Our in-depth research into Rocket Dollar reveals a platform that breaks from traditional self-directed IRA conventions—for better and worse.

While the $360 setup fee and ongoing monthly charges immediately stand out, the real story lies in how their LLC structure and checkbook control model compares to established competitors.

After analyzing Rocket Dollar’s offerings against industry standards, we found their streamlined approach addresses common pain points in alternative investing.

But simplified doesn’t mean simple. Our research uncovered critical nuances in their fee structure, investment limitations, and operational processes that directly impact returns.

Here’s what our comprehensive analysis revealed about Rocket Dollar’s position in the self-directed IRA landscape. Keep reading!

Table of Contents

- 1 What is Rocket Dollar?

- 2 Pros and Cons of Rocket Dollar

- 3 Understanding Rocket Dollar: How It Works

- 4 Investment Options with Rocket Dollar

- 5 Rocket Dollar Pricing and Fees

- 6 Setting Up and Managing Your Rocket Dollar Account

- 7 Customer Service and Support

- 8 Security and Compliance

- 9 Reputation and Real-Life Performance

- 10 Rocket Dollar Alternatives and Comparisons

- 11 Who is Rocket Dollar for?

- 12 Conclusion

What is Rocket Dollar?

Rocket Dollar transforms retirement investing by opening doors to assets most brokers won’t touch. Founded in 2018 by Henry Yoshida, Thomas Young, and Rick Dude in Austin, Texas, this financial services company specializes in self-directed IRAs and Solo 401(k)s that break free from the stock-and-bond box.

Picture your typical retirement account menu: mutual funds, ETFs, maybe some bonds. Now imagine investing that same money in a rental property, Bitcoin, or your friend’s startup.

That’s Rocket Dollar’s proposition—they give you checkbook control over your retirement funds to invest in alternative assets.

The platform operates through two main account types:

- Self-Directed IRA: Invest in real estate, cryptocurrency, precious metals, and private businesses.

- Solo 401(k): Available exclusively through their Gold tier membership for self-employed individuals.

Setup takes minutes online. You’ll sign documents, fund your account with $360 (setup fee), then pay $30 monthly for maintenance.

Gold tier members investing in Solo 401(k)s face higher costs but gain expedited funding options—crucial when closing time-sensitive deals.

Unlike traditional brokers limiting you to publicly traded securities, Rocket Dollar lets you write checks directly from your retirement account to purchase alternative investments. They’ve built their platform specifically for investors seeking diversification beyond Wall Street.

Pros and Cons of Rocket Dollar

Every self-directed investment platform comes with trade-offs, and understanding these helps determine if the platform aligns with your retirement goals. We’ve analyzed the key advantages and disadvantages based on comprehensive research and user feedback.

Pros

- Diverse Alternative Investment Options: Invest in real estate, cryptocurrencies, startups, and private equity beyond traditional stocks and bonds, expanding portfolio diversification opportunities.

- Flat Fee Structure Benefits Large Balances: Pay $180 annually regardless of account size, saving thousands compared to percentage-based competitors for accounts over $50,000.

- Checkbook Control for Both Account Types: Access funds immediately without custodian approval delays, enabling quick investment decisions for time-sensitive opportunities.

- Solo 401(k) Higher Contribution Limits: Contribute up to $66,000 annually (2025 limits) for self-employed individuals, tripling traditional IRA contribution caps.

- Expedited Funding for Urgent Deals: Close real estate transactions or private investments within 48 hours using Gold tier’s accelerated processing.

- User-Friendly Platform Interface: Navigate account management, track investments, and execute transactions through intuitive online dashboard.

Cons

- High Initial Setup Costs: Pay $360 upfront plus first month’s fee, totaling $390 before making any investments.

- Expensive for Small Balances: Annual fees of $360 represent 3.6% of a $10,000 account, significantly higher than traditional IRA costs.

- Limited Silver Tier Support: Access only email assistance without phone support, creating delays for urgent account questions.

