Precious metals have always been the financial world’s comfort food – where investors run when markets get scary. But here’s what caught our attention: while gold sits pretty in vaults worldwide, it typically just… sits there.

During our research into alternative investment strategies, we discovered Monetary Metals offers something different. They’ve created a platform where gold and silver actually work for you, earning interest paid in more metal.

We dug deep into this unusual approach after noticing how traditional precious metal investments often disappoint investors expecting stock-like returns.

What we found challenges conventional thinking about gold ownership. Instead of hoping metal prices climb, investors can now lease their bullion to businesses that need it – mints, refineries, jewelers – and earn yields regardless of market swings.

Table of Contents

What is Monetary Metals?

Monetary Metals operates as an online platform that connects precious metal investors with businesses needing gold and silver for production.

The company specializes in arranging leases where investors loan their physical metals to mints, jewelry manufacturers, bullion dealers, and refineries.

Founded on the principle that gold functions as a productive asset rather than a static holding, Monetary Metals facilitates two primary investment products: precious metal leases and gold bonds.

Through leases, investors earn interest payments in additional gold or silver ounces. Gold bonds work as debt instruments denominated in gold for both borrowers and lenders.

The platform serves accredited investors who meet specific account minimums. Once qualified, investors review detailed due diligence summaries for each potential lessee before committing their metals.

Companies using the platform typically include small and medium-sized businesses that incorporate precious metals into their manufacturing processes.

Interest rates vary based on lease terms and market conditions. Payments arrive in the form of physical metal rather than currency, allowing investors to accumulate more ounces regardless of spot price fluctuations.

This structure creates compound growth opportunities for gold and silver holdings through the accumulation of metal-based interest payments over time.

How the Platform Works

We discovered that this platform operates differently from traditional precious metals investments by creating a marketplace that connects metal owners with businesses needing physical gold and silver.

The platform manages the entire process from matching investors with vetted businesses to handling the logistics of metal transfers and interest payments.

Gold and Silver Leases

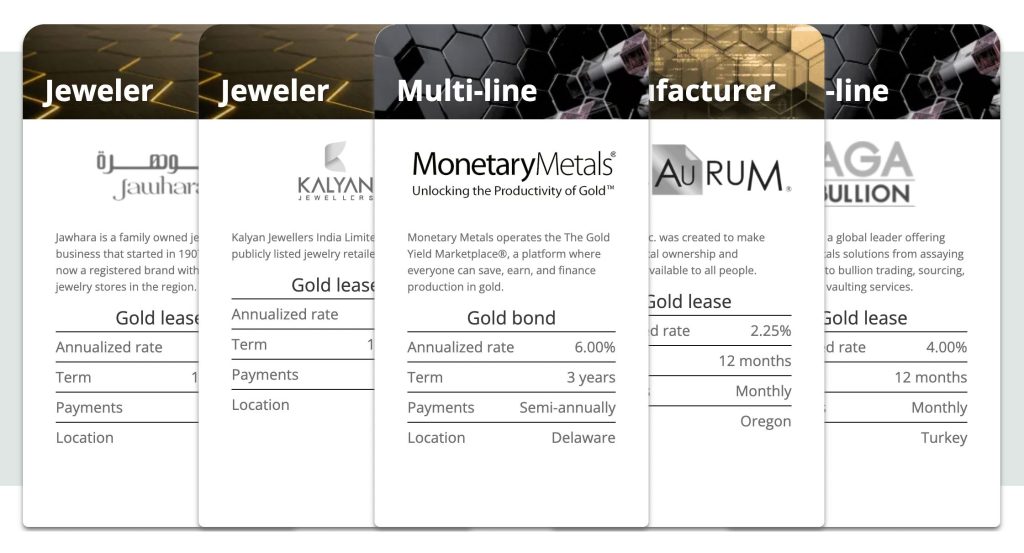

Gold and silver leases function as true leases of personal property with terms typically ranging up to 12 months. Businesses pay interest between 2% to 5% annually in physical gold or silver rather than currency.

We found that lessees include mints, jewelry manufacturers, and refineries who use the metals for production or inventory financing.

The platform protects investors by maintaining their ownership throughout the lease term. Metals remain physical assets rather than converting to paper derivatives.

Investors review each lease opportunity through the client portal and can opt out of any allocation before their metals are committed.

The platform’s expert origination team vets each business requesting a lease, examining their financial stability and operational history.

Investment Process

The investment process starts with browsing available lease or bond offerings in the client portal. Each opportunity displays the interest rate, term length, and repayment frequency (typically monthly or quarterly). Minimum investments require 10 ounces of gold or 1,000 ounces of silver for most opportunities.

