You’re scrolling through investment options at midnight when you realize your 401(k) can’t touch that rental property deal your colleague mentioned.

That’s when you discover self-directed IRAs exist—and The Entrust Group keeps popping up in your search results.

With over 40 years in the business and $5 billion under administration, The Entrust Group helps 45,000 clients invest retirement funds in everything from real estate to precious metals.

But you’re wondering if they’re worth the fees and effort. You need the real story before moving your hard-earned retirement savings.

Table of Contents

- 1 What is The Entrust Group?

- 2 Understanding Self-Directed IRAs with The Entrust Group

- 3 Investment Options Available with an SDIRA

- 4 Fees and Pricing Structure

- 5 Storage and Security

- 6 Reputation, Ratings, and Client Reviews

- 7 How to Open and Fund an Entrust SDIRA

- 8 The Entrust Group Compared to Competitors

- 9 Pros and Cons of The Entrust Group

- 10 Who Should Use The Entrust Group?

- 11 Conclusion

What is The Entrust Group?

The Entrust Group operates as a specialized custodian for self-directed retirement accounts, enabling you to invest in alternative assets beyond traditional stocks and bonds.

Based in Oakland, California, this 40-year-old company administers retirement plans for investors seeking control over their portfolio diversification.

Company History and Background

Hubert Bromma founded The Entrust Group in 1981, creating an alternative to traditional banking systems for retirement investors.

The company started by offering self-directed IRA services when alternative investments were largely unknown to mainstream investors. Over four decades, it’s grown into one of the largest self-directed IRA providers in the nation.

Jason Craig currently serves as president, leading the company’s expansion across multiple states. The firm transitioned from a franchise model in 2012 to centralize operations and improve service quality.

In 2018, they established The Entrust Trust Company (TETC), a dedicated trust entity that strengthens their administrative capabilities for complex alternative investments.

Size and Reach

The Entrust Group manages between $3 billion and $5 billion in client assets, serving 24,000 to 45,000 account holders nationwide.

You’ll find their offices strategically located across the United States, providing local support for account administration and investment transactions.

Their client base includes self-employed individuals, small business owners, and sophisticated investors diversifying into real estate, private equity, and precious metals.

The company processes thousands of alternative investment transactions annually, from rental property purchases to private loan originations. This scale positions them among the top three self-directed IRA custodians by assets under administration.

Core Mission/Commitment

The Entrust Group focuses on four pillars: wealth preservation, portfolio diversification, tax incentives, and customer service excellence.

Their mission centers on empowering you to take control of your retirement investments while maintaining IRS compliance.

The company prioritizes education, offering free consultations and resources to help you understand self-directed IRA rules and investment options. They maintain a passive custodian role, facilitating your investment decisions without providing advice.

Their commitment extends to developing user-friendly technology, including an online portal for account management and transaction processing. This approach ensures you retain full investment control while accessing professional administrative support.

Understanding Self-Directed IRAs with The Entrust Group

Self-directed IRAs transform retirement investing by putting you in control of alternative assets. These specialized accounts open doors to investments beyond Wall Street’s traditional offerings.

Definition and Benefits

A self-directed IRA (SDIRA) gives you complete control over your retirement investments. Unlike traditional IRAs limited to stocks and bonds, SDIRAs let you invest in real estate, precious metals, private equity, and tax liens. You make all investment decisions while The Entrust Group handles the administrative duties.

The benefits multiply quickly. You diversify your portfolio across multiple asset classes—investing $50,000 in rental property alongside $25,000 in gold bullion.

Your investments grow tax-deferred in traditional SDIRAs or tax-free in Roth SDIRAs. You capture higher potential returns through alternative investments like private businesses generating 15-20% annual yields versus stock market averages of 10%.

Key Differentiators

The Entrust Group’s 40-year track record sets them apart from newer competitors. They administer over $4 billion in alternative assets across 45,000 client accounts.