- Complex Solo 401(k) Administration: Handle annual filings, contribution calculations, and compliance requirements independently.

- No Traditional Investment Guidance: Navigate alternative investment decisions without platform-provided financial advice or recommendations.

Understanding Rocket Dollar: How It Works

Rocket Dollar operates through a unique LLC/trust structure that gives investors direct control over their retirement funds.

The platform transforms traditional retirement investing by eliminating custodian delays and expanding investment options beyond stocks and bonds.

Self-Directed Retirement Accounts

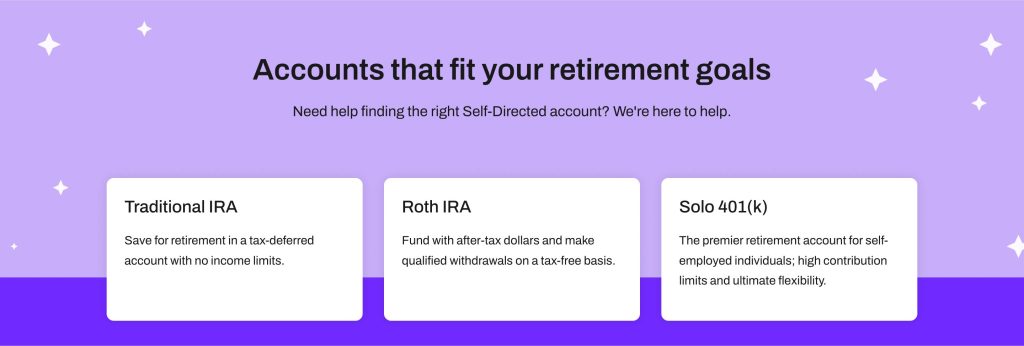

Rocket Dollar provides four types of self-directed IRAs: Traditional, Roth, SEP, and Beneficiary/Inherited IRAs.

Each account type offers tax advantages while allowing investments in alternative assets like real estate, cryptocurrency, startups, and precious metals. The platform also offers Solo 401(k)s exclusively through its Gold tier membership at $30 monthly.

Traditional and Roth IRAs follow standard contribution limits of $6,500 annually for individuals under 50. SEP-IRAs accommodate self-employed individuals and small business owners with contribution limits up to 25% of compensation or $66,000.

Beneficiary IRAs help inherited retirement assets maintain tax-deferred growth while providing investment flexibility.

The Solo 401(k) stands out with contribution limits reaching $66,000 for those under 50, combining employee deferrals and employer contributions.

This account type particularly benefits high-earning self-employed professionals maximizing retirement savings through alternative investments.

The LLC/Trust Structure (Checkbook Control)

Rocket Dollar establishes an IRA Limited Liability Company for IRAs and a trust structure for 401(k)s upon account creation.

The IRA becomes the single member of the LLC, with the account holder serving as the LLC manager. This arrangement provides checkbook control, enabling direct investment execution through the LLC’s bank account.

The trust structure for Solo 401(k)s operates similarly, with the account holder acting as trustee. Both structures eliminate traditional custodian approval requirements, reducing transaction times from weeks to minutes. Investors write checks or send wire transfers directly from their LLC or trust bank account to purchase assets.

This checkbook control model transfers compliance responsibility to the investor. Account holders must avoid prohibited transactions, such as self-dealing or investing in disqualified persons’ businesses.

The LLC/trust maintains all investment records, simplifying tax reporting and asset management while providing complete investment autonomy.

Investment Philosophy

Rocket Dollar embraces alternative asset investing as its core principle, encouraging diversification beyond traditional Wall Street offerings.

The platform specifically targets investors seeking local real estate deals, startup equity, cryptocurrency holdings, and other non-traditional assets within tax-advantaged retirement accounts.

The company advises maintaining traditional stock and bond investments through existing brokerage accounts rather than their platform.

