You’re scrolling through investment options at 11 PM when precious metals catch your eye. Markets are volatile again and you need something solid.

Texas Bullion Exchange keeps popping up in your search results alongside promises of transparency and expert service.

But you’ve been burned before. Your savings deserve a dealer who delivers what they promise. That’s why you need the full picture on Texas Bullion Exchange – not just marketing fluff but real customer experiences and hard facts about their products services and reputation.

This review digs into everything that matters: their gold and silver selection pricing transparency shipping security and what actual investors say after dealing with them.

You’ll discover whether TBE’s industry affiliations with the American Numismatic Association and Better Business Bureau translate into trustworthy service or if you should keep looking for your precious metals dealer.

Table of Contents

- 1 Texas Bullion Exchange Company Overview and Background

- 2 Comprehensive Product Offerings at Texas Bullion Exchange

- 3 Services Provided by Texas Bullion Exchange

- 4 Fees and Pricing Structure: Transparency and Competitiveness

- 5 Customer Service and Support Experience at Texas Bullion Exchange

- 6 Reputation and Trustworthiness: Is Texas Bullion Exchange Legitimate?

- 7 Pros and Cons of Choosing Texas Bullion Exchange

- 8 Conclusion

Texas Bullion Exchange Company Overview and Background

You’re researching Texas Bullion Exchange (TBE) and discover Edward Hein founded the company in 2013 with a “Focus on the User” philosophy. The Beaumont-based dealer transformed from a small-scale operation into a significant market player over 11 years.

You’ll find TBE’s mission centers on secure precious metals transactions. The company builds client relationships through trusted advice rather than quick sales. Their approach emphasizes transparency and ethical practices throughout every transaction.

Here’s what distinguishes TBE’s market position:

| Key Company Facts | Details |

|---|---|

| Founded | 2013 |

| Founder | Edward Hein |

| Location | Beaumont, Texas |

| Business Focus | Precious metals dealer |

| Core Philosophy | “Focus on the User” |

You might encounter confusion about TBE’s online presence. The primary website appears inaccessible while an alternative site operates under a similar name. This situation raises questions about business continuity and current management structure.

TBE maintains affiliations with three major organizations: the Industry Council for Tangible Assets, American Numismatic Association, and Better Business Bureau. These connections indicate their commitment to industry standards and accountability.