Their expertise spans virtually every IRS-approved investment—from apartment buildings to cryptocurrency trusts.

You gain access to investments most IRA providers prohibit. Purchase fractional ownership in commercial real estate, fund private mortgages at 12% interest, or acquire physical gold stored in approved depositories.

The Entrust Group processes these complex transactions daily, maintaining IRS compliance throughout. Their educational resources include free consultations, webinars, and investment guides that explain prohibited transactions and UBIT rules.

Types of Self-Directed Accounts Offered

The Entrust Group administers eight distinct account types:

- Traditional Self-Directed IRA: Contributions reduce taxable income up to $7,000 annually ($8,000 if you’re 50+). Investments grow tax-deferred until withdrawal at 59½.

- Roth Self-Directed IRA: Fund with after-tax dollars for tax-free growth and withdrawals after age 59½.

- SEP IRA: Business owners contribute up to 25% of compensation or $69,000 annually.

- SIMPLE IRA: Small businesses match employee contributions up to 3% of salary.

- Individual 401(k): Solo business owners contribute up to $69,000 plus $7,500 catch-up contributions.

- Self-Directed Gold IRA: Invest in physical gold, silver, platinum, and palladium meeting IRS purity standards.

- Health Savings Account (HSA): Triple tax advantage for healthcare expenses with investment options.

- Education Savings Account (ESA): Save $2,000 annually per child for education expenses with tax-free growth.

Investment Options Available with an SDIRA

You’re scanning your standard 401(k) statement—another quarter of mutual funds and index funds—when you realize there’s an entire investment universe beyond Wall Street.

The Entrust Group’s self-directed IRA opens doors to alternative investments that traditional brokers won’t touch.

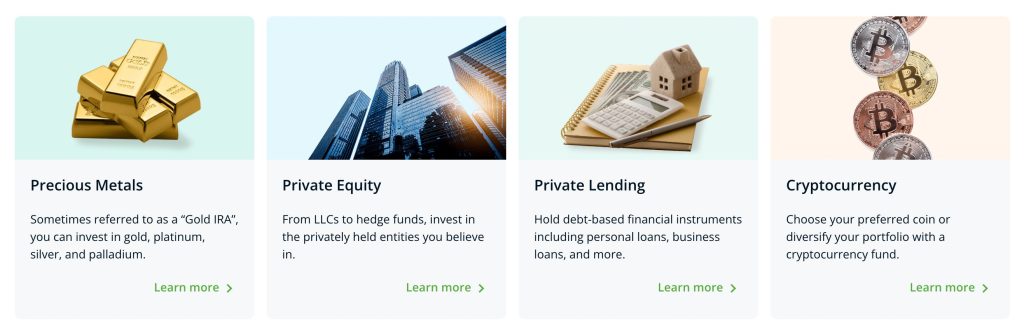

Broad Range of Assets

You spot a duplex in your neighborhood listed at $180,000 and think “investment opportunity”—except your regular IRA can’t touch it.

With The Entrust Group’s SDIRA, you buy that property, collect $2,400 monthly rent, and watch it appreciate tax-free inside your retirement account.

Your investment menu expands dramatically. You purchase IRS-approved gold coins (99.5% purity), silver bars (99.9% purity), or platinum bullion stored in approved depositories.

You fund a friend’s startup through private equity, provide $50,000 mortgage loans at 12% interest, or invest in cryptocurrency wallets.

Real estate options multiply: single-family rentals, raw land in growing markets, office buildings, even farmland producing annual crop income.

You explore unconventional investments—storage facilities generating $15,000 monthly, bowling alleys, retirement homes, or movie productions offering backend profits. You structure deals through LLCs, fund personal loans, or invest in life settlements paying 8-15% returns.

IRS Restrictions and Prohibited Transactions

You discover your vintage baseball card collection worth $25,000 can’t live in your SDIRA—the IRS prohibits collectibles including art, stamps, and most coins (except approved precious metals). That $100,000 whole life insurance policy you considered? Also banned, along with S-corporation stock.