This approach maximizes the value of Rocket Dollar’s flat-fee structure for alternative investments while avoiding unnecessary costs for publicly traded securities.

Founded on accessibility and transparency principles, Rocket Dollar democratizes investments previously reserved for ultra-wealthy individuals.

The platform’s educational resources help investors understand alternative asset regulations, prohibited transactions, and investment structuring.

This philosophy empowers everyday investors to build diversified portfolios including assets they understand and believe in, from local businesses to emerging technologies.

Investment Options with Rocket Dollar

Rocket Dollar transforms retirement investing by opening doors to alternative assets that traditional IRAs lock shut.

We discovered their platform supports investments ranging from cryptocurrency and real estate to startups and precious metals, giving investors control over assets that Wall Street typically reserves for institutional players.

Broad Range of Alternative Assets

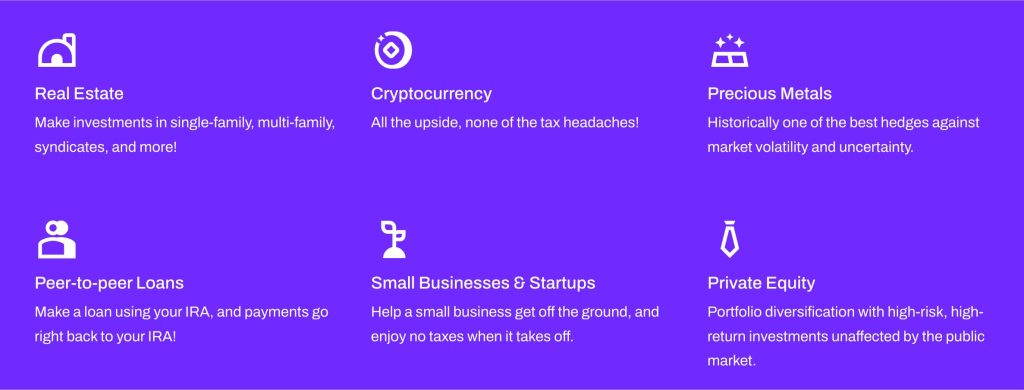

We found Rocket Dollar’s investment menu reads like a wealthy investor’s private portfolio. Real estate options span from single-family rentals to commercial properties and syndicate deals. Cryptocurrency enthusiasts can hold Bitcoin and other digital assets with tax-deferred gains until retirement.

The platform extends beyond typical alternatives:

- Private Equity and Angel Investing: Direct stakes in startups and small businesses

- Tangible Assets: Precious metals, commodities, and farmland

- Unique Investments: Artwork, fine wine, and hedge funds

- Peer-to-Peer Lending: Business loans and P2P platforms

Each asset class operates within IRS guidelines, meaning your Bitcoin gains or rental income grows tax-free inside the account.

We particularly appreciate how they’ve structured access to private equity deals, traditionally requiring millions in capital.

Bring Your Own Deal (BYOD)

The BYOD feature changed everything we thought about self-directed IRAs. Instead of limiting investors to pre-selected options, Rocket Dollar lets you invest in opportunities you discover yourself.

Found a promising local startup? Identified an undervalued rental property? As long as it’s IRS-eligible, you can include it.

This flexibility means your brother-in-law’s tech startup or that duplex down the street becomes a legitimate retirement investment. The platform handles the paperwork and compliance while you execute your investment strategy.

We’ve seen investors use BYOD for everything from franchise opportunities to private lending deals they sourced independently.

IRS Prohibited Investments

The IRS draws clear boundaries around retirement investments, and Rocket Dollar helps investors stay compliant.

Life insurance contracts and collectibles sit firmly on the prohibited list. This includes most coins (except certain bullion), gems, rugs, artwork (with specific exceptions), stamps, and alcoholic beverages.

S-Corporation stock also falls under prohibited investments, limiting some business investment strategies. The platform’s compliance tools flag potential violations before they occur.