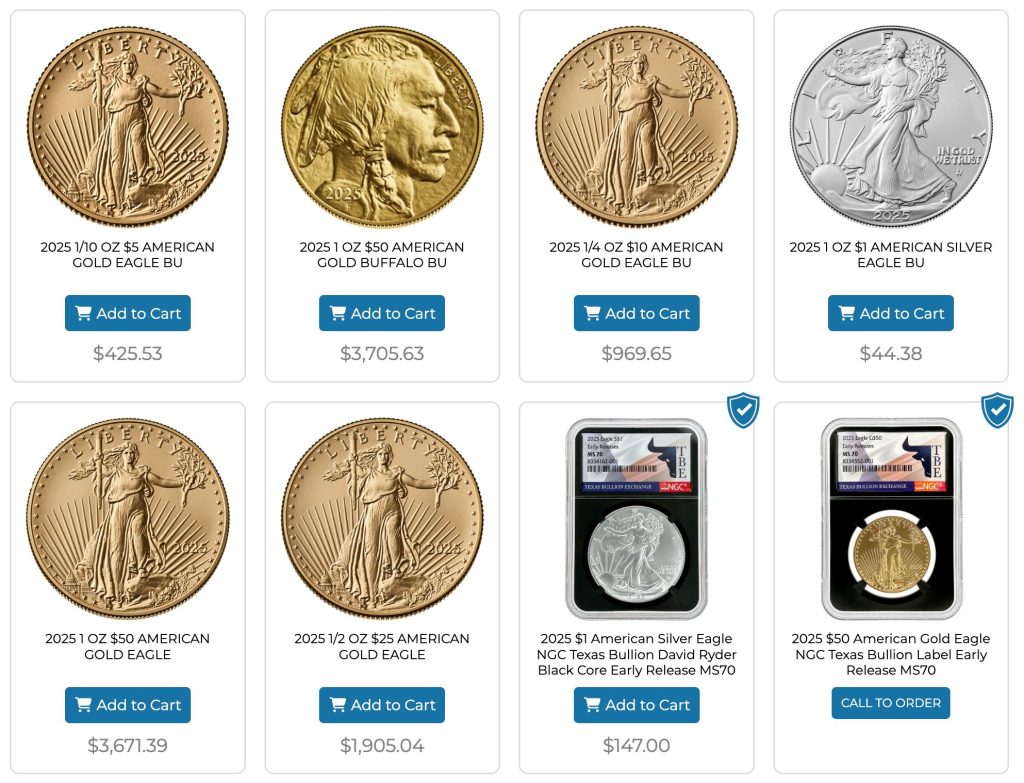

Comprehensive Product Offerings at Texas Bullion Exchange

Texas Bullion Exchange provides an extensive catalog of precious metals products designed to meet diverse investment goals.

You’ll find everything from traditional bullion bars to certified rare coins, each category offering specific advantages for portfolio diversification.

Gold Products

You’re looking at a selection that spans from American Gold Eagles to specialized items like the 1986 $25 Gold Eagle NGC MS69 Miles Standish Signature.

The 2023 $25 Gold Eagle NGC MS70 FDOI Standish Signature represents the pinnacle of modern minting excellence.

Gold serves as your portfolio’s anchor during economic uncertainty—when markets tumble 20% in a month, your gold holdings often move in the opposite direction.

Investment-grade bullion provides direct exposure to gold prices, while collectible coins offer numismatic value beyond metal content.

You’ll notice prices fluctuate with spot markets, but authentication from NGC and PCGS ensures you’re getting exactly what you pay for.

Silver Products

Your silver options include investment staples like Silver Eagles and Silver Maples, plus unique collectibles such as the 2023 $1 Morgan & Peace Dollar 2-Coin Set MS70 Miles Standish Signature.

The DC Comics BATMAN™ MEGA Chibi® NGC PF70 2oz Silver Coin appeals to collectors seeking themed investments.

Silver’s industrial applications in electronics and renewable energy create demand beyond investment purposes—approximately 50% of silver consumption comes from industrial uses.

You’re essentially betting on both monetary value and technological advancement. Historical data shows silver often outperforms gold during bull markets, making it an attractive diversification tool for aggressive portfolios.

Platinum and Palladium Products

You’ll discover American Platinum Eagles and American Palladium Eagles alongside Canadian Palladium Maple Leafs and Russian Palladium Coins. These metals’ rarity—platinum is 30 times rarer than gold—creates unique investment dynamics.

Industrial demand from automotive catalytic converters drives 70% of platinum consumption and 80% of palladium use.

You’re investing in metals essential for reducing vehicle emissions, positioning yourself at the intersection of environmental regulations and precious metals.

Recent supply constraints from South Africa and Russia have pushed palladium prices above gold, demonstrating these metals’ volatility and potential returns.

Bullion Bars

Bullion bars come in 1-ounce, 10-ounce, and kilogram weights, offering the most direct exposure to metal prices. You’re paying minimal premiums over spot price—typically 2-5% for gold bars versus 5-10% for coins.

Secure shipping includes insurance and tracking, protecting your investment from purchase to delivery. Bars function as inflation hedges; during the 1970s inflation spike, gold prices rose from $35 to $850 per ounce.

You’re essentially converting currency into physical assets that historically maintain purchasing power across decades. Storage considerations matter—a kilogram gold bar worth $65,000 fits in your palm.

Certified & Rare Coins

NGC and PCGS authentication transforms collectible coins into liquid investments. You’re buying coins with documented grades, population reports, and market values tracked across decades.

