You’re considering self-directed IRAs but don’t know which custodian to trust with your retirement savings.

New Direction Trust Company manages thousands of accounts holding alternative assets like real estate and precious metals—investments that go beyond traditional stocks and bonds.

Founded in 2003, this Louisville-based custodian handles complex portfolios requiring specialized licensing and expertise.

With over 50 employees managing billions in retirement assets, they’ve built a reputation for custom solutions and reliable transaction funding.

But do they deliver on their promises?

Let’s find out what customers actually experience when they open accounts with New Direction Trust Company!

Table of Contents

- 1 Overview of New Direction Trust Company

- 2 Setting Up and Funding Your Account with New Direction Trust Company

- 3 Investment Options Supported by New Direction Trust Company

- 4 Key Features and Services

- 5 Fees and Pricing Structure

- 6 Customer Feedback and Real-Life Experiences

- 7 Pros and Cons

- 8 New Direction Trust Company vs. Competitors

- 9 Final Verdict: Is New Direction Trust Company the Right Choice for You?

Overview of New Direction Trust Company

You’re looking at a self-directed IRA custodian that’s managed thousands of customer accounts since 2003. New Direction Trust Company operates from Louisville, Colorado, with 50-249 employees handling billions in retirement assets.

Company History and Leadership

Catherine Wynne and Bill Humphrey founded New Direction Trust Company in 2003, not 2001 as sometimes reported.

Wynne serves as board chair while Humphrey operates as co-founder and CFO. The company started with a clear mission: remove barriers to self-directed investing.

You’ll find their Louisville headquarters at 1070 W Century Drive, Suite 101. The office opens at 8:30 AM MST and closes at 5:00 PM Monday through Friday. They’ve maintained Better Business Bureau accreditation since 2004 and hold an A rating.

The founders built the company on three pillars: investor empowerment, personalized customer service, and comprehensive education. Their approach lets you invest tax-advantaged savings into alternative assets you understand and believe in.

Core Business Model

New Direction Trust Company specializes in self-directed IRAs that hold alternative assets beyond stocks and bonds.

You can invest in real estate, precious metals, private lending, private equity, and checkbook IRAs through their platform.

Their myDirection online portal gives you 24/7 account access. You pick from six different IRA depositories for precious metals storage. The company creates custom solutions based on your specific assets and diversification goals.

They manage both IRA and HSA accounts. Alternative investments require special licensing and complex documentation – expertise they’ve developed over 20 years.

Their transaction funding process handles the unique requirements of non-traditional assets like property deeds and private loan documents.

Setting Up and Funding Your Account with New Direction Trust Company

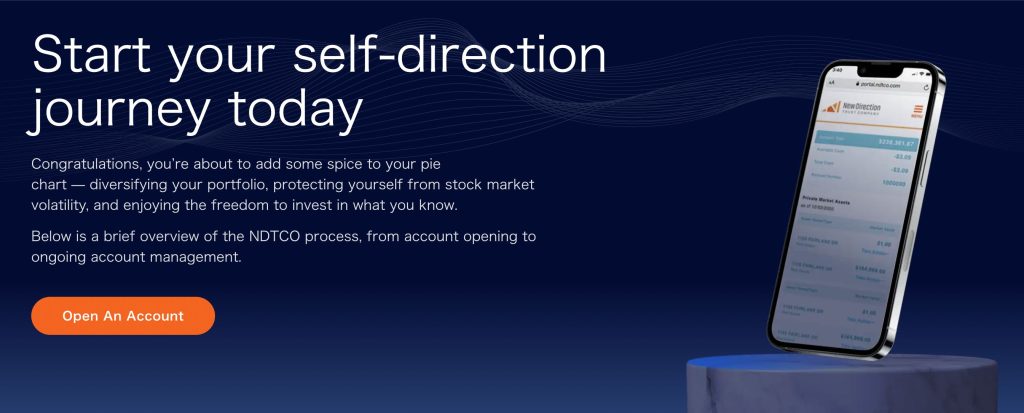

You’re ready to start investing in alternative assets through New Direction Trust Company. The process is straightforward—you’ll complete everything online in under 20 minutes.