After selecting a lease, investors complete the allocation agreement and their metals transfer to the lessee. The platform monitors compliance through real-time reporting and third-party audits.

We learned that investors maintain direct visibility into each lessee’s operations through API integration with their enterprise resource planning systems.

Interest payments arrive automatically in the investor’s account as additional ounces of the same metal they invested.

Returns and Yield Structure

Returns come from the interest businesses pay for leasing precious metals. The platform charges lessees approximately 2% above the marketed rates to investors.

This spread covers operational costs while investors receive their stated interest rate. Historical data shows gold leases generating around 3% annual interest, though specific opportunities vary.

We found that recent gold bond offerings yielded up to 7.1% annually. Interest compounds as payments arrive in physical metal rather than currency. Since 2016, the platform completed 55 leases and bonds with zero defaults or late payments.

The yield structure aligns platform revenue with investor success—the platform only earns money when investors receive their interest payments.

Key Features and Benefits

Monetary Metals distinguishes itself in the precious metals investment space through several compelling features that address common investor pain points.

Our research reveals three standout benefits that make this platform particularly attractive for gold and silver investors.

1. No Vault or Management Fees

Monetary Metals eliminates the traditional storage costs that eat into precious metal returns. While conventional gold storage providers charge 0.5% to 2% annually for vault services, this platform stores your metals at zero cost.

The company generates revenue by charging lessees a 2% premium above the advertised interest rate instead of billing investors.

Free insurance coverage accompanies all stored metals not actively leased. Your gold sits in secure vaults without generating monthly bills or reducing your returns through management fees.

This fee structure means a 10-ounce gold investment saves approximately $400 to $800 annually compared to traditional storage options.

The platform’s business model aligns company profits with investor success. Monetary Metals only earns money when lessees pay interest on your metals, creating a direct incentive to maintain high-quality lending standards.

2. Interest Payment Options

Investors earn returns through two distinct products: precious metal leases and gold bonds. Gold leases typically yield 2% to 5% annually, with most paying around 3% interest. Recent gold bond offerings have delivered higher returns, reaching 7.1% annual yields.

Interest payments arrive as additional gold or silver ounces rather than cash. A 100-ounce gold lease earning 3% interest adds 3 ounces to your holdings annually. Most leases distribute interest monthly, though some pay quarterly.

The platform displays each investment opportunity with clear terms: interest rate, duration, and payment frequency. Lease terms generally run up to 12 months, allowing regular portfolio adjustments.

Investors can browse available opportunities through the client portal and select investments matching their yield requirements.

3. Loss Protection Measures

Monetary Metals maintains a zero-default record across 55 completed deals since 2016. The platform requires lessees to purchase insurance policies covering all leased metals, with Monetary Metals listed as the beneficiary. Additional supplemental insurance creates a secondary protection layer.

Each potential lessee undergoes extensive due diligence before approval. The platform publishes summaries of their vetting process for every available lease, allowing investors to review borrower qualifications. Continuous monitoring ensures lessees meet their obligations throughout the lease term.

Investors retain ownership of their metals during leases. Most leases oversubscribe, creating waiting lists that enable early withdrawal options.

If you need to exit a lease before maturity, another investor typically steps in to assume your position, providing unexpected liquidity in precious metals investing.

Potential Drawbacks to Consider

While Monetary Metals offers an innovative approach to precious metals investing, we’ve identified several limitations that could impact your investment decision.

Our research reveals specific constraints around accessibility, investment variety, and fee structures that differ significantly from traditional gold and silver holdings.

1. High Minimum Investment Requirements

The entry barrier for Monetary Metals stands at 10 ounces of gold or 1,000 ounces of silver. At current market prices, this translates to over $20,000 for gold and $24,000 for silver investments.

We found this requirement particularly restrictive compared to other precious metals platforms that allow fractional ownership or smaller initial deposits.

This threshold creates challenges for investors who want to test the platform before committing substantial capital.

Small-scale investors looking to diversify with precious metals face immediate exclusion from Monetary Metals’ lease opportunities.

The minimum requirement also prevents dollar-cost averaging strategies that many investors use to build positions gradually.

For context, traditional gold ETFs allow investments starting at the price of a single share (often under $200), while physical gold dealers sell fractional ounces.

The 10-ounce gold minimum represents approximately 5-10% of many investors’ total portfolios, making it difficult to maintain proper asset allocation.

2. Limited Investment Options

Our analysis uncovered a surprisingly narrow range of investment opportunities on the platform. Currently, silver lease offerings dominate the available investments, with gold lease options appearing infrequently.

We noticed that most lease opportunities become oversubscribed within hours of posting, requiring investors to act immediately or miss out entirely.