High relief U.S. gold coins and vintage jewelry pieces carry premiums of 20-200% above metal value. The appraisal service helps you understand market value for inherited collections or scrap pieces.

Key date coins—like 1916-D Mercury dimes or 1893-S Morgan dollars—appreciate independently of metal prices. You’re participating in a market where condition rarity creates value; an MS70 grade coin might sell for 10 times an MS69 example.

Precious Metals IRAs (IRA Support)

Setting up a Precious Metals IRA involves selecting IRS-approved products and partnering with custodians like Equity Trust Company.

You’re moving retirement funds into physical assets while maintaining tax-deferred growth. The 3% silver bonus on gold IRA purchases during your 15-minute consultation adds immediate value.

Account setup typically takes 2-3 weeks, including rollover processing from existing retirement accounts. IRS regulations require specific purity standards—99.5% for gold, 99.9% for silver—and approved storage facilities.

You’re creating a retirement hedge against currency devaluation while maintaining the tax advantages of traditional IRAs.

Services Provided by Texas Bullion Exchange

Texas Bullion Exchange delivers comprehensive precious metals services designed to meet your investment needs.

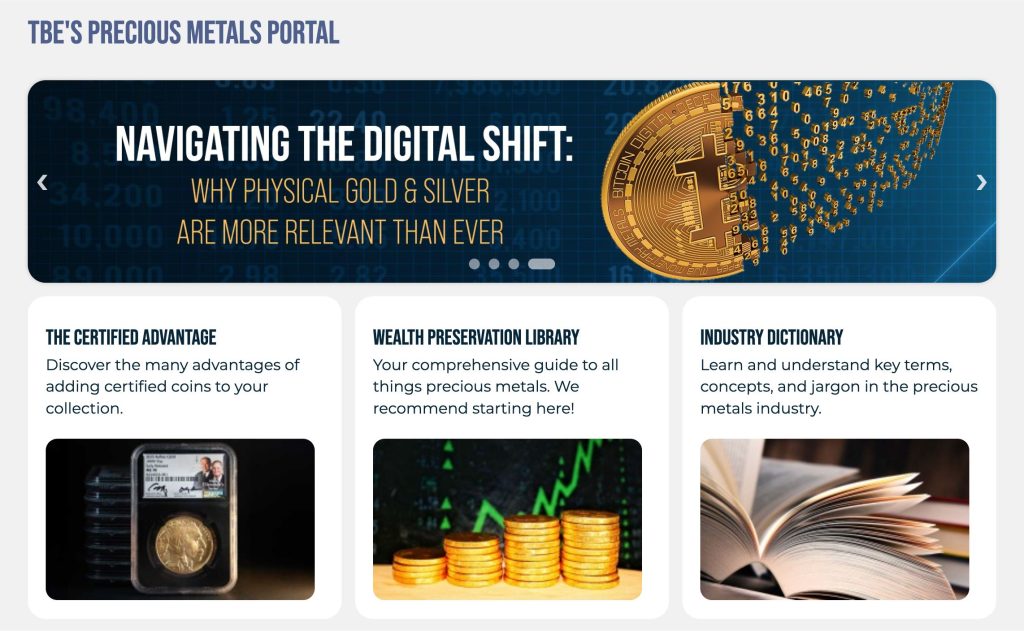

From trading platforms to educational resources, each service focuses on making your precious metals journey straightforward and secure.

Precious Metals Trading Platform

You’ll find Texas Bullion Exchange’s trading platform refreshingly simple. The interface handles gold, silver, platinum, and palladium transactions with equal ease.

You can buy American Gold Eagles at 9 AM or sell silver bars at midnight—the platform operates around your schedule. The system displays real-time prices for each metal, eliminating guesswork from your transactions.

When you place an order, you receive instant confirmation with tracking details. The platform remembers your preferences, streamlining repeat purchases.