The Account Setup Process

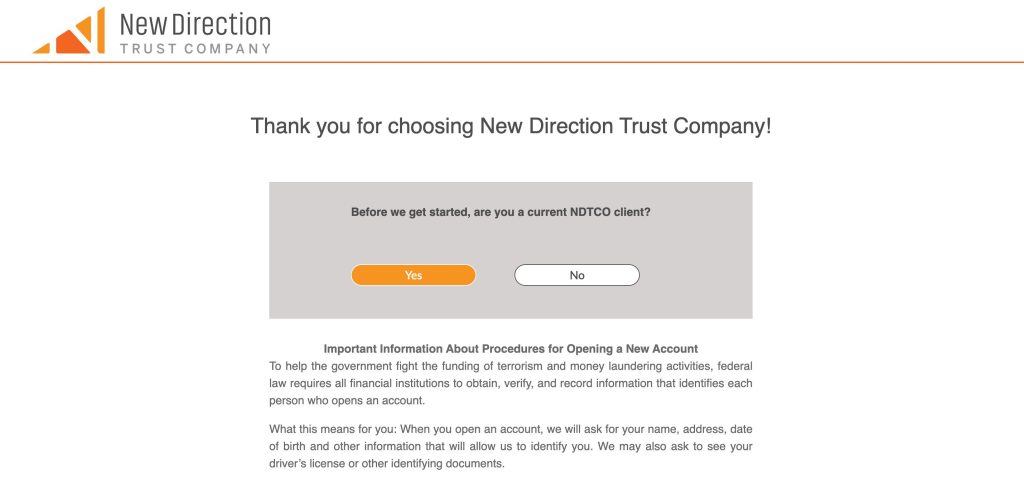

You begin by entering basic personal information on New Direction’s secure portal. You’ll provide your full legal name, permanent mailing address, date of birth, and Social Security number. The system immediately encrypts your data using 256-bit SSL encryption—the same security banks use.

Next, you’ll verify your identity. You upload a clear photo of your driver’s license or state-issued ID directly through the portal.

The automated verification typically takes 2-3 minutes. If you’re opening a business account, you’ll also submit your EIN documentation.

The compliance review happens automatically. New Direction’s system checks your information against federal databases to meet IRS and PATRIOT Act requirements. You’ll receive email confirmation within 24 hours that your account is active and ready for funding.

Flexible Funding Options

You have three ways to fund your new self-directed IRA. Direct contributions let you deposit up to $6,500 annually (or $7,500 if you’re 50 or older). You can set up automatic monthly contributions of $542 to max out your annual limit without thinking about it.

For transfers, you initiate the process through myDirection. You’ll enter your current custodian’s information and the amount you want to move. New Direction handles the paperwork—typically completing transfers within 5-7 business days.

Rollovers from 401(k)s, 403(b)s, or other employer plans work similarly. You’ll receive a rollover kit with pre-filled forms after providing your plan details. Most rollovers complete within 10-15 business days, depending on your previous custodian’s processing time.

Online Account Management

The myDirection platform becomes your investment command center. You log in with two-factor authentication for added security. Your dashboard displays your account balance, recent transactions, and pending investments in real-time.

You’ll find every document you need in the digital vault—contribution receipts, tax forms, and investment records. The platform generates your 5498 and 1099-R forms automatically each tax season. You can download them instantly or have copies mailed.

Making investments happens entirely online. You submit investment directions, upload supporting documents, and track funding progress through the portal.

The mobile-responsive design means you can check your account or initiate transactions from your phone during lunch breaks. Email alerts keep you informed when transactions complete or documents need your attention.

Investment Options Supported by New Direction Trust Company

New Direction Trust Company provides you with extensive investment flexibility through self-directed IRAs. Your portfolio can include traditional securities alongside alternative assets that match your investment strategy and risk tolerance.

