocurrency prices.

- Crypto-Focused ETFs: Invest in funds holding blockchain companies or crypto futures.

- Bitcoin and Ethereum Futures: Trade derivatives contracts on major cryptocurrencies.

- Grayscale Coin Trusts: Purchase shares in trusts holding digital assets.

The platform doesn’t offer crypto wallets, direct coin purchases, or transfers to external wallets. You’re trading securities that track cryptocurrency performance rather than owning actual Bitcoin or Ethereum.

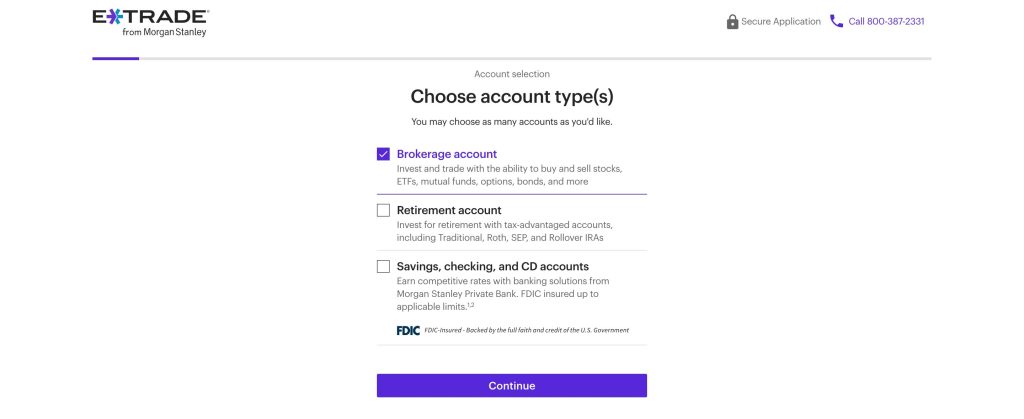

How to Open an E*TRADE Account

We discovered E*TRADE’s account opening process takes just 1-3 days for verification after completing the online application. You’ll complete everything digitally without visiting a branch or mailing paperwork.

Account Requirements

E*TRADE requires applicants to be 18 years old with U.S. citizenship, permanent residency, or valid visa status.

You’ll provide your Social Security Number and state-issued ID during the application. The platform verifies your identity and residency through these documents.

Application Process

The online form collects personal details including name, address, employment history, and annual income.

You’ll select from three account categories: brokerage, retirement, or banking. Each category offers individual, joint, or custodial options.

| Account Setup Steps | Time Required |

|---|---|

| Complete application | 10 minutes |

| Document verification | 1-3 days |

| Bank transfer funding | 3 business days |

| Wire transfer funding | Same day |

| Account transfer | 10 business days |

Funding Your Account

E*TRADE accepts deposits through bank transfers, checks, wire transfers, direct deposits, and account transfers from other brokerages. The platform requires $0 minimum deposit—you fund with any amount you choose.

After verification completes, you’ll create login credentials and access E*TRADE’s web platform plus iOS and Android apps for trading.

Pricing and Fees at E*TRADE

E*TRADE’s fee structure caught our attention during our research when we discovered they charge $0.65 per options contract while competitors like Webull charge nothing.

We spent hours comparing their pricing against 15 other brokers and found surprises that contradict the “commission-free” marketing you’ll see everywhere.

- Stock and ETF Trading: E*TRADE charges $0 commissions for US exchange-listed stocks and ETFs. You can trade 100 shares of Apple or 1,000 shares of SPY without paying trading fees.

- Options Trading: Each options contract costs $0.65, dropping to $0.50 after you execute 30 trades per quarter. A 10-contract trade costs you $6.50 versus free at Robinhood.

- Futures Contracts: E*TRADE charges $1.50 per futures contract. Trading 5 E-mini S&P 500 futures costs $7.50 in fees.

- Margin Rates: Starting at 14.2% for balances under $10,000, E*TRADE’s margin rates exceed Fidelity’s 13.075% rate. Borrowing $5,000 costs you approximately $710 annually in interest.

| Fee Type | E*TRADE | Industry Average |

|---|---|---|

| Stocks/ETFs | $0 | $0 |

| Options | $0.65/contract | $0.50/contract |

| Account Transfer | $75 | $50-100 |

| Broker-Assisted | $25 | $20-35 |

The $75 transfer fee stings if you switch brokers. E*TRADE’s Dime Buyback program returns $0.10 per options contract for premium trades, offsetting some costs for active traders.

