You’re scrolling through retirement options when you stumble upon IRA Financial—a company that’s caught the attention of over 24,000 investors.

With $5 billion in assets under custody and a 97% client retention rate, they’ve built something worth examining. But what makes them stand out in the crowded self-directed IRA space?

IRA Financial lets you invest retirement funds in alternative assets like real estate and cryptocurrency. You’ll find transparent flat-fee pricing without asset-based charges or setup fees.

Whether you’re considering rolling over an existing account or starting fresh, understanding how IRA Financial works could reshape your retirement strategy.

Table of Contents

What is IRA Financial Group?

You’re looking at a self-directed retirement plan provider that’s revolutionized how Americans invest their retirement funds.

IRA Financial Group, founded by Adam Bergman 13 years ago, empowers you to break free from the limitations of traditional 401(k)s and IRAs that restrict you to stocks and bonds.

The company operates with a clear mission: give you complete control over your retirement investments. You can diversify into real estate, cryptocurrency, precious metals, private businesses, and other alternative assets that traditional brokers won’t touch.

Since 2010, IRA Financial has grown to serve over 24,000 investors nationwide and manages more than $5 billion in retirement assets.

You’ll work directly with experienced specialists who understand alternative investments—not call center employees reading scripts.

The company maintains Better Business Bureau accreditation since 2011 with an A rating. Their 97% client retention rate tells you that investors who gain control of their retirement funds rarely go back to traditional providers.

Core Offerings: Diversified Self-Directed Retirement Plans

You’ve discovered the power of self-directed investing, and IRA Financial delivers four distinct retirement solutions that put you in control.

Each plan opens doors to alternative investments beyond traditional stocks and bonds, letting you build wealth through real estate, cryptocurrency, precious metals, and private businesses.

Self-Directed IRAs

You gain access to IRS-approved alternative assets through IRA Financial’s Self-Directed IRAs, breaking free from conventional retirement limitations.

Your investment universe expands dramatically with these account types:

- Custodian-Controlled Self-Directed IRA: IRA Financial executes investments at your request while holding asset titles as custodian.

- Self-Directed IRA LLC (Checkbook Control): You manage an LLC owned by your IRA, gaining faster investment execution and potentially lower fees.

Your portfolio transforms with diverse investment options. Real estate investments include rental properties, fix-and-flips, raw land, and mobile homes.

Precious metals investments focus on IRS-approved gold and silver meeting specific purity standards. Cryptocurrency holdings span 30+ tokens including Bitcoin and Ethereum for long-term growth. Private business investments round out your alternative asset choices.

Solo 401(k)s

Self-employed individuals and businesses without full-time employees unlock extraordinary retirement benefits through IRA Financial’s Solo 401(k)s. You contribute up to $69,000 annually ($76,500 if you’re over 50), dwarfing traditional IRA limits.

Your Solo 401(k) includes a loan feature allowing borrowing up to $50,000 from your account. Checkbook control eliminates custodian delays, letting you act instantly on investment opportunities.

This retirement vehicle combines the highest contribution limits with complete investment freedom, making it ideal for entrepreneurs maximizing tax-advantaged savings.

ROBS (Rollovers as Business Startups)

You transform retirement savings into business capital through IRA Financial’s ROBS solution without triggering early withdrawal penalties or taxes.

This structured process creates a C Corporation that adopts a 401(k) plan, then purchases newly issued corporate stock.

Your existing retirement funds roll into the new 401(k), which buys your C Corporation’s stock. The corporation receives cash to fund business operations while you draw a salary and can personally guarantee business loans.

ROBS converts dormant retirement assets into active business investments, perfect for entrepreneurs launching ventures or expanding existing operations.

IRAfi Crypto

Digital asset investing meets retirement planning through IRAfi Crypto, IRA Financial’s dedicated cryptocurrency platform. You trade over 30 cryptocurrencies including Bitcoin and Ethereum within your tax-advantaged retirement account.

The platform charges a 1% trade fee with a $10 minimum trade requirement and $100 annual fee. Your crypto investments grow tax-free or tax-deferred depending on account type.

This specialized platform eliminates the complexity of self-custody while maintaining IRS compliance, making cryptocurrency accessible for retirement portfolios.