Precious Metals

You can invest in physical gold, silver, platinum, and palladium through your New Direction Trust Company IRA.

Each metal must meet IRS purity standards: gold requires 99.5% purity, silver needs 99.9%, and both platinum and palladium demand 99.95% purity.

You select your own precious metals vendor from any dealer meeting IRS requirements. This flexibility lets you negotiate prices and choose dealers you trust. Your metals get stored in one of six IRS-approved depositories across the country.

Storage fees aren’t included in New Direction’s annual account fees. You’ll pay these directly to your chosen depository, typically ranging from $100-300 annually depending on your holdings’ value. Consider these additional costs when calculating your investment returns.

Diverse Alternative Assets

Your investment choices extend far beyond precious metals. Real estate forms a major category—you can purchase residential properties, commercial buildings, or raw land. Rental income flows directly into your IRA tax-free until withdrawal.

Private equity and private lending opportunities let you invest in businesses or loan money at interest rates you negotiate.

Cryptocurrency investments are possible through specialized platforms that integrate with New Direction’s custody services.

Checkbook IRAs give you immediate transaction control. You establish an LLC within your IRA, receive a business checkbook, and make investments instantly without waiting for custodian approval.

This structure works well for time-sensitive deals like property auctions or private business investments requiring quick funding decisions.

Traditional Investments

You’re not limited to alternative assets. New Direction Trust Company also handles stocks, bonds, mutual funds, and ETFs through partnerships with major brokerage platforms. This means you can maintain a balanced portfolio mixing traditional and alternative investments within one account.

The myDirection portal connects to various trading platforms, letting you execute trades and monitor traditional holdings alongside your alternative investments. You view everything in one dashboard—your rental property values next to your stock portfolio performance.

Transaction fees for traditional investments vary by brokerage partner. Some charge per-trade commissions while others offer commission-free trading on certain securities. Review fee schedules carefully before selecting your brokerage connection to minimize trading costs.

Key Features and Services

You’re looking at a self-directed IRA custodian that’s been managing alternative investments since 2003. New Direction Trust Company distinguishes itself by offering diverse investment options beyond traditional stocks and bonds, combined with technology that puts you in control of your retirement planning.

User-Friendly Platform and Tools

You access your accounts through the myDirection portal, an online platform that transforms complex investment management into straightforward tasks.

The interface displays your portfolio dashboard immediately upon login, showing account balances, recent transactions, and pending investments in real-time.

Your contribution process takes 3 clicks: select your account, enter the amount, and choose ACH transfer. The portal stores your banking information securely, eliminating repetitive data entry.

Document storage features organize your investment paperwork—purchase agreements, tax forms, transaction confirmations—in searchable folders.

You receive email alerts for every account activity: contributions received, investments executed, distributions processed.

The messaging center connects you directly with your account specialist without phone calls. Two-factor authentication protects your login, while mobile-responsive design lets you check investments from any device.

Comprehensive Account Types

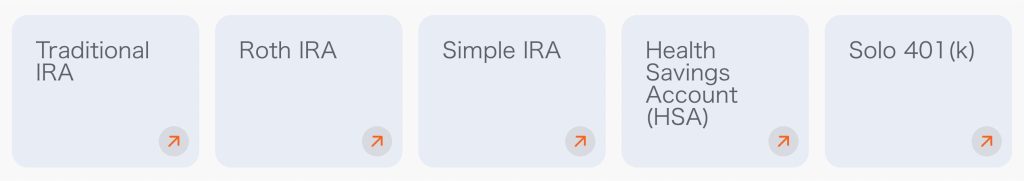

You can open 8 different tax-advantaged accounts through New Direction Trust Company:

- Traditional IRAs: Pre-tax contributions reducing current taxable income

- Roth IRAs: After-tax contributions for tax-free retirement withdrawals

- SEP IRAs: Simplified employee pension plans for self-employed individuals

- SIMPLE IRAs: Savings incentive match plans for small businesses

- Solo 401(k)s: Individual 401(k) plans for business owners without employees

- Health Savings Accounts (HSAs): Triple tax advantage for medical expenses

- Coverdell ESAs: Education savings accounts for K-12 and college costs

- Inherited IRAs: Beneficiary accounts preserving tax-deferred growth

Each account type supports the same alternative investments—real estate, precious metals, private equity, cryptocurrency.