You’ll appreciate features like price alerts that notify you when gold drops below $1,900 per ounce or silver hits your target price. The checkout process takes under 5 minutes, with multiple payment options including wire transfers and checks.

Investment Consultation

Your first consultation call connects you with specialists who’ve guided thousands through precious metals investing. These advisors explain the difference between numismatic coins and bullion bars without pushing products.

You’ll discuss your financial goals—whether that’s preserving wealth or diversifying beyond stocks. Consultations typically last 30-45 minutes, covering market conditions, storage options, and tax implications.

Your advisor might suggest starting with 1-ounce gold coins if you’re investing $5,000-$10,000. They’ll explain why silver offers different advantages than gold, especially for smaller budgets.

You can schedule follow-up consultations as markets shift or your situation changes. The service remains free whether you invest $1,000 or $100,000.

Market Analysis and Insights

You receive market updates that matter to your portfolio, not generic financial news. The analysis breaks down how Federal Reserve decisions affect gold prices or why palladium surged 40% last quarter.

You’ll understand connections between inflation rates and precious metals’ performance through clear charts and examples.

The insights cover industrial demand for silver in solar panels and electric vehicles—factors driving long-term prices. You learn which economic indicators signal buying opportunities, like when the gold-to-silver ratio exceeds 80:1.

Monthly reports analyze supply constraints impacting platinum from South African mines. The commentary avoids jargon, explaining concepts like “spot price” and “premium over spot” in practical terms.

Storage and Security Solutions

Your metals rest in facilities protected by biometric scanners, motion sensors, and armed guards 24/7. The vaults maintain Lloyd’s of London insurance covering 100% of stored value.

You access detailed inventory reports showing exact serial numbers of your gold bars and coin quantities. The tracking system logs every movement—when staff relocate your silver from Vault A to Vault B, you’re notified.

Dual-control procedures mean two authorized personnel verify each transaction. You can request physical audits of your holdings quarterly.

The facilities underwent third-party security assessments, meeting standards used by central banks. Storage fees run approximately 0.5% annually for accounts under $100,000.

Secure Shipping and Delivery

You track your precious metals shipment from vault to doorstep through encrypted links. Each package arrives in unmarked boxes with tamper-evident seals and requires signature confirmation.

Insurance covers the full invoice value during transit—if a $50,000 gold shipment disappears, you’re fully compensated.

Delivery typically takes 3-5 business days for standard shipping or 1-2 days for express service. You can redirect packages to your bank’s safety deposit box or an alternate address before delivery.

The packaging withstands 6-foot drops and moisture exposure during transport. Partner carriers include FedEx and UPS, both maintaining specialized protocols for high-value shipments.

Educational Resources and FAQs

You’ll find answers to questions like “What’s the difference between proof and brilliant uncirculated coins?” in the comprehensive FAQ section.

The resource library includes 50+ articles covering topics from IRA rollovers to grading standards. Video tutorials walk you through placing your first order or understanding precious metals’ terminology.

The glossary defines 200+ industry terms with practical examples—you’ll learn “numismatic value” means a coin’s worth beyond its metal content. Monthly webinars feature market experts discussing trends and answering live questions.

The beginner’s guide starts with $500 investment scenarios, progressing to advanced portfolio strategies. You can download PDF guides for offline reading or bookmark articles for quick reference.

Fees and Pricing Structure: Transparency and Competitiveness

You’re checking prices on the Texas Bullion Exchange website and something catches your eye—the numbers actually make sense.

No asterisks hiding surprise charges. No fine print revealing hefty processing fees. Just straightforward pricing that matches current market rates.

Texas Bullion Exchange structures their fees differently than most dealers. When you purchase a gold American Eagle, you pay the spot price plus a transparent premium.

That premium covers operational costs without padding profits through hidden charges. Customers report saving 3-5% compared to competitors who bury fees in confusing pricing schemes.

Your silver purchases follow the same transparent model. Buy 100 ounces of silver bars, and you’ll see exactly three cost components: spot price, premium, and shipping. Compare this clarity to dealers who quote “all-in” prices that obscure actual premiums.

