You’re searching for a custodian to handle your self-directed IRA and Kingdom Trust Company keeps popping up in your research.

With over $18 billion in assets under custody and 20,000+ accounts, they’ve built quite a reputation since launching their MyRA account in 2009. But you need to know if they’re the right fit for your alternative investments.

Whether you’re planning to invest in real estate, precious metals, or private equity through your retirement account, choosing the right custodian can make or break your investment strategy.

Kingdom Trust specializes in both individual and institutional custody services, offering access to traditional assets like stocks and bonds alongside alternative investments. This review digs into what you’ll actually experience as their client.

Table of Contents

- 1 What is Kingdom Trust Company?

- 2 Leadership and Management Team

- 3 Account Types Offered by Kingdom Trust

- 4 Investment Vehicles and Alternative Assets

- 5 Kingdom Trust Company Fees and Costs

- 6 Customer Support and Online Reviews

- 7 Pros and Cons of Kingdom Trust Company

- 8 Important Considerations

- 9 Conclusion: Is Kingdom Trust Company Right for Your Self-Directed IRA?

What is Kingdom Trust Company?

You’re looking at Kingdom Trust Company a qualified custodian that’s been handling self-directed IRAs since 2008.

Originally founded in South Dakota, the company packed up and moved to Murray, Kentucky, where it rebranded as “Choice by Kingdom Trust” to better reflect its expanded services.

At its core, Kingdom Trust operates as a self-directed IRA custodian and institutional custody provider. You’ll find they manage over $18 billion in assets across more than 20,000 accounts numbers that place them among the larger players in the alternative asset custody space.

The company specializes in custody solutions that go beyond traditional stocks and bonds. Through their platform, you can hold real estate, precious metals, private equity, marketplace lending investments, and even cryptocurrency in your retirement accounts. They’ve built their reputation on providing access to investments that most traditional IRA custodians won’t touch.

For institutional clients, Kingdom Trust offers custody services for pooled investment vehicles managed by advisors.

This dual focus—serving both individual investors and financial institutions—sets them apart from custodians that cater exclusively to one market or the other.

Their MyRA account, launched in 2009, remains their flagship offering for individual investors seeking alternative investment options within tax-advantaged retirement accounts.

Leadership and Management Team

You’ll find Kingdom Trust’s executive roster includes Matthew Jennings as Co-Founder and CEO, Charles Ives as President, and Lisa Tabors serving as COO.

Tim Kuhman holds the General Counsel position while Scott Foster operates as Senior VP of Business Development. Jeremy Byars rounds out the leadership as VP of Communication and Education.

Behind closed doors, you might encounter a different story than the polished corporate image suggests. Former employees paint a picture of workplace dynamics that contradict the company’s stated Christian faith principles.

You’d witness executives allegedly yelling and cursing at staff members without facing consequences behaviors that clash with the values Kingdom Trust publicly promotes.

The nepotism allegations hit particularly hard when you’re seeking career advancement. Multiple employee reviews describe a promotion system that favors family members and insiders over merit-based recognition.

You’re looking at a workplace where your professional growth might depend more on who you know than what you achieve.

Remote workers report experiencing a more supportive environment compared to those in the office. You’ll appreciate the flexibility if you’re working from home, though the cultural disconnect between locations raises questions about consistent leadership practices across the organization.

Account Types Offered by Kingdom Trust

Kingdom Trust provides diverse retirement account options designed for both individual investors and businesses seeking alternative investment opportunities.

Each account type offers distinct tax advantages and investment flexibility that align with different retirement planning strategies.

Individual Retirement Accounts (IRAs)

You’ll find Kingdom Trust’s IRA offerings include both Traditional and Roth options, each serving different tax planning needs.

Traditional IRAs let you deduct contributions from your current taxable income, reducing your tax bill today. Your investments grow tax-deferred until withdrawal, when you’ll pay ordinary income tax rates. This structure benefits you if you expect lower tax rates in retirement.

