When we started researching precious metals storage options, International Depository Services Group kept appearing at the top of custodians’ recommended lists.

We discovered why: they’re one of only three depositories operating Class III vaults—the highest security rating in the industry—with facilities in Delaware, Texas, and Canada.

What caught our attention wasn’t just their 24/7 security or Lloyds of London insurance coverage. It’s that they charge the same rate whether you choose segregated or non-segregated storage—a rare policy that typically costs extra elsewhere.

Their fee structure starts at 0.65% annually with a $100 minimum, and they process withdrawal requests within 48 hours.

We’ll break down everything you need to know about their services, security measures, and whether they’re the right choice for your precious metals storage needs.

Table of Contents

- 1 What is International Depository Services?

- 2 Security Features and Protocols

- 3 Storage Options and Facilities

- 4 Insurance and Protection Coverage

- 5 Fees and Pricing Structure

- 6 Pros and Cons of International Depository Services

- 7 Performance and User Experience

- 8 Comparison with Alternative Depositories

- 9 Conclusion

What is International Depository Services?

International Depository Services (IDS) Group operates as a premier precious metals storage provider with high-security vaults across North America.

International Depository Services (IDS) Group operates as a premier precious metals storage provider with high-security vaults across North America.

We found their unique position in the market stems from their direct connection to Dillon Gage Inc. and their ability to serve both individual IRA investors and major institutional clients.

Company Background and History

IDS Group started operations in 2010 as Diamond State Depository in Delaware before expanding internationally.

The company transformed when Dillon Gage Inc. established it as a subsidiary to meet growing demand for secure precious metals storage.

After opening their Canadian facility in Mississauga they rebranded to International Depository Services Group to reflect their cross-border capabilities. The Texas location followed shortly after solidifying their presence in three strategic markets.

Today IDS operates under the backing of Dillon Gage which has maintained its reputation in precious metals trading and refining since 1976.

This four-decade legacy provides IDS with industry connections and expertise that newer depositories simply cannot match.

Services Offered

IDS Group specializes in physical storage of gold, silver, platinum, and palladium for IRA accounts and private holdings.

You can choose between segregated storage where your metals remain separate from others or commingled storage at the same annual rate of 0.65%. The depository processes withdrawal and transfer requests within 48 hours through their online portal.

Monthly inventory reports arrive automatically showing exact holdings and current valuations. Transportation services move metals between facilities or to your designated location when needed.

IDS also provides specialized services for institutional clients including market makers refineries and mining companies.

Their vault facilities accommodate everything from standard bullion bars to rare certified coins with full chain-of-custody documentation.

Regulatory Compliance and Certifications

IDS maintains critical industry accreditations that validate their operational standards and security protocols.

The Delaware facility holds COMEX/CME accreditation plus approval from the Intercontinental Exchange Futures.

Their Canadian location earned approval from the Investment Industry Regulatory Organization of Canada placing it among only eight facilities nationwide with this distinction.

All IDS locations maintain membership in the London Bullion Market Association ensuring they meet international precious metals standards.

The company holds active membership in the Industry Council for Tangible Assets (ICTA) demonstrating commitment to industry best practices.

Lloyds of London provides comprehensive insurance coverage for all stored assets protecting your investment against loss or damage.

Security Features and Protocols

When we researched precious metals depositories, we discovered that security measures separate trustworthy facilities from risky ones.

Our investigation into International Depository Services revealed multiple layers of protection that work together to safeguard your assets.

Physical Security Measures

Class III vaults form the backbone of physical protection at IDS facilities. These vaults earned the highest rating from Underwriters Laboratories testing—requiring two full hours for a criminal to breach compared to just one hour for Class II vaults. Your metals rest behind reinforced barriers in Delaware, Texas, and Canada locations.

The facilities operate with armed security personnel and enforce strict access protocols. Only authorized staff enter vault areas through biometric scanners.

Motion detectors, sound sensors, and vibration monitors create an invisible security net around your holdings. The “dual control” policy means vault teams always work in pairs—never alone.

IDS employs only permanent staff members for vault operations, refusing to use temporary or contract workers who might pose security risks.