We appreciate their transparency about these restrictions – they provide detailed documentation explaining why certain investments violate IRS rules and suggest compliant alternatives.

Online Investment Partners

Rocket Dollar streamlines alternative investing through strategic partnerships. Kraken handles cryptocurrency transactions, providing institutional-grade security for digital assets.

Masterworks opens fine art investing to retirement accounts, fractionalizing blue-chip artwork previously accessible only to museums and billionaires.

OneGold facilitates precious metals purchases, offering allocated gold and silver storage. These partnerships eliminate the complexity of managing alternative assets independently.

Each partner undergoes vetting for IRS compliance and security standards. The integrated platforms mean you’re investing through established channels rather than exploring unfamiliar territory alone.

Rocket Dollar Pricing and Fees

Rocket Dollar’s pricing structure operates on a transparent subscription model with no assets under management (AUM) fees.

We found this approach particularly interesting during our research, as it creates predictable monthly costs regardless of account balance.

Transparent Pricing Model

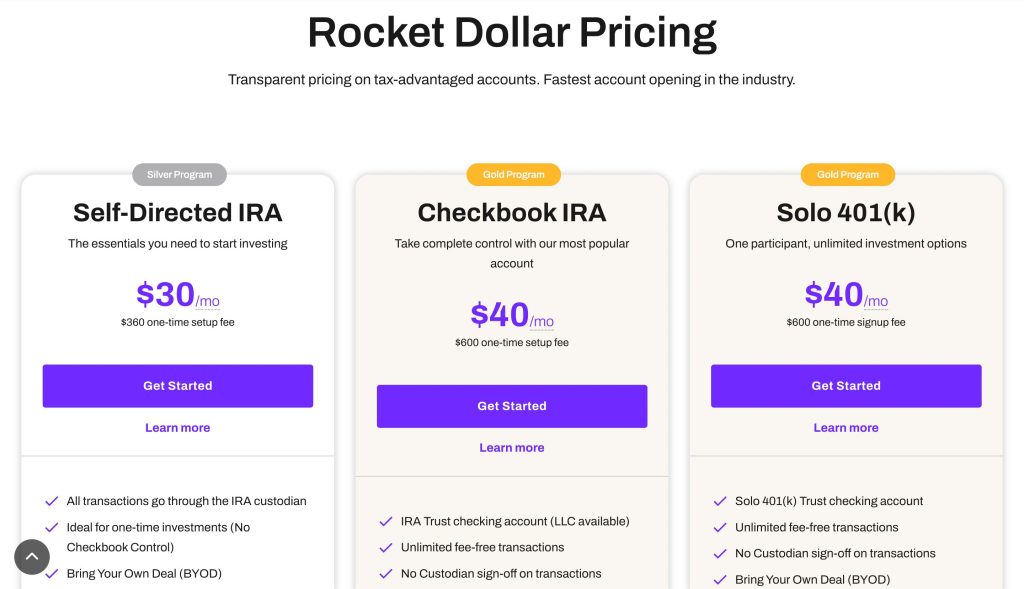

Self-directed IRA platforms typically charge percentage-based fees that grow with your portfolio. Rocket Dollar breaks this pattern with fixed monthly subscriptions.

The Silver tier costs $360 to set up plus $30 monthly, while Gold tier runs $600 initially with $40 monthly fees. This flat-fee structure means investors with $100,000 pay the same as those with $10,000.

For larger accounts, this translates to significant savings compared to traditional 1-2% AUM fees. The pricing includes account administration, compliance monitoring, and platform access. No hidden charges appear for adding new investments or managing existing ones.

