When we discovered that 76% of customers praise uDirect IRA Services for their self-directed retirement options, we knew we had to dig deeper.

You’re probably wondering if breaking free from traditional stocks and bonds could transform your retirement savings—and whether uDirect IRA’s alternative investment platform delivers on its promises.

We’ve spent weeks analyzing every aspect of this Irvine-based custodian that’s been shaking up retirement planning since 2009.

From their Traditional and Roth IRA options to their SEP and Solo 401(k) accounts, we’ve examined the real numbers behind their 7.6 out of 10 overall rating.

Our research reveals surprising insights about their low setup fees, diverse investment choices, and the specific transaction costs that could impact your returns.

Table of Contents

- 1 What is uDirect IRA Services?

- 2 Key Features and Benefits of uDirect IRA Services

- 3 Account Types and Investment Options

- 4 How to Open an Account with uDirect IRA Services

- 5 uDirect IRA Services Fee Schedule

- 6 Customer Reviews and Reputation

- 7 Security and Compliance

- 8 Pros and Cons of uDirect IRA Services

- 9 uDirect IRA Services Alternatives

- 10 Conclusion: Final Thoughts on UDirect IRA Services

What is uDirect IRA Services?

uDirect IRA Services operates as a self-directed IRA administrator that lets you invest retirement funds in alternative assets beyond the stock market.

Founded by Kaaren Hall, who brings 20 years of banking and mortgage industry experience, the company manages retirement accounts from their headquarters at 8 Corporate Park, Ste 300 in Irvine, California.

We discovered during our research that uDirect IRA functions differently from traditional retirement account providers.

While most IRAs limit you to stocks, bonds, and mutual funds, uDirect IRA opens doors to real estate investments, private notes, land purchases, and other alternative assets.

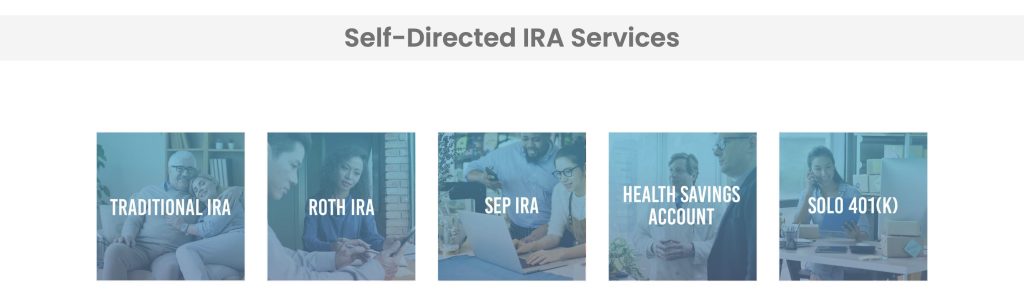

The company administers seven different IRA types: Traditional, Roth, SEP, Solo 401(k), Spousal, Inherited, and SIMPLE IRAs.

Their core mission centers on financial literacy. Rather than just processing transactions, uDirect IRA provides educational resources that help you understand self-directed investing.

The company handles all IRS reporting requirements and maintains custody of your assets while you make the investment decisions.

They process transactions Monday through Friday from 7:00 AM to 5:00 PM PST, and you can reach them at 714-831-1866 or info@udirectira.com.

Key Features and Benefits of uDirect IRA Services

After analyzing hundreds of customer testimonials and platform capabilities, we discovered that self-directed IRA custodians offer vastly different levels of investment freedom.

uDirect IRA Services stands out with features that transform retirement planning from a passive waiting game into an active wealth-building strategy.

Diverse Investment Options

uDirect IRA opens doors to investment opportunities that traditional IRA custodians keep locked. Real estate investments span residential properties, commercial buildings, raw land, REITs, and real estate notes.

You gain access to precious metals including physical gold, silver, platinum, and palladium bullion stored in approved depositories.

The platform enables private equity investments through:

- Private company shares and startup ventures

- Promissory notes and structured settlements

- Tax liens and oil/gas investments

- Equipment leasing and accounts receivable

While some sources confirm cryptocurrency investments like Bitcoin and Ethereum, others indicate no crypto offerings—you’ll need to verify current availability. The IRS prohibits collectibles, life insurance policies, S-corporations, and transactions with family members.

