You’re scrolling through investment options when you discover something crucial: Edward Jones doesn’t offer Gold IRAs that hold physical precious metals.

That’s right even though being one of the largest financial advisory firms with over 19,000 advisors nationwide, they don’t provide accounts for storing gold bullion or coins in your retirement portfolio.

This gap in their services might surprise you, especially since gold IRAs have become increasingly popular. While Edward Jones excels at traditional retirement planning and offers gold-related investments like ETFs and mining stocks, you’ll need to look elsewhere if you want actual gold in your IRA.

Table of Contents

An Overview of Edward Jones

You might recognize Edward Jones from the financial advisor office down the street they’re practically everywhere with over 15,000 branches across America.

While they excel at traditional investment services, their approach to gold IRAs differs significantly from specialized precious metals firms.

Edward Jones Company Profile and History

Edward D. Jones founded the company in St. Louis back in 1922, building it on face-to-face relationships rather than Wall Street flash.

Today, you’re looking at one of the largest financial firms globally, managing over $1.7 trillion in assets for 10 million customers. Their advisors pride themselves on knowing your kids’ names and remembering your retirement dreams.

You’ll find their green-and-gold storefronts in small towns and suburbs where advisors often become fixtures in the community.

The firm’s old-school approach means you get personalized service, though it comes with traditional investment philosophies that don’t always embrace alternative assets like physical gold.

Services Provided by Edward Jones

Your Edward Jones advisor offers comprehensive retirement planning through Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs, plus 529 college savings plans.

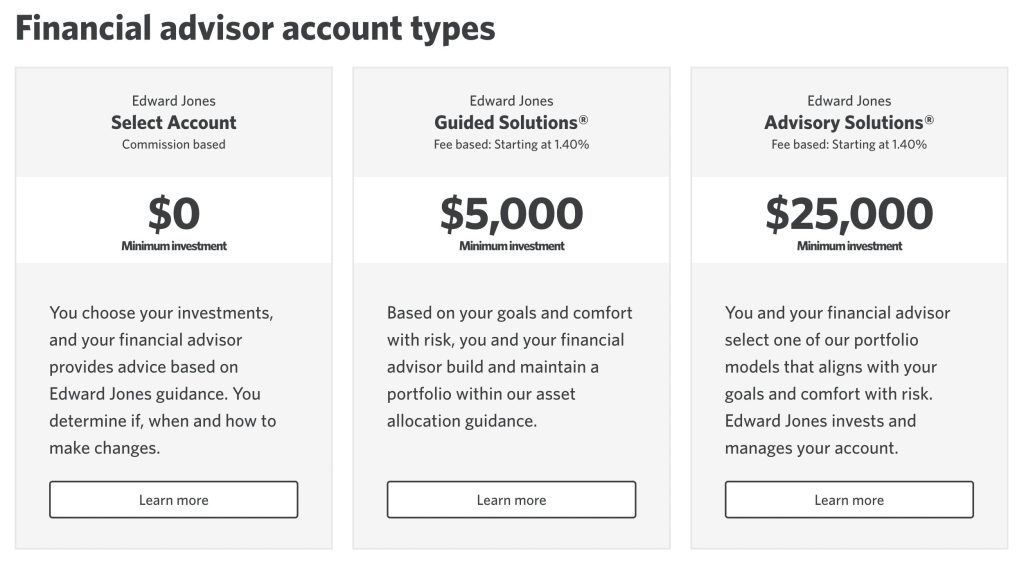

They’ll build you a portfolio using stocks, bonds, and mutual funds through three main programs: Select Account (you make the decisions), Guided Solutions (collaborative approach), and Advisory Solutions (they handle everything).

You get personalized investment advice tailored to your risk tolerance and timeline. They excel at conventional retirement strategies — think diversified portfolios heavy on equities and fixed income.

You won’t find self-directed IRA options here, which means no physical gold storage. Instead, they’ll suggest gold ETFs or mining company stocks if you express interest in precious metals exposure.

Edward Jones Fees and Rates

You’ll pay premium prices for Edward Jones’ personal touch — starting at 1.35% annually for portfolios under $250,000, dropping to lower percentages as your assets grow.

Trade commissions apply to Select Accounts, and you’ll encounter portfolio strategy fees on top of management costs.

Compare this to discount brokers charging 0.25% or robo-advisors at 0.50%, and you’re paying triple or more. Small investors feel this pinch most if you’ve got $50,000 invested, you’re handing over $675 yearly just in management fees.

Their fee structure makes sense if you value the advisor relationship and need extensive guidance. For cost-conscious investors or those wanting direct control over alternative investments like physical gold, these fees prove prohibitive.