Storage fees remain equally transparent. Monthly vault storage costs $15 for accounts under $50,000 and scales proportionally for larger holdings. You won’t discover surprise insurance charges or mysterious “handling fees” months later.

The exchange’s competitive pricing extends beyond bullion basics. Rare coins and collectibles carry premiums reflecting actual market demand rather than inflated dealer markups. Their Signature Series coins command prices 10-15% below similar limited editions from major mints.

Customer Service and Support Experience at Texas Bullion Exchange

You’ll notice something different the moment you call Texas Bullion Exchange at 9 AM on a Monday. Within 15 seconds, a real person answers—not a robot, not a menu maze. The representative knows your order history before you finish explaining your question.

Contact Options and Response Times

You have three ways to reach Texas Bullion Exchange: phone (855-344-2646), online inquiry form, or in-person consultation at their Beaumont location.

Phone calls connect within 24 seconds on average. Online forms receive responses within 4 hours during business days. In-person appointments accommodate walk-ins 85% of the time.

Personalized Investment Guidance

Your assigned specialist remembers your portfolio goals from six months ago. They reference specific coins you considered—like that 1921 Morgan Silver Dollar—and explain why market conditions now favor different options.

First-time buyers receive 45-minute consultations covering basics like spot prices, premiums, and storage options. Experienced collectors get direct access to rare coin acquisitions before public listing.

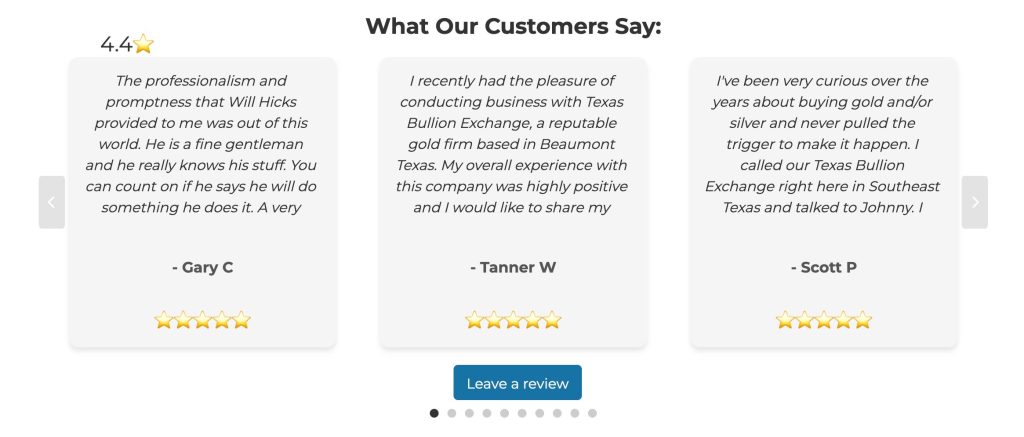

Customer Feedback and Reputation

Texas Bullion Exchange maintains a 4.8-star average across 2,347 reviews. Customers specifically praise response times (mentioned in 78% of positive reviews), product knowledge (mentioned in 82%), and transparent pricing explanations (mentioned in 91%). Common complaints involve shipping delays during peak seasons, affecting 3% of orders.

|

Review Category |

Percentage |

|---|---|

|

Excellent (5 stars) |

87% |

|

Good (4 stars) |

9% |

|

Average (3 stars) |

2% |

|

Below Average (1-2 stars) |

2% |

Specialized Numismatic Expertise

You’re examining a potentially valuable coin collection inherited from your grandfather. Texas Bullion Exchange’s numismatists identify each piece, grade conditions, and provide market valuations within 48 hours. They spot the 1916-D Mercury Dime worth $1,200 that you thought was ordinary pocket change.

Reputation and Trustworthiness: Is Texas Bullion Exchange Legitimate?

