You’re searching for a trustworthy custodian to protect your investment portfolio. Madison Trust Company promises to streamline your investing process with alternatives to Wall Street’s traditional approach. But when you dig deeper into customer experiences, you’ll discover a different story.

With a 1.4-star rating from customers and reports of unexpected fees hitting accounts, you need the full picture before trusting them with your money.

This review examines Madison Trust Company’s services, fee structure, and what actual investors say about their experiences.

You’ll learn exactly what to expect if you choose them as your custodian—including the hidden costs that frustrated customers warn about.

Table of Contents

- 1 What is Madison Trust Company?

- 2 Services Offered by Madison Trust Company

- 3 Investment Options and Allowable Assets

- 4 Fee Structure and Pricing

- 5 Account Management Process

- 6 Customer Service and Support

- 7 Customer Reviews and Ratings

- 8 Pros and Cons of Madison Trust Company

- 9 Comparison with Competitors

- 10 Conclusion: Is Madison Trust Company Right for You?

What is Madison Trust Company?

Madison Trust Company operates as a full-service custodian specializing in self-directed IRA services that help investment in alternative assets like real estate, startups, and precious metals.

The company positions itself as an alternative to traditional Wall Street investing, managing over $4.8 billion in assets for 20,000 clients across all 50 states.

History and Founding

You’re looking at a company that emerged from entrepreneurial frustration with existing IRA custodian services. Daniel Gleich and Mervyn Klein founded Broad Financial in 2009 as an IRA LLC Facilitation Firm.

After experiencing firsthand the lack of exceptional customer service from traditional IRA custodians, they established Madison Trust Company in 2014.

The founders brought in E. Brian Finkelstein as a partner, adding his 25+ years of global capital markets experience to strengthen the management team.

This transition from Broad Financial to Madison Trust represented their commitment to creating a custodian service that actually responds to investor needs—something they felt was missing in the industry.

Company Details and Scale

Madison Trust operates from its corporate headquarters at 401 East 8th Street, Suite 200P in Sioux Falls, South Dakota.

You’ll find their customer service office at 21 Robert Pitt Drive, Suite 201 in Monsey, New York, with a mailing address in Montvale, New Jersey.

| Key Metrics | Details |

|---|---|

| Founded | 2014 |

| Assets Under Custody | $4.8+ Billion |

| Number of Clients | 20,000+ |

| Employees | 70+ |

| BBB Rating | A |

| Locations | 3 offices (SD, NY, NJ) |

The company’s growth from startup to managing billions in alternative assets demonstrates significant market penetration in the self-directed IRA industry.

Leadership and Management Team

Daniel Gleich serves as CEO, President, Board Member, and Shareholder, bringing his entrepreneurial background in launching businesses and real estate investing.

E. Brian Finkelstein holds the position of Chairman and Shareholder, contributing over 25 years of experience in global capital markets. Mervyn Klein rounds out the core leadership as Board Member and Shareholder.

The board extends beyond these founders to include Jim Riswold, David Timpe, and Mark Golombeck, each bringing specialized expertise to the organization.

Industry analysts recognize Madison Trust’s executive team as one of its biggest strengths—few self-directed IRA companies match this depth of financial services expertise at the leadership level.

Services Offered by Madison Trust Company

Madison Trust Company provides comprehensive self-directed IRA custodial services designed to help you invest beyond traditional stocks and bonds.

Their service offerings combine standard custodial functions with unique tools that set them apart in the SDIRA industry.

Core SDIRA Custodial Services

You’ll find Madison Trust handles all essential custodial responsibilities for your self-directed IRA. They complete IRS-required tax reporting, ensuring your account stays compliant with federal regulations.

The company holds your alternative investments—real estate, private placements, promissory notes—in custody while you maintain control over investment decisions.

They administer IRA contributions, process rollovers from existing retirement accounts, and manage distributions.