Digital Security Systems

Your account information stays protected through sophisticated inventory management systems that separate client assets from depository balance sheets.

Each precious metal holding gets tracked in fully allocated, client-specific custody accounts. This means your gold and silver never mix with company assets or other clients’ holdings.

The digital infrastructure includes real-time monitoring by off-site security specialists working around the clock. Monthly inventory reports arrive in your online account, showing every transaction and current holdings.

The system sends email alerts whenever activity occurs in your account. IDS maintains comprehensive disaster response and business continuity plans to protect information systems.

Data security protocols keep your personal information separate from parent company records while multiple cybersecurity measures defend against unauthorized access.

Audit and Monitoring Procedures

IDS conducts perpetual internal and external audits to verify every ounce of metal matches client records. These audits happen continuously throughout the year—not just annually.

The process confirms compliance with industry standards and regulatory requirements. Key audit features include:

- 24/7 real-time monitoring by security specialists.

- Verification processes that check physical inventory against digital records.

- Lloyd’s of London all-risk insurance coverage protecting client assets.

- Strict “separation of duties” preventing any single employee from controlling transactions.

- External auditors who independently verify holdings and procedures.

Each audit creates a paper trail documenting the exact location and condition of your metals. The multi-redundant security layers mean several systems must fail simultaneously before any breach could occur.

Processing withdrawal requests within 48 hours demonstrates their confidence in these verification systems—they know exactly where your assets sit at any moment.

Storage Options and Facilities

International Depository Services Group operates three full-service precious metals depositories across North America with distinct storage solutions for different investor needs.

We found their approach to segregated storage particularly noteworthy since they charge the same rate as their standard storage option.

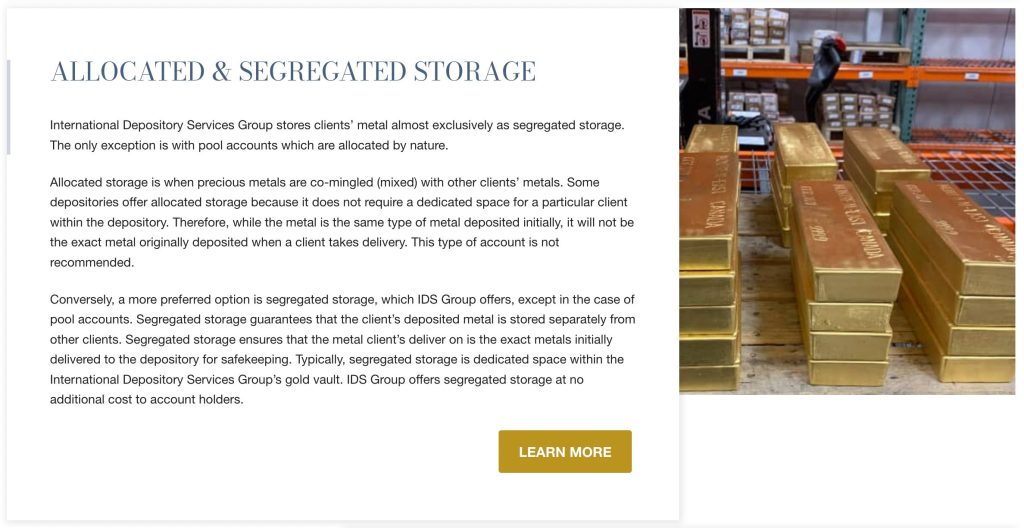

1. Segregated Storage

IDS provides fully segregated storage where your metals remain physically separated in dedicated vault space. Your exact gold bars and silver coins stay untouched in their original form rather than being mixed with other clients’ holdings.

We discovered that IDS includes segregated storage at no additional cost while competitors often charge 20-30% more for this service. This means you pay the same 0.65% annual fee whether you choose segregated or pooled storage.

Each client receives a unique storage location within the Class III vault with detailed inventory reports showing serial numbers and exact specifications of stored items.

2. Allocated Storage

Allocated storage at IDS pools your metals with other investors’ holdings of the same type and purity. You own a specific quantity of gold or silver but not the exact bars or coins you deposited.

