You’re searching for a self-directed IRA custodian and wondering if Strata Trust Company fits your investment strategy.

As a Texas-based trust company specializing in alternative assets since 2008, they’ve built a reputation as a national custodian for non-traditional retirement investments.

But here’s what matters: their 3.35-star average rating tells a more complex story. While they offer low starting annual fees and custody services for diverse alternative investments, you’ll find no cryptocurrency options or individual 401(k) accounts.

Some investors praise their knowledgeable support team, while others report frustrating delays getting distributions.

This review breaks down everything you need to know about Strata Trust Company’s services, fees, and real customer experiences.

Table of Contents

Company Overview and Background

You’re evaluating Strata Trust Company for your self-directed IRA needs. Understanding the company’s foundation and specialized services helps you determine if they’re the right custodian for your alternative investment strategy.

History and Establishment

You’re looking at a company that started in 2008 as Self Directed IRA Services Inc., a subsidiary of Horizon Bank SSB. The founders created it specifically for investors like you who wanted control over their retirement investments.

In 2010, they expanded into institutional services for financial professionals. The company rebranded as Strata Trust Company in 2017.

Today, you’ll find their headquarters in Waco, Texas, with an additional office in Austin. They’ve grown from a small trust company to a national custodian managing over $6 billion in assets for 35,000 clients. The company employs 75 professionals dedicated to self-directed IRA administration.

Core Services and Specializations

You can open five types of self-directed retirement accounts with Strata Trust Company:

- Traditional IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

- Beneficiary IRA

Your investment options extend far beyond stocks and bonds. Strata Trust Company specializes in alternative asset custody including real estate, precious metals, promissory notes, private equity, and crowdfunding investments.

They handle all IRA administration tasks—processing your contributions, executing investment transactions, maintaining proper asset registration, and completing required tax reporting.

The company focuses exclusively on custody services. They don’t provide investment advice or sell financial products. You make all investment decisions while they ensure compliance with IRS regulations.

Self-Directed IRA Services

Strata Trust Company gives you complete control over your retirement investments through their self-directed IRA services.

You’ll work with their custody team to manage everything from account setup to tax reporting while maintaining full investment decision authority.

Available Account Types

You can open five different self-directed retirement accounts with Strata Trust Compnay. Traditional IRAs let you deduct contributions now and pay taxes during retirement. Roth IRAs work opposite—you pay taxes upfront but withdraw tax-free later.

SEP IRAs serve self-employed individuals and small business owners, allowing contributions up to 25% of compensation or $69,000 for 2024.

SIMPLE IRAs target businesses with 100 or fewer employees, featuring lower contribution limits but easier administration.

Beneficiary IRAs help you inherit retirement accounts while preserving tax advantages. Each account type follows standard IRS rules but opens doors to alternative investments beyond typical stocks and bonds.

Investment Options and Restrictions

Your Strata Trust IRA unlocks investment possibilities most custodians won’t touch. Real estate deals include commercial properties, apartment buildings, raw land, and condos. Precious metals investing covers IRA-approved gold, silver, platinum, and palladium coins and bullion.

Private equity opportunities span non-publicly traded companies and real estate ventures. You can fund corporate loans, trust deeds, and mortgage notes through private debt investments. Crowdfunding platforms connect you to marketplace lending and equity deals.

Structured settlements and secondary market annuities add another alternative asset class. Traditional investments like publicly traded stocks, bonds, and mutual funds remain available too. The IRS prohibits collectibles, life insurance, and S-corporation stock in any IRA.

Fee Structure and Pricing

You’ll encounter a multi-tiered fee structure at Strata Trust Company that combines competitive annual rates with numerous transaction charges. Understanding these costs upfront helps you budget accurately for your self-directed IRA investments.

Account Setup and Maintenance Fees

You pay annual fees based on your total account value, ranging from $75 for accounts under $100,000 to $300 for accounts exceeding $200,000. Your first annual fee comes due when you open the account, then recurs each anniversary date.

