You’re searching for a self-directed IRA custodian and GoldStar Trust Company keeps appearing in your results.

Founded in 1989, this Texas-based company manages alternative investments for retirement accounts, but you need to know if they’re worth your trust and money.

With over three decades of experience, GoldStar Trust specializes in precious metals IRAs, real estate investments, and church bonds.

Their customer ratings tell a mixed story – from a solid A rating with the Better Business Bureau to a modest 2.6/5 rating from Focus on the User. You’ll find they’ve handled 1 BBB complaints while maintaining 784 Trustpilot reviews.

Before you commit your retirement savings, you need the complete picture of their services, fees, and customer experiences.

Let’s find out what actual investors say about working with GoldStar Trust Company!

Table of Contents

- 1 GoldStar Trust Company at a Glance

- 2 Services Offered and Investment Options

- 3 Pricing and Fees

- 4 Customer Reviews, Ratings, and Complaints

- 5 How To Open a Gold IRA with GoldStar Trust

- 6 Precious Metals Storage and Security

- 7 Comparative Performance: GoldStar vs. Competitors

- 8 Pros and Cons

- 9 Final Verdict: Is GoldStar Trust Worth It?

GoldStar Trust Company at a Glance

GoldStar Trust Company stands as a specialized custodian for self-directed IRAs, operating from Canyon, Texas since 1989.

You’ll find they’ve carved out a unique position in the retirement industry by focusing on alternative investments that traditional custodians typically avoid.

History and Background

GoldStar Trust began its journey as Colonial Trust Company in 1989. The company expanded its expertise through strategic acquisitions, including American Church Trust, which positioned them as specialists in church bond investments.

Today, GoldStar operates as the trust-only branch of Happy State Bank, combining the stability of bank backing with specialized IRA custodial services.

This 34-year history gives you insight into their staying power. You’re dealing with a company that’s weathered multiple economic cycles and regulatory changes.

Their evolution from a small trust company to managing billions in assets demonstrates their ability to adapt and grow within the self-directed IRA space.

Company Profile and Services

GoldStar Trust specializes in custodial services for self-directed IRAs, particularly focusing on non-traditional retirement investments.

You can hold precious metals, real estate, private equity, church bonds, and crowdfunding investments through their platform. Their custodial services extend to Swiss annuities, privately offered investments, and structured cash flows.

The company’s focus on alternative investments sets them apart from conventional IRA custodians. You won’t find them pushing standard mutual funds or stocks.

Instead, they’ve built their entire operation around helping investors diversify into assets that most retirement custodians won’t touch. This specialization means their staff understands the complex regulations surrounding these alternative investments.

Track Record and Industry Standing

GoldStar Trust manages between $2.7 billion and $3 billion in assets under management across more than 60,000 accounts.

These numbers place them among the larger self-directed IRA custodians in the industry. You’re looking at a company that’s earned particular respect in the church bond investment niche, where they’ve become a go-to custodian.

Their industry standing reflects in their longevity and client base. Managing 60,000+ accounts requires substantial operational infrastructure and regulatory compliance.

The company’s focus on church bonds has created a specialized reputation that attracts religious organizations and investors seeking faith-based investment options. This niche expertise contributes to their overall credibility in the alternative investment space.

About the Management

Jeff Kelly has served as President of GoldStar Trust since 2020, bringing a focus on leadership transparency to the organization.

The management team includes executives with extensive experience in trust services and alternative investments.

You’ll notice the company emphasizes accessibility, with leadership actively involved in educational initiatives and client communications.

The management structure reflects a commitment to specialized knowledge. Unlike larger financial institutions with rotating executives, GoldStar’s leadership maintains long-term positions within the company.

This stability means you’re working with people who understand the nuances of self-directed IRAs and have built relationships within the alternative investment community over years of service.

Services Offered and Investment Options

GoldStar Trust Company expands your retirement investment possibilities beyond traditional stocks and bonds. The company specializes in alternative assets that conventional IRA custodians typically restrict.

Self-Directed IRA Services

You control every investment decision within your GoldStar Trust self-directed IRA. The company handles administrative tasks including IRS compliance, required documentation, and annual reporting while you select investments matching your financial goals.

Your investment choices range from physical precious metals to private equity stakes. GoldStar Trust processes transactions, maintains records, and ensures each investment meets IRS regulations.