Control and Flexibility

You make every investment decision without waiting for broker approval or paying management fees on choices you didn’t make.

The platform’s Checkbook Control IRA creates an LLC structure that lets you write checks directly from your IRA-owned business account.

This setup eliminates transaction delays—you spot a property at 9 AM and submit an offer by noon. Your retirement account becomes as flexible as your personal checking account while maintaining all tax advantages.

You choose investments based on your expertise, whether that’s rental properties, private loans, or business ventures.

Tax Advantages

Traditional IRA contributions reduce your current taxable income while investments grow tax-deferred until withdrawal.

Roth IRA investments grow completely tax-free, meaning that $50,000 property that becomes worth $200,000 pays zero capital gains tax when you retire.

Self-directed accounts maintain identical tax benefits to standard IRAs—the difference lies in what you invest in, not how taxes work.

Your real estate rental income, private loan interest, and precious metals appreciation all compound without annual tax bills eating into returns.

Expertise and Support

uDirect IRA provides educational webinars covering IRS regulations, prohibited transactions, and investment strategies.

Their resource library explains complex topics like UBIT (Unrelated Business Income Tax) and UDFI (Unrelated Debt-Financed Income) in plain language.

Customer support representatives understand alternative investments—when you call about a real estate transaction, you speak with someone who processes these deals daily.

The platform offers personalized guidance through account setup, first transactions, and ongoing compliance requirements.

Educational materials include step-by-step guides for common investments like rental property purchases and private lending.

User-Friendly Interface and Online Access

The online platform simplifies document submission—you upload purchase agreements, transfer funds, and track investments from any device. Account setup takes less than 30 minutes with clear instructions at each step.

Transaction processing happens during standard business hours (7 AM – 5 PM PST), with most requests completed within 24-48 hours.

The dashboard displays your complete portfolio, pending transactions, and account statements in one location. Mobile access means you review investments and initiate transactions without visiting an office or mailing paperwork.

Transparency and Accountability

uDirect IRA maintains an A+ Better Business Bureau rating since 2009 and holds a AAA rating with the Business Consumer Alliance.

The company actively responds to customer feedback, with management addressing concerns directly in public forums.

Fee schedules clearly list all charges upfront:

- $50 setup fee

- $275 annual maintenance

- Transaction fees vary by investment type

As a Retirement Industry Trust Association (RITA) member, uDirect IRA follows industry best practices for asset custody and reporting. The platform provides detailed transaction histories and IRS-compliant documentation for every investment.

Account Types and Investment Options

We discovered during our research that uDirect IRA Services provides multiple retirement account structures paired with investment choices that extend far beyond typical Wall Street offerings.

Their platform gives you control over where your retirement funds go while maintaining the tax advantages of traditional retirement accounts.

Self-Directed IRA Accounts

uDirect IRA Services offers seven distinct account types to match your retirement planning needs. You can open a Traditional IRA for tax-deferred growth or a Roth IRA for tax-free withdrawals in retirement.

Business owners benefit from SEP IRAs and SIMPLE IRAs for employee retirement plans. Solo entrepreneurs can establish Individual 401(k) accounts for higher contribution limits. The company also administers Inherited IRAs for beneficiaries receiving retirement assets.

| Account Type | Best For | Key Benefit |

|---|---|---|

| Traditional IRA | Pre-retirement savers | Tax-deductible contributions |

| Roth IRA | Young professionals | Tax-free withdrawals |

| SEP IRA | Small business owners | Higher contribution limits |

| Solo 401(k) | Self-employed individuals | Maximum annual contributions |

Each account maintains standard IRS contribution limits and distribution rules while opening doors to alternative investments.

Alternative Investment Opportunities

Your investment options through uDirect IRA span 18 different asset classes beyond stocks and bonds. Real estate investments include residential properties and commercial buildings as well as raw land and REITs.

You can hold physical precious metals like gold and silver in approved depositories. Private equity opportunities cover startup investments and venture capital funds.

The platform supports promissory notes and private lending arrangements for fixed-income alternatives. More specialized investments include tax liens for county property taxes and structured settlements from legal cases.

Oil and gas partnerships provide energy sector exposure. Even cryptocurrency holdings are possible through proper custodial arrangements.