You’ll save $30 annually by choosing electronic statements over paper ones. Real estate holdings trigger an additional $100 yearly fee, while private investments add $50 to your annual costs. These asset-specific fees combine with your base annual fee, creating a cumulative expense structure.

|

Account Value |

Annual Fee |

|---|---|

|

Under $100,000 |

$75 |

|

$100,000 – $200,000 |

$125-$225 |

|

Over $200,000 |

$300 |

Transaction and Service Charges

You face processing fees between $25 and $50 for each transaction you execute. Real estate transactions carry additional charges beyond these base rates.

Precious metals storage costs you $100 to $140 annually, depending on whether you choose segregated or non-segregated storage.

Late payments trigger a $15 fee. Sales transactions cost $40 each. Account closure carries its own fee. Some clients report multiple fees hitting their accounts on the same day, though Strata Trust states they disclose all fees upfront and send regular updates about fee changes.

These per-transaction costs accumulate rapidly if you’re an active investor, potentially offsetting the savings from lower annual fees compared to competitors who bundle these services into their custodial duties.

Customer Experience and Reviews

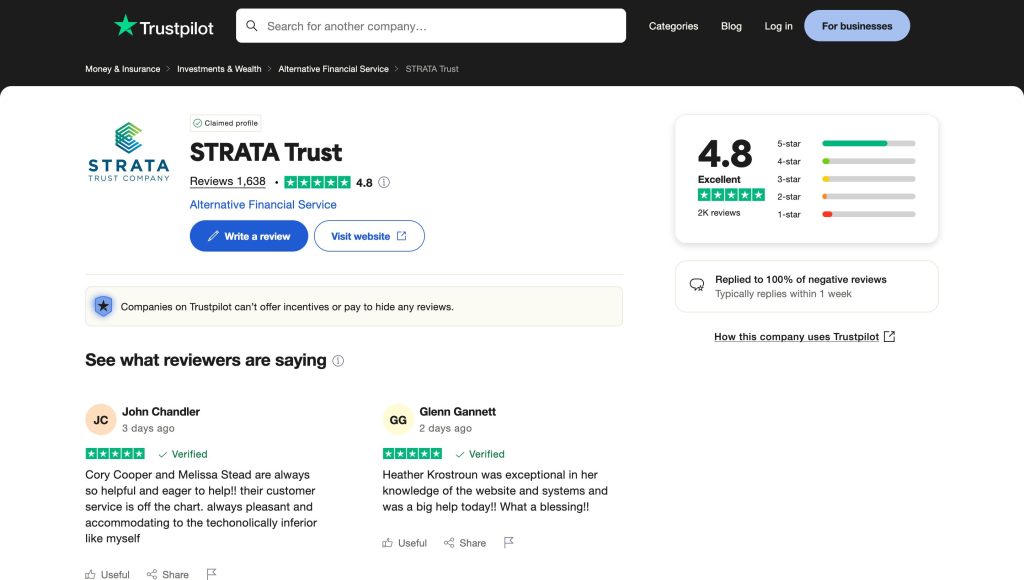

Customer feedback reveals a distinct pattern in Strata Trust Company’s service delivery. You’ll find their reputation centers on exceptional customer support balanced against operational challenges.

Client Testimonials and Ratings

You’ll discover Strata Trust maintains an A+ Better Business Bureau accreditation even though not being BBB-accredited.

Customer ratings average 3.5 stars across platforms with 74% recommending the company to friends. Five-star reviews dominate their website testimonials—though companies rarely publish negative feedback on their own platforms.

Representatives earn consistent praise by name. Mary receives recognition for patience during complex transactions. Heather gets mentioned for swift issue resolution. Victoria stands out for clear communication during account setup.

You’ll notice customers repeatedly highlight staff professionalism across Trustpilot reviews where specific employees receive individual commendations for going beyond standard service expectations.

Common Praise Points

You’ll appreciate their customer service team’s immediate availability through phone support. Staff members demonstrate expertise in alternative investment custody while maintaining friendly communication styles. Response times impress clients—particularly for account access issues and transaction questions.

Knowledge depth marks another strength. Representatives explain IRS regulations clearly and guide you through self-directed IRA complexities without rushing.

They handle inherited account transfers with care and provide step-by-step assistance for first-time alternative asset investors.