Roth IRAs work differently you contribute after-tax dollars now but enjoy tax-free withdrawals later. Your investments grow without tax consequences, and qualified distributions after age 59½ come out completely tax-free.

This appeals to younger investors expecting higher future tax rates or anyone wanting predictable retirement income.

Kingdom Trust’s Choice IRA platform supports both types, allowing investments in alternative assets like real estate, precious metals, and cryptocurrencies alongside traditional securities.

Business Retirement Accounts

Kingdom Trust’s business retirement solutions include SEP and SIMPLE IRAs, each tailored for different company sizes and contribution structures.

SEP IRAs enable employers to contribute up to 25% of employee compensation or $69,000 (2024 limit), whichever is less. Only employers make contributions, simplifying administration for businesses with fluctuating profits.

SIMPLE IRAs suit small to medium businesses with 100 or fewer employees. Employees contribute through salary deferrals up to $16,000 annually (2024), with employers required to match up to 3% of compensation or provide 2% non-elective contributions. This structure encourages employee participation while keeping costs predictable for employers.

Both account types integrate with Kingdom Trust’s alternative investment platform, expanding investment options beyond typical 401(k) limitations.

Self-Directed IRA (Primary Offering)

Kingdom Trust’s self-directed IRA stands as their flagship product, granting you control over investment decisions typically restricted by conventional custodians.

You can diversify into real estate (including single-family homes, vacation properties, and foreclosures), precious metals, private equity, marketplace lending, and cryptocurrency all within one tax-advantaged account.

The Choice IRA platform eliminates investment barriers found at traditional custodians. You’re not limited to stocks, bonds, and mutual funds. Instead, you can pursue investments matching your expertise and interests.

Real estate investors can purchase rental properties, cryptocurrency enthusiasts can hold digital assets, and precious metals advocates can own physical gold and silver all under Kingdom Trust’s custody with full regulatory compliance.

MyRA Account

Kingdom Trust introduced their MyRA account in 2009, pioneering alternative asset custody in retirement accounts.

This groundbreaking offering opened doors for everyday investors to access investment options previously reserved for institutional clients. The MyRA account operates as a specialized self-directed IRA with enhanced features for alternative investments.

You gain access to Kingdom Trust’s full investment menu through MyRA, including their partnerships with Interactive Brokers and Kraken for traditional and cryptocurrency trading.

The account maintains transparent fee structures $195 annual administration fee with $40 per transaction making alternative investing accessible without hidden costs.

With over 50,000 members utilizing MyRA accounts, Kingdom Trust demonstrated that retirement investors wanted choices beyond Wall Street’s standard offerings.

Investment Vehicles and Alternative Assets

Kingdom Trust opens doors to investment opportunities beyond traditional stocks and bonds. You gain access to alternative assets that conventional custodians typically restrict, giving you control over diversifying your retirement portfolio.

Broad Investment Spectrum

You can invest in real estate, precious metals, private equity, promissory notes, marketplace lending, cryptocurrencies, and single-member LLCs through Kingdom Trust’s custody services.

This extensive selection lets you build a retirement portfolio that matches your investment strategy rather than limiting you to mutual funds and publicly traded securities.

The custodian supports both conventional and alternative investments within the same account. You maintain control over investment decisions while Kingdom Trust handles the administrative and regulatory requirements. This flexibility appeals to investors seeking diversification beyond the stock market’s volatility.

Kingdom Trust’s platform accommodates institutional investors alongside individual account holders. You benefit from the same custody infrastructure that serves family offices, advisory firms, and broker-dealers managing complex alternative asset portfolios.

Digital Currencies/Cryptocurrencies

Kingdom Trust became the first regulated US custodian to offer Bitcoin custody for retirement accounts in 2017.

You can hold Bitcoin and other cryptocurrencies within your IRA, capitalizing on digital asset growth while maintaining tax advantages.

The company provides secure storage solutions for digital currencies through partnerships with established cryptocurrency exchanges.