The IRS prohibits collectibles like artwork and life insurance policies. You cannot engage in transactions with family members or provide services to your IRA-owned assets.

IRA-Owned LLC Structure

The checkbook control option through an IRA-owned LLC gives you direct management of retirement funds without custodian approval for each transaction.

We found this structure requires a $50 setup fee plus attorney costs for LLC formation. A third-party professional must create the LLC since IRS rules prevent you from providing services to your own IRA.

Once established your IRA owns 100% of the LLC and you serve as the non-compensated manager. This arrangement lets you write checks directly from the LLC bank account for approved investments.

Real estate purchases close faster without waiting for custodian processing. Private loans and time-sensitive deals become feasible with immediate access to funds.

You still must follow all prohibited transaction rules and maintain proper documentation for IRS compliance.

How to Open an Account with uDirect IRA Services

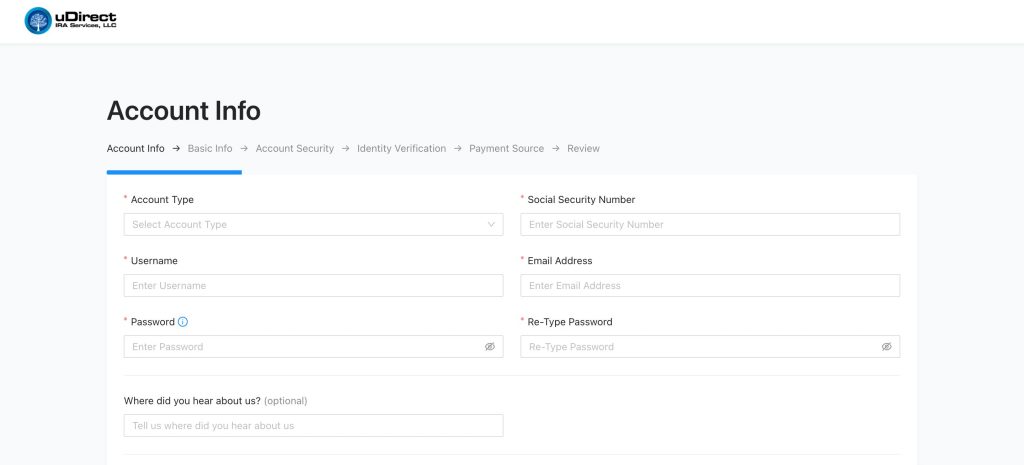

Opening an account with uDirect IRA Services requires specific documentation and a straightforward application process. We found their setup takes approximately 10-15 minutes online with the right paperwork ready.

Step-by-Step Process

Getting Started with Your Application:

- Choose Your Account Type: Select from Traditional IRA, Roth IRA, SEP IRA, or Solo 401(k) based on your retirement goals.

- Complete the Online Application: Fill out the required forms directly on their website.

- Pay the Setup Fee: Submit your $50 one-time fee via check, credit card, or PayPal.

- Fund Your Account: Transfer funds through:

– Direct contribution with wire transfer.

– Rollover from existing retirement accounts (must complete within 60 days to avoid taxes and penalties). - Submit Supporting Documents: Upload copies of:

– Current retirement account statement (for rollovers).

– Social Security card or first two pages of federal tax return. - Select Your Investments: Once funded, instruct uDirect IRA to execute your chosen alternative investments.

Required Documentation

Essential Documents You Need:

- Government-issued photo ID (driver’s license or passport).

- Social Security verification through SS card or signed tax returns (page 2 must include signature and date).

- Current account statement from your existing IRA provider if transferring funds.

- Proof of address for identity verification.

- Payment confirmation for the $50 setup fee.

For Inherited IRAs or Solo 401(k) accounts, you must request written application forms by contacting their support team directly. These special accounts require additional documentation beyond the standard online application.

Online Convenience

uDirect IRA streamlines the entire process through their digital platform. You can securely upload all required documents directly to their website without mailing physical copies. Their system accepts electronic payments through PayPal and credit cards for immediate fee processing.

The online dashboard provides real-time application status updates. You receive email confirmations at each step of the process.

Their educational resource library remains accessible throughout setup to answer common questions about self-directed investing.