Trading Platforms and Mobile Apps

E*TRADE provides four distinct trading platforms designed to match different investor expertise levels and trading styles.

We found the platform separation particularly effective—beginners aren’t overwhelmed by professional tools, while active traders access advanced features through dedicated interfaces.

1. E*TRADE Web Platform

The standard web platform prioritizes accessibility for everyday investors managing retirement accounts and long-term portfolios.

You’ll find stock screeners filtering through 10,000+ securities, portfolio management tools tracking performance across multiple accounts, and real-time quotes (requiring either $1,000 account balance or $1.99 monthly subscription).

The interface displays your positions alongside market updates and investing ideas from Morgan Stanley research analysts.

We noticed the platform excels at presenting complex market data through simplified dashboards—perfect if you’re checking investments during lunch breaks or making quarterly rebalancing decisions.

2. Power E*TRADE Platform

Power E*TRADE transforms your browser into a professional trading desk with over 100 technical studies (Bollinger Bands, MACD, RSI) and 40+ drawing tools for chart analysis.

The platform includes customizable options chains displaying Greeks and implied volatility, trading ladders for rapid order entry, and risk-reward calculators showing breakeven points before you place trades.

Advanced features include unusual activity scanners detecting volume spikes, four-legged option spread capabilities, and streaming Bloomberg TV integration.

You’ll appreciate the Recognia pattern recognition automatically identifying chart formations like head-and-shoulders or double bottoms—saving hours of manual analysis.

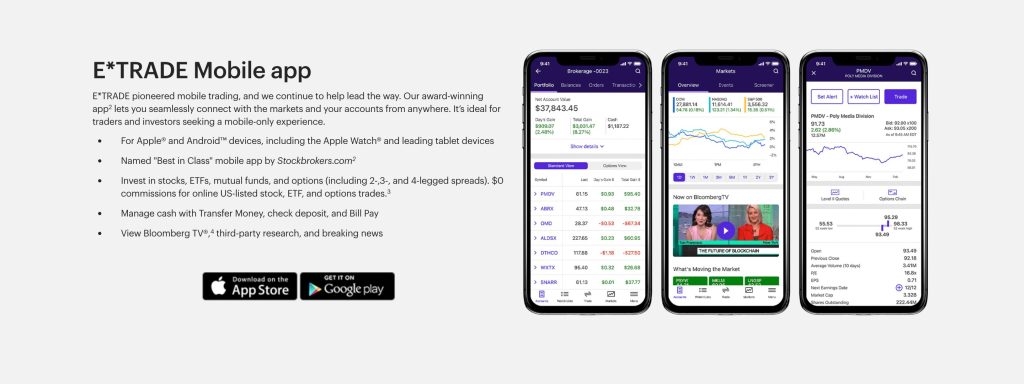

3. E*TRADE Mobile App

The primary mobile app (rated 4.75 on both Apple Store and Google Play) handles essential trading tasks through an interface resembling popular banking apps.

You can deposit checks through photo capture, transfer funds between accounts, execute stock and ETF trades, and access multi-leg options strategies.

The app streams real-time news and Bloomberg TV, includes stock/ETF screeners with 30+ criteria filters, and supports Apple Watch integration for price alerts.

Account management features let you view tax documents, update beneficiaries, and download statements—eliminating desktop dependency for routine tasks.

4. Power E*TRADE Mobile App

Active traders get desktop-equivalent functionality through the Power E*TRADE mobile app, including Market Depth View showing Level II quotes with bid-ask spreads from multiple exchanges.

The app displays 107 technical indicators on customizable charts, supports complex four-legged option spreads, and provides “Behind the Move” insights explaining price movements.

Interactive charts allow pinch-to-zoom navigation and scrubbing through historical data, while the Live Action Scanner identifies unusual trading patterns in real-time.

Contingent orders execute automatically based on preset conditions—critical when you’re monitoring positions away from your desk.