IDS generally advises against this option since you cannot guarantee receiving your original metals back. The company maintains this service primarily for institutional clients who prioritize liquidity over maintaining specific pieces.

While allocated storage works identically to segregated storage in terms of fees and insurance coverage through Lloyd’s of London, you lose the ability to retrieve your exact deposited items during withdrawal.

3. Facility Locations

IDS maintains three strategically positioned depositories serving different regions of North America.

- The Delaware facility features Class III gold vaults meeting the highest industry security standards.

- The Texas location provides convenient access for southwestern investors and maintains the same UL-rated vault specifications.

- The Ontario facility holds accreditation from the Investment Industry Regulatory Organization of Canada and serves Canadian retirement account holders.

All three locations operate with 24/7 off-site monitoring and dual control protocols requiring two authorized personnel for vault access. Each facility processes withdrawal and transfer requests within 48 hours regardless of location.

Insurance and Protection Coverage

When we researched precious metals depositories, we discovered that insurance coverage often makes or breaks investor confidence.

International Depository Services Group partners with Lloyd’s of London to protect your stored assets, providing coverage that extends beyond basic vault security.

Insurance Policies

Lloyd’s of London underwrites all insurance policies for metals stored at IDS facilities. This coverage protects your precious metals against theft, damage, and loss while in storage. The policy also extends to outbound shipments, with carrier-specific insurance available upon request.

IDS maintains client-designated accounts where they cannot transact without your explicit instructions. This separation of authority adds another layer of protection beyond physical insurance.

While IDS doesn’t publish complete policy details publicly, their use of Lloyd’s indicates coverage structured specifically for precious metals storage risks.

You can request detailed insurance guidelines directly from IDS to understand specific coverage limits and exclusions for your holdings.

Liability Coverage

IDS provides protection against physical loss or damage to stored metals through their Lloyd’s of London policy.

The coverage addresses risks during both storage and transit phases. Standard liability protection in the precious metals depository industry covers losses from negligence or security breaches.

IDS supplements insurance coverage with Class III vaults and multi-redundant security systems to minimize liability risks.

Their strict separation of duties for security personnel and continuous audits reduce potential breach points. The depository maintains no authority over client accounts without written instructions, limiting their liability exposure and protecting your autonomy.

While specific liability limits aren’t publicly disclosed, Lloyd’s reputation suggests comprehensive coverage matching industry standards for high-value precious metals storage.

Claims Process

Filing a claim requires contacting IDS directly, as they don’t publish detailed claims procedures online. Their Lloyd’s of London insurance typically handles claims through established protocols for precious metals losses.

You’ll need documentation of your holdings, which IDS provides through monthly inventory reports and online account access.

The 24/7 account monitoring system tracks all transactions and movements, creating an audit trail for potential claims.

For shipping-related claims, the process depends on whether you selected standard coverage or carrier-specific insurance.

IDS administrative staff provides support throughout the claims process according to their customer service protocols.

Processing times vary based on claim complexity and required documentation, though Lloyd’s established reputation suggests professional handling of legitimate claims.

Fees and Pricing Structure

Understanding the cost of precious metals storage can make or break your investment strategy. We discovered that IDS structures their fees differently than most competitors in ways that could save you thousands annually.