You maintain separate logins for multiple accounts or manage them through a single dashboard. Rollovers from employer plans like 401(k)s transfer within 2-3 weeks.

Commitment to Investor Education

Your learning journey starts in the Help Center, where 200+ articles explain self-directed investing concepts. The FAQ section answers account setup questions, investment rules, and fee structures with specific examples.

Live webinars run twice monthly, covering topics like “Real Estate IRAs 101” and “Understanding Prohibited Transactions.”

You register through the portal and receive recordings afterward. The video library contains 50+ tutorials demonstrating platform features—from making contributions to executing complex investments.

Investment guides download as PDFs, providing step-by-step instructions for specific asset types. The “Precious Metals Guide” details IRS purity requirements, approved depositories, and storage options. Email newsletters deliver regulatory updates and investment strategies monthly.

Dedicated Customer Support

You reach customer service at 877-742-1270 between 8:30 AM and 5:00 PM MST. Representatives answer within 2 minutes on average, according to internal metrics. Email support through info@ndira.com typically responds within 24 hours.

The client portal messaging system connects you with your assigned account specialist. These specialists handle your account exclusively, learning your investment preferences and transaction history. Live chat operates during business hours for quick questions about fees, forms, or platform navigation.

Your specialist guides complex transactions—like purchasing rental property or funding private loans—through completion.

They review documents before submission, catching errors that could delay investments. Annual account reviews with your specialist identify optimization opportunities and ensure compliance with IRS regulations.

Fees and Pricing Structure

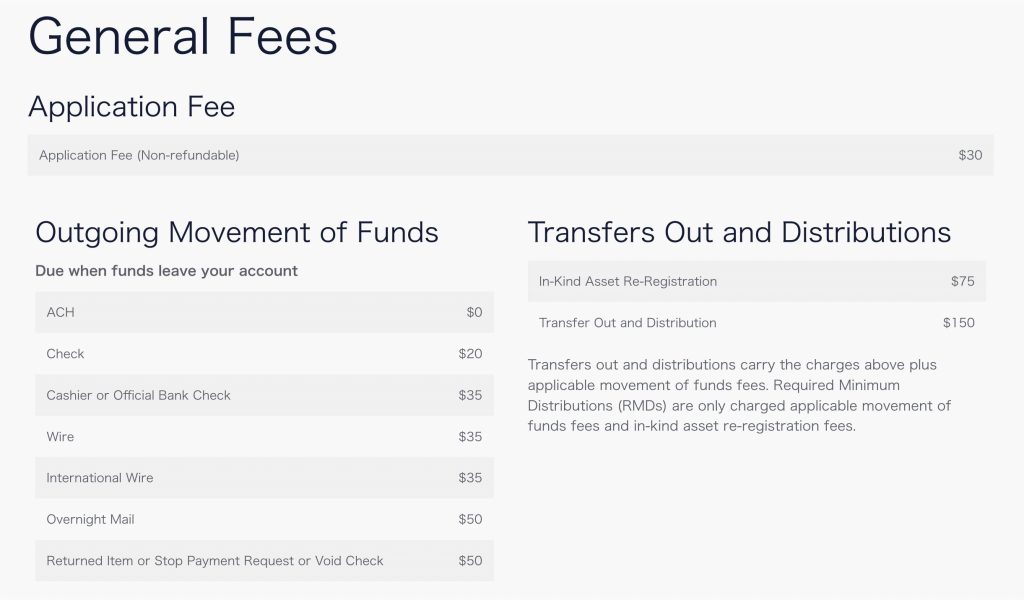

New Direction Trust Company’s fee structure operates on multiple tiers, charging separately for administration, storage, and transactions.