The “disqualified persons” rule hits closer to home. You can’t sell your personal residence to your IRA, rent your IRA-owned beach house to your daughter, or hire your spouse to manage properties.

Transactions with parents, children, grandchildren, or their spouses trigger immediate taxation plus a 10% penalty if you’re under 59½.

You learn prohibited transactions extend beyond family. Your IRA can’t loan money to you personally, pay your business expenses, or invest in companies where you own 50% or more.

Breaking these rules converts your entire IRA to a taxable distribution—a $500,000 account becomes a $500,000 tax bill overnight.

Fees and Pricing Structure

You’re looking at a $50 one-time account setup fee to open your self-directed IRA with The Entrust Group. That’s pocket change compared to what you’ll pay annually.

Your annual recordkeeping fee starts at $199 for accounts under $15,000. Once your portfolio hits $50,000, you’ll pay $549. The fee climbs with your account value but caps at $2,299 even if you’re sitting on millions in alternative assets.

| Account Value | Annual Fee |

|---|---|

| Under $15,000 | $199 |

| $15,000 – $24,999 | $299 |

| $25,000 – $49,999 | $399 |

| $50,000 – $99,999 | $549 |

| $100,000+ | Capped at $2,299 |

You’ll face transaction fees for each investment move. Real estate purchases cost $175 per transaction. Most other alternative assets private equity, promissory notes, LLCs—run $95 per transaction. Here’s the kicker: precious metals transactions through approved depositories cost nothing.

Your account closure sets you back $250 if you decide to leave. ACH transfers between your bank and SDIRA? Free every time.

The Entrust Group’s online fee calculator lets you punch in your portfolio details and see exact annual costs. A $40,000 investment typically costs $344 in year one that’s 0.86% of your portfolio value. Year two drops to $299 since you’ve already paid the setup fee.

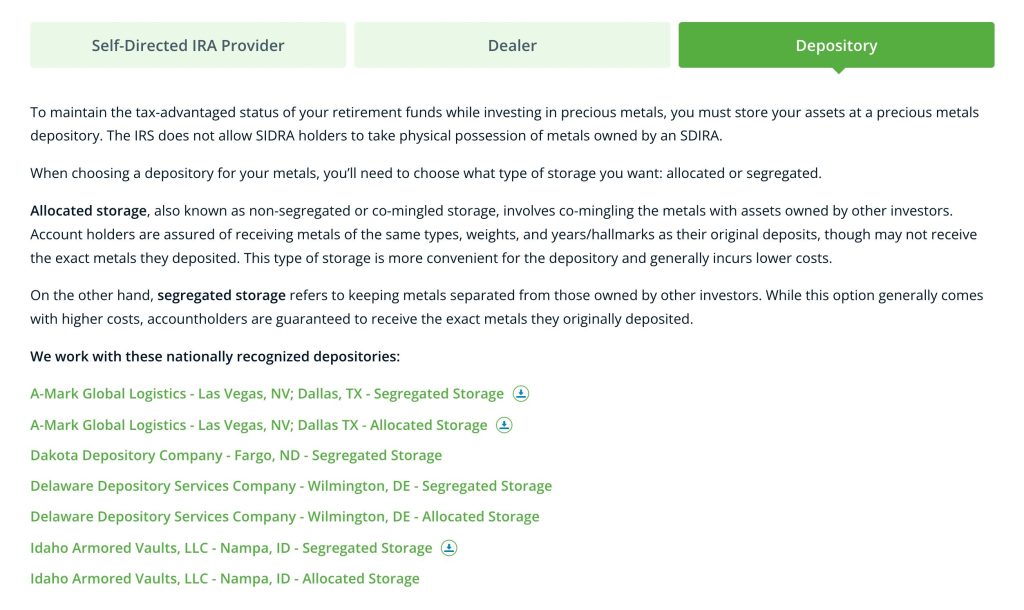

Storage and Security

Entrust acts as a custodian, safeguarding your investments and ensuring IRS compliance through comprehensive security measures.