Storage Fees

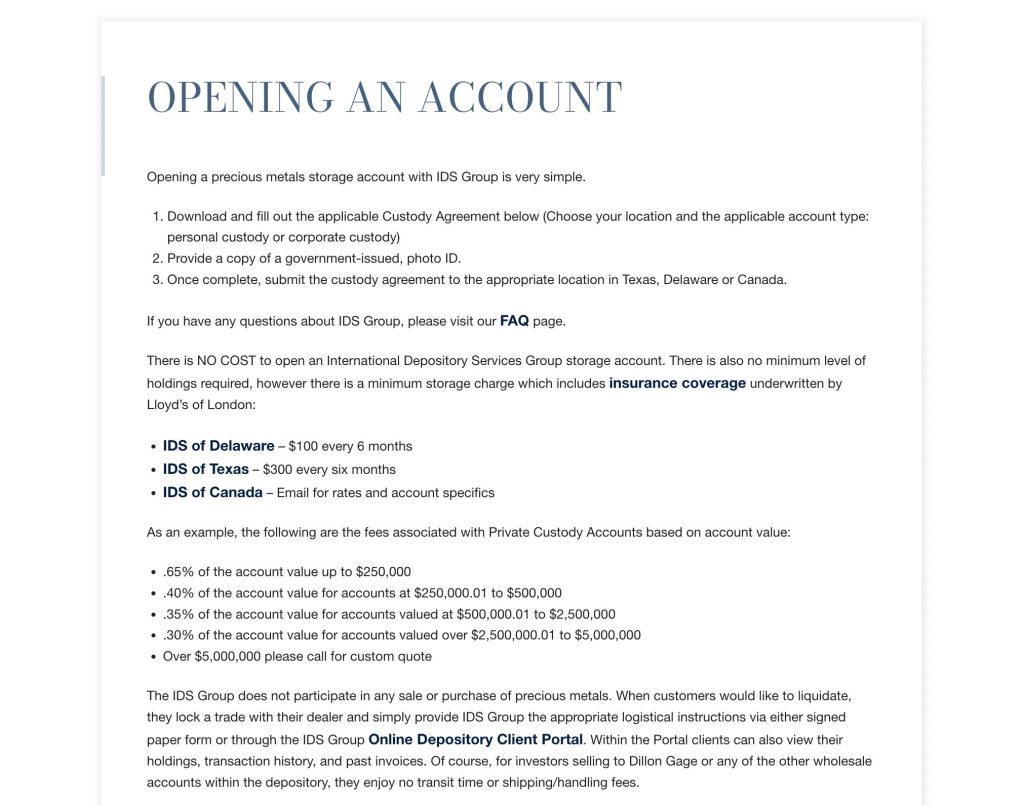

IDS charges annual storage fees based on a tiered percentage of your account value. For accounts up to $250,000 you’ll pay 0.65% annually.

The rate drops to 0.40% for accounts between $250,000 and $500,000. Larger accounts between $500,000 and $2.5 million pay just 0.35% while accounts up to $5 million are charged 0.30%.

The minimum storage fees vary by location – Delaware requires $100 every six months while Texas charges $300 semi-annually.

What caught our attention during research was that IDS includes segregated storage at these standard rates. Most depositories charge 20-40% more for keeping your metals physically separated from other clients’ holdings.

Transaction Costs

IDS processes withdrawal and transfer requests within 48 hours without charging setup fees or extra segregated storage charges.

While specific transaction fees for buying and selling metals aren’t publicly listed online you’ll need to contact them directly for these rates.

The efficiency stands out here – many depositories take 5-7 business days just to process paperwork. IDS handles worldwide shipping and distribution as part of their transaction services.

Their COMEX accreditation means they can help larger institutional trades alongside individual investor transactions. The lack of published transaction fees means you should request a complete fee schedule before opening an account.

Additional Service Charges

Your storage fees already include all-risk insurance coverage underwritten by Lloyd’s of London protecting 100% of your stored value. This eliminates the need for separate insurance policies that other depositories might require.

Administrative services like handling dividend payments and tax documents may incur additional charges though these aren’t detailed in their public fee schedule.

Custom business logistics including specialized shipping arrangements fall into this category too. The online account access and monthly inventory reports come standard without extra fees. IRA accounts work differently – fees vary depending on which custodian you choose to work with IDS.

Pros and Cons of International Depository Services

After analyzing IDS through hundreds of customer reviews and comparing their services against industry standards, we discovered both impressive strengths and notable limitations.

Here’s what stands out when you consider storing precious metals with them:

Pros

- Class III Vault Security with 24/7 Monitoring: These vaults require two hours to breach and feature biometric scanners plus armed security personnel protecting your assets around the clock.

- Free Segregated Storage for All Account Sizes: You pay the same 0.65% annual fee whether storing $10,000 or $1 million in segregated vaults while competitors charge 1-2% extra for this service.

- Lloyd’s of London Insurance Coverage: Your metals receive full protection against theft and damage with coverage extending to outbound shipments.

- 48-Hour Withdrawal Processing: You can access your metals within two business days of written notice compared to 5-7 days at most depositories.