Their team processes investment transactions you initiate, maintains accurate records of all account activity, and provides quarterly statements detailing your holdings and transactions.

Standard Services

Madison Trust delivers six core services every SDIRA investor needs. You get 24/7 online account access to monitor investments and initiate transactions.

Their team facilitates existing IRA fund transfers, typically completing rollovers within 5-10 business days. Investment processing covers purchase documentation, fund disbursements, and asset titling.

Account maintenance includes updating beneficiary information, address changes, and investment record-keeping.

You receive detailed quarterly statements showing account values, transactions, and fee assessments. They handle all IRS tax reporting, including Forms 5498 and 1099-R.

Unique Services

You gain access to two distinctive tools at Madison Trust. Their Comparison Calculator analyzes fees from eight top SDIRA custodians based on your expected account value, pulling data from Google, BBB, Yelp, and Facebook reviews.

The Fundraising Toolbox—free for Investment Sponsors—includes educational brochures, webinar templates, employee training materials, digital marketing collateral, and event participation resources.

This toolkit helps fund managers educate potential investors about using SDIRAs for alternative investments, streamlining capital raises for real estate syndications, private equity funds, and startup investments.

Live Call Support

You connect directly with CISP-trained specialists when calling Madison Trust—no automated phone trees or offshore call centers.

Their investments team explains complex transactions, clarifies IRS compliance requirements, and guides you through prohibited transaction rules.

Representatives help you navigate UBIT (Unrelated Business Income Tax) issues, understand investment documentation requirements, and resolve account questions in real-time.

This personalized support contrasts sharply with competitors who rely heavily on email-only communication or outsourced customer service, though some customers report inconsistent response times during peak periods.

Investment Options and Allowable Assets

Madison Trust Company opens doors to investment opportunities you can’t find at traditional brokerages. Your self-directed IRA gains access to alternative assets that diversify your retirement portfolio beyond stocks and bonds.

Breadth of Alternative Investments

You control your retirement funds through Madison Trust’s wide range of alternative investments. Real estate properties, limited partnerships, and private equity opportunities become accessible through your self-directed IRA.

Energy-related investments offer tax advantages like depreciation deductions and tax credits. Your portfolio expands into socially responsible energy projects and private loans secured by tangible assets.

Madison Trust charges higher fees than traditional custodians—justified by specialized administration expertise. Your quarterly flat-rate fee remains constant regardless of investment earnings, providing predictable costs.

Alternative assets require longer commitment periods than publicly traded securities, yet offer potential tax-advantaged growth unavailable through conventional retirement accounts.

Specific Asset Classes

Your Madison Trust self-directed IRA accommodates these investment categories:

- Real Estate: Direct property ownership, rental properties, commercial buildings

- Private Placements: Regulation A/D offerings, REITs, Business Development Companies (BDCs)

- Promissory Notes: Both secured and unsecured lending opportunities

- Precious Metals: Physical gold, silver, platinum stored in approved depositories

- IRA LLCs/Checkbook Control: Draw checks using your company name, access debit/credit cards for transactions (IRS scrutinizes this structure)

- Trust Deeds: Secured debt instruments backed by real property

- Tax Liens: Government-issued certificates for unpaid property taxes

- Private Lending: Unsecured notes, secured notes with collateral

- Private Company Stock: Equity in non-publicly traded businesses

- Multi-member LLCs: Partnership interests in limited liability companies

Cryptocurrency custody remains unclear—conflicting information exists about Bitcoin availability through Madison Trust accounts.

Assets Not Allowed

Madison Trust excludes certain investment categories from custody services. You cannot hold futures contracts or FOREX positions in your self-directed IRA.

Public company stocks, ETFs, and publicly traded options fall outside Madison Trust’s alternative investment focus. Mutual funds and closed-end funds remain unavailable through their platform.

These restrictions align with Madison Trust’s specialization in alternative assets rather than traditional securities. Your investment choices concentrate on private market opportunities instead of publicly traded instruments.