Your precious metals are stored through partnered depositories including CNT Depository, Dakota Depository Company, Delaware Depository, and Idaho Armored Vaults, LLC—all state-licensed facilities with regular financial audits and insurance coverage protecting your assets.

Your personal data receives enterprise-level protection through encryption and secure servers. Entrust implements multi-factor authentication for account access, preventing unauthorized entry to your investment information. Their Data Protection Impact Assessments evaluate potential risks before processing sensitive financial details.

These security protocols maintain compliance through regular audits while insurance coverage provides additional investor protection.

The combination of physical security for precious metals and digital safeguards for personal information creates multiple protective layers for your self-directed IRA assets.

Reputation, Ratings, and Client Reviews

The Entrust Group’s 40+ year track record speaks volumes, yet mixed client experiences paint a complex picture. You’ll find passionate supporters praising their educational resources alongside frustrated users citing service issues.

Accreditations

The Entrust Group maintains an A+ rating from the Better Business Bureau (BBB), demonstrating their commitment to resolving customer concerns.

You’ll discover they’re active members of prestigious financial organizations including the National Association of Financial Professionals and the International Precious Metals Institute. These memberships require adherence to strict ethical standards and ongoing professional development.

The company’s BBB accreditation since 2012 reflects their dedication to transparency and fair business practices.

Their participation in industry organizations connects you with a custodian that stays current with regulatory changes and best practices in alternative asset management.

Industry Recognition

Major financial publications recognize The Entrust Group’s expertise in self-directed investing. Forbes featured their insights on retirement diversification strategies, while Coindesk highlighted their cryptocurrency IRA offerings.

The Chicago Tribune interviewed their experts about alternative investment trends, positioning them as thought leaders in the self-directed IRA space.

This media coverage validates their industry standing beyond paid advertisements. When reputable publications seek expert commentary on self-directed IRAs, they turn to The Entrust Group’s leadership team.

You benefit from their established relationships with financial journalists and their proven ability to explain complex investment concepts clearly.

Client Feedback (Pros)

Satisfied clients consistently praise The Entrust Group’s personalized service approach. You’ll work with knowledgeable staff who understand alternative investments inside and out. Account setup proves straightforward, with representatives guiding you through each step of the process.

Many investors appreciate the competitive fee structure, particularly when compared to specialized gold IRA custodians.

One client noted saving $200 annually versus their previous custodian while gaining access to more investment options.

The educational resources receive frequent mentions, with clients valuing the free consultations and comprehensive learning materials that demystify self-directed investing.

Client Feedback (Cons)

Trustpilot data reveals concerning patterns with a 1.8 rating from 17 reviews—93.33% giving one star. Dissatisfied clients report unresponsive customer service, with some waiting weeks for account transfers. Processing delays frustrate investors trying to capitalize on time-sensitive opportunities.

Fee transparency emerges as another pain point. Several reviews mention unexpected charges appearing after account setup, particularly for storage and shipping costs not disclosed upfront.

Employee reviews on Glassdoor show only 48% recommend the company, suggesting internal challenges that may impact client service. The Overall Trust Index of 2.5 indicates below-average performance compared to industry peers.