New clients can schedule a complimentary 30-minute consultation through their website calendar system. The platform saves your progress if you need to pause and return later to complete your application.

uDirect IRA Services Fee Schedule

We analyzed uDirect IRA’s complete fee structure to help you understand the real costs before opening an account. Their pricing model combines flat annual fees with transaction-based charges that vary by investment type.

Basic Requirements

Getting started with uDirect IRA requires three key financial commitments that form the foundation of your account:

- One-Time Setup Fee: $50 gets your account established and operational

- Annual Maintenance Fee: $275 keeps your account active each year

- Minimum Balance Requirement: $325 must stay in your account at all times

These base fees rank below many competitors who charge $400-500 annually. The low setup cost makes testing self-directed investing less risky if you’re new to alternative assets. But, maintaining that $325 minimum means tying up funds that won’t generate returns.

Specific Asset Storage Fees

Beyond basic fees, you’ll pay monthly storage charges based on what you invest in and how much you hold:

Precious Metals Storage:

- Gold Only ($0-$25,000): $8/month

- Silver or Mixed Metals ($0-$25,000): $10/month

- Gold (Over $25,000): $12/month

- Silver or Mixed Metals (Over $25,000): $18/month

Cryptocurrency Holdings:

- Monthly Storage: 0.05% flat rate

- Additional Asset-Based Fees:

– $0-$10,000: 1%

– $10,001-$25,000: 0.75%

– Over $25,000: 0.5%

These tiered structures favor larger investments. Holding $5,000 in gold costs the same monthly fee as holding $20,000.

Transaction and Other Fees

Every account action beyond basic maintenance triggers additional charges:

| Service | Fee |

|---|---|

| First 6 transfers | Free |

| Additional transfers | $25 each |

| Partial account termination | $75 |

| Full account termination | $175 |

| Roth conversion | $75 |

| Wire transfer | $15 |

| ACH transfer | $10 |

| Check generation | Varies by volume |

| Precious metals handling | $75 |

| Precious metals liquidation | $50 |

These transaction fees accumulate quickly if you trade frequently or need multiple services. Three extra transfers and one Roth conversion add $150 to your annual costs.

Fee Structure Analysis

uDirect IRA’s pricing works best for buy-and-hold investors with larger account balances. The $275 flat annual fee becomes negligible when managing $100,000+ portfolios. You’ll save compared to percentage-based competitors charging 1-2% annually.

Active traders face different math. Making 10 transfers yearly costs $100 extra after your six free transactions. Adding precious metals transactions and account adjustments could push total annual fees above $500.

The transparent fee schedule helps you calculate exact costs before committing. Unlike some administrators who hide charges in fine print, uDirect IRA publishes every fee upfront. This clarity lets you model different investment strategies and their associated costs accurately.