- COMEX/CME and LBMA Accreditation: These certifications verify IDS meets strict regulatory standards for precious metals storage.

Cons

- $100 Minimum Semi-Annual Charge: Small accounts under $15,000 pay higher effective rates due to this minimum fee requirement.

- Limited Facility Locations: With only three vaults in Delaware, Texas and Canada you have fewer options than global depositories.

- No BBB Accreditation: IDS lacks Better Business Bureau ratings making independent verification of customer complaints difficult.

- Transaction Fees Not Publicly Listed: You must contact them directly for buying and selling costs which prevents easy price comparison.

Performance and User Experience

When we researched International Depository Services Group’s operational performance, we discovered their system handles precious metals custody with remarkable efficiency.

Their track record shows consistent delivery on their 48-hour withdrawal promise while maintaining the security protocols that protect billions in stored assets.

Account Setup Process

Opening an account with IDS takes approximately 24 hours after submitting your paperwork. Here’s what the process actually involves:

- Choose Your Vault Location: Select between Delaware, Texas, or Canada facilities based on your proximity or preference.

- Submit Three Documents: Complete the personal custody agreement, provide a valid driver’s license or passport photo, and fill out the transaction request form.

- Receive Confirmation: IDS processes applications within one business day and sends account credentials via secure email.

- Arrange Delivery: Ship metals directly or coordinate through your dealer using the provided account number.

The entire setup requires no phone calls or in-person visits. Their online portal handles everything from document uploads to delivery scheduling.

Customer Service Quality

IDS maintains customer support through multiple channels with response times that beat industry standards. Their team answers phone inquiries during business hours and processes email requests within 24 hours.

Online reviews consistently mention the staff’s knowledge about IRA regulations and precious metals logistics.

The company assigns dedicated account representatives who handle complex transactions like international transfers or large-volume movements.

Their whistleblower protection program ensures staff members report any service issues immediately – a transparency measure we rarely see in this industry.

Monthly inventory reports arrive automatically through their client portal. These detailed statements show every transaction, current holdings, and market values without requiring customer requests.

Accessibility and Convenience

IDS operates through a 24/7 client portal that displays real-time inventory status and allows immediate transaction requests. You can access your account from any device to review holdings, download statements, or initiate transfers.

Their three North American locations serve both U.S. and Canadian citizens without international shipping complications.

The Texas facility holds COMEX approval for commercial trading while Delaware offers proximity to East Coast financial centers.

Physical visits require 48-hour advance notice but allow direct inspection of segregated holdings. The company processes standard withdrawals within two business days and expedites urgent requests for an additional fee.

Their membership in the London Bullion Market Association enables seamless transfers to international depositories.