Account Tiers

Rocket Dollar offers two distinct service levels:

Silver Tier ($360 setup + $30/month)

- Online document storage for investment records

- Email support during business hours

- Investment dashboard tracking portfolio performance

- Standard 2-4 week account setup timeline

- Access to all self-directed IRA types

Gold Tier ($600 setup + $40/month)

- Priority phone and email support

- Expedited 15-day account setup

- IRA LLC option for enhanced control

- Four complimentary wire transfers annually

- Tax filing assistance (Forms 1099-R and 5500)

- Exclusive Solo 401(k) access for self-employed investors

Other Potential Fees

Beyond monthly subscriptions, certain transactions incur additional costs. Wire transfers cost $35 for Direct Custody accounts and $10 for Solo 401(k)s.

ACH transfers remain free for all account types. Account closure triggers a $50 processing fee. Investment-specific costs like real estate closing fees or cryptocurrency exchange charges apply separately.

Rocket Dollar doesn’t charge for buying or selling assets within accounts, unlike many competitors who add transaction fees.

Multiple account holders receive discounts: second accounts get $100 off setup and $5 monthly reduction, while third accounts save $200 on setup and $10 monthly.

Cost-Effectiveness for Different Account Balances

The fixed-fee model creates varying value propositions based on portfolio size. For accounts under $10,000, the effective annual fee exceeds 3.6% at Silver tier pricing.

Accounts reaching $25,000 drop to 1.44% annually, while $100,000 portfolios pay just 0.36%. This structure favors investors planning substantial alternative asset allocations.

Traditional brokerages offering free self-directed IRAs limit investment choices to stocks and bonds. Rocket Dollar’s fees unlock real estate, private equity, and cryptocurrency options.

Investors comparing costs should factor in both fee percentages and investment flexibility when evaluating whether premium pricing delivers sufficient value.

Setting Up and Managing Your Rocket Dollar Account

Opening a self-directed retirement account transforms how we invest for the future, and Rocket Dollar’s streamlined process makes this transition remarkably smooth.

The platform’s modern approach eliminates traditional barriers, letting investors access alternative assets within days rather than weeks.

Account Setup Process

The entire account opening completes online in approximately 10 minutes. We start by visiting RocketDollar.com and providing basic identity verification documents along with existing retirement account information.

The platform requires standard KYC (Know Your Customer) documentation including driver’s license, Social Security number, and bank account details.

After submitting the application, Rocket Dollar’s fulfillment team takes over. They handle the LLC formation, EIN acquisition, and bank account setup—tasks that typically overwhelm first-time self-directed investors. Account approval arrives within 2 business days, followed by login credentials and account documentation.

The fulfillment team assigns each new account a dedicated specialist who guides investors through initial setup questions.

This support proves invaluable when exploring IRS regulations for alternative investments. The $360 setup fee covers all administrative work, legal entity formation, and initial compliance review.

Funding Your Account

Three primary methods exist for funding Rocket Dollar accounts: direct contributions, IRA transfers, and 401(k) rollovers.

Direct contributions follow annual IRS limits—$6,500 for IRAs ($7,500 if over 50) and up to $66,000 for Solo 401(k)s in 2025.

Rocket Dollar’s patent-pending transfer module simplifies moving existing retirement funds. We upload current account statements, and their team initiates the transfer request with the previous custodian. Most transfers complete within 7-14 business days, though complex 401(k) rollovers occasionally take longer.

Cash moves via ACH transfer or wire, while in-kind asset transfers currently maintain a waitlist. The platform accepts checks for larger transactions, particularly useful for real estate purchases.

Each funding method incurs no additional fees beyond standard bank charges, keeping costs predictable for investors planning major alternative asset purchases.

Account Management

Rocket Dollar’s dashboard displays all investments across asset classes in real-time. The interface organizes holdings by category—real estate, startups, cryptocurrency—with current valuations and performance metrics.

Mobile accessibility through responsive web design enables investment monitoring and transaction initiation from any device.

Checkbook control means writing checks or initiating wires directly from the account’s dedicated bank account.

No custodian approval delays transactions, crucial for time-sensitive deals like property auctions or startup funding rounds. The platform tracks every transaction for IRS compliance, automatically generating required documentation.