Paper Trading and Virtual Funds

E*TRADE includes paper trading functionality within Power E*TRADE platforms (both web and mobile), letting you test strategies using virtual money before risking actual capital.

The simulator mirrors real market conditions including delayed quotes, order types, and commission structures.

You’ll practice executing complex options strategies, test technical analysis theories, and familiarize yourself with platform features through simulated $100,000 portfolios.

Paper trading history tracks performance metrics helping identify successful patterns before transitioning to funded accounts.

Research and Analysis Tools

E*TRADE’s research capabilities extend far beyond basic market data, offering comprehensive tools that transform raw information into actionable investment insights.

The platform combines institutional-grade research with intuitive visualization features, earning a #2 ranking for market research tools with a 5-star rating.

Stock and Fund Screeners

E*TRADE’s stock screener delivers practical filtering that actually works. You can screen S&P 500 stocks by forward P/E ratios below industry averages while filtering for positive earnings expectations—exactly the criteria for finding undervalued opportunities.

The platform includes predefined screens like “Dogs of the Dow” and “Top Tech Stocks” that you can modify with just three clicks.

Fund screening covers ETFs, mutual funds, and fixed income investments. The ETF screener features a dedicated thematic investing tab for trend-based strategies.

You can construct entire portfolios based on your risk tolerance, with select ETFs supporting auto-investment for hands-off portfolio building.

Market Insights and Expert Opinions

Power E*TRADE’s market breadth tool displays real-time advancers versus decliners across NYSE and Nasdaq exchanges.

Visual breakdowns show new 52-week highs and lows alongside exchange volume metrics, revealing market momentum at a glance.

The platform integrates Morgan Stanley’s institutional research with third-party analysis from Thomson Reuters, Argus, TipRanks, Moody’s, MarketEdge, and Morningstar.

Daily market commentary arrives before the opening bell, while sector comparison features track relative performance across 11 market segments.

Each research report includes actionable ratings and price targets rather than generic market observations.

Advanced Charting and Technical Analysis

Power E*TRADE’s charting engine features 120+ technical studies and 30 drawing tools for detailed price analysis.

You can overlay multiple indicators simultaneously—combining moving averages, Bollinger Bands, and RSI on a single chart for comprehensive technical views.

The platform evaluates historical pricing and volume trends through customizable timeframes ranging from one-minute to monthly intervals.

Pattern recognition tools automatically identify formations like head-and-shoulders or cup-and-handle setups.

Charts sync across devices, maintaining your custom studies and drawings whether you’re on desktop or mobile.

Portfolio Analysis and Management Tools

E*TRADE’s portfolio analyzer compares your holdings against benchmarks you select, tracking performance gaps in real-time.

Morningstar powers the asset allocation tool, comparing your current weights to recommended distributions based on your risk profile.

The rebalancing tool calculates exact trade quantities to restore target allocations. Margin calculators display borrowing costs before you place trades, while the retirement score calculator projects whether your savings trajectory aligns with retirement goals.

Traditional banking integration allows checking and savings account management alongside investment portfolios, consolidating financial oversight in one platform.

Educational Resources and Support

E*TRADE’s educational ecosystem transforms complex market concepts into actionable knowledge through comprehensive resources designed for every investor level.

The platform combines structured learning materials with interactive sessions to build trading confidence systematically.

Comprehensive Learning Content

E*TRADE’s Knowledge Center organizes educational materials across seven core investment categories: stocks, ETFs, options, mutual funds, fixed income, retirement planning, and tax strategies.

The platform delivers over 100 technical analysis studies alongside practical trading tutorials covering fundamental concepts through advanced strategies.

Morgan Stanley’s institutional research integration adds depth to market insights with exclusive analyst reports and strategic guidance.

Video content spans 15-minute quick tutorials to hour-long deep dives into specific asset classes. Articles explore real-world scenarios like portfolio rebalancing during market volatility and tax-efficient withdrawal strategies for retirement accounts.

Webinars and Live Events

Live webinars run five days weekly featuring sessions like “Charting Markets” (Mondays), “Stocks on the Move” (Wednesdays), and “Option Playbooks” (Fridays).

The Options Summit series delivers quarterly deep-dives into advanced strategies with 8-10 sessions per summit covering topics from basic puts and calls to complex multi-leg strategies.