Contact Madison Trust directly to confirm specific asset eligibility, as IRS rules prohibit certain investments within IRAs regardless of custodian policies.

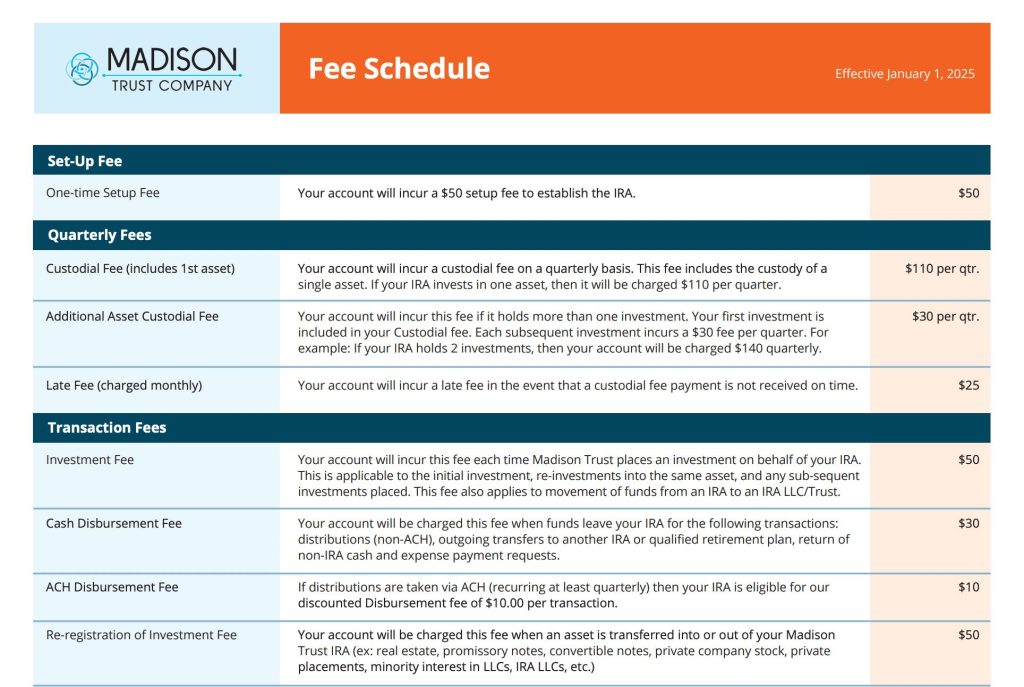

Fee Structure and Pricing

Madison Trust Company’s fee structure directly impacts your investment returns when managing self-directed IRAs.

Understanding their pricing models and specific charges helps you evaluate whether their services align with your investment goals.

Pricing Models

Madison Trust Company uses a hybrid pricing approach combining flat-rate fees with asset-based charges.

The flat-rate model charges you $110 quarterly for a single asset in your IRA, regardless of investment size. This structure benefits you when investing in high-value assets like real estate or private placements.

For multiple investments, each additional asset adds $30 per quarter to your custodial fees. The company provides a fee calculator tool allowing you to estimate total costs based on your portfolio composition before opening an account.

Detailed Fee Schedule

Here’s Madison Trust Company’s comprehensive fee breakdown:

Account Management Fees:

- Setup Fee: $50

- Quarterly Custodial Fee: $110 (single asset)

- Additional Asset Fee: $30 per quarter per asset

- Account Termination: $100

Transaction Fees:

- Investment Processing: $50

- Cash Disbursement: $30

- ACH Disbursement: $10

- Asset Sale: $50

Specialized Services:

- IRA LLC Setup: $100

- Precious Metals Storage: Minimum $100

- Corrected Tax Forms: Additional charges apply

- Stop Payment Requests: Service fees apply

Late payment penalties apply if you delay custodial fee payments beyond the due date.