Transferring and Rolling Over Assets

Your existing retirement accounts seamlessly transfer to IRA Financial through their guided rollover process. Compatible accounts include traditional IRAs, Roth IRAs, SEP-IRAs, 401(k)s, and 403(b)s.

IRA Financial’s specialists provide step-by-step support ensuring IRS compliance throughout the transfer. They handle paperwork complexities preventing costly tax penalties.

High demand occasionally creates processing delays, but their team maintains communication throughout. The rollover process typically completes within 2-4 weeks, transforming restrictive traditional accounts into self-directed powerhouses ready for alternative investments.

Customer Experience and Reliability

You’re trusting IRA Financial with your retirement future—here’s what 24,000+ clients actually experience. From account setup to daily platform use, real customers paint a picture that’s both promising and occasionally frustrating.

Account Creation Process

You’ll complete your online application in minutes, but that’s where experiences diverge. Some customers report their accounts activated within 48 hours, funds transferred seamlessly.

Others find themselves waiting weeks, refreshing their inbox for updates that don’t arrive. One reviewer noted: “Setup took 3 weeks instead of the promised 3 days.”

Processing delays spike during market volatility or year-end rushes. You’ll fare better starting your application mid-month when volume drops.

Pro tip: Call directly at 1-800-472-1043 if your setup stalls past day five—customers report immediate resolution after phone contact versus email chains.

Customer Support

You’re connected to specialists who actually understand alternative investments—not script-reading call center employees. Response times average under 24 hours for complex questions.

Customers specifically praise staff members by name in reviews, highlighting personalized service. You’ll get direct email addresses, not generic support tickets.

Phone support operates Monday-Friday, 9 AM-6 PM EST. Weekend warriors take note: no weekend support exists. The team excels at IRS compliance questions but occasionally stumbles on technical platform issues.

One customer shared: “They walked me through a complicated real estate transaction step-by-step.” Support quality remains consistent whether you’re investing $10,000 or $1 million.

You’ll encounter a Jekyll-and-Hyde experience with IRA Financial’s technology. The mobile app launches smoothly—you’re checking balances and initiating transfers within seconds. Desktop users praise the dashboard’s clean layout.

But dig deeper into alternative investment documentation, and confusion sets in. Forms hide behind multiple menu layers.

Some investment types require paper submissions even though digital promises. First-time crypto investors find the IRAfi platform intuitive. Real estate investors wrestle with upload requirements.

You’ll master basic functions quickly but expect a learning curve for complex transactions. The platform handles straightforward rollovers brilliantly; multi-asset portfolios demand patience.

Consumer Ratings

Numbers tell the reliability story: Better Business Bureau awards an A+ rating (accredited since 2011) with 2.33/5 stars from 9 reviews.

TrustPilot users rate 4.8/5 across 1,416 reviews—remarkably high for financial services. Google Reviews show 4.3/5 from 336 customers.

The disconnect between BBB’s low review score and high accreditation rating? Most BBB reviews stem from isolated service hiccups, while satisfied customers flock to Trustpilot.

Negative reviews cluster around setup delays and fee confusion. Positive reviews consistently mention transparency, service recovery, and specialist expertise. IRA Financial responds to 95% of negative reviews within 72 hours, often resolving issues publicly.

Company Reliability

You’re joining 24,000+ investors who’ve entrusted $5 billion in alternative assets to IRA Financial over 13 years. The company maintains a 97% client retention rate—exceptional in an industry averaging 85%.

Employee satisfaction mirrors client success: Glassdoor shows 4.5/5 stars from 28 employee reviews, 21% above industry average. South Dakota Division of Banking licenses their custodian operations.

They’ve weathered market crashes, regulatory changes, and pandemic disruptions without service interruptions. Unlike competitors who’ve faced lawsuits or shutdowns, IRA Financial’s record remains clean. Your retirement funds join a proven ecosystem, not a startup experiment.

Security of Investments

Your money travels through multiple protective layers. IRS regulations govern every transaction. South Dakota Division of Banking oversees IRA Financial Trust custodial operations—among the strictest state regulations nationwide.