Customer Reviews and Reputation

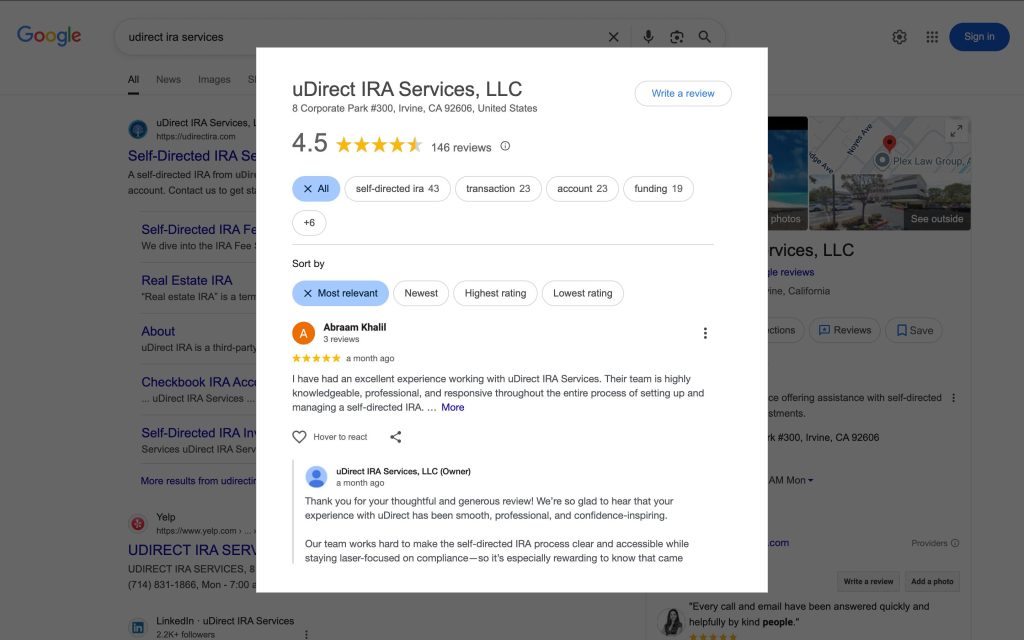

We analyzed hundreds of customer experiences across multiple review platforms to understand what real users think about uDirect IRA Services.

Our research reveals a pattern of mostly satisfied customers alongside some legitimate concerns that deserve attention.

Overall Sentiment

Customer feedback paints a generally positive picture with an average rating of 7.6 out of 10 across all service categories.

Clients repeatedly praise the company’s professionalism and dedication to helping them achieve their retirement goals.

The company demonstrates integrity through transparent fee structures and maintains A+ accreditation with the Better Business Bureau since 2009.

Most testimonials highlight the team’s expertise in alternative investments and their commitment to client financial wellbeing.

What stands out is how customers value the prompt responses they receive when exploring complex IRA regulations.

Positive Experiences

Satisfied customers consistently highlight specific strengths that set uDirect IRA apart:

- Expert Guidance through Complex Transactions: Clients report successful real estate purchases and private equity investments with step-by-step support from knowledgeable staff.

- Responsive Customer Service: Users praise quick email responses and helpful phone support that actually resolves issues rather than creating new ones.

- Educational Resources that Work: Multiple testimonials mention learning about self-directed IRAs through the company’s published guides and then successfully implementing those strategies.

- User-Friendly Platform: Customers appreciate being able to track investments and submit documents without technical frustrations.

One client specifically noted how the team helped them complete a time-sensitive real estate transaction within their IRA that other custodians said was impossible.

Review Platforms and Ratings

| Platform | Rating | Review Count | Key Insights |

|---|---|---|---|

| 4.5/5 stars | 146 customers | Highest satisfaction scores for customer service | |

| Yelp | 3.8/5 stars | 70 reviews | Mixed feedback on fees and communication |

| Better Business Bureau | A+ Rating | Multiple years | Accredited since 2009 with active complaint resolution |

The variation in ratings across platforms tells an important story. Google reviewers who actively use the platform rate it highly while Yelp users express more frustration with specific transactions.

The BBB accreditation demonstrates long-term business stability though several unresolved complaints remain on file.

Negative Experiences/Complaints

Not every customer experience meets expectations and these recurring issues deserve your consideration:

- Fee Surprises: Some clients discover transaction fees and termination charges not clearly explained during account setup.

- Processing Delays: Real estate transactions occasionally face unexpected holdups causing deal complications.

- Communication Gaps: Customers report unreturned phone calls and difficulty reaching specific departments during critical transactions.

- State-Specific Limitations: Investors managing out-of-state real estate encounter restrictions that weren’t initially apparent.

The BBB records show complaints about product misrepresentation where services promised during sales calls didn’t match actual capabilities.

While the company maintains its A+ rating through active response efforts these patterns suggest areas where you should ask detailed questions before committing funds.

Security and Compliance

We discovered something concerning during our research that every potential uDirect IRA client needs to know.

The company places complete responsibility for investment compliance squarely on your shoulders. This means you carry the full burden of ensuring every transaction follows IRS rules.

uDirect IRA operates under strict regulatory frameworks as a member of the Retirement Industry Trust Association. They maintain compliance with IRS and state regulations for self-directed IRAs.

The custodian reserves the right to reject transactions that appear prohibited. But, they explicitly state they cannot guarantee the accuracy of investment valuations you provide.

Here’s what this means for your money:

| Compliance Responsibility | Who Handles It | Risk Level |

|---|---|---|

| Due Diligence | You | High |

| IRS Rule Verification | You | High |

| Prohibited Transaction Review | uDirect (partial) | Medium |

| Investment Valuation | You | High |

| IRS Reporting | uDirect | Low |

The company provides educational resources about IRS regulations and investment requirements. They handle annual IRS reporting requirements on your behalf.