You execute trades through platforms like Kraken while Kingdom Trust maintains custody of your digital assets. This arrangement protects your retirement funds from exchange failures or security breaches.

Your cryptocurrency holdings receive the same regulatory oversight as traditional investments. Kingdom Trust’s insurance coverage through Lloyd’s of London extends to digital assets, providing additional protection for your Bitcoin and other cryptocurrency investments within retirement accounts.

Real Estate Investing

You can purchase rental properties, commercial buildings, raw land, and real estate investment trusts (REITs) through your self-directed IRA. Kingdom Trust processes the paperwork and holds the property title on behalf of your retirement account.

Real estate investments generate rental income that flows directly into your IRA tax-free. You avoid capital gains taxes when selling properties within the account, maximizing returns on successful real estate ventures.

The custodian handles property-related transactions, ensuring compliance with IRS regulations governing retirement account investments.

Kingdom Trust’s real estate custody services extend to fix-and-flip projects, tax liens, and real estate crowdfunding platforms.

You diversify across multiple property types and geographic locations without managing individual properties directly.

Precious Metals

You allocate retirement funds to physical gold, silver, platinum, and palladium through Kingdom Trust’s precious metals program.

The custodian partners with approved dealers who deliver IRS-compliant bullion and coins to secure storage facilities.

Your precious metals investments must meet specific purity standards: gold (99.5%), silver (99.9%), platinum (99.95%), and palladium (99.95%).

Kingdom Trust arranges storage at depositories that provide segregated or allocated storage options, ensuring your metals remain separate from other investors’ holdings.

The custody process includes purchasing metals at market prices, arranging insured delivery to approved vaults, and providing regular statements showing your holdings’ current value. You sell metals through the same dealer network when rebalancing your portfolio or taking distributions.

Private Lending and Promissory Notes

You extend loans to businesses or individuals through promissory notes held within your IRA. Kingdom Trust documents loan terms, processes payments, and ensures borrowers meet their obligations according to the note’s provisions.

Private lending generates fixed income through interest payments that accumulate tax-free in your retirement account.

You set loan terms including interest rates, repayment schedules, and collateral requirements. The custodian handles loan servicing, collecting payments and managing defaults according to your instructions.

Your lending activities must avoid prohibited transactions with disqualified persons, including family members and businesses you control.

Kingdom Trust screens potential borrowers to maintain IRS compliance while maximizing your lending opportunities.

Marketplace Lending and Crowdfunding

You participate in peer-to-peer lending platforms and crowdfunding investments through Kingdom Trust’s custody services.

The company integrates with marketplace lending sites, allowing you to fund small business loans, consumer debt, and startup equity rounds.

Crowdfunding platforms offer fractional ownership in real estate developments, small businesses, and creative projects.

You spread risk across multiple investments while potentially earning higher returns than traditional fixed-income securities. Kingdom Trust processes platform transactions and maintains records for tax reporting.

Your marketplace lending portfolio benefits from automated diversification tools on partner platforms. You select lending criteria, and algorithms distribute funds across qualifying loans, reducing concentration risk while maintaining your desired risk-return profile.

Private Equity and Publicly Traded Securities

You invest in private companies, hedge funds, and venture capital opportunities alongside traditional stocks and bonds.

Kingdom Trust processes private placement memorandums, subscription agreements, and capital calls for alternative investment funds.

Private equity investments offer potential returns exceeding public markets, though with longer holding periods and limited liquidity.

You access institutional quality investments typically reserved for accredited investors while maintaining retirement account tax advantages.

The custodian also supports traditional brokerage accounts for publicly traded securities. You maintain positions in stocks, bonds, mutual funds, and ETFs through partnerships with Interactive Brokers, combining conventional and alternative investments within a single custody relationship.

Single-Member LLCs

You establish single-member LLCs within your IRA for enhanced investment flexibility and checkbook control. Kingdom Trust registers the LLC with your retirement account as the sole member, allowing you to write checks and execute transactions directly.