Capital One holds uninvested funds with FDIC insurance up to $250,000 per account. Once invested, security depends on your chosen assets—real estate carries different risks than cryptocurrency.

The platform uses bank-level encryption, two-factor authentication, and monitors suspicious activity 24/7. Regular third-party audits verify compliance, though specific audit details aren’t publicly disclosed. You control investment decisions, but regulatory guardrails prevent prohibited transactions automatically.

Fees and Cost Analysis

You’re staring at your IRA statement when you notice your custodian charged another $1,250 in asset-based fees last quarter. That’s when you discover IRA Financial’s flat-fee structure could save you thousands.

IRA Financial charges $495 annually for a Self-Directed IRA—regardless if you have $50,000 or $500,000 in your account.

Traditional custodians charge 0.25% to 1% of your assets yearly. With $500,000 invested, you’d pay $1,250 to $5,000 annually elsewhere versus IRA Financial’s flat $495.

Here’s the complete fee breakdown:

|

Account Type |

Annual Fee |

Setup Fee |

Transaction Fees |

|---|---|---|---|

|

Self-Directed IRA |

$495 |

$0 |

$0 |

|

Solo 401(k) |

$495 |

$0 |

$0 |

|

ROBS |

$1,200 |

$0 |

$0 |

|

IRA LLC |

$750 |

$0 |

$0 |

|

Basic IRA |

$100 |

$0 |

$0 |

Over 10 years with $500,000 in assets, you’d save nearly $14,000 choosing IRA Financial over asset-based fee custodians.

The math gets better as your account grows—you pay the same $495 whether your real estate investment doubles or your crypto holdings explode.

You won’t find hidden charges for wire transfers, account terminations ($100 if you leave), or investment transactions.

Compare that to Equity Trust’s tiered pricing starting at $750 annually plus transaction fees. Alto IRA charges less ($10-$25 monthly) but limits your investment options.

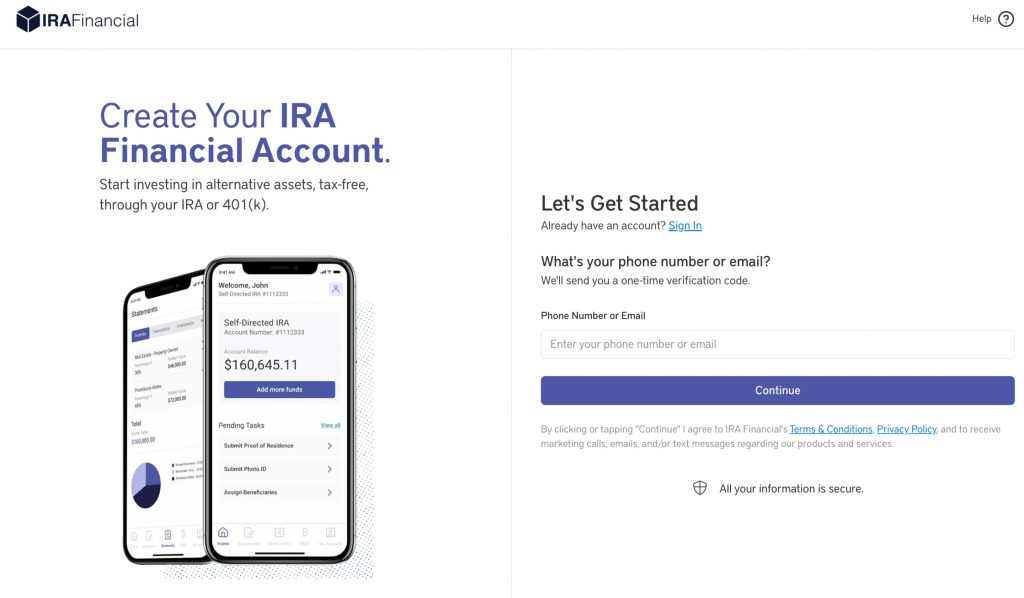

How to Open an Account

You’re sitting at your desk ready to take control of your retirement investments. Opening an IRA Financial account takes 15 minutes online without setup fees or hidden charges.