Comparison with Alternative Depositories

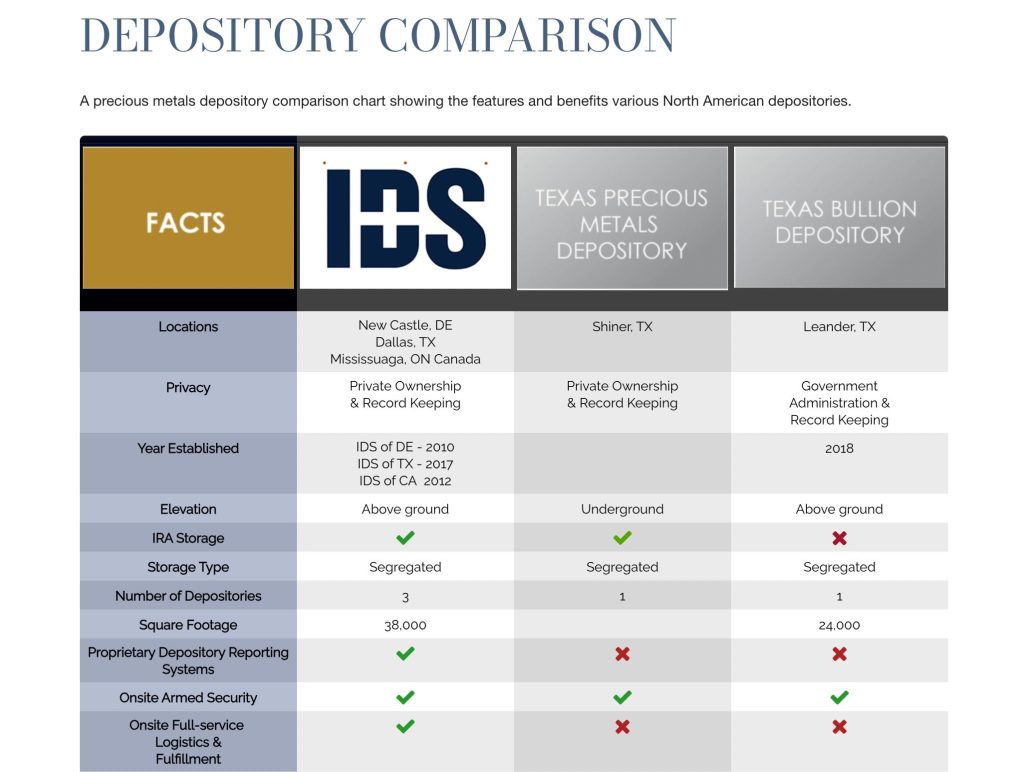

When evaluating precious metals storage options, understanding how IDS stacks up against competitors reveals crucial differences in security protocols and service offerings. We analyzed the key differentiators that set each depository apart in today’s market.

Security Standards Comparison

IDS employs Class III gold vaults while many competitors like Loomis International operate with Class II facilities.

This distinction matters because Class III vaults require two hours to breach versus 30 minutes for Class II models.

The company enforces strict dual-control protocols where no single employee can access client assets alone. Their 24/7 off-site surveillance uses dedicated security professionals rather than contract staff that other depositories often employ.

Unlike facilities that conduct quarterly audits, IDS performs perpetual internal and external inventory checks. Every asset receives full insurance coverage through Lloyd’s of London while some competitors self-insure or offer limited protection.

Their whistleblower provisions ensure staff adherence to security protocols—a feature absent at many alternative depositories.

Pricing Comparison

IDS charges between 0.30% and 0.65% annually based on account value with these tiers:

- Accounts up to $250,000: 0.65% per year

- $250,001 to $500,000: 0.40% per year

- $500,001 to $2,500,000: 0.35% per year

- $2,500,001 to $5,000,000: 0.30% per year

The $100 semi-annual minimum at Delaware falls below industry averages where competitors often charge $150-$200 minimums.

Segregated storage comes at no additional cost while Brinks and similar depositories typically add 0.10% to 0.25% for this service.

Transaction fees remain unpublished but processing happens within 48 hours compared to the 72-96 hour industry standard.

Service Features Comparison

IDS provides several distinct advantages over competitors:

- Real-time inventory tracking through their client portal versus monthly-only reports at other facilities.

- Segregated and allocated storage for gold, silver, platinum and palladium.

- Assets held in bailment off IDS’s balance sheet ensuring true ownership separation.

- COMEX and CME membership plus London Bullion Market Association compliance.

- IRA and RRSP regulatory approvals for retirement account storage.

Phone, email and portal support operates during business hours with dedicated account representatives. Loomis offers broader global reach but fewer direct client services while Malca-Amit focuses on logistics over customer interaction.

Conclusion

Choosing the right depository for precious metals requires careful consideration of security standards and service quality. IDS Group stands out as a trusted option that balances robust protection with reasonable costs.

Their Class III vaults and Lloyd’s of London insurance provide peace of mind that’s hard to match in today’s market.

We’re particularly impressed by their commitment to transparency through real-time inventory tracking and straightforward pricing that doesn’t penalize smaller investors with hidden fees for segregated storage.

While they’re not perfect – limited locations and the absence of BBB accreditation might concern some investors – their track record speaks volumes.

The combination of institutional-grade security and accessible customer service makes them suitable for both first-time precious metals investors and seasoned collectors.

If you’re looking for a depository that prioritizes both security and value we believe IDS Group deserves serious consideration.

Their proven operational efficiency and industry certifications demonstrate they’re equipped to protect your precious metals investments for the long term.