The platform typically lists only 2-3 active investment opportunities at any given time. This scarcity contrasts sharply with traditional investment platforms offering hundreds of options across various risk levels and terms. Investors seeking specific lease durations or yield targets often wait weeks or months for suitable opportunities.

The limited selection prevents proper diversification within precious metals investments. Investors cannot spread risk across multiple lessees or vary lease terms to create laddered maturity schedules.

The oversubscription issue means qualified investors frequently fail to secure desired positions even though meeting all requirements and having funds ready.

3. Transaction Fees and Costs

Monetary Metals charges transaction fees through spreads above market prices when investors buy or sell metals on the platform.

For transactions under $250,000, the spread equals 0.75% above the London Fix Price or spot price. This fee decreases to 0.55% for transactions between $250,000 and $1 million, and 0.40% for amounts exceeding $1 million.

Beyond the spread, Monetary Metals earns revenue by taking approximately 2% from the interest lessees pay. For example, if a silver lease advertises 5% annual interest to investors, the lessee likely pays 7% total – with Monetary Metals keeping the 2% difference as their market-making fee.

These costs compound when investors frequently adjust positions or take advantage of short-term opportunities. An investor buying $50,000 in gold pays $375 in spread fees upon purchase.

If they later sell to enter a different lease, another $375 fee applies. The 2% market-making fee reduces potential yields throughout the investment period, though investors only see the net rate advertised on each lease opportunity.

Safety and Security Measures

Monetary Metals implements comprehensive security protocols to protect investor assets. The platform stores precious metals at Delaware Depository, a facility operating with “defense in depth” security architecture.

This multi-layered approach includes UL-rated vaults, motion detectors, sound sensors, vibration monitors, and metal detection systems.

The depository enforces strict multi-person protocols. No single employee can access stored metals without another authorized person present. This dual-control system prevents internal theft and ensures accountability at every access point.

Insurance coverage forms another critical protection layer. Monetary Metals requires all lessees to maintain insurance policies naming the company as beneficiary.

The platform adds supplemental insurance beyond standard coverage and secures both corporate and personal guarantees from businesses leasing metals.

Financial oversight extends throughout each lease term. The company conducts ongoing monitoring of lessee obligations and performs regular audits. This continuous supervision helps identify potential issues before they impact investor returns.

Physical security measures at storage facilities include 24/7 surveillance monitoring, ISO certification standards, and restricted access zones. Smart locks with programmable access controls limit entry to authorized personnel during specific timeframes.

The platform encrypts all client information and stores data on secure servers. Personal information remains confidential unless legal disclosure requirements apply. These digital safeguards complement physical security measures to create comprehensive asset protection.

Comparison with Alternative Investment Platforms

When we researched precious metals investment platforms, we discovered Monetary Metals operates fundamentally differently from traditional options.

Most platforms charge storage fees ranging from 0.5% to 1% annually, while Monetary Metals eliminates these costs entirely.

Traditional Physical Metal Platforms

Money Metals Exchange focuses on physical metal sales and gold IRA accounts. Their customers pay $100-200 annual storage fees plus transaction costs averaging 3-5% per purchase.

JM Bullion and APMEX follow similar models, charging premium markups of 5-10% above spot prices for coins and bars.

These platforms generate revenue through:

- Buy-sell spreads (2-4%)

- Annual storage fees ($100-300)

- Insurance costs (0.5-1% of holdings)

- IRA administration fees ($50-250)

Precious Metals ETFs

Gold ETFs like SPDR Gold Shares (GLD) charge expense ratios of 0.40% annually. Silver ETFs typically cost 0.50-0.60% per year. These fees compound over time, reducing long-term returns by 10-15% over 20 years.

| Platform Type | Annual Fees | Minimum Investment | Return Type |

|---|---|---|---|

| Monetary Metals | 0% | 10 oz gold | 2-7% in metal |

| Physical Dealers | 1-2% | $100 | Price appreciation only |

| Gold ETFs | 0.40% | 1 share (~$180) | Price appreciation only |

| Gold Mining Stocks | 0.05-1% | 1 share | Dividends + appreciation |

Yield Generation Differences

Traditional platforms offer zero yield on metal holdings. Monetary Metals generates 2-5% annual returns through leasing arrangements. This distinction matters significantly for long-term investors seeking income from precious metals exposure.