Pros and Cons of Edward Jones

Edward Jones presents a mixed bag for investors seeking retirement planning services. Understanding both the advantages and limitations helps you determine if this firm aligns with your investment goals.

Pros

You’ll find several compelling benefits when working with Edward Jones:

- Face-to-Face Financial Guidance: You meet directly with one of 19,000 advisors across the US and Canada who creates personalized investment strategies based on your specific retirement goals.

- Extensive Branch Network: You can walk into any of their 15,000+ physical locations nationwide when you need assistance or prefer in-person consultations.

- Comprehensive Financial Services: You gain access to traditional IRAs, Roth IRAs, 529 college savings plans, estate planning, and retirement income strategies all under one roof.

- Established Reputation: You’re working with a firm managing $1.7 trillion in assets for 10 million clients since 1922.

- Research and Analysis Tools: You receive market insights and investment research to support your financial decisions.

Cons

You’ll encounter significant drawbacks that may impact your investment experience:

- No Physical Gold IRA Options: You can’t store gold bullion or coins in your retirement account, limiting your precious metals diversification to ETFs and mining stocks.

- High Fee Structure: You pay 1.35% annually for portfolios under $250,000, plus commissions, account service fees, custodial fees, and termination charges that compound your costs.

- Limited Market Access: You get fewer investment choices compared to discount brokers and online platforms offering broader market exposure.

- Not Built for Active Traders: You face restrictions on short-term trading strategies with fee structures that penalize frequent transactions.

What is a Gold IRA?

A Gold IRA lets you hold physical gold, silver, platinum, and palladium in your retirement account. Unlike traditional IRAs that limit you to stocks and bonds, this self-directed account stores actual precious metals in IRS-approved depositories.

You fund it through rollovers from existing IRAs or 401(k)s. The IRS sets the same contribution limits as regular IRAs—$7,000 annually if you’re under 50, or $8,000 if you’re 50 or older in 2025.

Choose between Traditional Gold IRAs (tax-deductible contributions), Roth Gold IRAs (tax-free withdrawals), or SEP Gold IRAs for self-employed individuals.

Your gold stays in secure facilities like Delaware Depository or Brink’s Global Services. You can’t store it at home that triggers immediate taxes and a 10% penalty.

The metals must meet specific purity standards: gold requires 99.5% purity, silver needs 99.9%, and platinum and palladium require 99.95%.

Gold prices often climb during stock market crashes. In 2008’s financial crisis, gold surged 25% while stocks plummeted 37%.

This inverse relationship makes Gold IRAs attractive for protecting retirement savings against economic uncertainty.

Reasons to Invest in a Gold IRA

Gold IRAs attract investors seeking portfolio protection beyond traditional stocks and bonds. While Edward Jones doesn’t offer physical gold IRAs, understanding their benefits explains why 10.8% of Americans now own gold investments.

1. Diversification

You reduce portfolio risk by adding gold to your retirement accounts. Gold moves independently from stocks—when the S&P 500 dropped 37% in 2008, gold prices rose 5.5%. Physical gold IRAs let you hold actual bullion worth $1,800-$2,000 per ounce, balancing against paper assets.

Investment advisors recommend 5-10% gold allocation for optimal diversification. You’re creating a hedge when stock markets crash or bonds underperform.

Gold’s negative correlation to equities means your retirement savings gain stability through market cycles. Smart diversification protects your wealth from single-asset exposure.

2. Hedge Against Inflation

You preserve purchasing power when inflation erodes dollar value. Gold prices increased 360% from 2000-2020 while cumulative inflation reached 53.8%. Your $50,000 in cash lost significant buying power, but gold maintained its worth.

Physical gold protects against currency devaluation each ounce retains intrinsic value regardless of monetary policy. During the 1970s inflation crisis, gold surged from $35 to $850 per ounce.

You’re safeguarding retirement funds from Federal Reserve money printing that dilutes fiat currency. Historical data shows gold outpaces inflation over 20-year periods.

3. Financial Stability/Security

You gain peace of mind holding tangible assets during economic turmoil. Gold prices typically rise during recessions jumping 25.5% during the 2007-2009 financial crisis. Physical metals in IRS-approved depositories remain secure regardless of bank failures or market crashes.

Your gold IRA provides insurance against systemic financial risks. During March 2020’s pandemic panic, gold reached $2,067 per ounce while stocks plummeted 34%.

You’re protecting retirement savings from geopolitical tensions, currency crises, and market volatility. Gold’s 5,000-year history as stored value offers unmatched stability.