The custodian executes your instructions without offering investment advice, giving you complete autonomy over portfolio decisions.

Types of IRAs Offered

GoldStar Trust supports four distinct IRA structures for your retirement planning. Traditional IRAs let you deduct contributions from taxable income, with taxes due upon withdrawal.

Roth IRAs use after-tax dollars but provide tax-free withdrawals in retirement. SEP IRAs serve self-employed individuals and small business owners, allowing higher contribution limits up to $66,000 annually.

SIMPLE IRAs work for businesses with 100 or fewer employees, featuring employer matching options. Each account type maintains the same investment flexibility across GoldStar’s alternative asset options.

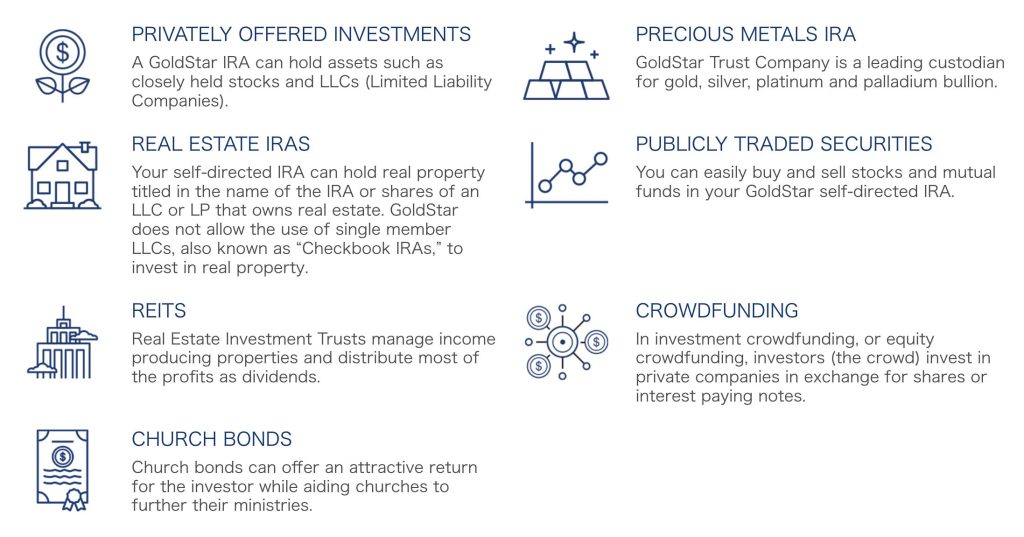

Diverse Investment Options

Your GoldStar Trust IRA accesses 15 investment categories beyond conventional markets. Precious metals include physical gold, silver, platinum, and palladium stored in approved depositories.

Church bonds yield 4-7% annually while supporting religious institutions. Real estate investments span direct property ownership, REITs, and real estate LLCs. Private investments encompass equity stakes, promissory notes, and closely-held stocks.

Additional options include Swiss annuities, secondary market annuities, crowdfunding trusts, and charter school bonds. Public securities, mutual funds, money market funds, and CDs remain available for portfolio balance.

Custodial Services

GoldStar Trust maintains comprehensive records for every transaction in your account. The company generates monthly statements detailing holdings, valuations, and transaction history.

Tax forms including 1099-R and 5498 arrive automatically each year. Compliance monitoring ensures investments meet IRS guidelines for self-directed IRAs.

Asset reporting includes fair market valuations required for annual IRS filings. The custodian coordinates with investment sponsors, transfer agents, and depositories to track your holdings accurately.

Paying Agent and Escrow Services

GoldStar Trust operates specialized financial services beyond IRA custodianship. The paying agent division processes distributions for structured settlements and secondary market annuities.

Escrow services hold funds temporarily during complex transactions including real estate closings and private placements.

These services leverage GoldStar’s $3 billion asset management infrastructure and 34-year operational history. Transaction processing occurs through secure ACH transfers, with wire transfers and overnight check delivery available upon request.

Pricing and Fees

GoldStar Trust Company’s fee structure directly impacts your investment returns over time. Understanding these costs helps you evaluate whether their services align with your retirement goals.