You’ll encounter various costs throughout your account lifetime that can significantly impact your investment returns.

Annual Fees

Your annual administration fee depends on your precious metals account value. Accounts below $100,000 pay $75 annually, while accounts valued at $100,000 or above pay $125. For publicly traded securities, you’ll pay a flat fee between $115 and $150 depending on your account type.

Other private assets like LLCs, notes, and real estate carry either quantity-based fees ($315 per asset or $215 per mortgage annually) or value-based fees assessed semi-annually on total market value. The company claims transparent pricing, yet this sliding scale contradicts a simple flat-rate model.

You’ll notice the fee increase triggers automatically once your account crosses the $100,000 threshold. This structure penalizes successful investors whose portfolios grow over time.

Storage Fees

Your annual administration fees don’t cover precious metals storage—a crucial detail often overlooked during account setup.

You’ll pay additional annual storage fees directly to one of six IRS-approved depositories, independent of NDTCO’s charges.

Storage costs vary by depository, metal type, and quantity stored. You select your depository during the purchase process, but you’re locked into their fee schedule afterward. These separate storage fees can add hundreds to thousands of dollars annually to your total costs.

The separation of administration and storage fees means you’re managing two different fee relationships. You’ll receive bills from both NDTCO and your chosen depository, complicating your expense tracking and potentially catching you off-guard with unexpected charges.

Setup and Termination Fees

Opening your account costs $30 for online applications or $75 for paper and electronically signed applications. HSA accounts carry a reduced $25 setup fee. These upfront costs apply regardless of your initial investment amount.

Termination fees range from $25 minimum to $250 maximum, depending on your assets. The company determines your exact termination fee based on asset complexity and account holdings at closure. You won’t know your potential exit cost until you’re ready to leave.

Transaction fees must be paid before funding occurs. This requirement means you’re paying fees on transactions that might not complete successfully, adding financial risk to your investment decisions.

Transaction Fees

You’ll pay $50 for each precious metals purchase, sale, or reregistration. Exchanges cost $70 per transaction. These fees apply regardless of transaction size, making smaller investments proportionally more expensive.

Clients report unexpected fees for fund movements and precious metals receipts that weren’t clearly defined during account opening.

Processing checks costs between $5 and $40, while bank wire transfers carry additional charges. Special services outside the standard fee schedule bill at $150 per hour.

The fee structure lacks transparency for complex transactions. You might encounter charges for document preparation, asset valuation, or compliance reviews without advance notice. These surprise fees can erode your investment returns and complicate your financial planning.

Customer Feedback and Real-Life Experiences

Customer feedback reveals both strengths and weaknesses in New Direction Trust Company’s service delivery. Real experiences from clients and employees paint a complex picture of this self-directed IRA custodian.