4. Tax Advantages

You receive identical tax benefits as traditional IRAs when investing in gold. Traditional Gold IRA contributions reduce taxable income up to $6,500 annually ($7,500 if over 50). Your investments grow tax-deferred until retirement withdrawals.

Roth Gold IRAs offer tax-free growth and withdrawals after age 59½. You pay taxes upfront but never on gains crucial if gold appreciates significantly.

Converting existing IRAs to Gold IRAs maintains tax-advantaged status. Annual contribution limits and required minimum distributions at 73 apply equally to gold and regular IRAs.

5. Long-Term Growth Potential

You capture gold’s historical appreciation over extended periods. Gold prices increased from $271 per ounce in 2001 to $1,943 in 2023—a 617% gain. Long-term investors benefit from gold’s tendency to preserve and grow wealth across decades.

Central banks added 1,136 tonnes of gold reserves in 2022, signaling institutional confidence. You’re investing alongside governments recognizing gold’s enduring value.

Industrial demand from technology and jewelry sectors supports price floors. Gold’s finite supply and mining costs create natural appreciation pressure over time.

6. Liquidity

You maintain access to funds through established gold markets. Major dealers offer buy-back programs at 1-3% below spot prices. Gold IRAs allow penalty-free withdrawals after 59½, with metals shipped directly or liquidated for cash.

Physical gold trades globally 24/7 with transparent pricing. You convert holdings to cash within 1-3 business days through approved custodians.

Unlike real estate or collectibles, gold offers instant liquidity during emergencies. IRA custodians help seamless transactions while maintaining IRS compliance. Gold’s universal acceptance ensures you’re never locked into illiquid positions.

How to Invest in a Gold IRA

Since Edward Jones doesn’t offer physical gold IRAs, you’ll work with a specialized custodian. Here’s your step-by-step process:

1. Choose a Gold IRA Custodian

You’ll research companies that specifically handle precious metals IRAs. Compare their storage facilities, insurance policies, and customer reviews.

2. Open Your Account

You’ll complete the application online or by phone. The process takes 10-15 minutes. You’ll provide your Social Security number, employment information, and beneficiary details.

3. Fund Your Gold IRA

You’ll transfer funds through:

- Direct rollover from your 401(k) or existing IRA (tax-free)

- 60-day indirect rollover (you receive and redeposit funds)

- Annual contributions ($7,000 limit, $8,000 if you’re 50+)

4. Select Your Precious Metals

You’ll choose IRS-approved products:

- American Eagle gold coins

- Canadian Maple Leaf gold coins

- Gold bars (99.5% purity minimum)

- Silver, platinum, and palladium options

5. Arrange Secure Storage

Your custodian ships metals directly to an IRS-approved depository. Delaware Depository and Brink’s Global Services store most Gold IRA assets. You’ll pay $100-$300 annually for segregated storage.

Top Companies to Choose Over Edward Jones

Since Edward Jones doesn’t offer physical gold IRAs, you’ll want to explore specialized companies that excel in precious metals retirement accounts. These firms provide the expertise and services Edward Jones lacks in this specific investment area.

1. Goldco

Goldco stands out as the ideal starting point for gold IRA beginners, boasting an A+ BBB rating and thousands of positive customer reviews.

You can open an IRA account with minimal investment requirements—a significant improvement from their previous $25,000 minimum.

The company limits offerings to gold and silver, keeping your choices straightforward. What sets Goldco apart is their exceptional customer service paired with complete transparency in pricing.

You’ll appreciate their buy-back program, which provides an exit strategy when you’re ready to liquidate. The setup process is remarkably simple, and their educational resources help you understand each step. Direct purchases are available alongside IRA options, giving you flexibility in how you invest.

2. Augusta Precious Metals

Augusta Precious Metals earns Joe Montana’s endorsement and maintains zero negative BBB complaints—an impressive achievement in the precious metals industry.

You’ll need $50,000 to start, but the investment comes with lifetime support and comprehensive client education. The company focuses exclusively on gold and silver, offering IRA-compliant metals stored in IRS-approved facilities.

Their transparent pricing model eliminates hidden fees, and you can purchase metals directly or through an IRA. Educational webinars and one-on-one consultations ensure you understand market dynamics before investing.

The A+ BBB rating reflects their commitment to customer satisfaction, and their team provides personalized guidance throughout your investment journey.

3. American Hartford Gold

American Hartford Gold specializes in gold IRAs and maintains hundreds of positive Trustpilot reviews. You’ll find their expert team provides extensive resources and educational materials to guide your investment decisions.