Getting Started with Your First Investment

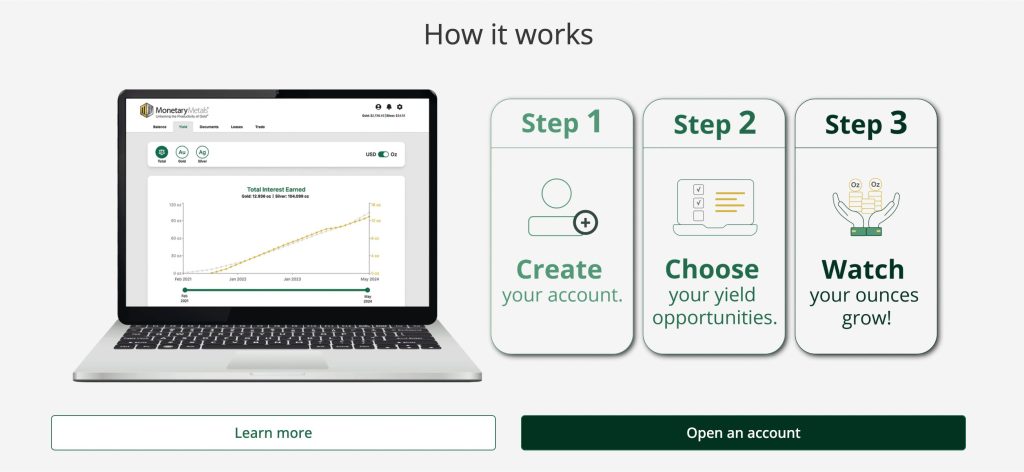

Opening an account with Monetary Metals takes approximately 15 minutes and requires meeting specific financial thresholds.

The platform’s streamlined process moves investors from signup to their first lease opportunity within 48 hours of approval.

Account Requirements

Monetary Metals requires investors to qualify as accredited investors under SEC regulations. This means individuals must have a net worth exceeding $1 million (excluding primary residence) or annual income above $200,000 for single filers ($300,000 for joint filers) for the past two years.

The platform’s minimum investment starts at 10 ounces of gold or 1,000 ounces of silver per lease opportunity. Investors can open individual accounts, joint accounts, trust accounts, or company accounts.

Each account type requires different documentation – trusts need trust agreements while companies provide operating agreements or corporate bylaws.

All investors must pass Know Your Customer (KYC) verification, which includes providing a government-issued photo ID and proof of address dated within 90 days. The platform accepts US citizens and permanent residents, with international investors evaluated case-by-case.

Steps to Open an Account

- Creating your Monetary Metals account begins at their secure portal where you’ll enter basic information: full name, email address, phone number, and account type selection. The system immediately sends a verification email to confirm your contact details.

- Next, you’ll complete the accredited investor questionnaire, uploading supporting documents like tax returns or bank statements. The platform’s compliance team reviews submissions within 24 hours during business days.

- After approval, you’ll electronically sign account agreements through DocuSign. These documents outline lease terms, risk disclosures, and investor rights.

- You then choose your funding method – either wire transfer cash or ship existing bullion to Delaware Depository. Cash deposits process within one business day, while physical metal shipments take 5-7 days for verification and vault storage.

- Once funded, you’ll access the investor portal showing available lease opportunities, each displaying yield rates, duration, and lessee information.

Performance Track Record and Customer Reviews

Monetary Metals demonstrates a remarkable track record since launching operations in 2016. The platform completed between 55 and 74 funded deals globally without a single default or loss of metal.

Their weighted average return reaches 7.1% annually when combining gold leases and gold bonds. Active leases generate between 3.27% and 6.7% returns depending on investment type.

The company’s zero percent default rate stems from rigorous vetting processes and continuous monitoring of lessees. Each lessee undergoes thorough due diligence before approval.

Monetary Metals requires regular reporting and third-party audits from lessees. The platform maintains direct visibility into lessee operations through API integration with their enterprise resource planning systems.

Customer feedback remains limited across review platforms. The few existing reviews highlight positive experiences with customer service and secure metal transfers.

This scarcity of reviews presents challenges for potential investors seeking peer experiences. The platform’s relatively new approach to precious metals investing contributes to fewer public testimonials compared to traditional bullion dealers.

Geographic expansion demonstrates business growth and market confidence. Monetary Metals opened offices in Dubai and engages with global industry leaders. This international presence supports their ability to source diverse lease opportunities for investors while maintaining their perfect repayment history.

Conclusion

Monetary Metals reshapes precious metals investing by turning gold and silver into income-generating assets.

We’ve seen how their innovative lease and bond programs offer returns of 2-7% annually while eliminating storage fees that traditionally drain investor profits.

Their zero-default track record since 2016 demonstrates the platform’s commitment to security and due diligence.

For accredited investors who meet the minimum requirements of 10 ounces of gold or 1,000 ounces of silver, it’s an opportunity to earn passive income from metals that would otherwise sit idle in vaults.

While the high entry barriers and limited investment options won’t suit everyone, we believe Monetary Metals fills a crucial gap in the precious metals market.

It’s particularly valuable for long-term investors who want their gold and silver holdings to work harder without sacrificing the safety that makes precious metals attractive in the first place.