How to Open and Fund an Entrust SDIRA

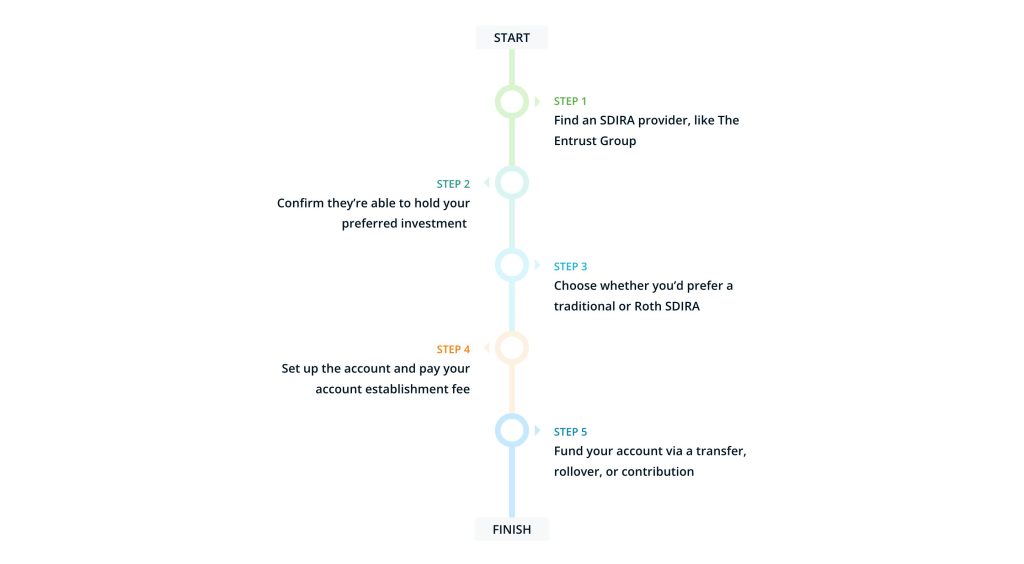

Opening your Entrust SDIRA takes less than 10 minutes through their online portal. You’ll complete straightforward forms and choose from multiple funding methods to start investing in alternative assets.

Steps to Setup

You’ll start by identifying your investment goals and choosing between Traditional or Roth SDIRA options. Traditional SDIRAs use pre-tax dollars while Roth SDIRAs use after-tax funds for tax-free qualified distributions.

Complete the online application with your social security number, driver’s license, and basic personal information. Pay the $50 establishment fee to activate your account.

Select your investment strategy based on the alternative assets you’re targeting. Real estate investors often choose Traditional SDIRAs for immediate tax deductions. Cryptocurrency enthusiasts frequently opt for Roth SDIRAs to avoid taxes on potential gains.

Your account activation email arrives within 24-48 hours. The Entrust Connect marketplace becomes available immediately after account approval.

Funding Options

- IRA Contributions let you deposit up to $6,500 annually (or $7,500 if you’re 50+) directly into your SDIRA. These contributions happen through electronic transfers or checks.

- IRA Rollovers move retirement funds from employer plans like 401(k)s into your Entrust SDIRA. Direct rollovers transfer funds between institutions without you touching the money. Indirect rollovers give you 60 days to deposit funds after receiving them.

- IRA Transfers shift existing IRA assets from other custodians to Entrust without changing account types. Traditional IRAs transfer to Traditional SDIRAs. Roth IRAs transfer to Roth SDIRAs. This process involves no IRS reporting or tax implications.

Each funding method processes within 5-10 business days through Entrust’s online portal.

The Entrust Group Compared to Competitors

You’re comparing custodians for your self-directed IRA and wondering where The Entrust Group stacks up. The company manages $5 billion in assets across 45,000 clients—making them one of the industry’s largest players since 1982.

| Custodian | Assets Under Management | Client Base | Founded | Key Differentiator |

|---|---|---|---|---|

| The Entrust Group | $5 billion | 45,000 | 1982 | Educational focus |

| Equity Trust | $34 billion | 225,000 | 1974 | Largest scale |

| IRA Financial | Not disclosed | 7,000+ | 2010 | Checkbook control |

| Pacific Premier Trust | $16.7 billion | Not disclosed | 2001 | Banking integration |

The Entrust Group charges mid-range fees compared to competitors. Your annual costs range from $199-$2,000 based on account value, while Equity Trust starts at $225 and IRA Financial begins at $360.