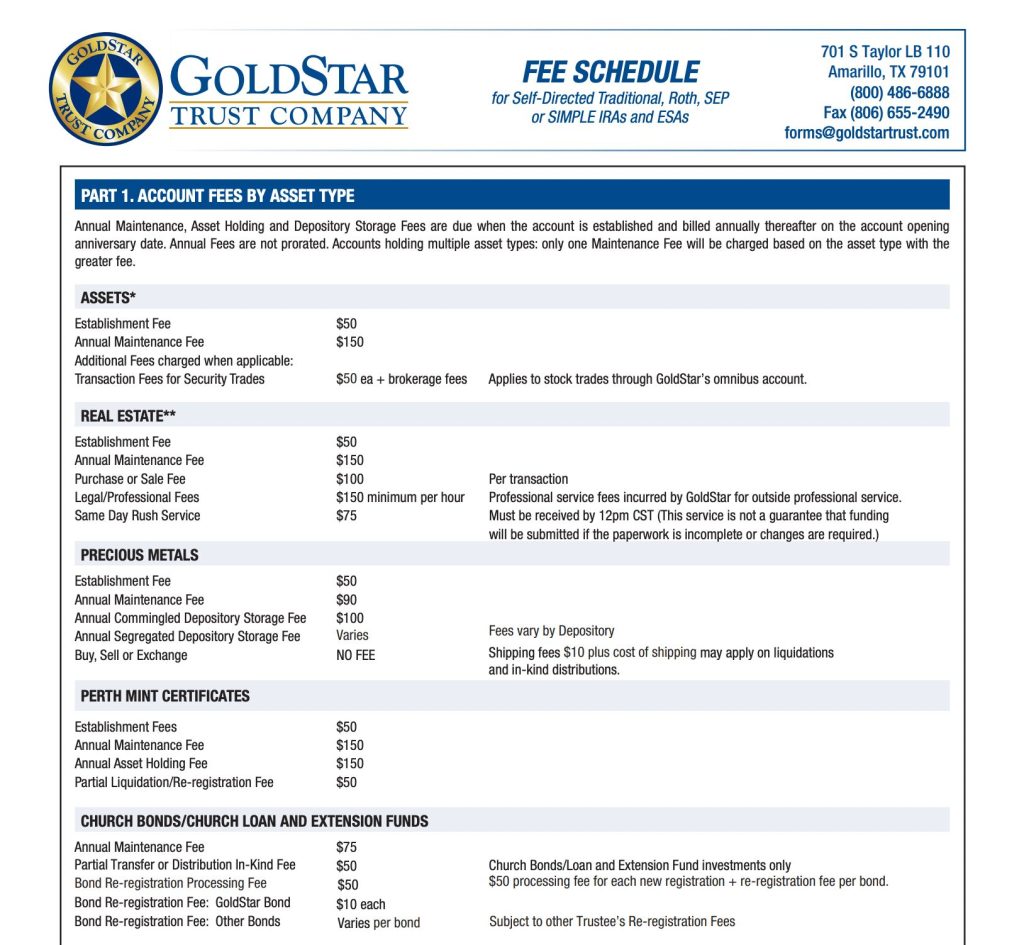

Transparent Fee Structure

GoldStar Trust posts their complete fee schedule online, letting you calculate exact costs before opening an account.

You’ll find detailed breakdowns for each service type—from account setup to transaction processing. Their published fee schedule eliminates surprises that plague investors with other custodians.

The company provides specific pricing for every investment category. You can review fees for precious metals storage, real estate transactions, and specialized services like church bond management. This upfront disclosure lets you budget accurately for your self-directed IRA expenses.

Understanding GoldStar Trust’s Fee Structure

You’ll pay $50 to establish your GoldStar Trust account, whether opening a Traditional, Roth, or SEP IRA. Annual maintenance runs $150, though some accounts qualify for the lower $75 rate depending on asset type. Each transaction—buying or selling investments—costs $100, plus any brokerage fees for securities trades.

Precious metals investors face additional storage costs starting at $100 yearly for segregated vault space. The company charges $40 for each physical delivery of gold or silver, plus shipping expenses. Account termination triggers a $100 closing fee if you transfer assets elsewhere.