This structure streamlines real estate purchases, private loans, and other time-sensitive investments. You sign contracts and fund deals immediately without waiting for custodian approval on each transaction. The LLC must maintain separate bank accounts and avoid prohibited transactions to preserve tax benefits.

Kingdom Trust screens LLC registrations to ensure IRS compliance before approving the structure. You gain transaction speed and flexibility while the custodian maintains oversight through periodic reporting requirements and annual valuations of LLC-held assets.

Kingdom Trust Company Fees and Costs

You’ll find Kingdom Trust Company’s pricing structure splits into three distinct fee schedules. The standard schedule covers alternative investments, while separate schedules apply to digital currencies and crowdfunding ventures.

Your annual account fee starts at $150 for up to two assets. Each additional asset adds $75 to your yearly costs. Opening an account costs $25 online or $60 if you prefer paper applications.

Standard Transaction Fees

|

Fee Type |

Amount |

|---|---|

|

Check Distribution |

$5 |

|

Domestic Wire Transfer |

$35 |

|

International Wire Transfer |

$75 |

|

Asset Purchase/Sale/Exchange |

$75 |

|

Asset Re-registration |

$25 per asset |

|

Cashier’s Check |

$40 |

|

Account Transfer Out |

$100 per asset |

Digital Asset Fees

You’ll pay $150 per investment direction for cryptocurrency transactions. The annual holding fee runs 0.25% of your digital asset value, charged at $225 minimum yearly.

Crowdfunding and Marketplace Lending Costs

The crowdfunding fee structure mirrors standard pricing at $150 annually for two assets. Additional custody fees remain $75 per asset beyond the initial two.

Kingdom Trust’s fees compete favorably against other self-directed IRA custodians. You won’t encounter hidden charges the company publishes all fees transparently on their fee schedule pages. Use their online fee calculator to estimate your specific costs before opening an account.

Customer Support and Online Reviews

Kingdom Trust’s customer support infrastructure affects your experience when managing self-directed retirement accounts. Understanding their support channels and reputation helps you evaluate if they match your service expectations.

Contact Channels

You can reach Kingdom Trust through multiple communication methods. The primary customer service number is 1-888-753-6972, with corporate headquarters accessible at 1-270-226-1000. Email support operates through help@kingdomtrust.com for general inquiries.

Physical locations span three states. The main office sits at 1105 State Route 121 Bypass North, Suite B in Murray, Kentucky 42071. Additional offices operate in Tuscaloosa and Birmingham, Alabama, plus Brentwood, Tennessee.

Kingdom Trust doesn’t offer live chat support. This absence means you’ll rely on phone calls during business hours or email correspondence for assistance. Response times vary based on inquiry complexity and current support volume.

Customer Support Quality

Employee feedback reveals contrasting perspectives on Kingdom Trust’s internal culture. Former staff members report concerns about management practices and promotion systems favoring insiders. Remote workers describe more positive experiences than office-based colleagues.

The company emphasizes educational resources over direct financial advice. You’ll find webinars, white papers, and blog posts covering self-directed IRA topics. This approach aims to empower your investment decisions without crossing into advisory territory.