Competitiveness

Madison Trust Company’s annual fees average $440 for single-asset accounts, positioning them competitively among self-directed IRA custodians.

Industry comparisons show competitors charge between $367-$750 annually, with Madison Trust ranking in the mid-range.

The company’s fee structure particularly benefits investors holding fewer, higher-value alternative assets. Live customer support distinguishes Madison Trust from competitors who often rely solely on automated systems.

But, customer reviews mention concerns about fees charged on zero-balance accounts, suggesting you verify account closure procedures before terminating services.

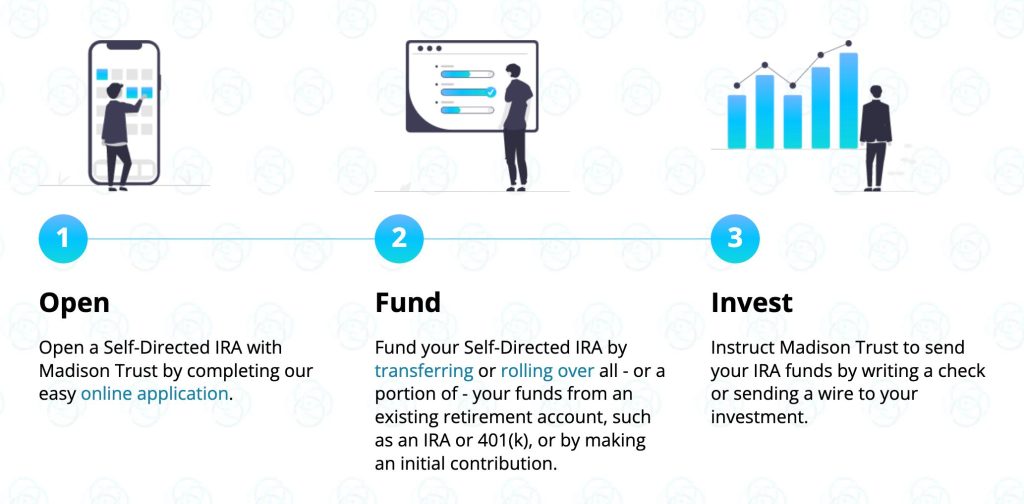

Account Management Process

Madison Trust Company’s account management process combines standard custodial procedures with specialized self-directed IRA features. You’ll navigate specific requirements and timelines that differ from traditional investment accounts.

Opening an Account

You start your Madison Trust account by completing transfer authorization forms with your signature. Madison Trust doesn’t require a Medallion Signature Guarantee, though your current custodian might demand one during the transfer process.

You’ll work with CISP-trained specialists who guide you through paperwork for Traditional IRAs, Roth IRAs, SEP IRAs, or SIMPLE IRAs.

The $50 setup fee covers account establishment. Processing takes 3-4 weeks standard time, depending on your releasing institution’s speed. You can access online applications and submit forms electronically through their client portal.

Funding and Transfers

You execute transfers through direct custodian-to-custodian rollovers or indirect rollovers where you receive funds personally.

Direct rollovers remain non-taxable and unreported on tax returns. Indirect rollovers require tax reporting and limit you to one per 12-month period.

Madison Trust charges transaction fees for each funding event. Wire transfers process faster than checks—wires become available next business day while bank checks hold for 5 business days and non-bank checks for 7 business days.

You’ll coordinate with both custodians since total transfer duration depends on your current institution’s release procedures.

Processing Timeframes

Madison Trust starts your 4-business-day processing clock when they receive your forms. You can expedite to next-business-day processing for $50.

Forms submitted after 1 PM count toward the following business day’s queue. Your actual transfer completion extends beyond Madison Trust’s internal timeline—external custodians control fund release schedules.

Customer feedback reveals frequent delays beyond stated timeframes, with some reporting weeks of additional waiting. You’ll receive quarterly statements tracking your account status throughout the process.