Sliding Scale Annual Fees

GoldStar Trust calculates annual fees based on your account’s fair market value, not a flat rate. Accounts under $50,000 pay the minimum $50 yearly fee, while those exceeding $100,000 cap at $250 annually. This structure penalizes successful investors whose growing portfolios trigger higher maintenance costs.

The sliding scale particularly affects precious metals IRAs where gold appreciation increases your fee burden. You might start paying $50 yearly on a $25,000 gold investment, then watch fees climb to $250 as gold prices rise. Flat-fee competitors charge the same amount regardless of account growth.

Specific Investment Fees

Church bond investments carry a $75 annual fee per bond series held in your account. Perth Mint certificate programs require $50 for setup, $75 for administration, and $150 for custody services. Real estate investments demand $50 to establish, then $200-$300 yearly depending on property complexity.

Foreign account holders face the steepest charges—up to $275 annually for international custody. Liquidating foreign assets triggers surrender fees between $50-$75 per transaction. Gold purchases cap at $25,000 per transaction, with management fees reaching 1.25% for gold-backed IRAs.

Comparing Costs to Competitors

Flat-fee custodians like Equity Trust charge $225 yearly regardless of account value, making them cheaper for high-balance accounts.

Madison Trust offers $169 annual pricing that beats GoldStar for accounts over $75,000. But, GoldStar’s specialized services—particularly church bonds and Perth Mint programs—aren’t available at most competitors.

Your decision hinges on investment type and expected growth. GoldStar costs less for small accounts under $50,000 or specialized investments like church bonds. Large precious metals portfolios fare better with flat-fee alternatives that don’t penalize asset appreciation.

Customer Reviews, Ratings, and Complaints

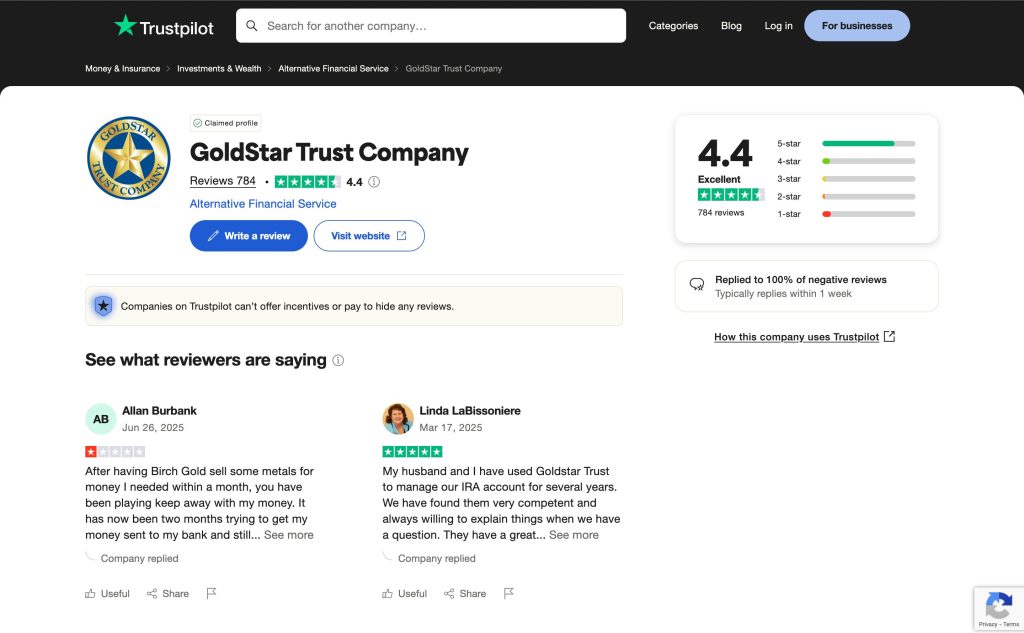

GoldStar Trust Company’s reputation varies dramatically across review platforms, revealing a complex picture of customer satisfaction.

Your experience with this custodian depends heavily on your investment needs and expectations for customer service.

Ratings Breakdown

GoldStar Trust’s ratings paint a conflicting portrait across major review platforms:

| Platform | Rating | Reviews | Key Insight |

|---|---|---|---|

| BBB | A (1/5 stars) | 1 review | A-rated but minimal feedback |

| Trustpilot | 4.4/5 | 784 reviews | 77% gave 5-star ratings |

| 3.2/5 | 140 reviews | Mixed experiences | |

| Yelp | 1.7/5 | 53 reviews | Lowest satisfaction score |

The stark contrast between Trustpilot’s 4.4 rating and Yelp’s 1.7 rating suggests wildly different customer experiences.