You’ll find their educational approach helps demystify processes like real estate purchases within IRAs or precious metals storage requirements.

Frequent Complaints and Issues

You might encounter frustration with distribution delays. Several customers report waiting weeks for fund withdrawals after submitting required paperwork.

High fees generate repeated criticism—transaction charges accumulate quickly for active investors managing multiple alternative assets.

Processing bottlenecks create additional friction. You’ll face potential delays when liquidating assets or transferring funds between accounts.

Communication gaps sometimes emerge during complex transactions with one customer reporting miscommunication between their advisor and Strata Trust causing payout delays.

Fee transparency remains inconsistent—some investors discover unexpected charges only after completing transactions affecting their investment returns.

Account Management and Technology

You’re managing a self-directed IRA with alternative investments, which means you need robust tools and responsive support.

Strata Trust Company delivers account management through digital platforms and customer service teams, though experiences vary significantly depending on your transaction complexity.

Online Platform Features

You’ll access Strata’s online portal designed specifically for self-directed IRA management. The platform lets you track alternative assets like real estate and precious metals alongside traditional holdings.

You can submit investment directions, view account statements, and monitor transaction history through the digital interface.

The system supports document uploads for investment paperwork and provides downloadable tax forms. You’ll find account funding options and distribution request features built into the dashboard.

Some users report the interface works smoothly for basic transactions, while others encounter delays when processing complex alternative asset transfers.

Transaction processing times vary – simple contributions typically complete within 3-5 business days, but alternative investment transactions can take 2-3 weeks. The platform doesn’t offer mobile app functionality, limiting you to web browser access.

Customer Support Quality

You’ll reach customer service representatives who consistently receive praise for their knowledge and patience. Multiple reviews highlight staff members who provide clear explanations of IRS regulations and investment procedures.

Phone support operates during standard business hours, and you’ll typically connect with representatives within 5-10 minutes.

Email responses arrive within 24-48 hours for routine inquiries. Complex account issues receive dedicated case managers who guide you through multi-step processes.

But, you might experience frustration during high-volume periods. Some customers report 30+ minute hold times and delayed responses to liquidation requests.

Transaction fees averaging $50-$100 per investment movement become particularly irritating when coupled with processing delays that extend 4-6 weeks for certain alternative asset transfers.

Regulatory Compliance and Security

Strata Trust Company operates under Texas Department of Banking regulations, maintaining strict compliance standards for safeguarding your retirement assets. You’ll find their security protocols align with industry benchmarks for self-directed IRA custodians.

Licensing and Certifications

Your assets rest with a Texas-chartered trust company that’s answered to state banking regulators since 2008. Strata maintains membership in the Retirement Industry Trust Association (RITA), demonstrating commitment to industry standards.

The Texas Department of Banking conducts regular examinations, verifying Strata follows state trust laws and federal IRA regulations.

You won’t find FDIC insurance here—trust companies operate differently than banks. Instead, Strata segregates client assets from corporate funds, a requirement under Texas trust law.

Independent auditors review their operations annually, checking compliance procedures and asset handling protocols.

The company holds required bonds and insurance policies typical for custodians managing $6 billion in client assets.

Their Horizon Bank ownership adds another layer of regulatory oversight, as parent companies face additional scrutiny from banking regulators.

Asset Protection Measures

Your physical precious metals sit in segregated depository facilities, separated from other clients’ holdings. Strata partners with established depositories that maintain their own insurance policies, typically covering millions in precious metals storage.

Digital security follows SOC 2 framework principles—think access controls, intrusion detection systems, and incident response protocols.

Your login credentials trigger multi-factor authentication, and all data transmissions use encryption standards meeting financial industry requirements.

Strata educates you on fraud prevention through their investor protection program. They’ll point you toward FINRA BrokerCheck and SEC databases to verify investment promoters independently.

The custodian won’t investigate specific investments—that’s your responsibility—but they flag common scam patterns in their educational materials.

Account statements arrive monthly, letting you track every transaction. Suspicious activity triggers internal reviews, though response times vary based on transaction volume.

You maintain sole control over investment decisions, while Strata handles the custody mechanics under regulatory guidelines.