Online Ratings

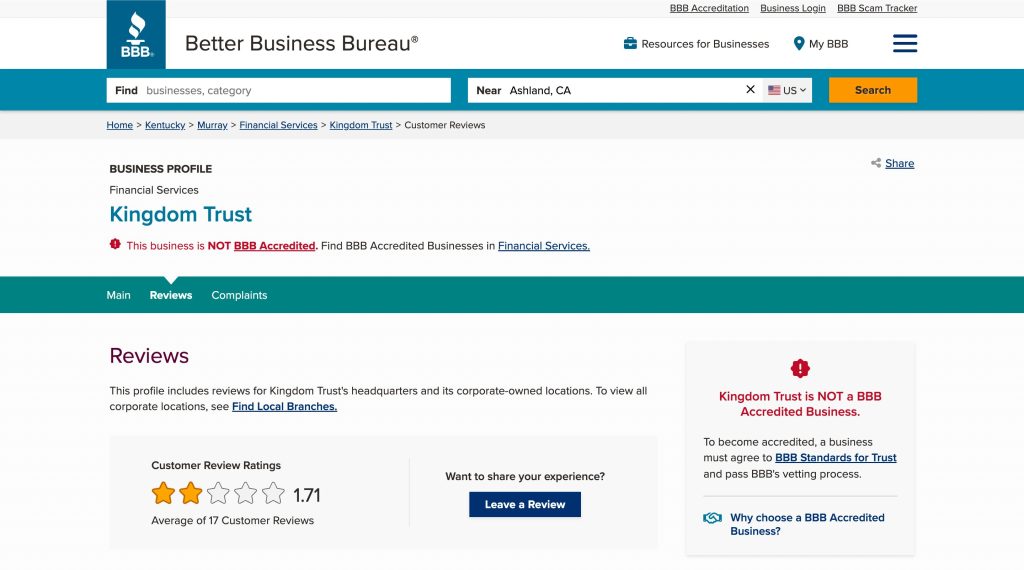

Kingdom Trust maintains an A- Better Business Bureau rating even though not being BBB accredited. But, customer reviews paint a mixed picture with 1.7 out of 5 stars from 17 reviews. Recent complaint numbers show 14 filed over three years and 2 within the last 12 months.

User feedback highlights specific frustrations. Customers report “substandard level of service” when attempting complex transactions. Others describe unexpected “fraudulent fees” appearing on accounts without clear explanation.

Account dissolution proves particularly challenging, with multiple reviewers detailing lengthy processes and unresponsive support.

G2 reviews from institutional clients offer a different perspective. These users praise Kingdom Trust’s regulatory compliance and capital security measures. The contrast between individual and institutional experiences suggests varying service levels based on account type.

|

Review Platform |

Rating |

Key Issues |

|---|---|---|

|

Better Business Bureau |

1.7/5 stars (17 reviews) |

Service complaints, fee disputes |

|

G2 |

Positive institutional feedback |

Praised for compliance, security |

|

Employee Reviews |

4.3/5 on Glassdoor |

Management concerns, promotion issues |

Pros and Cons of Kingdom Trust Company

Kingdom Trust Company presents both compelling advantages and notable drawbacks for investors considering self-directed IRA custody.

Understanding these factors helps you make an well-informed choice about whether their services align with your investment goals.

Pros

- Strong Reputation with Transparent Pricing: Kingdom Trust manages over $18 billion in assets across 20,000+ accounts. Their fee calculator lets you estimate costs before opening an account, eliminating surprise charges.

- Extensive Alternative Investment Options: You can diversify beyond stocks into real estate, precious metals, private equity, marketplace lending, and crowdfunding. Each asset class opens new opportunities for portfolio growth.

- First Regulated Crypto Custodian: In 2017, Kingdom Trust pioneered Bitcoin custody for retirement accounts. They now secure multiple digital currencies with institutional-grade storage protocols.

- Comprehensive Educational Resources: Access webinars, white papers, and detailed investment guides. These resources empower you to make confident decisions without relying on direct financial advice.

- Single-Member LLC Flexibility: Create corporate structures within your IRA for streamlined transactions. This setup lets you execute deals directly while maintaining IRS compliance.

Cons

- Mid-Range Pricing Structure: Annual fees start at $150 for two assets, plus transaction charges. Digital asset holdings incur an additional 0.25% annual fee that compounds over time.

- Limited Documentation Trail: Former clients report minimal paper records for transactions. This lack of documentation complicates tax reporting and audit preparation.

- Mixed Customer Experiences: The Better Business Bureau shows 14 complaints in three years even though an A- rating. Users report service delays and unexpected fee assessments.

Important Considerations

Before opening a self-directed IRA with Kingdom Trust, you face critical decisions that impact your retirement strategy.

These considerations determine whether Kingdom Trust aligns with your investment goals and financial situation.