You’ll find satisfied investors praising specific services while others express frustration with basic account management.

Analyzing Consumer Feedback (Pros & Cons)

Customer feedback reveals distinct patterns in GoldStar Trust’s performance:

Pros

- Asset diversity: Access to 15 investment categories including precious metals and church bonds

- Fee transparency: Published fee schedules let you calculate costs upfront

- Investment control: Direct management appeals to experienced self-directed investors

Cons

- Navigation challenges: Complex processes frustrate average investors without IRA expertise

- Service inconsistency: Customer support quality varies between representatives

- Billing problems: Multiple reports of incorrect charges and delayed distributions

You’ll encounter these issues most frequently when dealing with account transfers or requesting distributions during busy periods.

How To Open a Gold IRA with GoldStar Trust

Opening a Gold IRA with GoldStar Trust takes just three steps and roughly 7-10 business days from start to finish.

You’ll discover the process is straightforward, though the fees and minimums require careful consideration before you commit.

Step-by-Step Process

- You start by completing GoldStar’s application paperwork and mailing a check to their Canyon, Texas office. The check covers four components: a $25 opening fee, administration costs (0.08% of account value, $50-$250 annually), storage fees (0.1% of assets, $90 minimum), and a $40 transaction fee.

- Next, you fund your account through a rollover from your existing IRA or 401(k), or via direct transfer from another qualified retirement plan. GoldStar processes these transfers within 5-7 business days once they receive your completed paperwork.

- Finally, you work with CMIGS (their preferred metals dealer) to acquire IRS-approved precious metals. You provide specific purchase instructions, and CMIGS handles the transaction while GoldStar manages custody and storage of your physical metals.

Account Minimums & Contribution Limits

GoldStar requires a $5,000 minimum for new Gold IRA accounts, though existing customers adding precious metals face just a $1,000 minimum. These minimums apply to your initial precious metals purchase, not your account balance.

Annual contribution limits follow standard IRA rules: $6,500 for individuals under 50 and $7,500 for those 50 and older in 2025. You can contribute cash or roll over funds from existing retirement accounts without annual limits on rollovers.

Storage fees start at $90 annually regardless of account size, making smaller accounts proportionally more expensive to maintain. For example, a $5,000 account pays 1.8% in storage fees alone, while a $50,000 account pays just 0.18%.

Precious Metals Storage and Security

GoldStar Trust partners with secure depositories to protect your precious metals investments. Your physical gold, silver, platinum, and palladium holdings require specialized storage that meets IRS requirements for IRA-eligible assets.

Storage Details

GoldStar Trust uses Delaware Depository Services Company in Wilmington, Delaware as their primary storage facility.

This depository specializes in precious metals custody for retirement accounts and maintains segregated storage areas for IRA assets.

Your metals are stored separately from other investors’ holdings and tracked with unique serial numbers. The facility operates 24/7 with restricted access zones and maintains detailed inventory records for every transaction.

Delaware Depository holds certifications from major industry organizations and undergoes regular third-party audits to verify holdings.

Annual Fees & Coverage

Storage fees cost 0.1% of your precious metals’ market value annually with a $90 minimum and no maximum cap. A $100,000 gold IRA pays $100 per year while a $50,000 account pays the $90 minimum.

The depository carries full insurance coverage that protects your metals against theft, damage, or loss. Insurance policies cover 100% of the market value without deductibles.

You receive quarterly statements showing your holdings’ current value and any fee calculations. The flat percentage structure means fees grow proportionally with your investment’s success.

Security Protocols

Your precious metals benefit from multiple security layers including physical vault systems, digital encryption, and multi-factor authentication (MFA).

The depository employs armed guards, motion sensors, and biometric access controls throughout the facility. Digital security includes 256-bit encryption for all electronic communications and transaction records.

You access your account through MFA that requires both password and phone verification. Vault areas feature time-delay mechanisms and dual-control procedures requiring two authorized personnel for access. All security systems undergo monthly testing and annual independent assessments.