Customer Service and Support

Madison Trust Company structures its customer service around direct client interaction and personalized support. You’ll find their approach focuses on accessibility and education for self-directed IRA investors.

Client-First Philosophy

Madison Trust Company emphasizes “unstinting client support” as a core operational value. Customer experiences reveal mixed results with this philosophy—some clients praise individual representatives like Maria for knowledgeable assistance while others report frustration with unclear fee communications.

The company maintains BBB accreditation since 2015 with an A+ rating, indicating commitment to professional standards.

You’ll encounter staff trained in retirement planning and IRA investment management, though consistency in service delivery varies across customer interactions.

Direct Interaction

Employees answer incoming calls directly rather than routing through automated systems. CISP-trained specialists handle your inquiries about investment transactions and compliance requirements.

Response times fluctuate—some customers receive prompt assistance while others experience delays during peak periods. The company’s 70 employees manage over 20,000 client accounts, which impacts individual attention levels.

You’ll work with representatives who understand self-directed IRA regulations, though customer reviews indicate varying expertise levels among staff members.

Accessibility

Contact Madison Trust Company at 1-800-721-4900 or 1-833-739-0135 during business hours (8:00 AM – 5:00 PM EST, Monday-Friday).

Email inquiries go to info@madisontrust.com or hello@madisontrust.com. Their corporate office operates from 401 East 8th Street, Suite 200P, Sioux Falls, SD 57103, with customer service at 21 Robert Pitt Drive, Suite 201, Monsey, NY 10952.

You can schedule appointments with customer service representatives in advance. Multiple customers report difficulties reaching support during tax season and account transfer periods.

Education Focus

Madison Trust provides educational resources through webinars, articles, and animated explainer videos about self-directed investing.

Their Comparison Calculator helps you analyze fees across eight custodians. The Fundraising Toolbox educates potential investors about alternative asset opportunities. You’ll access online resources explaining IRA regulations and investment processes.

Customer feedback suggests these educational materials help clarify complex transactions, though some investors desire more comprehensive guidance on specific alternative asset classes like cryptocurrencies and private placements.

Customer Reviews and Ratings

Madison Trust Company presents a complex customer satisfaction world with dramatically different experiences across review platforms. You’ll find ratings ranging from 1.4 stars to 4.9 stars depending on where you look.

Positive Experiences

You’ll discover Madison Trust Company maintains strong ratings on major platforms. Google Business Profile shows 4.8 out of 5 stars from 964 reviews, while the Better Business Bureau displays 4.85 out of 5 stars from 106 reviews.

Satisfied clients praise the company’s efficient self-directed IRA processing and knowledgeable staff members who guide complex alternative investment transactions.

You’ll appreciate their specialized expertise in handling real estate investments, private placements, and precious metals within retirement accounts. Many reviewers highlight smooth account transfers and responsive customer service during initial setup phases.

Common Complaints

You’ll encounter serious concerns about hidden fees across multiple transactions. Sitejabber reviews reveal a 1.4-star rating from frustrated investors citing unexpected charges for routine services.

You’re facing fees for account maintenance, transfers, disbursements, and even zero-balance accounts. Customers report slow IRS payment processing, incorrect transfer handling, and difficulty accessing funds when needed.

Communication breakdowns plague some accounts, with representatives providing unclear fee explanations upfront.

You’ll notice complaints about the company holding funds hostage through excessive transaction charges that accumulate quickly.

Pros and Cons of Madison Trust Company

Evaluating Madison Trust Company reveals distinct advantages and limitations that directly impact your self-directed IRA experience. Understanding these factors helps you determine if their services align with your investment goals.

Pros

- BBB A+ Rating Since 2014: You get assurance from their decade-long track record with the Better Business Bureau, reflecting established business practices and complaint resolution.

- CISP-Certified Specialists: Your complex IRA transactions receive support from personnel trained in IRS regulations, reducing compliance errors.