Pros and Cons

Evaluating Strata Trust Company reveals distinct advantages and disadvantages that directly impact your self-directed IRA experience. Understanding these factors helps you determine if this custodian matches your investment goals.

Pros

- Established Reputation Since 2008: You’re working with a company backed by Horizon Bank that manages over $6 billion in assets for 35,000 clients across the nation.

- Exceptional Customer Service: You’ll connect with knowledgeable representatives who receive praise for patience and professionalism, with 74% of customers recommending the company.

- Competitive Fee Structure: You pay just $75 annually for accounts under $100,000, significantly lower than many competitors charging $200-$500.

- Diverse Investment Options: You access real estate, precious metals, private equity, and numerous alternative assets beyond traditional stocks and bonds.

- Educational Resources Online: You learn investment strategies through their comprehensive educational materials and guidance documents.

Cons

- Transaction Delays Reported: You might wait weeks for fund distributions, with some customers experiencing frustrating bottlenecks during account liquidation.

- Accumulating Transaction Fees: You face charges for wire transfers ($30), asset purchases ($50-$150), and document processing that quickly add up for active investors.

- No Cryptocurrency Custody: You can’t hold Bitcoin or other digital assets directly, limiting modern investment strategies.

- Missing 401(k) Options: You won’t find individual 401(k) accounts, restricting choices for self-employed individuals seeking higher contribution limits.

Comparison with Competitors

Evaluating Strata Trust Company against other self-directed IRA custodians reveals crucial differences in fees, services, and customer satisfaction. Understanding these distinctions helps you choose the custodian that best matches your investment strategy.

Industry Standing

Strata Trust Company maintains a 16-year presence in the self-directed IRA market, positioning itself among established custodians.

The company manages over $6 billion in assets for 35,000+ clients, placing it in the mid-tier range compared to larger competitors like Equity Trust (150,000+ clients) and smaller firms with under 10,000 accounts.

Customer satisfaction metrics show Strata Trust’s 3.35-star average rating falls below industry leaders. Top-rated custodians typically achieve 4+ stars through faster processing times and fewer transaction fees. The Better Business Bureau gives Strata Trust an A+ rating, matching most reputable custodians.

Fee competitiveness varies by account size. Strata’s $75 annual fee for accounts under $100,000 beats many competitors charging $150-$250.

But, transaction fees of $30-$50 per process can quickly surpass competitors offering flat-rate structures or free transactions.

Alternative Options

You’ll find several custodians offering distinct advantages over Strata Trust Company.

- Equity Trust provides cryptocurrency custody and individual 401(k) options—two services Strata lacks. Their transaction fees average $15-$25, potentially saving active investors hundreds annually.

- Millennium Trust attracts high-volume traders with unlimited transaction packages starting at $495 yearly.

- Pacific Premier Trust specializes in real estate investments with dedicated property management support unavailable at Strata.

For precious metals investors, Goldco and Augusta Precious Metals offer integrated dealer-custodian services, streamlining purchases and storage.

Technology-focused investors prefer Rocket Dollar’s modern platform with faster processing times than Strata’s system.

Consider IRA Financial Group if you want checkbook control through LLC structures. New Direction Trust Company provides similar alternative asset options with 24-hour transaction processing guarantees—addressing Strata’s primary weakness of delayed distributions.

Conclusion

Strata Trust Company’s mixed customer feedback and operational challenges make it a cautious choice for self-directed IRA investors.

While you’ll benefit from competitive annual fees and experienced customer support staff who excel at handling complex alternative investments, you’ll need patience for transaction processing and fund distributions.

Your investment strategy plays a crucial role in determining whether Strata Trust fits your needs. If you’re planning infrequent transactions with traditional alternative assets like real estate or precious metals, their services might work well for you.

But, if you’re seeking cryptocurrency custody or require rapid transaction processing, you’ll find better options elsewhere.

Before committing to Strata Trust Company, evaluate your tolerance for potential delays against their lower annual fees.

Consider reaching out to their customer service team to discuss your specific investment plans and expected transaction volume.

This direct conversation will help you determine if their strengths align with your retirement investment goals while understanding the limitations you might face.