Overall Satisfaction

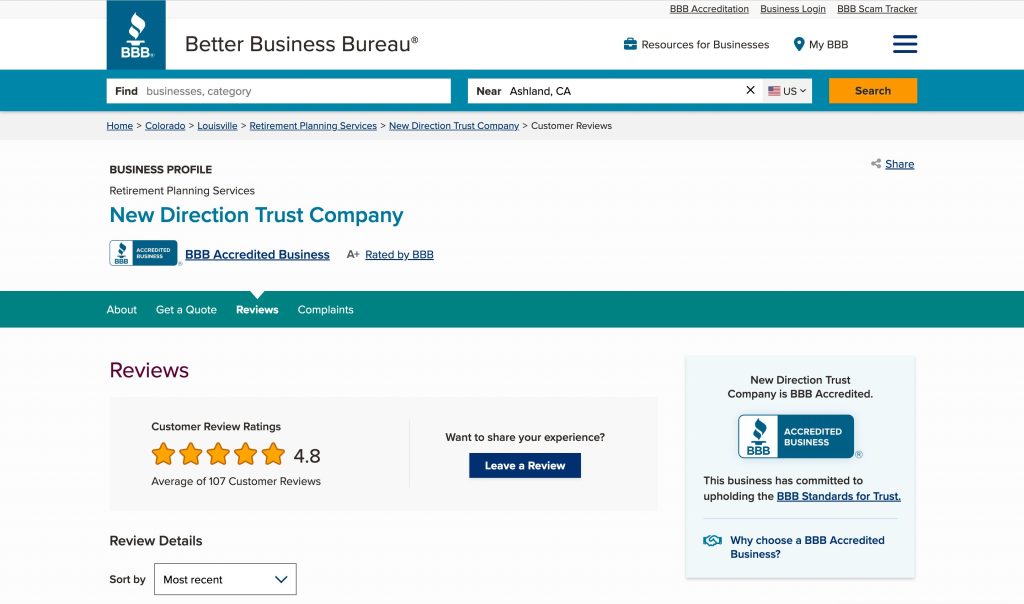

New Direction Trust Company maintains an A+ Better Business Bureau rating with 19 years of continuous accreditation.

The firm earns recognition as a top IRA custodian, with clients appreciating the variety of investment options including real estate, precious metals, and alternatives. The proprietary myDirection platform receives positive feedback for its functionality and 24/7 account access.

Employee satisfaction tells a different story. Glassdoor reviews show 82% of employees recommend working at the company, rating it 4.2 out of 5 stars based on 18 reviews.

Work-life balance scores 3.4/5 while compensation rates 2.8/5. Former employees cite friendly management and low micromanagement as positives but mention high turnover and management challenges as ongoing issues.

Consumer Review Site Ratings

Review platforms show mixed ratings for New Direction Trust Company:

| Platform | Rating | Details |

|---|---|---|

| Trust Score | 7.7/10 | Overall company reliability |

| Service Rating | 7.5/10 | Customer service quality |

| Pricing Rating | 7.5/10 | Fee competitiveness |

| Better Business Bureau | A+ | Accredited since 2004 |

| Google Reviews | 4.7 stars | Based on 772 reviews |

| Yelp | 1.9 stars | Based on 58 reviews |

The stark contrast between Google’s 4.7-star average and Yelp’s 1.9-star rating reflects the polarized customer experiences.

Positive reviews praise individual service representatives and complex IRA management capabilities. Negative reviews focus on fee structures and service delays.

Reported Issues and Complaints

Common complaints center on three main areas:

- Transaction Processing Delays: Customers report waiting weeks for routine transactions. Account transfers and investment purchases face unexpected holdups without clear communication about timelines.

- Fee Surprises: Setup fees, termination charges, and precious metal storage costs catch clients off-guard. Transaction fees for various activities add unexpected costs that impact investment returns.

- Storage Facility Incident: A third-party storage unit mishandled inventory affecting hundreds of New Direction accounts. The company responded by moving cases to team leaders and implementing improved customer care policies. A senior specialist reviewed affected accounts and offered individual assistance with precious metal rollovers, which clients found satisfactory.

Pros and Cons

New Direction Trust Company presents distinct advantages and drawbacks for self-directed IRA investors. Understanding these factors helps you determine if their services align with your retirement investment goals.

Pros

- Portfolio Diversification through Alternative Assets: You gain access to precious metals, real estate, and private equity investments that protect your retirement savings from stock market volatility. These alternative assets historically maintain value during economic downturns when traditional securities underperform.

- Comprehensive Investment Flexibility: Your account supports over 20 asset types including gold bullion (99.5% purity), rental properties, cryptocurrency platforms, and private business investments. The myDirection portal connects with multiple trading platforms for seamless management.

- Extensive Educational Resources: You access 200+ Help Center articles, monthly live webinars, and video tutorials covering IRS compliance and investment strategies. The learning materials break down complex regulations into actionable steps.