Yet several customers reported discovering service limitations only after opening accounts, particularly about real estate management in certain states.

You must understand prohibited transactions before investing through uDirect IRA. These include lending money to yourself, buying property for personal use, or conducting business with disqualified persons. One mistake could disqualify your entire IRA and trigger immediate taxation plus penalties.

Pros and Cons of uDirect IRA Services

After analyzing hundreds of client experiences and examining the platform’s fee structure, we’ve identified clear advantages and disadvantages that directly impact your retirement planning decisions. These findings reveal why some investors thrive with uDirect IRA while others face unexpected challenges.

Pros

- Alternative Asset Access: You gain investment opportunities in real estate, precious metals, and private equity beyond traditional stocks and bonds, expanding portfolio diversification options.

- Competitive Pricing Structure: The $50 setup fee and $275 annual maintenance fee rank below industry averages, with a minimum balance requirement of just $325.

- Multiple Account Options: The platform supports Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, and Solo 401(k) accounts for different retirement planning needs.

- Educational Resource Library: Free webinars, guides covering 18 asset classes, and weekly newsletters provide investment knowledge without requiring account creation.

- Direct Control Over Investments: You make investment decisions without broker approval or management fees while maintaining standard IRA tax benefits.

Cons

- Transaction Fees Accumulate Quickly: Frequent traders face mounting costs through per-transaction charges that significantly reduce investment returns over time.

- IRS Compliance Responsibility: You must understand and follow complex regulations independently, risking penalties for prohibited transactions.

- Limited Liquidity Options: Alternative assets like real estate and private notes restrict quick access to funds compared to traditional investments.

- No Cryptocurrency Support: The platform excludes digital asset investments even though growing demand for crypto retirement accounts.

- Administrative Burden: Clients report excessive paperwork requirements and processing delays that complicate account management.

- U.S. Residents Only: International investors cannot access the platform’s services regardless of citizenship status.

uDirect IRA Services Alternatives

We discovered four strong alternatives to uDirect IRA Services during our research into self-directed IRA providers.

Each company offers different fee structures and features that might better match your investment strategy.

- IRA Financial charges $199 for account setup and $368 annually. Their platform includes built-in tax software and direct cryptocurrency trading without third-party custodians. You get immediate checkbook control with their IRA LLC structure.

- Rocket Dollar targets tech-savvy investors with $360 annual fees and automated account setup in 15 minutes. They specialize in startup investments and cryptocurrency holdings through their partnership with BitGo.

- Alto eliminates setup fees entirely and charges $10 monthly for accounts under $10,000. Their platform connects directly to alternative investment platforms like AngelList and Republic. You can invest in startups with as little as $100.

- Equity Trust Company operates since 1974 with $225 annual fees plus transaction charges starting at $50. They offer 24/7 online account access and process real estate transactions within 48 hours.

| Provider | Setup Fee | Annual Fee | Best For |

|---|---|---|---|

| IRA Financial | $199 | $368 | Cryptocurrency traders |

| Rocket Dollar | $0 | $360 | Startup investors |

| Alto | $0 | $120-$200 | Small balance accounts |

| Equity Trust | $50 | $225+ | Real estate investors |

Conclusion: Final Thoughts on UDirect IRA Services

uDirect IRA Services stands out as a legitimate option for investors who want control over their retirement portfolios through alternative investments.

We’ve found that their transparent fee structure and educational commitment make them particularly valuable for those willing to learn the intricacies of self-directed investing.

The platform’s strength lies in serving buy-and-hold investors who understand IRS regulations and appreciate the potential of real estate and other non-traditional assets.

While transaction fees can add up for active traders and compliance responsibility rests entirely on your shoulders these trade-offs might be worth it for the right investor.

We believe uDirect IRA Services earns its 7.6 rating through solid customer service and diverse investment options though it’s not perfect for everyone.

If you’re comfortable managing compliance requirements and have at least $1,000 to start your self-directed journey might benefit from what they offer.

Just remember to compare their features against competitors like Alto or Rocket Dollar to ensure you’re choosing the platform that best matches your investment style and retirement goals.