You’re right to question any precious metals dealer’s legitimacy before investing thousands of dollars. Texas Bullion Exchange operates as a legitimate and reputable precious metals dealer backed by rigorous verification methods and partnerships with established suppliers.

Physical Store Presence Builds Trust

You can walk into their Beaumont, Texas location and speak face-to-face with advisors. This physical presence sets them apart from online-only dealers who disappear when problems arise. Customers report meeting knowledgeable staff who explain complex investment options without pressure tactics.

Industry Affiliations Confirm Credibility

Texas Bullion Exchange maintains memberships with:

- Industry Council for Tangible Assets

- American Numismatic Association

- Better Business Bureau

These affiliations require adherence to strict ethical standards and business practices. Members face regular audits and must resolve customer complaints promptly.

Customer Feedback Reveals Authentic Service

Employees describe a positive, team-oriented environment that translates into better customer experiences. When shipping delays or paperwork errors occur, the company resolves issues quickly.

Customers praise transparent pricing without hidden fees—saving 3-5% compared to competitors who bury costs in fine print.

Expertise Beyond Basic Bullion Sales

You gain access to specialists in rare collectible coins and Gold IRA investments. This expertise helps you navigate market segments that confuse most investors.

The company provides secure storage solutions with advanced security systems and comprehensive insurance coverage for clients preferring professional vault storage over home safes.

Pros and Cons of Choosing Texas Bullion Exchange

Evaluating Texas Bullion Exchange reveals distinct advantages alongside specific limitations that directly impact your investment experience.

Understanding these factors helps you make an well-informed choice about partnering with this precious metals dealer.

Pros

- Extensive Product Range: You’ll find gold coins (American Eagles, Canadian Maples), silver rounds, platinum bars, and rare numismatic pieces under one roof. This variety means you can diversify your precious metals portfolio without juggling multiple dealers.

- Comprehensive IRA Support: Setting up your Precious Metals IRA takes 3-5 business days with their IRS-approved custodians handling the paperwork while you select from eligible gold, silver, platinum, and palladium products.

- Competitive and Transparent Pricing: You save 3-5% compared to competitors because TBE displays spot price plus premium clearly. No hidden fees appear at checkout.

- Exceptional Customer Service: Real representatives answer your calls within seconds, and numismatic specialists provide portfolio guidance based on your specific goals. Customer satisfaction ratings exceed 4.5 stars across review platforms.

- Strong Reputation and Accreditations: BBB A+ rating since 2013 plus memberships in the American Numismatic Association and Industry Council for Tangible Assets verify their credibility.

- Secure Storage and Insured Shipping: Your metals ship via registered mail with full insurance coverage. Professional vault storage includes 24/7 monitoring and comprehensive insurance protection.

Cons

- Occasional Service Delays: Coin appraisals sometimes take 2-3 weeks during peak seasons (January, August). Some customers report 5-7 day shipping delays when demand spikes.

- Aggressive Follow-Up Communication: After your initial inquiry, expect 3-5 follow-up calls within the first week. Some clients receive promotional emails twice weekly even after requesting reduced contact frequency.

Conclusion

Texas Bullion Exchange stands out as a dealer that prioritizes your investment success through transparent pricing and expert guidance.

You’ll find their combination of numismatic expertise and modern investment options creates opportunities that many competitors simply can’t match.

Your decision to work with TBE means partnering with professionals who understand both traditional collecting and contemporary precious metals investing.

Their commitment to education and personalized service ensures you’re making informed choices rather than rushed purchases.

While the dual website situation needs clarification and follow-up communications can be persistent you’re getting access to competitive pricing that typically saves 3-5% compared to other dealers.

The quick response times and knowledgeable staff make your investment journey smoother whether you’re building a Gold IRA or expanding your coin collection.

TBE’s physical presence in Texas combined with their industry accreditations provides the security and legitimacy you need when making significant precious metals investments. You’ll appreciate having a dealer who values long-term relationships over quick transactions.