- Flat-Rate Fee Structure: You pay $110 quarterly for single assets instead of percentage-based fees, potentially saving thousands on larger investments.

- Alternative Asset Expertise: You can invest in real estate, private placements, and promissory notes with specialized administrative support.

- $4.8 Billion Under Management: Your assets join those of 20,000+ clients across all 50 states, indicating substantial operational scale.

- Multiple Office Locations: You access services through offices in South Dakota, New York, and New Jersey for regional convenience.

Cons

- Higher Starting Fees: You pay more upfront compared to competitors, with $50 setup fees plus quarterly charges beginning immediately.

- Cryptocurrency Confusion: You encounter conflicting information about crypto custody availability, requiring direct confirmation before investing.

- IRA LLC Complications: You face IRS scrutiny if pursuing checkbook control structures, as the agency “frowns upon” these arrangements.

- No Financial Advice: You receive zero investment guidance or recommendations, requiring independent decision-making for all transactions.

- Limited Direct Support: You can’t access immediate live chat or speak with representatives without scheduling appointments first.

- Hidden Fee Complaints: You might discover unexpected charges for routine services, with customers reporting fees for mailing and even paying fees.

Comparison with Competitors

You’re evaluating Madison Trust Company against other self-directed IRA custodians and discovering crucial differences in fees and service quality.

The SDIRA custodian market includes established players like Equity Trust, IRA Services Trust Company, and Kingdom Trust, each offering distinct advantages.

Madison Trust charges $440 annually for single-asset accounts ($110 quarterly), while Equity Trust starts at $225 yearly for basic accounts.

Kingdom Trust offers $100 annual fees for precious metals accounts. IRA Services Trust Company charges $95 annually plus transaction fees.

| Custodian | Annual Base Fee | Setup Fee | Transaction Fees |

|---|---|---|---|

| Madison Trust | $440 | $50 | $30-$150 |

| Equity Trust | $225-$500 | $50 | $35-$240 |

| Kingdom Trust | $100-$350 | $50 | $35-$100 |

| IRA Services | $95 | $100 | $75-$150 |

You’ll notice competitors excel in specific areas where Madison Trust faces criticism. Equity Trust provides transparent fee disclosure upfront, addressing the hidden fee complaints plaguing Madison Trust. Kingdom Trust specializes in cryptocurrency custody, an area where Madison Trust remains ambiguous.

Customer service ratings reveal stark contrasts. While Madison Trust holds a 1.4-star Sitejabber rating, Equity Trust maintains 4.2 stars with 250+ reviews. Kingdom Trust scores 3.8 stars, emphasizing responsive support teams.

The BBB ratings tell a different story. Madison Trust’s A+ rating matches Kingdom Trust and exceeds Equity Trust’s B+ rating.

This discrepancy between review platforms highlights the importance of checking multiple sources before choosing your custodian.

Conclusion: Is Madison Trust Company Right for You?

Madison Trust Company’s self-directed IRA services present a double-edged sword for investors seeking alternative asset custody. Your decision eventually hinges on what matters most to your investment strategy and risk tolerance.

If you’re prioritizing BBB ratings and specialized alternative asset expertise, Madison Trust’s A+ rating and CISP-certified specialists might align with your needs. Their flat-rate pricing structure could save you money if you’re managing high-value alternative investments.

But, if transparent fee practices and consistent customer service are non-negotiable for you, the stark contrast between review platforms raises red flags.

The 1.4-star Sitejabber rating isn’t something you can ignore when competitors offer clearer pricing and better customer satisfaction scores.

Before committing your retirement funds, you’ll want to request detailed fee schedules in writing and thoroughly research competitor offerings.

Consider reaching out to current clients directly through investment forums to gather unfiltered feedback about their experiences with hidden fees and service quality.

Your self-directed IRA deserves a custodian that matches your investment goals without compromising on transparency or support quality.