The company offers diverse investment options beyond standard gold coins and bars, including promotional deals that add value to your portfolio.

Their responsive customer service addresses questions quickly, though fees might run higher than competitors. Geographic limitations may affect service availability in your area, and market volatility remains a risk with any precious metals investment.

The wide range of IRA-eligible products gives you flexibility in building your retirement portfolio, and their specialists help navigate IRS regulations.

How to Choose the Right Gold IRA Company

Selecting a Gold IRA company demands careful evaluation of several critical factors that directly impact your retirement savings.

Your choice determines not just where your precious metals are stored but how effectively your investment grows over time.

Reputation and Experience

You start by checking the Better Business Bureau rating—anything below A- raises red flags. Top companies like Goldco maintain A+ ratings alongside 4.8+ stars on Trustpilot from thousands of reviews. You’re looking for firms operating at least 10 years with transparent ownership and physical offices you can verify.

Check Google reviews focusing on recent entries from the past 6 months. Companies with 4.5+ stars across 500+ reviews demonstrate consistent service.

You’ll find legitimate firms list their founders’ names and company registration numbers prominently. Avoid any company making unrealistic profit promises or using high-pressure sales tactics during your initial consultation.

Fees and Minimum Investments

You’ll encounter four main fees: setup ($50-$250), annual maintenance ($80-$300), storage ($100-$300), and transaction fees (1-5%).

Compare total first-year costs—reputable companies charge $500-$1,000 including storage. Minimum investments typically range from $10,000 to $50,000.

Storage fees vary by type: segregated storage costs $150-$300 annually while commingled runs $100-$200. Transaction fees hit hardest during liquidation expect 1-2% for buybacks. Some companies waive first-year fees for investments over $50,000.

Request written fee schedules before signing anything. Hidden fees often appear in insurance costs ($1 per $1,000 value) and wire transfer charges ($30-$50).

Customer Service and Support

You test responsiveness by calling during off-hours quality companies answer within 2 minutes even at 8 PM. Educational resources distinguish leaders: Augusta provides one-on-one web conferences while Goldco offers downloadable guides covering IRA rules and market analysis.

Live chat features prove invaluable when you’re comparing options at midnight. Top firms assign dedicated account representatives who remember your name and investment goals.

You’ll receive quarterly market updates and annual account reviews. Companies worth considering offer 24/7 phone support and respond to emails within 4 hours. Educational webinars run weekly covering topics from inflation hedging to estate planning.

Secure Storage Options

Your metals require IRS-approved depositories Delaware Depository and Brink’s Global Services lead the industry.

Segregated storage keeps your specific coins separate in sealed containers with your name. Commingled storage mixes your holdings with others’ in a common vault, reducing costs but complicating audits.

Insurance coverage reaches $1 billion at major depositories through Lloyd’s of London. You receive detailed manifests showing exact serial numbers and photographs of your holdings. Annual third-party audits verify your metals’ existence.

Some companies offer international storage in Singapore or Switzerland for additional fees. Avoid any firm suggesting home storage—it violates IRS regulations and risks your tax-deferred status.

Reviews and Testimonials

You scrutinize reviews on ConsumerAffairs and TrustLink beyond just star ratings. Read 3-star reviews they reveal honest pros and cons.

Common legitimate complaints involve slower processing during market volatility. Red flags include multiple reviews posted the same day or generic praise without specifics.

Check precious metals forums like Reddit’s r/Gold for unfiltered opinions. Financial bloggers often share detailed experiences with specific companies. Video testimonials on company websites carry less weight than independent YouTube reviews.

Focus on reviews mentioning specific employees by name—it indicates genuine interactions. Companies with 95%+ positive ratings across 1,000+ reviews demonstrate consistent excellence.

Conclusion

Edward Jones excels at traditional investment services but falls short for investors seeking physical gold in their retirement portfolios.

While their personalized approach and extensive branch network benefit many clients, you’ll need to look elsewhere if you want to hold actual gold coins or bullion in your IRA.

Your best path forward depends on your investment goals. If you’re satisfied with gold ETFs or mining stocks and value face-to-face financial guidance, Edward Jones might still serve you well.

But, if you’re determined to add physical precious metals to your retirement strategy, specialized Gold IRA companies like Goldco, Augusta Precious Metals, or American Hartford Gold offer the expertise and services you need.

Take time to evaluate your options carefully. Compare fees, read customer reviews, and consider what level of service you require.

Whether you choose Edward Jones for traditional investments or a specialized custodian for physical gold, make sure your decision aligns with your long-term financial objectives and risk tolerance.