Comparative Performance: GoldStar vs. Competitors

Evaluating GoldStar Trust against competitors reveals critical differences in service delivery and cost structures. Your choice impacts both investment flexibility and long-term returns.

What to Compare

Fee structure determines your investment’s true cost over time. GoldStar’s sliding scale fees increase with account value, while competitors like STRATA Trust Company offer flat annual fees of $75. You’ll pay $75-$150 annually at GoldStar for basic accounts, plus transaction fees of $100 per trade.

Service responsiveness affects your investment timeline. GoldStar processes new accounts in 7-10 business days, matching industry standards. Phone support operates during business hours, though some customers report 24-48 hour email response times.

Investment access shapes portfolio diversity. GoldStar supports 15 investment categories including church bonds—a unique offering most competitors lack. You gain access to real estate, private placements, and precious metals through approved dealers.

User interface impacts daily account management. GoldStar’s online portal provides monthly statements and transaction history. The platform lacks mobile optimization, unlike modern competitors offering dedicated apps for account monitoring.

Competitor Mentions (Precious Metals)

- Augusta Precious Metals specializes exclusively in gold and silver IRAs, offering educational resources and lifetime customer support. Their minimum investment starts at $50,000, targeting high-net-worth investors.

- Goldco focuses on precious metals, offering direct buyback programs and streamlined rollover services without a minimum investment requirement. They emphasize education through one-on-one consultations.

- American Hartford Gold caters to smaller investors with a $10,000 minimum, featuring price-match guarantees and free storage for qualifying accounts. Their A+ BBB rating reflects consistent customer satisfaction.

- Birch Gold Group diversifies beyond metals into cryptocurrencies and other alternative assets. They require a $10,000 minimum and offer personalized portfolio recommendations.

- Noble Gold Investments stands out with international storage options and a $20,000 minimum investment. They provide rare coins and collectibles unavailable through most custodians.

Pros and Cons

Evaluating GoldStar Trust Company reveals distinct advantages and disadvantages that directly impact your retirement investment experience. Understanding these factors helps you determine if their services align with your investment goals.

Pros

- 34+ Years of Experience: GoldStar Trust manages over $3 billion in assets across 60,000+ accounts, demonstrating stability since 1989.

- Alternative Asset Access: You can invest in church bonds, physical precious metals (gold, silver, platinum, palladium), real estate partnerships, and private placements beyond traditional stocks and bonds.

- Transparent Pricing Structure: Their complete fee schedule appears online, letting you calculate exact costs before opening an account with no hidden charges.

- Delaware Depository Partnership: Your precious metals stay secure in segregated storage with 24/7 monitoring, full insurance coverage, and regular third-party audits.

- Specialized Financial Services: GoldStar offers escrow services for complex transactions and acts as paying agent for church bond investments, leveraging their infrastructure for your benefit.

Cons

- Complex Investment Navigation: Some investors report difficulty completing certain transactions without additional guidance, particularly for first-time alternative asset buyers.

- Mixed Customer Reviews: Yelp shows 1.7/5 rating (53 reviews) while Trustpilot displays 4.4/5 (784 reviews), indicating inconsistent customer experiences.

- Limited Educational Resources: Unlike competitors offering comprehensive guides and market analysis, GoldStar provides minimal learning materials for new investors exploring alternative assets.

Final Verdict: Is GoldStar Trust Worth It?

GoldStar Trust Company’s worth depends entirely on your specific investment goals and risk tolerance. If you’re seeking church bonds or need a custodian with decades of alternative asset experience, they’re hard to beat.

But, if you’re looking for competitive fees on larger accounts or prefer modern digital platforms, you’ll find better options elsewhere. Their sliding fee structure particularly hurts successful investors who watch costs rise alongside portfolio growth.

The mixed customer feedback signals you’ll need patience exploring their systems and potentially dealing with service inconsistencies.

Yet their Delaware Depository partnership and established infrastructure provide solid security for your physical assets.

Before committing, calculate the total costs for your planned investment size and compare them against flat-fee competitors.

Consider whether their specialized expertise justifies potentially higher expenses and whether you’re comfortable with their traditional approach to customer service.

Your decision eventually hinges on whether GoldStar’s unique strengths align with your retirement strategy or if their limitations outweigh the benefits for your situation.