1. Choosing the Right Account

You start by evaluating Kingdom Trust’s account options against your personal circumstances. Your age determines whether you qualify for catch-up contributions—if you’re 50 or older, you can contribute an extra $1,000 annually to IRAs.

Business owners gravitate toward SEP IRAs for higher contribution limits of up to $69,000 in 2024, while SIMPLE IRAs suit smaller companies with 100 or fewer employees.

Your contribution capacity shapes the decision between Traditional and Roth IRAs. Traditional IRAs offer immediate tax deductions on contributions up to $7,000 annually ($8,000 if you’re 50+), reducing your current tax burden.

Roth IRAs provide tax-free withdrawals in retirement—ideal if you expect higher future tax rates. Your retirement timeline matters: Kingdom Trust’s MyRA account accommodates alternative assets that require longer investment horizons, like real estate or private equity.

2. IRA Conversions

You convert Traditional IRAs to Roth IRAs through Kingdom Trust using either rollovers or transfers. Direct transfers move funds between custodians without touching your hands, avoiding the 60-day rollover deadline and potential penalties.

You’ll pay income tax on the converted amount in the year of conversion a $100,000 conversion adds $100,000 to your taxable income.

Kingdom Trust facilitates conversions for alternative assets, though the process differs from traditional securities.

Real estate conversions require professional appraisals to establish fair market value for tax purposes. Precious metals need current spot price valuations.

You coordinate with Kingdom Trust’s operations team to ensure proper documentation and IRS compliance. The custodian charges $75 per asset for transfers, plus potential valuation fees for complex assets.

3. Early Withdrawals/Emergencies

You face steep penalties for withdrawing IRA assets before age 59½. The IRS imposes a 10% early withdrawal penalty on top of regular income taxes a $50,000 withdrawal costs you $5,000 in penalties plus income tax. Kingdom Trust enforces these rules strictly, as required by federal regulations.

Alternative assets complicate emergency withdrawals. You can’t instantly liquidate real estate or private equity like stocks.

Precious metals require physical delivery or sale coordination, taking 5-10 business days. Digital assets face market volatility that impacts withdrawal timing.

First-time homebuyers and qualified education expenses offer penalty exceptions, though regular income tax still applies.

Kingdom Trust charges $35 for domestic wire transfers and $5 for check distributions during the withdrawal process.

4. Due Diligence

You compare Kingdom Trust’s A- rating with Better Business Bureau against competitors’ typically higher ratings.

- Strata Trust Company and Equity Trust Company both maintain A+ ratings with fewer customer complaints.

- GoldStar Trust Company specializes in precious metals with lower annual fees at $95 versus Kingdom Trust’s $150.

- New Direction Trust Company offers similar alternative asset options with 24/7 online account access a feature Kingdom Trust lacks.

- The Entrust Group provides live chat support and maintains higher customer satisfaction scores.

You examine Kingdom Trust’s 14 BBB complaints over three years against competitors averaging 10-20 complaints.

Former employees report management issues and nepotism concerns that don’t surface at other custodians. You contact multiple providers for fee schedules, processing times, and customer references before committing your retirement funds.

Conclusion: Is Kingdom Trust Company Right for Your Self-Directed IRA?

Kingdom Trust’s position as a pioneering alternative asset custodian makes it worth considering if you’re looking to diversify beyond traditional investments.

Their established track record with over $18 billion in custody and regulated crypto offerings demonstrates institutional credibility that many newer competitors lack.

Your decision eventually depends on your investment goals and comfort level with their fee structure. If you’re planning to hold multiple alternative assets or frequently trade digital currencies you’ll want to carefully calculate the total costs using their fee calculator.

The mixed customer feedback suggests your experience may vary based on your specific needs and expectations. While institutional clients report satisfaction you should weigh the BBB ratings against the company’s proven capabilities in alternative asset custody.

Before committing take time to compare Kingdom Trust with other self-directed IRA custodians. Request detailed fee schedules and ask specific questions about your planned investments.

The right custodian will align with both your retirement strategy and your need for responsive support throughout your investment journey.