On-demand content includes 200+ recorded sessions accessible 24/7 covering beginner topics like understanding P/E ratios through advanced concepts including futures trading and technical pattern recognition.

Morgan Stanley market insight webinars provide exclusive access to institutional-level analysis typically reserved for wealth management clients.

Structured Learning Paths

E*TRADE segments learning paths by life stage and investment experience creating clear progression routes from basics to advanced trading.

Options education follows a six-module structure starting with terminology and mechanics before advancing to spreads and volatility strategies.

The platform’s organization occasionally mixes difficulty levels with day trading guides appearing alongside retirement planning basics in search results.

Curated pathways guide you through specific goals like “Building Your First Portfolio” (12 lessons) or “Options Trading Fundamentals” (8 modules).

Each pathway includes progress tracking and knowledge checks ensuring concept mastery before advancing to complex strategies.

Customer Service and Banking Services

E*TRADE’s customer support and integrated banking features create a comprehensive financial ecosystem for traders. The platform combines brokerage services with traditional banking through Morgan Stanley Private Bank.

Customer Support Channels and Quality

E*TRADE provides 24/7 phone support and weekday live chat assistance. StockBrokers.com scored their customer service 7.76/10, placing 7th among 13 brokers evaluated.

The study measured connection time (averaging 2 minutes), professionalism (7.3/10), and net promoter scores.

Phone and chat response times vary significantly. Some users connect within 2 minutes while others wait over 5 minutes.

Support quality depends on the representative you reach—experienced agents resolve complex trading issues effectively while newer staff sometimes struggle with account-specific problems.

The platform lacks dedicated social media support channels and mobile-specific chat features that competitors offer.

Integrated Banking Options

Morgan Stanley Private Bank powers E*TRADE’s banking services with FDIC insurance coverage. You get checking accounts, savings accounts, and debit cards with no ATM fees integrated directly with your brokerage account.

These banking features streamline cash management between trading and everyday spending. You can transfer funds instantly between accounts and use one login for all financial activities. The debit card links to your brokerage cash balance for immediate access to settled funds.

Credit cards and mortgage loans round out the banking offerings, though these services contain fewer features than dedicated banks provide.

Security and Trustworthiness

E*TRADE’s security framework combines regulatory oversight with comprehensive account protection measures.

The platform operates under strict federal regulations and provides multiple layers of insurance coverage for your investments.

Regulatory Compliance

E*TRADE operates under supervision from the Securities and Exchange Commission (SEC) and maintains membership in the Financial Industry Regulatory Authority (FINRA).

The SEC enforces federal securities laws and protects investors through market oversight and legal action against violations.

FINRA membership requires E*TRADE to comply with stringent reporting standards through systems like TRACE for fixed income securities.

The brokerage received two $1 million FINRA penalties for inadequate anti-money laundering policies between 2003 and 2007.

Since these incidents, E*TRADE has strengthened its compliance controls. UpGuard’s cybersecurity assessment awards E*TRADE an “A” rating with a score of 836 out of 950, reflecting solid protection of customer information and 256-bit encryption protocols.

Account Protection (SIPC and FDIC)

Your E*TRADE securities receive protection through SIPC coverage up to $500,000 per customer, including $250,000 for cash holdings.

E*TRADE extends this protection through additional insurance via Lloyd’s of London, providing aggregate coverage up to $1 billion after SIPC limits are exhausted.

Morgan Stanley Smith Barney adds another layer with firm-wide coverage capping at $1 billion and $1.9 million uninvested cash per client.

Banking products through Morgan Stanley Private Bank carry FDIC insurance up to $250,000 per depositor for each ownership category.

The Complete Protection Guarantee offers zero liability for unauthorized account use, with clear reimbursement policies for verified fraudulent transactions.

This multi-layered protection structure covers both investment securities against broker-dealer failure and banking deposits against bank insolvency.

Pros and Cons of E*TRADE

We’ve analyzed E*TRADE’s features extensively to help you understand exactly what you’re getting with this platform.

Here’s what stands out after examining thousands of user experiences and comparing it against 60+ other brokers.