- 24/7 Account Management Portal: Your myDirection dashboard displays real-time portfolio values and enables three-click contributions. Two-factor authentication protects your account while document storage keeps investment records organized.

- Dedicated Account Specialists: You’re assigned a personal representative who guides complex transactions and ensures IRS compliance. Email response times average 24 hours with phone support available 8:30 AM – 5:00 PM MST.

Cons

- Above-Average Fee Structure: You pay $125 annually for accounts over $100,000 plus transaction fees ranging from $25-250. Precious metals storage adds $100-200 yearly through separate depositories not included in base pricing.

- Limited Fund Accessibility: You face 10% early withdrawal penalties before age 59½ and precious metals require physical liquidation through dealers. Processing times extend 7-14 business days for alternative asset transactions.

- Processing Delays Reported: You might experience 2-3 week transaction times during peak periods according to customer reviews. Unexpected fees for wire transfers ($25) and asset re-registrations ($50) appear on statements.

- Third-Party Custody Risks: Your assets depend on external depositories and storage facilities. A 2021 incident affected multiple precious metals accounts when a storage partner mishandled inventory tracking.

New Direction Trust Company vs. Competitors

Understanding how New Direction Trust Company stacks up against other self-directed IRA custodians helps you make the smartest choice for your alternative investments. Let’s examine the competitive world to see where this custodian excels and where others might serve you better.

Direct Competitors

New Direction Trust Company competes directly with several established self-directed IRA custodians:

- Equity Trust Company: Founded in 1974, manages over $34 billion in assets across 175,000+ accounts. Charges $225 annual fees for accounts under $15,000 versus New Direction’s $75 for accounts under $100,000.

- Advanta IRA: Processes transactions within 24-48 hours compared to New Direction’s reported delays. Offers flat $295 annual fee regardless of account value.

- GoldStar Trust Company: Specializes in precious metals IRAs with integrated storage solutions. Provides storage fees starting at $100 annually while New Direction charges storage separately.

- The Entrust Group: Maintains 17 physical locations nationwide versus New Direction’s single Colorado office. Offers in-person consultations and regional seminars for beginners.

Key Differentiators

New Direction Trust Company distinguishes itself through specific strengths while competitors excel in other areas:

New Direction’s Advantages

- MyDirection Portal: 24/7 digital platform processes contributions in 3 clicks

- Investment Variety: Supports cryptocurrencies, private equity, and checkbook IRAs alongside traditional assets

- Educational Resources: 200+ Help Center articles and live webinars included free

- Account Specialist Assignment: Each client receives dedicated support throughout their investing journey

Competitor Advantages

- Lower Fees: Advanta IRA’s flat $295 beats New Direction’s sliding scale

- Physical Presence: Entrust’s 17 locations offer face-to-face guidance

- Faster Processing: Advanta IRA completes transactions 24-48 hours faster

- Bundled Storage: GoldStar includes precious metals storage in base fees

Final Verdict: Is New Direction Trust Company the Right Choice for You?

Your decision to work with New Direction Trust Company eventually depends on your investment goals and comfort level with fees.

If you’re seeking diverse alternative investment options and value comprehensive educational support, they’ll serve you well.

The myDirection portal stands out as a powerful tool that simplifies complex transactions. You’ll appreciate having dedicated specialists guide you through regulatory requirements and investment processes.

But, you’ll need to weigh these benefits against higher-than-average fees and potential processing delays. Your investment returns might take a hit from multiple fee layers, especially with smaller account balances.

For experienced self-directed investors who prioritize variety and control, New Direction Trust Company offers the tools you need. But if you’re cost-conscious or prefer simpler investment strategies, you might find better value elsewhere.

Take time to calculate total costs based on your planned investments. Request detailed fee schedules and compare them with competitors before committing. Your retirement deserves a custodian that aligns with both your investment strategy and budget constraints.