Account Setup Process

You start by visiting IRA Financial’s website and clicking “Open Account.” The platform presents two paths: schedule a free consultation with a specialist or complete the application independently.

Most clients finish the online application in 8-12 minutes by entering basic information like Social Security number, employment details, and beneficiary designations.

Required Documentation

You’ll upload these documents during application:

- Government-issued ID (driver’s license or passport)

- Recent bank statement for funding verification

- Previous retirement account statements for rollovers

- Employer Identification Number for Solo 401(k) applicants

Funding Your Account

You fund your IRA Financial account through three methods. Electronic transfers from checking accounts process in 3-5 business days.

Rollover transfers from existing 401(k)s or IRAs take 7-14 days with IRA Financial handling the paperwork. Direct contributions accept checks mailed to South Dakota processing center.

Account Activation Timeline

Your account activates within 24-48 hours after document approval. IRA Financial Trust holds your funds at Capital One with FDIC insurance protecting up to $250,000 in uninvested cash. You receive login credentials via email to access the investment platform immediately.

How IRA Financial Group Compares to Alternatives

You’re comparing IRA Financial Group to competitors like Rocket Dollar and Equity Trust. Here’s what sets them apart.

IRA Financial charges $495 annually for a self-directed IRA with zero setup fees. Rocket Dollar hits you with $360 upfront plus $30 monthly – that’s $720 yearly for smaller accounts.

Fee Structure Comparison

|

Provider |

Setup Fee |

Annual Fee |

Transaction Fees |

|---|---|---|---|

|

IRA Financial |

$0 |

$495 |

$0 |

|

$360 |

$360 |

Varies |

|

|

$50-$75 |

$295-$2,000 |

$30-$100 per transaction |

|

|

$50 |

$365+ |

Asset-based pricing |

You save approximately $14,000 over ten years with IRA Financial’s flat fee versus Equity Trust’s asset-based pricing on a $500,000 account.

Investment Options

IRA Financial supports real estate, cryptocurrency, precious metals, and private businesses. Equity Trust offers similar alternatives but restricts certain crypto investments. Madison Trust provides broader international investment access but charges higher fees for complex transactions.

Your decision depends on investment priorities. Choose IRA Financial for transparent pricing and cryptocurrency flexibility. Select Equity Trust for established custodial services with traditional alternative assets.

Who is IRA Financial Group Best Suited For?

You’re browsing investment forums at midnight when you stumble upon discussions about self-directed IRAs. Your traditional 401(k) feels limiting—stocks and bonds aren’t cutting it anymore. You want real estate in your portfolio. Maybe some gold. Even cryptocurrency catches your eye.

IRA Financial Group fits experienced investors who crave control. You make investment decisions without waiting for custodian approval. Your Solo 401(k) or self-directed IRA gives you checkbook control—you spot an opportunity at 9 AM and close by noon.

Perfect Match Indicators:

- You run your own business or work as a consultant

- You’ve invested in real estate before

- You understand cryptocurrency markets

- You want precious metals protecting against inflation

- You need loan options from your retirement account

Red Flags This Isn’t For You:

- You prefer set-it-and-forget-it investing

- You want someone else making decisions

- You’re uncomfortable with alternative assets

- You need hand-holding through every transaction

Self-employed professionals find the Solo 401(k) particularly valuable. You contribute up to $69,000 annually (2024 limits) and borrow up to $50,000 for business needs. Your spouse can participate too, doubling contribution limits.

Final Verdict

Your retirement future deserves more than the standard stock and bond portfolio. IRA Financial’s self-directed approach opens doors to investments you’ve likely considered but couldn’t access through traditional retirement accounts.

The flat-fee structure alone could save you thousands compared to percentage-based custodians. When you factor in the direct specialist support and streamlined online platform you’re looking at a comprehensive solution that puts you in the driver’s seat.

Whether you’re eyeing real estate deals or want to add Bitcoin to your retirement mix IRA Financial delivers the tools and flexibility to make it happen.

Just remember you’ll need to be comfortable making your own investment decisions and managing the due diligence process.

Take time to evaluate your investment goals and risk tolerance before making the switch. If you’re ready to take control of your retirement investments and explore beyond traditional markets IRA Financial stands ready to support your journey.