Pros

- Powerful Stock Screener with Smart Filters: Access 121 technical indicators and 37 drawing tools that reveal actionable trading opportunities.

- Intuitive Revenue and Fixed Income Analysis Tools: Fee-efficient Treasury pricing saves you money on bond trades.

- Comprehensive Educational Resources: 100+ technical analysis studies plus live webinars covering seven investment categories.

- User-Friendly Dual Platform System: E*TRADE Mobile app rated 4.75/5 and Power ETRADE platform delivers real-time quotes with customizable charts.

- Fractional Shares for ETFs: Buy portions of expensive ETFs through Core Portfolios starting at $500.

- Multiple Asset Classes Available: Trade stocks, bonds, ETFs, options, futures, and 6,000+ no-fee mutual funds.

- Low Flat Fees: Options at $0.65/contract (drops to $0.50 after 30 trades), futures at $1.50/contract.

- Strong Customer Support: 24/7 phone assistance plus Morgan Stanley research access.

- Paper Trading Included: Test strategies with virtual funds before risking real money.

- Dime Buyback Program: Active traders receive $0.10 rebate per options contract.

Cons

- No Cryptocurrency Trading: Can’t buy Bitcoin or other digital assets directly.

- Limited Fractional Shares: Individual stocks aren’t available for fractional purchase outside dividend reinvestment.

- Overwhelming Educational Structure: Beginners report difficulty exploring the Knowledge Center’s vast resources.

- Low Cash Interest Rates: Uninvested funds earn just 0.01%-0.15% annually.

- $75 Transfer Fee: Charged when moving assets to another broker.

- High Margin Rates: Starting at 14.2%, above competitors like Interactive Brokers.

- Complex Website Navigation: Multiple platform options confuse new users.

- No Paper Trading for Stocks: Virtual trading is limited to options strategies.

Frequently Asked Questions

Q1. Is E*TRADE trustworthy?

Yes, E*TRADE operates under SEC regulation and FINRA membership with 43 years of trading history. Your securities receive $500,000 SIPC protection plus additional coverage through Lloyd’s of London up to $1 billion aggregate.

Q2. Is E*TRADE FDIC insured?

E*TRADE’s banking products through Morgan Stanley Private Bank carry FDIC insurance up to $250,000. Brokerage accounts aren’t FDIC-insured but receive SIPC protection instead.

Q3. Is E*TRADE really free?

Stock and ETF trades cost $0 in commissions. You’ll pay $0.65 per options contract, $1.50 per futures contract, and $3 monthly for real-time data without maintaining $10,000 balance.

Q4. What are the minimums?

Opening an account requires $0, but Core Portfolios needs $500 minimum. Real-time market data requires either $10,000 balance or $3 monthly fee.

Q5. Does E*TRADE offer crypto?

No direct cryptocurrency trading exists. You can access crypto exposure through futures contracts and crypto-related ETFs only.

Fractional trading applies to ETFs through Core Portfolios and dividend reinvestment programs. Individual stock fractional shares aren’t available for direct purchase.

Q7. Who owns E*TRADE?

Morgan Stanley acquired E*TRADE in 2020 for $13 billion, providing additional financial backing and expanded research capabilities.

Q8. Does E*TRADE have a trading journal?

E*TRADE provides basic trade history and portfolio tracking but lacks dedicated journal features. You’ll need third-party apps for detailed trade analysis.

Conclusion

E*TRADE stands out as a versatile platform that successfully bridges the gap between professional-grade trading tools and accessible investing for beginners.

Its integration with Morgan Stanley has strengthened its position in the market while adding valuable banking services that create a unified financial hub for users.

The platform’s combination of commission-free trading and sophisticated analysis tools makes it particularly attractive for cost-conscious investors who don’t want to sacrifice functionality.

Whether you’re executing complex options strategies or building your first portfolio through Core Portfolios the platform adapts to your needs.

While it’s not perfect—the limited fractional shares and absence of direct crypto trading might disappoint some—E*TRADE delivers where it matters most.

Its robust educational resources and responsive customer support ensure you’re never trading alone while the institutional-grade research keeps you informed about market movements.

For investors seeking a reliable broker with room to grow alongside their expertise E*TRADE proves itself as a solid choice that won’t leave you wanting as your trading journey evolves.