You’ll find The Entrust Group’s 40-year track record beats newer entrants like Rocket Dollar (2018) and Alto IRA (2015).

The company’s dedicated precious metals office (established 2012) and trust company division (launched 2018) offer services many competitors lack.

Customer support distinguishes The Entrust Group from discount providers. You get free consultations and access to IRA Academy courses—resources absent at bare-bones custodians focusing solely on transaction processing.

Pros and Cons of The Entrust Group

You’re evaluating The Entrust Group for your self-directed IRA needs, and understanding both advantages and limitations helps you make an well-informed choice. Here’s what 45,000 clients have discovered about this 40-year-old custodian.

Pros

- Competitive Fee Structure: You pay $199-$2,000 annually based on account value, with fees capping at higher balances—significantly lower than some competitors charging $3,000+.

- Extensive Investment Selection: You gain access to real estate, precious metals, private equity, cryptocurrency, and dozens of other alternative assets beyond traditional stocks and bonds.

- Established Industry Reputation: You’re working with a company managing $5 billion in assets since 1981, maintaining an A+ BBB rating and membership in respected financial organizations.

- No Account Minimums: You can open your SDIRA without meeting minimum balance requirements, unlike competitors demanding $25,000+ initial deposits.

- Educational Resources: You receive free consultations, IRA Academy coursework, and dedicated representatives helping you understand complex investment rules.

Cons

- Hidden Storage and Shipping Costs: You won’t find upfront pricing for precious metals storage or document shipping fees on their website—you discover these charges only after account setup.

- No Investment Advice: You make all investment decisions independently since The Entrust Group cannot legally recommend specific investments or provide financial guidance.

- Self-Arranged Storage: You must find and contract with your own storage facilities for physical assets like gold or collectibles, adding complexity to your investment process

- Limited Transparency on Auxiliary Fees: You encounter unexpected charges for services like wire transfers ($25), overnight delivery ($45), or account closures ($150) not clearly disclosed upfront.

Who Should Use The Entrust Group?

You’re self-employed and tired of watching your retirement savings sit in underperforming mutual funds. The Entrust Group’s self-directed 401(k) plans let you invest in rental properties or private businesses instead.

Business owners running companies with 10+ employees use Entrust to offer retirement plans that attract talent while encouraging private investment through self-directed IRAs.

Your investment appetite extends beyond Apple stock and government bonds. Real estate investors use Entrust SDIRAs to purchase rental properties, flip houses, or invest in REITs.

Precious metals enthusiasts store gold and silver in their retirement accounts through Entrust’s specialized custody services.

You’ve accumulated $100,000+ in old 401(k)s from previous employers. Rolling these funds into an Entrust SDIRA opens doors to cryptocurrency, private equity, and direct business investments.

The company’s 40-year track record and management of $5 billion in alternative assets provides confidence for significant portfolio transfers.

Your financial knowledge surpasses basic investing principles. Entrust operates as a passive custodian—they process transactions without offering investment advice.

You research deals, evaluate risks, and make all investment decisions independently. Their IRA Academy provides education on compliance rules, but you drive every investment choice.

Conclusion

Your retirement savings deserve a custodian that matches your investment ambitions. The Entrust Group’s four-decade legacy and $5 billion in managed assets demonstrate their staying power in an evolving financial world.

Whether you’re drawn to real estate deals or precious metals investments you’ll find the tools and support needed to execute your strategy.

Their transparent fee structure and educational resources through the IRA Academy empower you to make informed decisions about your financial future.

The choice eventually depends on your comfort level with self-directed investing and willingness to navigate IRS regulations independently.

If you’re ready to take control of your retirement portfolio beyond traditional stocks and bonds The Entrust Group provides the platform to make it happen.

Take time to calculate potential fees and assess whether their services align with your investment goals. Your path to portfolio diversification starts with understanding what a self-directed IRA can truly offer.