Investment updates happen through manual entry or integration with partner platforms. For cryptocurrency holdings via Kraken or real estate crowdfunding through connected platforms, values update automatically.

The dashboard’s document storage feature maintains all investment agreements, K-1s, and tax forms in one accessible location, simplifying year-end reporting and future audits.

Customer Service and Support

Customer service quality varies significantly between Rocket Dollar’s account tiers. Our research reveals distinct differences in support access and response times that directly impact the investor experience.

Support Channels

Email support serves as the primary contact method for all Rocket Dollar users. Gold account holders ($40/month) can call support directly during business hours (9 AM to 4:30 PM CST), while Silver account holders ($30/month) must schedule phone appointments in advance. The sales team remains accessible at 1-855-762-5383 for prospective investors exploring account options.

Customer feedback indicates Gold members receive responses within 24-48 hours, whereas Silver members report waiting 3-5 business days.

The tiered approach creates a clear service distinction – Gold investors bypass email queues entirely when urgent investment decisions require immediate assistance.

Knowledge Base and Educational Resources

Rocket Dollar’s self-help center contains over 100 articles covering account setup, investment processing, and IRS compliance regulations.

The platform publishes weekly webinars featuring alternative investment strategies, with past sessions archived for on-demand viewing. Their podcast series explores specific asset classes like cryptocurrency IRAs and real estate syndications.

The FAQ section addresses common concerns: prohibited transactions, UBIT taxes, and LLC formation requirements. Video tutorials walk investors through dashboard navigation and document uploads.

Educational content updates monthly to reflect regulatory changes, though some users note certain advanced topics lack depth compared to competitor resources.

Security and Compliance

Rocket Dollar conducts annual SOC 2 Type II audits covering security, availability, integrity, and confidentiality of their systems.

These independent assessments verify the platform meets industry standards for protecting customer data and maintaining operational controls.

The platform implements two-factor authentication for all account logins, adding an extra security layer beyond standard passwords. This protection prevents unauthorized access even if login credentials become compromised.

Penetration testing occurs regularly to identify potential vulnerabilities before malicious actors can exploit them. These proactive security measures test the platform’s defenses against real-world attack scenarios.

About IRS compliance, Rocket Dollar provides tools and resources to help investors avoid prohibited transactions.

The platform’s structure allows investments in alternative assets while maintaining tax-advantaged status, though investors bear responsibility for following IRS regulations.

The company recommends consulting with attorneys before complex transactions to validate their legality within IRA rules.

This guidance protects investors from inadvertently violating regulations that could trigger penalties or disqualification of their retirement accounts.

Unlike traditional bank accounts, Rocket Dollar investments lack FDIC insurance coverage. Alternative investments carry inherent risks, and the platform clearly discloses this limitation to ensure investors understand their exposure.

Reputation and Real-Life Performance

Rocket Dollar’s self-directed retirement platform has built a notable presence in the alternative investment space since 2018.

The company’s reputation rests on its ability to deliver accessible retirement solutions while maintaining consistent growth metrics.

Growth and Assets Under Management

Rocket Dollar’s assets under management exceeded $300 million within its first few years of operation. This growth trajectory reflects strong investor adoption of self-directed retirement accounts.

The platform’s 2020 data revealed that 23% of new clients selected the premium Gold plan, transferring larger account balances than the platform average.

Founded in 2018, the company targets a specific segment of the $30+ trillion U.S. retirement market. This focus on alternative investments positions Rocket Dollar outside the mainstream stock market’s $28+ trillion in passive investments.

The platform’s rapid asset accumulation demonstrates investor demand for retirement account flexibility beyond traditional stocks and bonds.

Customer Satisfaction and Reviews

Customer feedback presents a mixed picture across different review platforms. Google Reviews shows Rocket Dollar maintaining a 4.9/5 rating from 103 reviews, indicating strong user satisfaction.

Customers frequently cite the platform’s transparency, straightforward pricing structure, and investment flexibility as primary benefits.

The Better Business Bureau awards Rocket Dollar an A+ rating, though customer reviews remain absent on that platform.

User testimonials emphasize appreciation for the $360 setup fee and $15 monthly maintenance cost structure (Core Plan) compared to percentage-based fees at competing platforms.

Gold Plan members report enhanced satisfaction with expedited services and priority support features included in their $600 setup and $30 monthly fee tier.

Rocket Dollar Alternatives and Comparisons

Several self-directed IRA providers compete with Rocket Dollar in the alternative investment space. Each platform offers unique features and pricing structures that cater to different investor needs.

- Alto IRA specializes in alternative investments with a focus on startups and real estate. The platform charges $10 monthly for traditional assets or $19 monthly for alternative investments. Alto partners with AngelList and Republic for startup investments, making it ideal for investors interested in early-stage companies. Unlike Rocket Dollar’s checkbook control model, Alto handles transactions directly through their custodian.

- Kingdom Trust provides self-directed accounts with extensive alternative asset options. Setup fees start at $50 with annual fees ranging from $195 to $795 depending on account complexity. Choice offers more hand-holding than Rocket Dollar but lacks the immediate transaction capability that checkbook control provides.

- Equity Trust operates as one of the oldest self-directed IRA custodians, founded in 1974. Annual fees range from $225 to $2,000 based on asset value. Equity Trust processes each transaction individually, creating delays compared to Rocket Dollar’s LLC structure. The platform excels in educational resources with regular webinars and local workshops.

- Bitcoin IRA focuses exclusively on cryptocurrency investments within retirement accounts. The platform charges a one-time setup fee starting at 5.99% of the initial investment. Bitcoin IRA provides 24/7 trading capabilities and cold storage security, making it the specialist choice for crypto-only investors who don’t need Rocket Dollar’s broader asset options.

Who is Rocket Dollar for?

Rocket Dollar targets Americans who want control over their retirement investments beyond traditional stocks and bonds.

The platform serves self-employed individuals, business owners with Solo 401(k) eligibility, and investors with existing IRA accounts seeking alternative asset exposure.

Ideal Candidates Include:

- Self-Employed Professionals: Freelancers, consultants, and small business owners qualify for Solo 401(k)s with contribution limits up to $66,000 annually

- Real Estate Investors: Property buyers who want tax-advantaged retirement funds for rental properties, fix-and-flips, or REITs

- Startup Enthusiasts: Angel investors backing local businesses or equity crowdfunding platforms through retirement accounts

- Cryptocurrency Holders: Digital asset investors seeking IRS-compliant crypto storage within tax-sheltered accounts

The $360 setup fee plus $30 monthly charges make Rocket Dollar cost-effective for accounts above $20,000. Smaller balances face proportionally higher fees compared to percentage-based competitors.

Not Recommended For:

- Passive investors satisfied with index funds and mutual funds.

- Beginners lacking alternative investment experience.

- Accounts under $10,000 where fees exceed 3.6% annually.

- Those wanting traditional investment guidance or robo-advisor features.

Rocket Dollar works best for financially sophisticated investors comfortable managing compliance requirements and conducting due diligence on alternative investments.

Conclusion

Rocket Dollar’s self-directed IRA platform represents a significant shift in retirement investing. We’ve found that it opens doors to alternative investments that traditional brokers can’t match. The checkbook control feature eliminates custodian delays and puts investment decisions directly in your hands.

The platform’s flat-fee structure works best for larger portfolios above $20,000. We believe sophisticated investors who understand compliance requirements will find the most value here. The Gold tier membership particularly shines for self-employed professionals needing Solo 401(k) options.

While the upfront costs might seem steep compared to conventional IRAs, the investment flexibility often justifies the expense.

We recommend carefully weighing your investment goals and experience level before committing. For those ready to explore beyond stocks and bonds, Rocket Dollar provides the tools and freedom to build a truly diversified retirement portfolio.